Question

Need to Solve Requirements 1 - 7 ordered by date similar to this format below : Requirements The accounts used by the business are provided

Need to Solve Requirements 1 - 7 ordered by date similar to this format below :

Requirements

The accounts used by the business are provided in the Chart of Accounts (click on "Chart of Accounts" to view.)

1. Record each January transaction in the journal. Explanations are not required.

2. Review each of the accounts in the ledger to see the results of posting the journal entries, including the changes in each account as well as the unadjusted balance. (Click on "General Ledger" to view.)

3. Review the unadjusted trial balance as of January 31, 2015. Note: This is an unadjusted trial balance since the adjusting entries have not yet been prepared and posted. (Click on "Trial Balance" to view.)

4. Journalize the adjusting entries. Explanations are not required.

5. Review each of the accounts in the ledger to see the results of posting the adjusting entries, including the changes in each account as well as the adjusted balance. (Click on "General Ledger" to view.)

6. Review the adjusted trial balance as of January 31, 2015. Note: This is an adjusted trial balance since the adjusting entries have been prepared and posted. (Click on "Trial Balance" to view.)

7. Review the income statement for the month ended January 31, 2015 (click on "Income Statement" to view) and the classified balance sheet on January 31, 2015 (click on "Balance Sheet" to view).

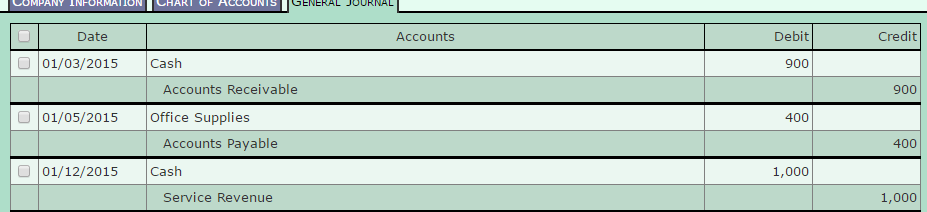

01/03/2015

Collected $900 cash from customer on account.

01/05/2015

Purchased office supplies on account, $400.

01/12/2015

Performed delivery services for a customer and received $1,000 cash.

01/15/2015

Paid employee salary including the amount owed on December 31, $1,500.

01/18/2015

Performed delivery services on account, $750.

01/20/2015

Paid $300 on account.

01/24/2015

Purchased fuel for the truck, paying $150 cash.

01/27/2015

Completed the remaining work due for Unearned Revenue. (Go to Bottom of page for this info)

01/28/2015

Paid office rent, $600, for the month of January.

01/30/2015

Collected $1,200 in advance for delivery service to be performed later.

01/31/2015

Cash dividends of $1,000 were paid to stockholders.

Background:

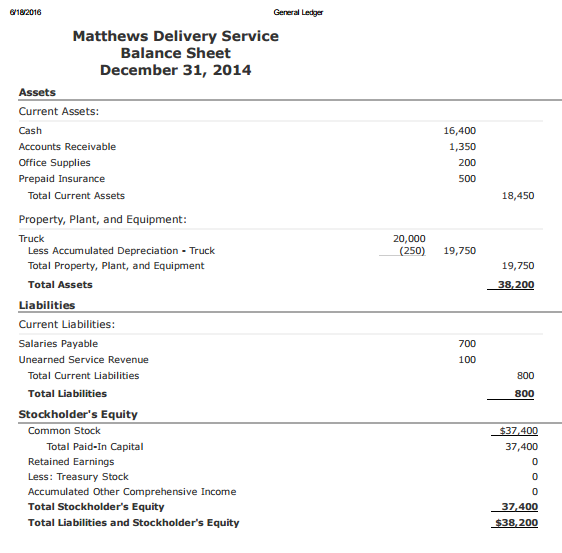

Matthews Delivery Service has completed closing entries and the accounting cycle for 2014. The business is now ready to record January 2015 transactions.

Adjustment data:

a. Office Supplies on hand, $80.

b. Accrued Service Revenue, $1,000.

c. Accrued Salaries Expense, $850.

d. Prepaid Insurance for the month has expired. On December 1, Matthews paid $600 cash for a 6-month insurance policy. The policy began December 1. On December 31, Matthews recorded $100 as an expense for the expiration of this prepaid insurance for the month of December.

e. Depreciation was recorded on the truck for the month. On December 1, Matthews received a truck with a fair value of $20,000 from Robert Matthews. On December 31, Matthews recorded $250 as an expense for the month of December for depreciation on the truck using the straight-line method, a useful life of 5 years, and a salvage value of $5,000.

Assignment:

This question has 7 requirements. Scroll down to review the requirements and ensure you complete all requirements before submitting your work for grading.

01/27/2015

Completed the remaining work due for Unearned Revenue. Information below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started