Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need to learn step by step explanation for all questions Use the following information to answer questions 1 through 5. Jump Technology uses an operational

need to learn step by step explanation for all questions

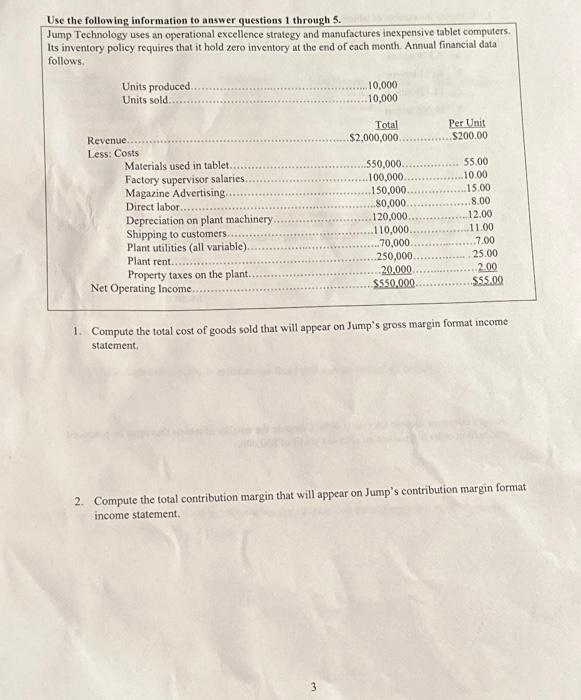

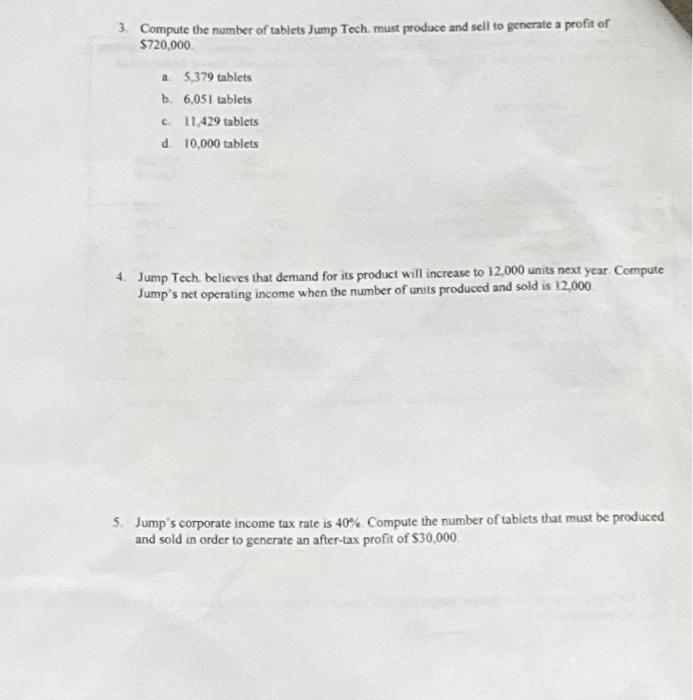

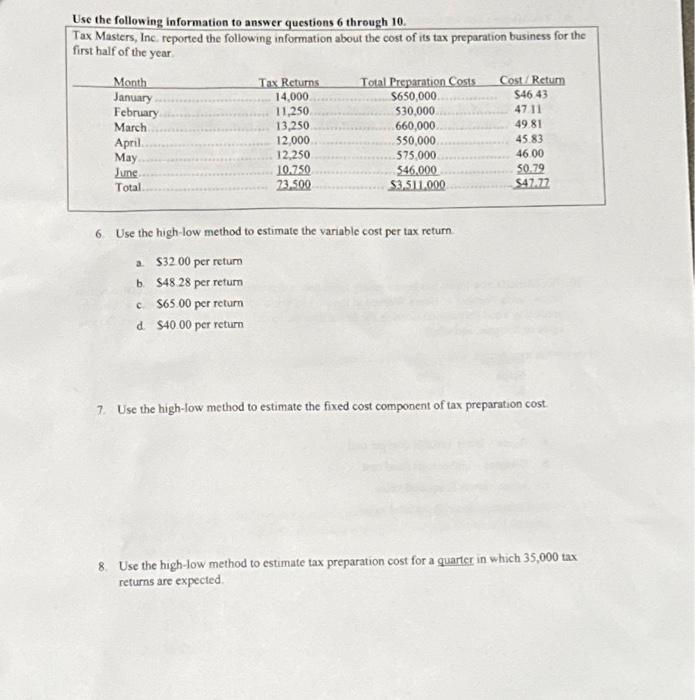

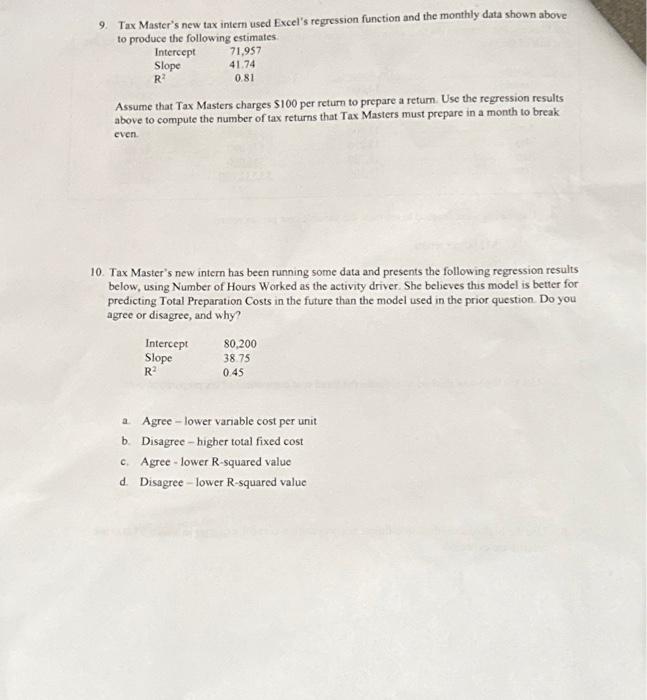

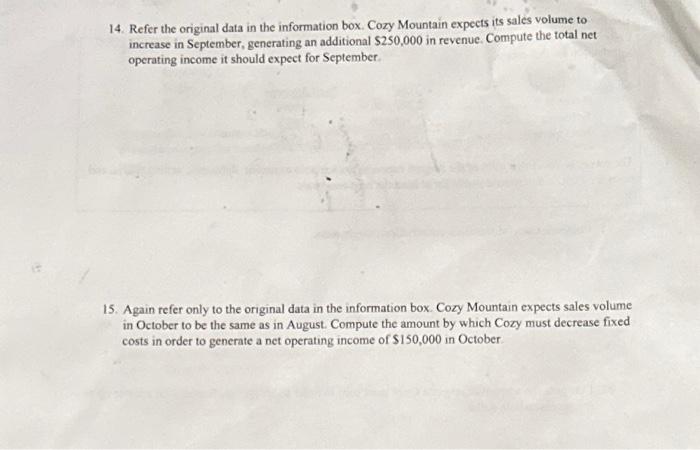

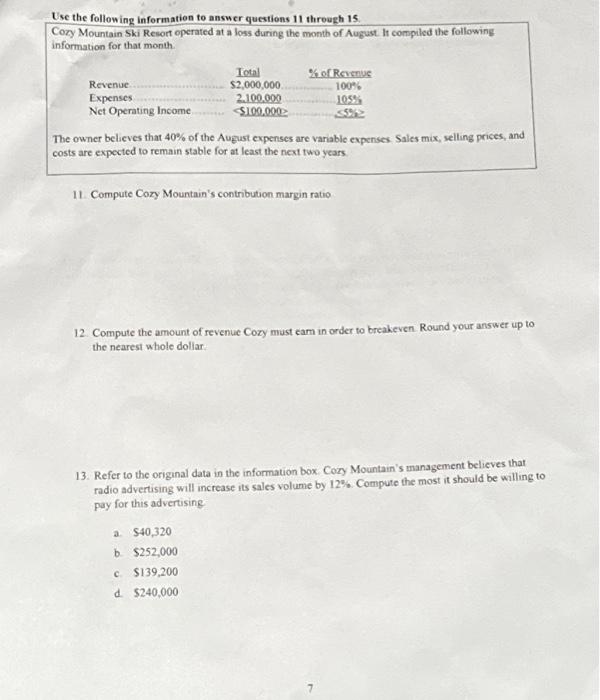

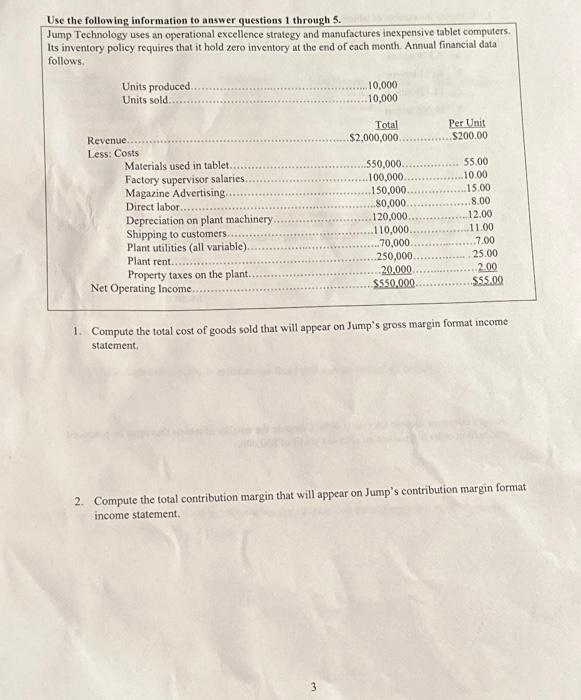

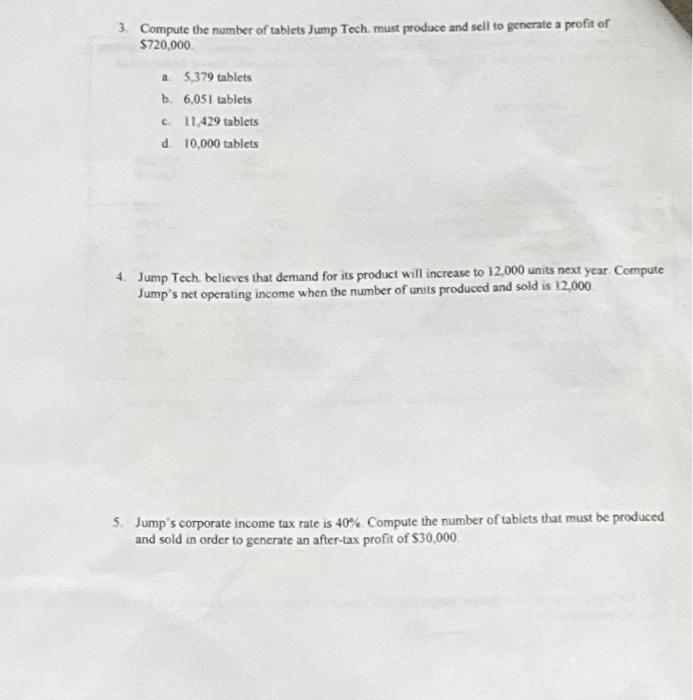

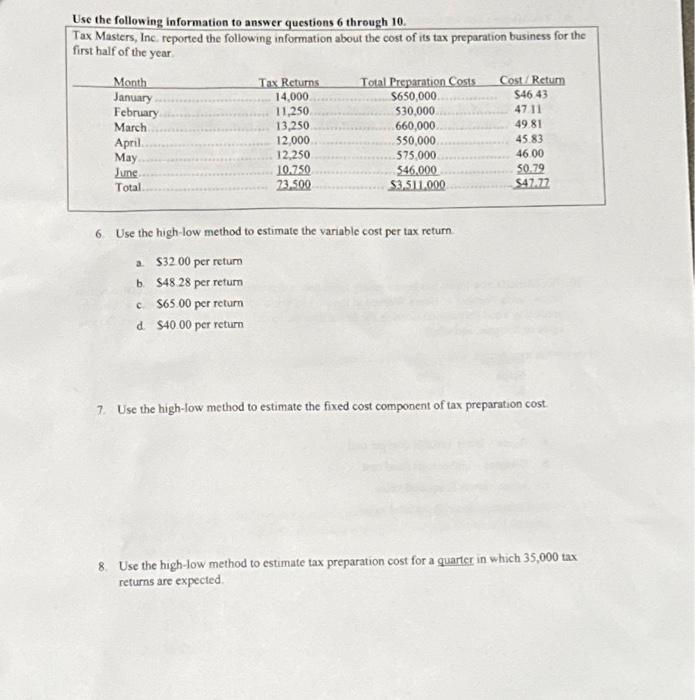

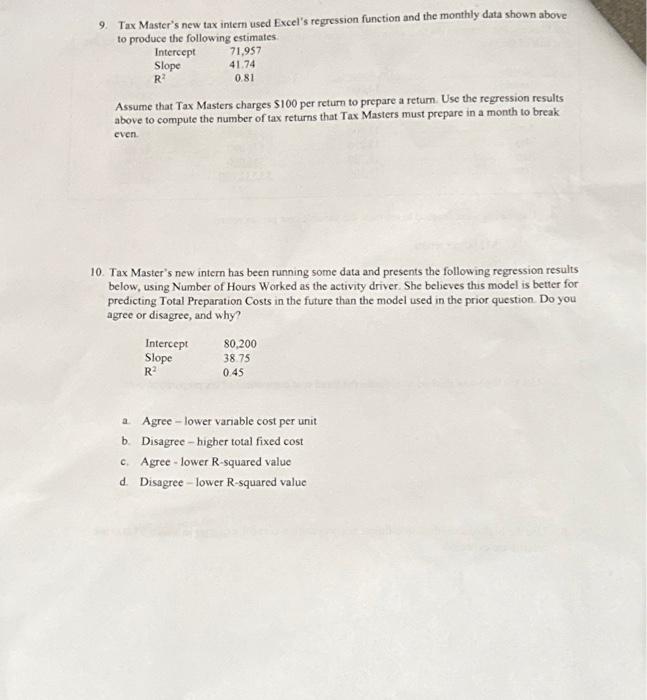

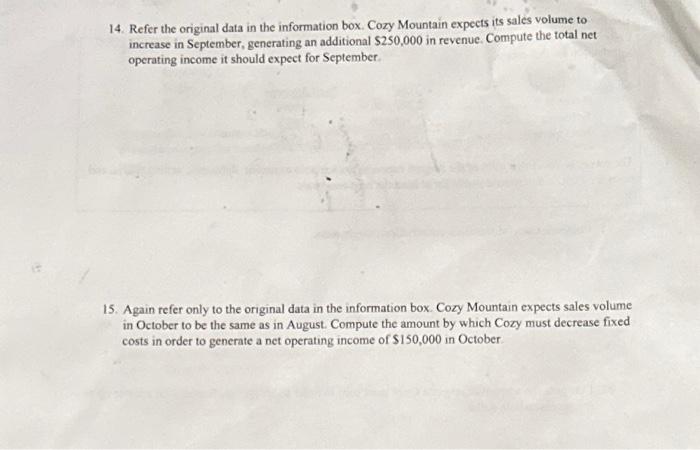

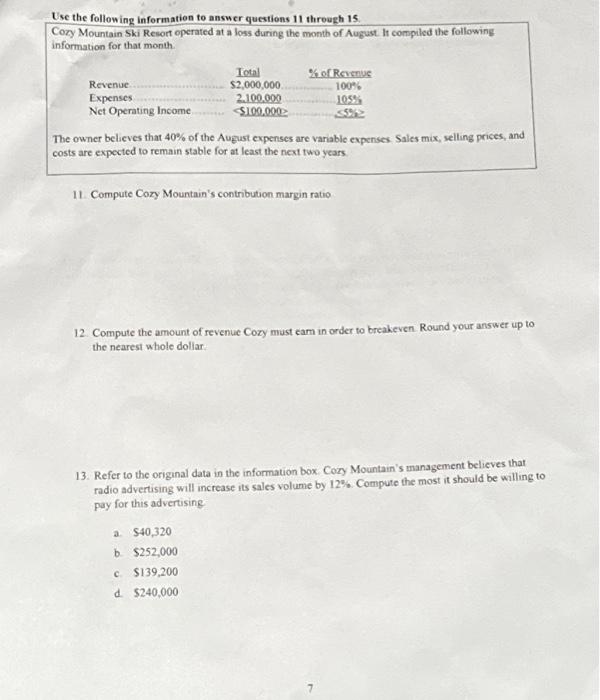

Use the following information to answer questions 1 through 5. Jump Technology uses an operational excellence strategy and manufactures inexpensive tablet computers. Its inventory policy requires that it hold zero inventory at the end of each month. Annual financial data follows. 1. Compute the total cost of goods sold that will appear on Jump's gross margin format income statement. 2. Compute the total contribution margin that will appear on Jump's contribution margin format income statement. 3. Compute the number of tabiets Jump Tech must produce and sell to generate a profit of $720,000 a. 5,379 tablets b. 6,051 tablets c. 11,429 tablets d. 10,000 tablets 4. Jump Tech believes that demand for its product will increase to 12,000 units next year Compute Jump's net operating income when the number of units produced and sold is 12,000 5. Jump's corporate income tax rate is 40%. Compute the number of tablets that must be produced and sold in order to generate an after-tax profit of $30,000. Use the following information to answer questions 6 through 10. Tax Masters, Ine. reported the following information about the cost of its tax preparation business for the first half of the year 6 Use the high-low method to estimate the variable cost per tax return a. $32.00 per return b. $4828 per return c $65.00 per return d. $40.00 per return 7. Use the high-low method to estimate the fixed cost component of tax preparation cost. 8. Use the high-low method to estimate tax preparation cost for a quarter in which 35,000 tax returns are expected. 9. Tax Master's new tax intern used Excel's regression function and the monthly data shown above to produce the following estimates: Assume that Tax Masters charges $100 per return to prepare a return. Use the regression results above to compute the number of tax returns that Tax Masters must prepare in a month to break even. 10. Tax Master's new intern has been running some data and presents the following regression results below, using Number of Hours Worked as the activity driver. She believes this model is better for predicting Total Preparation Costs in the future than the model used in the prior question. Do you agree or disagree, and why? a. Agree-lower vanable cost per unit b. Disagree - higher total fixed cost c. Agree-lower R-squared value d. Disagree - lower R-squared value 14. Refer the original data in the information box. Cozy Mountain expects its sales volume to increase in September, generating an additional $250,000 in revenue. Compute the total net operating income it should expect for September. 15. Again refer only to the original data in the information box. Cozy Mountain expects sales volume in October to be the same as in August. Compute the amount by which Cozy must decrease fixed costs in order to generate a net operating income of $150,000 in October. Use the following information to answer questions 11 through 15. Cozy Mountain Ski Resort operated at a loss during the month of August It compiled the following information for that month. The owner believes that 40% of the August expenses are variable expenses. Sales mix, selling prices, and costs are expected to remain stable for at least the next two years 11. Compute Cory Mountain's contribution margin ratio 12. Compute the amount of revenue Cozy must eam in order to breakeven. Round your answer up to the nearest whole dollar: 13. Refer to the original data in the information box. Cory Mountain's management believes that radio advertising will increase its sales volume by 12%. Compute the most it should be willing to pay for this advertising a. $40,320 b. $252,000 c. $139,200 d. $240,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started