Answered step by step

Verified Expert Solution

Question

1 Approved Answer

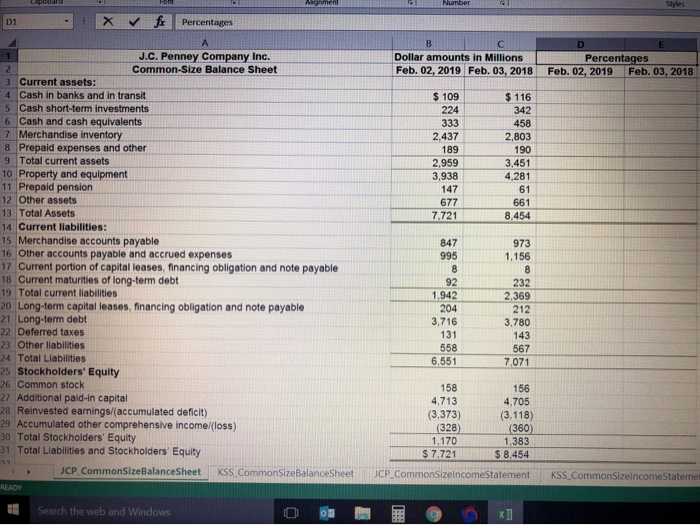

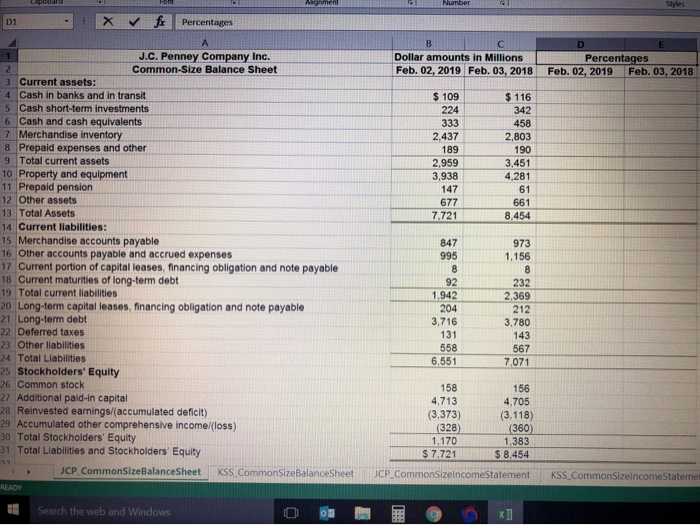

need to show work on these D1 - X V for Percentages Dollar amounts in Millions Feb. 02, 2019 Feb. 03, 2018 Percentages Feb. 02,

need to show work on these

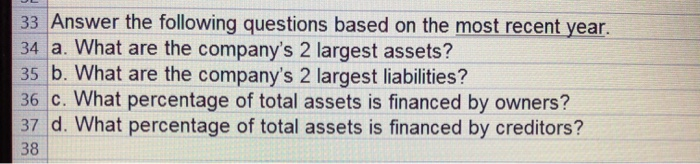

D1 - X V for Percentages Dollar amounts in Millions Feb. 02, 2019 Feb. 03, 2018 Percentages Feb. 02, 2019 Feb. 03, 2018 $ 109 224 333 2.437 189 2,959 3,938 147 677 7.721 $ 116 342 458 2.803 190 3,451 4,281 61 661 8,454 847 995 973 1,156 J.C. Penney Company Inc. Common Size Balance Sheet 3 Current assets: 4 Cash in banks and in transit 5 Cash short-term investments 6 Cash and cash equivalents 7 Merchandise inventory 8 Prepaid expenses and other 9 Total current assets 10 Property and equipment 11 Prepaid pension 12 Other assets 13 Total Assets 14 Current liabilities: 15 Merchandise accounts payable 16 Other accounts payable and accrued expenses 17 Current portion of capital leases, financing obligation and note payable 18 Current maturities of long-term debt 19 Total current liabilities 20 Long-term capital leases, financing obligation and note payable Long-term debt Deferred taxes Other liabilities Total Liabilities Stockholders' Equity Common stock Additional paid-in capital Reinvested earnings/(accumulated deficit) Accumulated other comprehensive income/loss) Total Stockholders' Equity Total Liabilities and Stockholders' Equity JCP CommonSizeBalanceSheet KSS CommonSizeBalanceSheet 92 232 2,369 212 3.780 1.942 204 3,716 131 558 6.551 143 567 7,071 158 156 4,713 4.705 (3,373) (3.118) (328) (360) 1.170 1.383 $ 7.721 $ 8,454 CP CommonSizeincomeStatement KSS CommonsizeIncome Stateme Search the web and Windows O 03 33 Answer the following questions based on the most recent year. 34 a. What are the company's 2 largest assets? 35 b. What are the company's 2 largest liabilities? 36 c. What percentage of total assets is financed by owners? 37 d. What percentage of total assets is financed by creditors? 38

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started