Need to know:

Information Balance Sheet:

Income Statement:

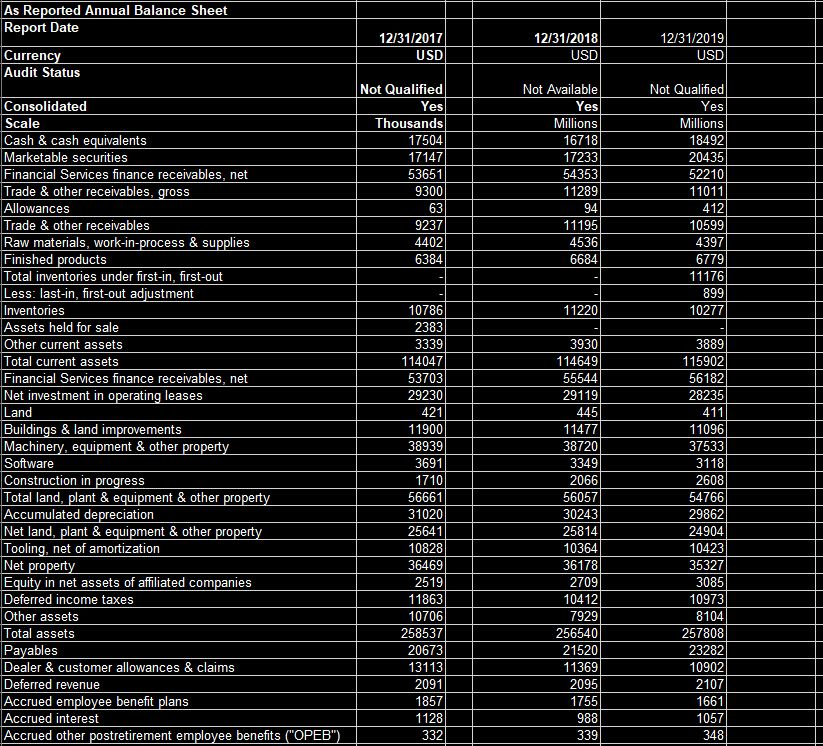

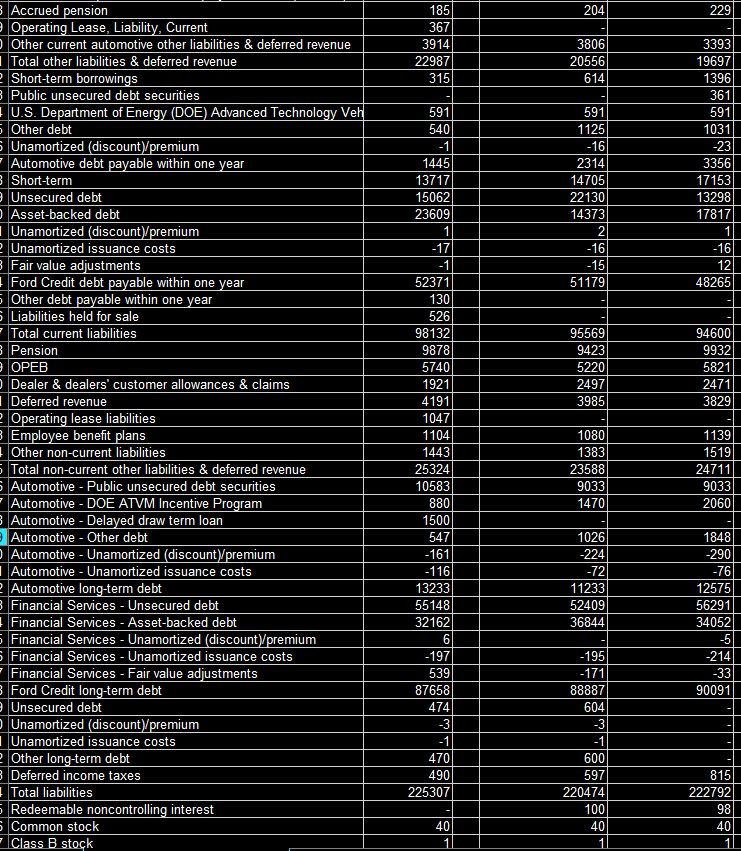

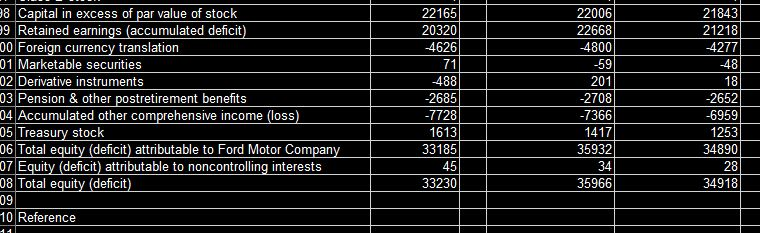

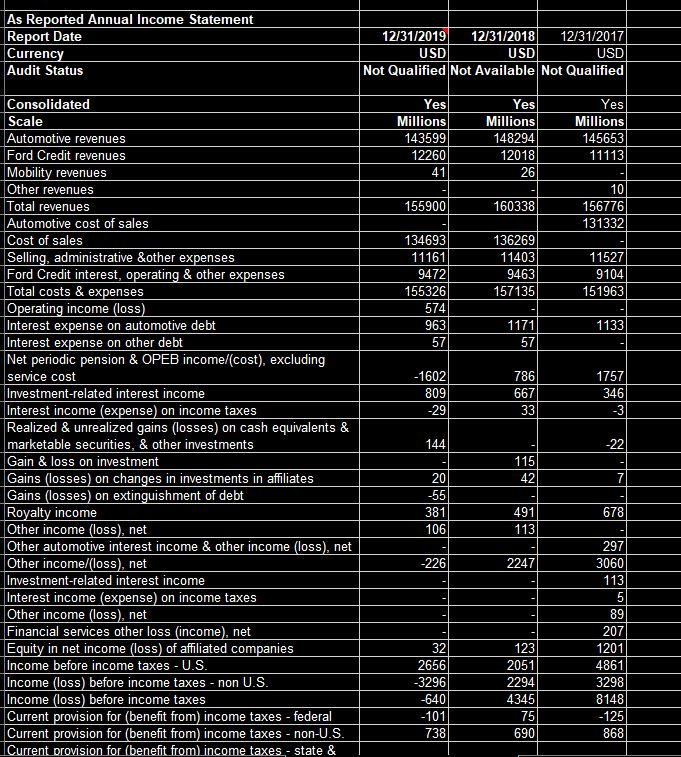

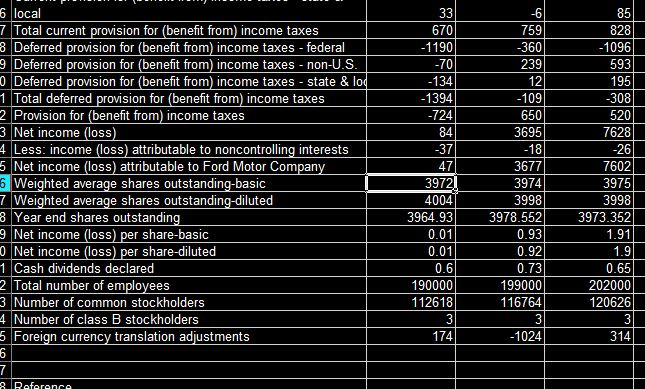

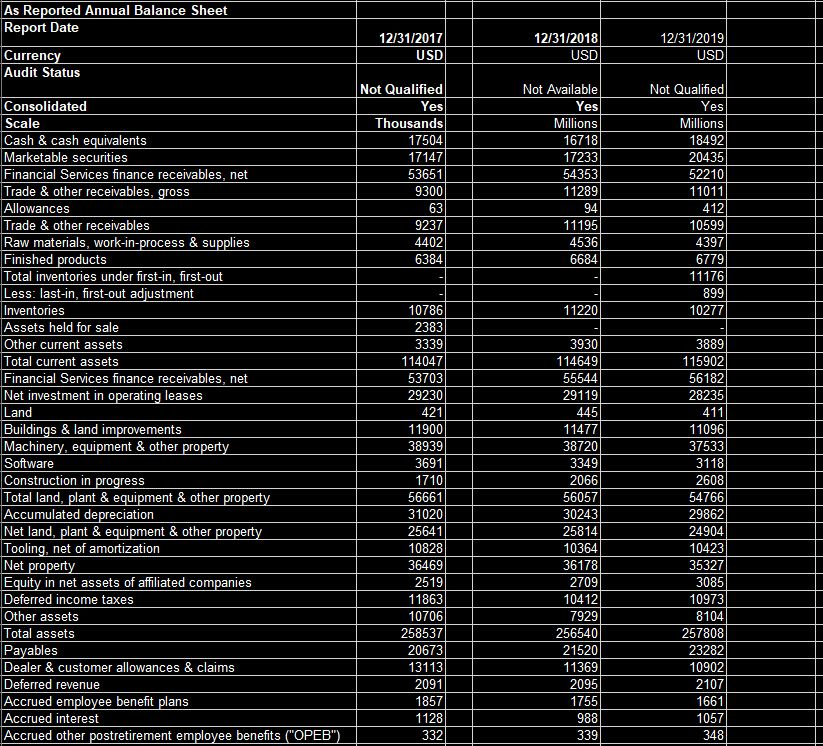

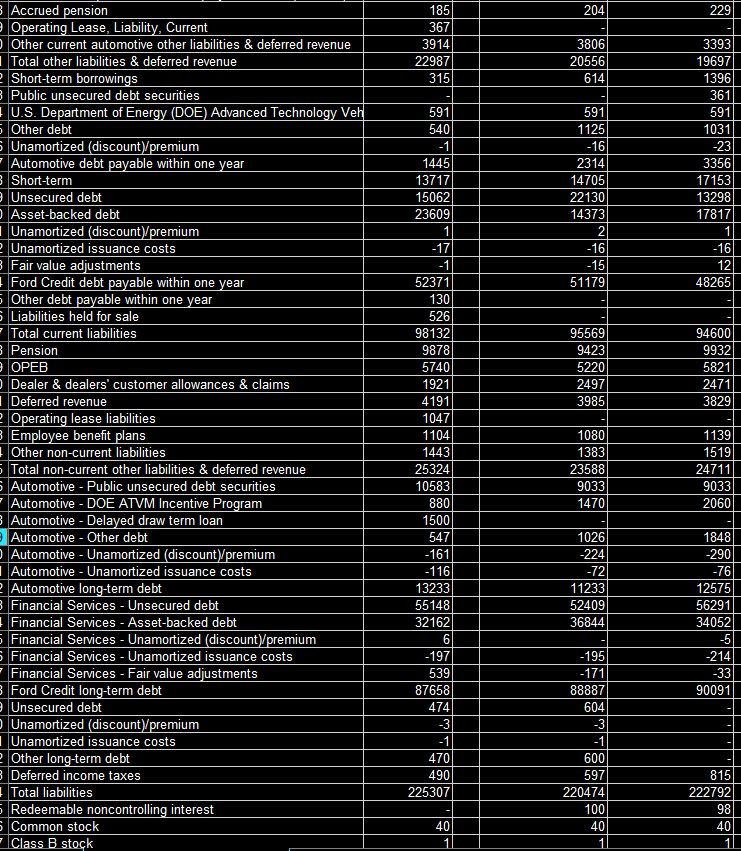

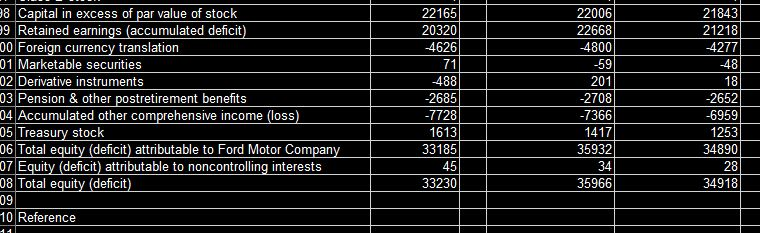

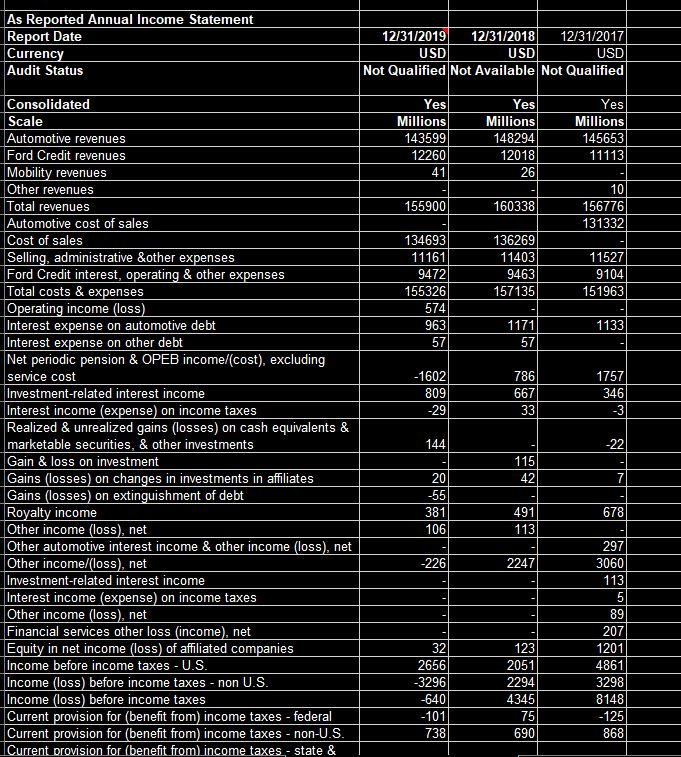

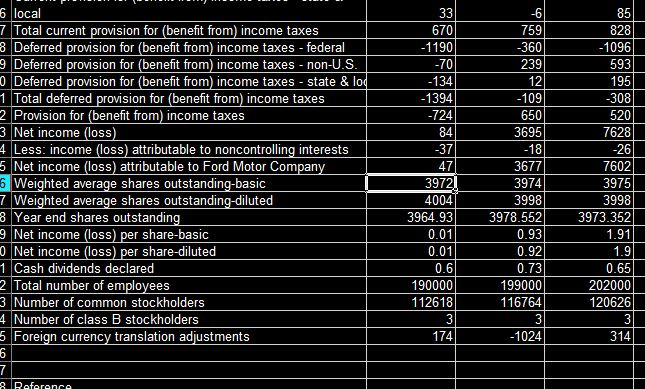

2017 2018 2019 6.78 6.13 6.38 Current Ratio Debt / Equity Ratio Free Cash Flow (000) Earnings per Share Price learnings ratio Return on Equity Net profit margin As Reported Annual Balance Sheet Report Date 12/31/2017 USD 12/31/2018 USD 12/31/2019 USD Currency Audit Status Not Qualified Yes Thousands 17504 17147 53651 9300 63 9237 4402 6384 Not Available Yes Millions 16718 17233 54353 11289 94 11195 4536 6684 Not Qualified Yes Millions 18492 20435 52210 11011 412 10599 4397 6779 11176 899 10277 11220 Consolidated Scale Cash & cash equivalents Marketable securities Financial Services finance receivables, net Trade & other receivables, gross Allowances Trade & other receivables Raw materials, work-in-process & supplies Finished products Total inventories under first-in, first-out Less: last-in, first-out adjustment Inventories Assets held for sale Other current assets Total current assets Financial Services finance receivables, net Net investment in operating leases Land Buildings & land improvements Machinery, equipment & other property Software Construction in progress Total land, plant & equipment & other property Accumulated depreciation Net land, plant & equipment & other property Tooling, net of amortization Net property Equity in net assets of affiliated companies Deferred income taxes Other assets Total assets Payables Dealer & customer allowances & claims Deferred revenue Accrued employee benefit plans Accrued interest Accrued other postretirement employee benefits ("OPEB") 10786 2383 3339 114047 53703 29230 421 11900 38939 3691 1710 56661 31020 25641 10828 36469 2519 11863 10706 258537 20673 13113 2091 1857 1128 332 3930 114649 55544 29119 445 11477 38720 3349 2066 56057 30243 25814 10364 36178 2709 10412 7929 256540 21520 11369 2095 1755 988 339 3889 115902 56182 28235 411 11096 37533 3118 2608 54766 29862 24904 10423 35327 3085 10973 8104 257808 23282 10902 2107 1661 1057 348 185 204 229 367 3914 22987 315 3806 20556 614 591 540 -1 1445 13717 15062 23609 591 1125 -16) 2314 14705 22130 14373 2 -16 -15 51179 3393 19697 1396 361 591 1031 -23 3356 17153 13298 17817 1 -17 -16 12 48265 95569 9423 5220 2497 3985 94600 9932 5821 2471 3829 B Accrued pension Operating Lease, Liability, Current Other current automotive other liabilities & deferred revenue 1 Total other liabilities & deferred revenue 2 Short-term borrowings Public unsecured debt securities U.S. Department of Energy (DOE) Advanced Technology Veh 5 Other debt s Unamortized (discount premium Automotive debt payable within one year Short-term Unsecured debt Asset-backed debt Unamortized (discount\/premium 2 Unamortized issuance costs 3 Fair value adjustments Ford Credit debt payable within one year 5 Other debt payable within one year Liabilities held for sale - Total current liabilities 3 Pension 3 OPEB Dealer & dealers' customer allowances & claims Deferred revenue 2 Operating lease liabilities Employee benefit plans Other non-current liabilities Total non-current other liabilities & deferred revenue Automotive - Public unsecured debt securities Automotive - DOE ATVM Incentive Program Automotive - Delayed draw term loan Automotive - Other debt Automotive - Unamortized (discount premium Automotive - Unamortized issuance costs Automotive long-term debt Financial Services - Unsecured debt Financial Services - Asset-backed debt 5 Financial Services - Unamortized (discount premium S Financial Services - Unamortized issuance costs - Financial Services - Fair value adjustments Ford Credit long-term debt Unsecured debt Unamortized (discount premium 1 Unamortized issuance costs Other long-term debt Deferred income taxes Total liabilities Redeemable noncontrolling interest Common stock Class B stock 1080 1383 23588 9033 1470 1139 1519 24711 9033 2060 52371 130 526 98132 9878 5740 1921 4191 1047 1104 1443 25324 10583 880 1500 547 -161 -116 13233 55148 32162 6 -197 539 87658 474 -3 -1 470 490 225307 1026 -224 -72 11233 52409 36844 1848 -290 -76 12575 56291 34052 -5 -214 -33 90091 -195 -171 88887 604 -3 600 597 220474 100 40 815 222792 98 40 1 10 22006 22668 4800 -59 38 Capital in excess of par value of stock 9 Retained earnings (accumulated deficit) 00 Foreign currency translation 01 Marketable securities 02 Derivative instruments 03 Pension & other postretirement benefits 04 Accumulated other comprehensive income (loss) 05 Treasury stock 06 Total equity (deficit) attributable to Ford Motor Company 07 Equity (deficit) attributable to noncontrolling interests 08 Total equity (deficit) 09 10 Reference 22165 20320 4626 71 488 -2685 -7728 1613 33185 45 33230 201 -2708 -7366 1417 35932 34 35966 21843 21218 -4277 48 18 -2652 -6959 1253 34890 28 34918 11 As Reported Annual Income Statement Report Date Currency Audit Status 12/31/2019 12/31/2018 12/31/2017 USD USD USD Not Qualified Not Available Not Qualified Yes Millions 143599 12260 41 Yes Millions 148294 12018 26 Yes Millions 145653 11113 155900 160338 10 156776 131332 134693 11161 9472 155326 574 963 57 136269 11403 9463 157135 11527 9104 151963 1133 1171 57 -1602 809 -29 786 667 33 1757 346 -3 Consolidated Scale Automotive revenues Ford Credit revenues Mobility revenues Other revenues Total revenues Automotive cost of sales Cost of sales Selling, administrative &other expenses Ford Credit interest, operating & other expenses Total costs & expenses Operating income (loss) Interest expense on automotive debt Interest expense on other debt Net periodic pension & OPEB income/(cost), excluding service cost Investment-related interest income Interest income (expense) on income taxes Realized & unrealized gains (losses) on cash equivalents & marketable securities, & other investments Gain & loss on investment Gains (losses) on changes in investments in affiliates Gains (losses) on extinguishment of debt Royalty income Other income (loss), net Other automotive interest income & other income (loss), net Other income/(loss), net Investment-related interest income Interest income (expense) on income taxes Other income (loss), net Financial services other loss (income), net Equity in net income (loss) of affiliated companies Income before income taxes - U.S. Income (loss) before income taxes - non U.S. Income (loss) before income taxes Current provision for benefit from) income taxes - federal Current provision for (benefit from) income taxes - non-U.S. Current provision for (benefit from income taxes - state & 144 22 115 42 7 20 -55 381 106 678 491 113 -226 2247 297 3060 113 5 89 207 1201 4861 3298 8148 -125 868 32 2656 -3296 -640 -101 738 123 2051 2294 4345 75 690 6 local 7 Total current provision for (benefit from) income taxes 8 Deferred provision for (benefit from) income taxes - federal 9 Deferred provision for (benefit from income taxes - non-U.S. 0 Deferred provision for (benefit from) income taxes - state & lod 1 Total deferred provision for (benefit from) income taxes 2 Provision for (benefit from) income taxes 3 Net income (loss) 4 Less: income (loss) attributable to noncontrolling interests 5 Net income (loss) attributable to Ford Motor Company 6 Weighted average shares outstanding-basic 7 Weighted average shares outstanding-diluted 8 Year end shares outstanding 9 Net income (loss) per share-basic 0 Net income (loss) per share-diluted 1 Cash dividends declared 2 Total number of employees 3 Number of common stockholders 4 Number of class B stockholders 5 Foreign currency translation adjustments 33 670 -1190 -70 -134 -1394 -724 84 -37 47 3972! 4004 3964.93 0.01 0.01 0.6 190000 112618 3 174 -6 759 -360 239 12 -109 650 3695 -18 3677 3974 3998 3978.552 0.93 0.92 0.73 199000 116764 3 -1024 85 828 -1096 593 195 -308 520 7628 -26 7602 3975 3998 3973.352 1.91 1.9 0.65 202000 120626 3 314 6 7 8 Reference 2017 2018 2019 6.78 6.13 6.38 Current Ratio Debt / Equity Ratio Free Cash Flow (000) Earnings per Share Price learnings ratio Return on Equity Net profit margin As Reported Annual Balance Sheet Report Date 12/31/2017 USD 12/31/2018 USD 12/31/2019 USD Currency Audit Status Not Qualified Yes Thousands 17504 17147 53651 9300 63 9237 4402 6384 Not Available Yes Millions 16718 17233 54353 11289 94 11195 4536 6684 Not Qualified Yes Millions 18492 20435 52210 11011 412 10599 4397 6779 11176 899 10277 11220 Consolidated Scale Cash & cash equivalents Marketable securities Financial Services finance receivables, net Trade & other receivables, gross Allowances Trade & other receivables Raw materials, work-in-process & supplies Finished products Total inventories under first-in, first-out Less: last-in, first-out adjustment Inventories Assets held for sale Other current assets Total current assets Financial Services finance receivables, net Net investment in operating leases Land Buildings & land improvements Machinery, equipment & other property Software Construction in progress Total land, plant & equipment & other property Accumulated depreciation Net land, plant & equipment & other property Tooling, net of amortization Net property Equity in net assets of affiliated companies Deferred income taxes Other assets Total assets Payables Dealer & customer allowances & claims Deferred revenue Accrued employee benefit plans Accrued interest Accrued other postretirement employee benefits ("OPEB") 10786 2383 3339 114047 53703 29230 421 11900 38939 3691 1710 56661 31020 25641 10828 36469 2519 11863 10706 258537 20673 13113 2091 1857 1128 332 3930 114649 55544 29119 445 11477 38720 3349 2066 56057 30243 25814 10364 36178 2709 10412 7929 256540 21520 11369 2095 1755 988 339 3889 115902 56182 28235 411 11096 37533 3118 2608 54766 29862 24904 10423 35327 3085 10973 8104 257808 23282 10902 2107 1661 1057 348 185 204 229 367 3914 22987 315 3806 20556 614 591 540 -1 1445 13717 15062 23609 591 1125 -16) 2314 14705 22130 14373 2 -16 -15 51179 3393 19697 1396 361 591 1031 -23 3356 17153 13298 17817 1 -17 -16 12 48265 95569 9423 5220 2497 3985 94600 9932 5821 2471 3829 B Accrued pension Operating Lease, Liability, Current Other current automotive other liabilities & deferred revenue 1 Total other liabilities & deferred revenue 2 Short-term borrowings Public unsecured debt securities U.S. Department of Energy (DOE) Advanced Technology Veh 5 Other debt s Unamortized (discount premium Automotive debt payable within one year Short-term Unsecured debt Asset-backed debt Unamortized (discount\/premium 2 Unamortized issuance costs 3 Fair value adjustments Ford Credit debt payable within one year 5 Other debt payable within one year Liabilities held for sale - Total current liabilities 3 Pension 3 OPEB Dealer & dealers' customer allowances & claims Deferred revenue 2 Operating lease liabilities Employee benefit plans Other non-current liabilities Total non-current other liabilities & deferred revenue Automotive - Public unsecured debt securities Automotive - DOE ATVM Incentive Program Automotive - Delayed draw term loan Automotive - Other debt Automotive - Unamortized (discount premium Automotive - Unamortized issuance costs Automotive long-term debt Financial Services - Unsecured debt Financial Services - Asset-backed debt 5 Financial Services - Unamortized (discount premium S Financial Services - Unamortized issuance costs - Financial Services - Fair value adjustments Ford Credit long-term debt Unsecured debt Unamortized (discount premium 1 Unamortized issuance costs Other long-term debt Deferred income taxes Total liabilities Redeemable noncontrolling interest Common stock Class B stock 1080 1383 23588 9033 1470 1139 1519 24711 9033 2060 52371 130 526 98132 9878 5740 1921 4191 1047 1104 1443 25324 10583 880 1500 547 -161 -116 13233 55148 32162 6 -197 539 87658 474 -3 -1 470 490 225307 1026 -224 -72 11233 52409 36844 1848 -290 -76 12575 56291 34052 -5 -214 -33 90091 -195 -171 88887 604 -3 600 597 220474 100 40 815 222792 98 40 1 10 22006 22668 4800 -59 38 Capital in excess of par value of stock 9 Retained earnings (accumulated deficit) 00 Foreign currency translation 01 Marketable securities 02 Derivative instruments 03 Pension & other postretirement benefits 04 Accumulated other comprehensive income (loss) 05 Treasury stock 06 Total equity (deficit) attributable to Ford Motor Company 07 Equity (deficit) attributable to noncontrolling interests 08 Total equity (deficit) 09 10 Reference 22165 20320 4626 71 488 -2685 -7728 1613 33185 45 33230 201 -2708 -7366 1417 35932 34 35966 21843 21218 -4277 48 18 -2652 -6959 1253 34890 28 34918 11 As Reported Annual Income Statement Report Date Currency Audit Status 12/31/2019 12/31/2018 12/31/2017 USD USD USD Not Qualified Not Available Not Qualified Yes Millions 143599 12260 41 Yes Millions 148294 12018 26 Yes Millions 145653 11113 155900 160338 10 156776 131332 134693 11161 9472 155326 574 963 57 136269 11403 9463 157135 11527 9104 151963 1133 1171 57 -1602 809 -29 786 667 33 1757 346 -3 Consolidated Scale Automotive revenues Ford Credit revenues Mobility revenues Other revenues Total revenues Automotive cost of sales Cost of sales Selling, administrative &other expenses Ford Credit interest, operating & other expenses Total costs & expenses Operating income (loss) Interest expense on automotive debt Interest expense on other debt Net periodic pension & OPEB income/(cost), excluding service cost Investment-related interest income Interest income (expense) on income taxes Realized & unrealized gains (losses) on cash equivalents & marketable securities, & other investments Gain & loss on investment Gains (losses) on changes in investments in affiliates Gains (losses) on extinguishment of debt Royalty income Other income (loss), net Other automotive interest income & other income (loss), net Other income/(loss), net Investment-related interest income Interest income (expense) on income taxes Other income (loss), net Financial services other loss (income), net Equity in net income (loss) of affiliated companies Income before income taxes - U.S. Income (loss) before income taxes - non U.S. Income (loss) before income taxes Current provision for benefit from) income taxes - federal Current provision for (benefit from) income taxes - non-U.S. Current provision for (benefit from income taxes - state & 144 22 115 42 7 20 -55 381 106 678 491 113 -226 2247 297 3060 113 5 89 207 1201 4861 3298 8148 -125 868 32 2656 -3296 -640 -101 738 123 2051 2294 4345 75 690 6 local 7 Total current provision for (benefit from) income taxes 8 Deferred provision for (benefit from) income taxes - federal 9 Deferred provision for (benefit from income taxes - non-U.S. 0 Deferred provision for (benefit from) income taxes - state & lod 1 Total deferred provision for (benefit from) income taxes 2 Provision for (benefit from) income taxes 3 Net income (loss) 4 Less: income (loss) attributable to noncontrolling interests 5 Net income (loss) attributable to Ford Motor Company 6 Weighted average shares outstanding-basic 7 Weighted average shares outstanding-diluted 8 Year end shares outstanding 9 Net income (loss) per share-basic 0 Net income (loss) per share-diluted 1 Cash dividends declared 2 Total number of employees 3 Number of common stockholders 4 Number of class B stockholders 5 Foreign currency translation adjustments 33 670 -1190 -70 -134 -1394 -724 84 -37 47 3972! 4004 3964.93 0.01 0.01 0.6 190000 112618 3 174 -6 759 -360 239 12 -109 650 3695 -18 3677 3974 3998 3978.552 0.93 0.92 0.73 199000 116764 3 -1024 85 828 -1096 593 195 -308 520 7628 -26 7602 3975 3998 3973.352 1.91 1.9 0.65 202000 120626 3 314 6 7 8 Reference