Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need to solve this question with respect to years comparison with the help o line chart Net Sales Net Profit Account Receivables/ Trade Debts (current

need to solve this question

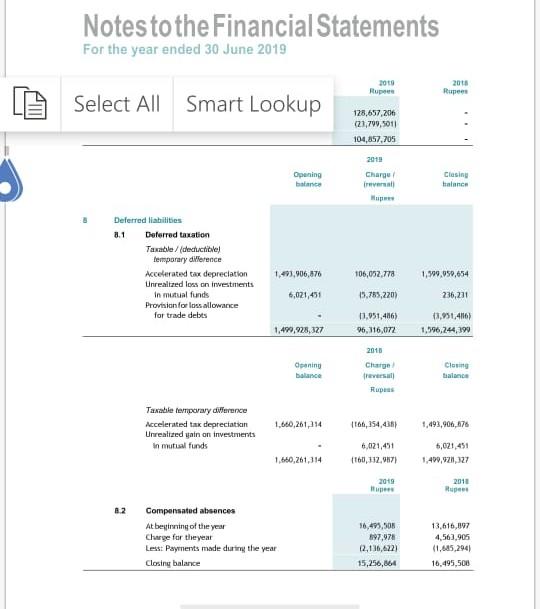

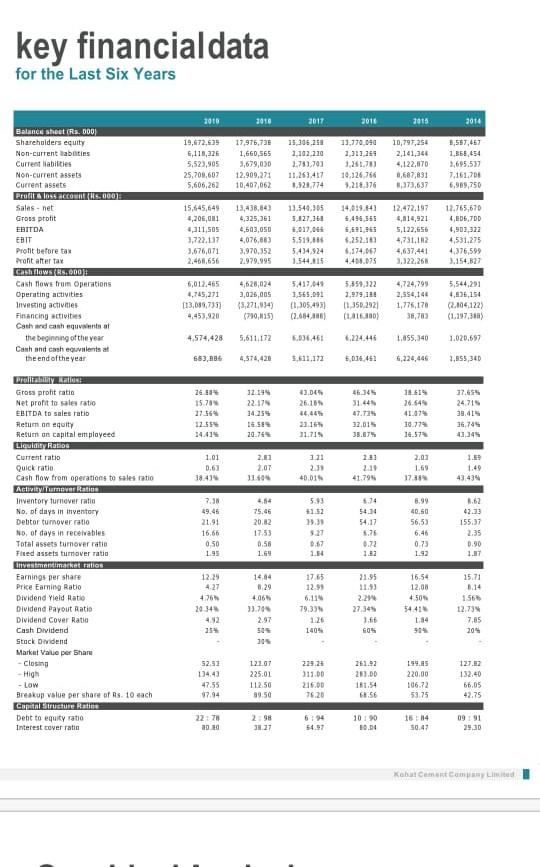

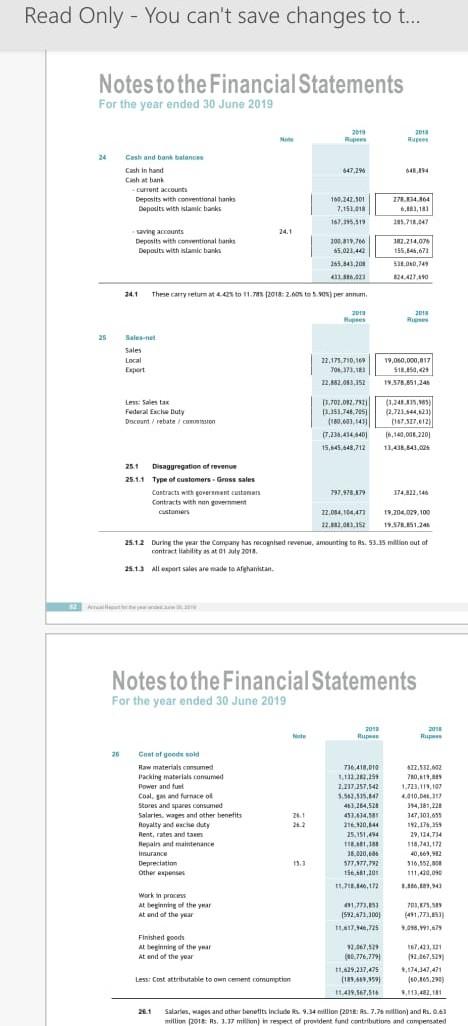

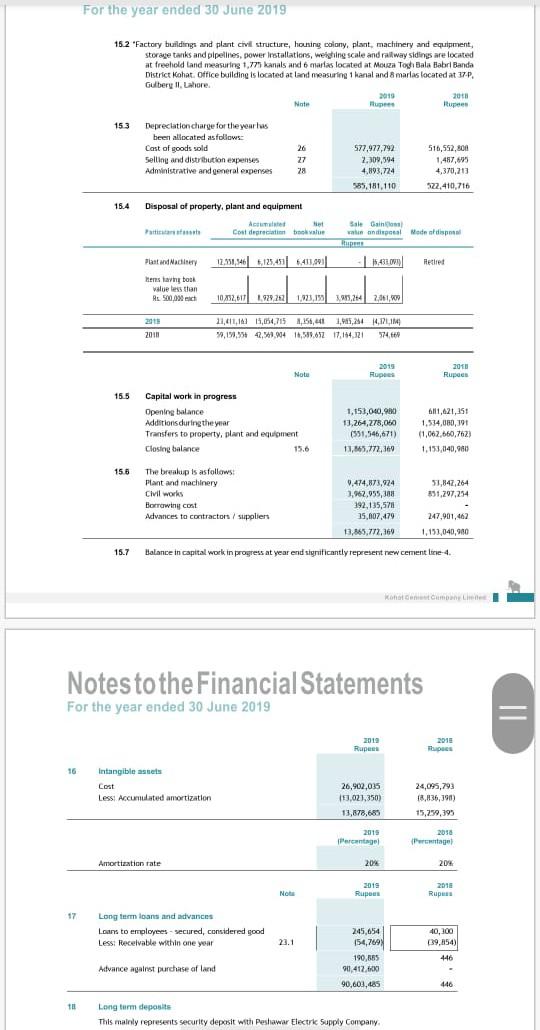

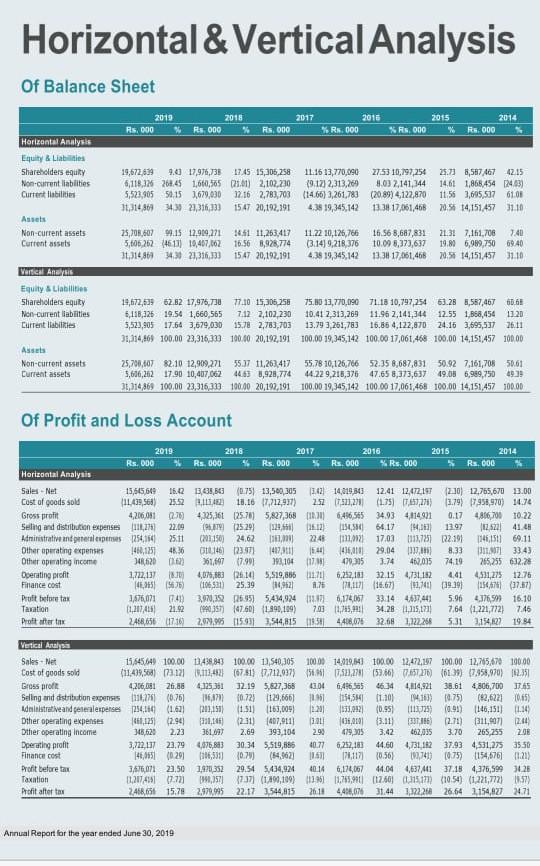

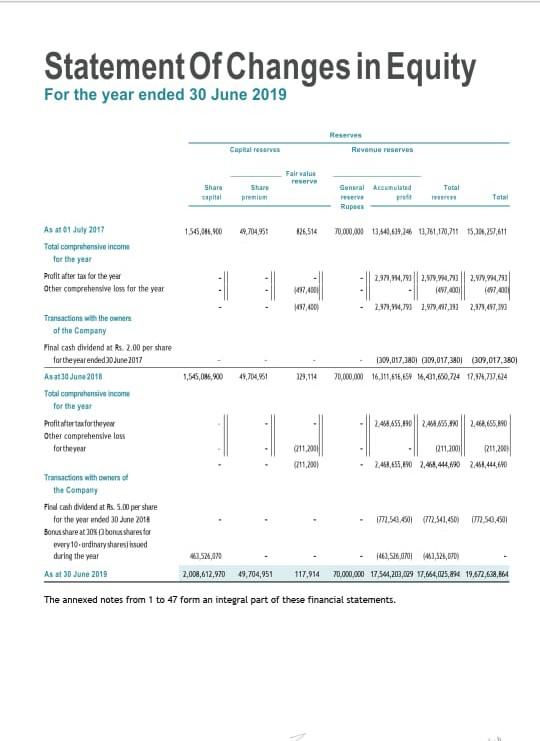

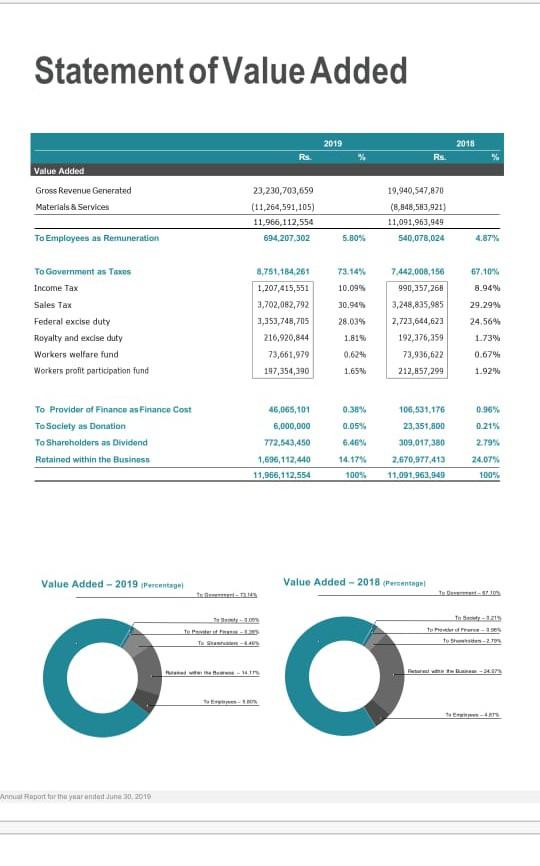

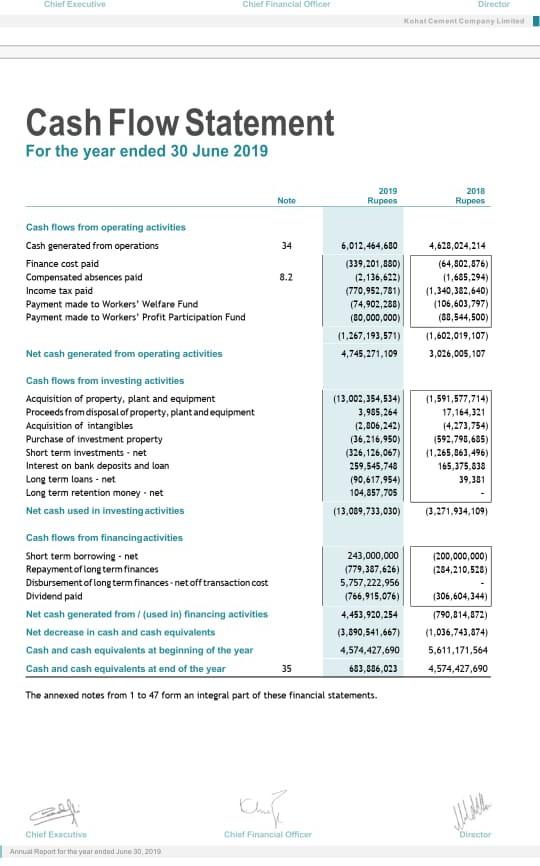

with respect to years comparison with the help o line chart Net Sales Net Profit Account Receivables/ Trade Debts (current assets) / Trade Receivables >Short term Investments Current Assets Current Liabilities Property plant and Equipment > Long term loans/Long term Financing > Account payable/ Trade Payable Authorized Shares Capital > Issued, subscribed and paid-up Capital >Reserves > Owner Equity Total Assets Total Liabilities Net Cash from Operating activities Net Cash from Investing activities Net Cash from Financing activities of line chart. Account Receivable Turnover Ratio Average Collection period in days Current Ratio >Assets Turn Over Ratio Debt to Assets Ratio Earnings per share Book Value per Share Notes to the Financial Statements For the year ended 30 June 2019 Rupees Am Select All Smart Lookup 128,657,206 (21,790,5011 104,857,705 2013 Charge reversal Wipes Opening hatan Closing balance Deferred liabilities 8.1 Deferred taxation Table/ (decucitle) temporary derence Accelerated tax depreciation Unrealted loss on investments In mutual funds Provision for loss allowance for trade debts 1,401,906,876 106,052.778 1,599,050,654 6,021,451 15.783,220) 236,271 1,490,928,327 11.951,486) 96,116,072 13,951,4116) 1,596,244,390 2013 Clarge Opening balance Closing talace Rupes Taxable temporary difference Accelerated tak depreciation Unrealized yain on investments in mutual funds 1,660,261,114 1166,254,438) 1,493.906,875 6,021,451 (160), 12.957) 1,021,451 1,400,921, 127 1,660,261,314 2019 2011 Rupee 8.2 Compensated absences At being of the year Charge for the year Less: Payments made during the year Closiny balance 16,495,500 897,978 12,136,422) 15,256,866 13,616,897 4,563,905 (1,685,294) 16,495,500 key financialdata for the Last Six Years 2010 2016 2017 2011 2018 2014 19,672,635 6,118,326 5,523,905 25,209,607 5,606,262 17.976,70 1,660,565 3,679,030 12,909,271 10,407,062 15,306,250 2.102.210 2.731,701 11.263.417 20.774 11,170.090 2,313,255 1,281.711 10.126.766 1.214,376 10,797,254 2,141.341 4,122,170 0,687,831 1,373,637 1,557,457 1,855,454 2,695.537 7.161,701 6,989,750 Balance sheet (f. 000 Shareholders equity Non-current labaitis Current liabilities Non-current assets Current assets Profile Secco S000 Salas - net Gross profit EBITDA EBIT Profit before tas Profit after tax Cashflows Rs.000) Cash flows from Operations Operating activities Investing activities Financing activities Cash and casheuvent at the beginning of the year Cash and cash events at the end of the year 15,645,649 4,206,081 4,311,SOS 3,722.137 3,676,071 2.468,656 13,438,64) 4,325,261 4,503,050 4,076,683 3,970,352 2.979.995 11.540,305 5,127.361 1,017.04 5.519.116 5,434,924 14.09.04) $494.555 5,591.965 6.252.16 6.174.067 4.431.05 12,472,197 4,614,921 5,122.656 4,731,182 4,637.441 3.122.26 12.765,670 4,605,70D 4,903,322 4,531,275 4.376,599 3.154,327 4,628,024 3,026,005 6,012,465 4.745,271 113,089,7351 4,453,920 5.417.041 1,555.01 1.105.493) (2.654 486) 5,359,322 2.979.111 11.350.2021 (1.01300) 4,724,799 2,554,140 1,776,170 5,544,291 4,636,154 (2.104.122) (790,815) 4.574,428 5,611.172 5,036461 4.224.446 1.855.340 1.020.697 653,086 4,574,420 3,611.172 5,0.34.451 6,224,445 2,855,34D 12.15 22.179 14.255 4) DEN 26.169 11619 26.54 15.78 17.564 12.559 2016 11.IS 31.449 47.7 32.015 33.875 24715 39.405 36,745 43.345 20.75 10.774 16.574 111 1.01 0.67 2.1 2.07 31.504 1.31 2.11 2.03 1.69 17.30 40.01 1.49 43434 6.74 54.34 7.38 49.46 21.91 16.66 0.50 1.95 . TILFE Gross proht ratio Net profit to saler ratio EBITDA to sales ratio Return on quity Return on capital employeed Liquidation Current ratio Quick ratio Cash flow from operations to sales ratio Activity Turnover Rain Inventory turnover ratio No. of days in thventory Debtor turnover ratio No. of days in receivables Total assets turnover ratin Fixed assets tumover ratio Investmentmarket ratios Earnings per share Price Earning Ratio Dividend Yield Ratio Dividend Payout Ratio Dividend Cover Ratio Cash Dividend Stock Dividend Market Value per Share - Closing High - Low Breakup value per share of Rs. 10 each Contructure Debt to equity ratio Interest cover ratin 4.14 75.46 20.82 17.53 0.56 1.64 6.76 8.99 40.50 56.53 6.46 0.73 1.92 42.33 155.37 2.35 0.90 1.17 1.42 17.5 16.54 12.29 4.27 4.76 2014 0.29 11.93 2.21 27.345 12.00 4.50 15.71 1.14 1561 12.73 7.85 204 33.700 2.97 79,33 1.84 1409 GOS 105 52.53 124.43 47.55 121.07 225.01 112.50 89.50 229.24 311.00 216.00 76.20 261.92 20.00 181.54 19.15 220,00 106.72 59.75 127.2 132.40 66.05 42.75 298 6:14 10 190 22.78 2010 16:14 50.47 09191 2930 3.27 Kabutment Comme Read Only - You can't save changes to t... Notes to the Financial Statements For the year ended 30 June 2019 2018 2018 647.24 Cash and band balance Cash in hand Cihat bant current accounts Deposits with conventional tanks Deposits with Islamic banks 100.242.101 7.5. 2746 6,112,181 20171,041 157,115,519 24.1 saving amounts Deposits with conventional trans Deposits with islamic banks 100,310.00 $5,0234 351843.00 107,214,076 155, 145,621 . an 124.411.40 341 These can returato 11.783 2018-2.sto.) 2013 2018 25 Sales Sales Local 12.171.710,10 To 23 12.12.03.152 19,000,000,017 1.000.000,017 S11.50,21 11.378,851.241 Le Sales tax Federal Esche Duty Decount/rebate cu 11.02.02 12.151.745.7057 (180,001,1437 17.234,414.5401 15.145.648,712 (1.241.119,1893 2.723.944,023 107.317.612) 1,140,0012201 11. L 54, 25.1 Disaggregation of revenge 25.1.1 Type of customers. Gross sales Contract with great Contracts with grunt customer 797.28.179 IT4 2.140 22.014.184,471 12.12.03.15 19.204.029,100 19.371.551 208 25.12 Burn the year the correany has recognised revenue, mounting to Rs. 53.15 minuta contractability at 01 sty 2018 25.1. All export sales are made to Afghanistan Notes to the Financial Statements For the year onded 30 June 2019 2013 2018 26 Coff yold Raw materials comune Packing materials con Power and tu and furnace 26.1 22 Stores and pares comuned Salaries wages and other benefits Royalty and enche duty Tentand tem Hepaintenance surance Depreciatim other expenset 736,418,00 10,29 2.217.257,542 3.512,335,147 403.184,521 457.614101 1140,141 25.151.494 1,181 16.000,00 5777, 1,1,200 112.12.03 70,11,1 1.723,119,103 4.410.04.17 314,181,220 147, 101.699 192,174, 155 29, 114,714 118,741,17 40,663,912 316.152.000 111,400,00 1.100,00 13.3 1.1.140,172 Work in process At beginning of the year At end of the year 01.173.131 (592471,3001 17.146,725 O, 4491,771,331 1.098,191,79 Finished goods Albeginning of the year At end of the year 192.167,579 92.067, 106.776,7701 119.237,475 ( (129,511.1991 11.419.167.816 1.174,141,471 (10.109,290) Less Coast attributable to own cement comunition 9,113,111 211 Salaries, wage and other benefits indulo R1.34 million 2018: 7.7 million and Rs.0.1 million 2013 H. 3.17 million in resect of provident funt contribution and compensated For the year ended 30 June 2019 15.2 "Factory buildings and plant civil structure, housing colony, plant, machinery and equipment, storage tanks and pipelines, power Installations, weighing scale and railway sidings are located at freehold land measuring 1.77 kanals and 6 marlas located at Mouza Toch Bala Babri Banda District Kohat office building is located at land measuring 1 kanal and 8 marlas located at 37p. Gubery II, Lahore 2018 Note Rupee 2019 153 Depreciation charge for the year las been allocated as follows Cast of goods sold Selling and distribution expenses Administrative and general expenses 26 27 28 577,977,792 2,309,394 4.893.724 516,552,800 1,487,675 4,370,213 122,410,716 585,181,110 15.4 Disposal of property, plant and equipment A Net Path Cost depressie Sale Gain walional Modeli LE Fast and Nadine 12,081,546 6,125,41 641,901|| 116.410 letlet ens havnost value less than Rs.500,00 1092,611 1.929,20 1,223,1 3,24 2,061, 2015 20111 11,41,14 1,654,715 4,156,441 1,45,2 14,17,18 9,19,95 42.59.904 14,590.697 17,164,321 574. Notu Rupees 2010 Rupees 15.5 Capital work in progress Opening balance Additions during the year Transfers to property, plant and equipment Closing balance 15.6 1,153,040,980 13,264,278,000 (531,546,671) 13,565,772,360 6111,421,35 1,534,080,191 (1,062,660,762) 1,153,040,980 15.6 The breakup is as follows: Plant and machinery Civil works 51,847,264 831,207,254 Borrowing con 9.474 873.924 1,962,055, 392,135,578 35,007,479 13,865,772,369 Advances to contractors / suppliers 247,901,462 1,151,040,900 15.7 Balance in capital work in progress at year end significantly represent new cement line 4 Kontman Notes to the Financial Statements For the year ended 30 June 2019 2019 Rupees 2018 Tu OS Intangible et Cost Less Accumulated amortization 26,902,035 24,095,793 18,836, 1961) 113,021.350) 13,878,685 15,259,395 2015 Percentage 2030 Pentage Amortization rate 20% 204 NO 2019 Rupes 2018 Rupes 17 Long term loans and advances Loans to employees - secured, considered good Less Receivable within one year 40,100 139,054) 22.1 245,654 154,7098 190,585 90,412.000 90,601,185 446 Advance against purchase af land 440 TIL Long term deposits This mainly represents security deposit with Peshawar Electric Supply Company Horizontal & Vertical Analysis Of Balance Sheet 2017 2019 2018 Rs.000 % Rs.000 % Rs.000 2016 Rs.000 2015 XRs.000 % 2014 Rs.000 Horizontal Analysis Equity & Liabilities Shareholders equity Non-current liabilities Current liabilities 19,672,839 9.0 17,976,735 1745 15,306,258 111613,770,090 27:53 10,197,254 6,118,13 268.45 1,660,565 21:01) 2,102,230 (9.12) 2,313,269 8.03 2,141,344 5,523,905 5115 3.679,030 12.16 2,783,703 (1466) 3,261,783 (2089) 4122,870 11,314869 340 21,316,33 1547 20,192,191 4.38 19,345,142 1334 17,061,466 25.73 6,587467 42.15 14.61 1,868,454 2463) 11.55 3,695,517 61.08 20.56 14,151,457 31.10 Non-current assets Current assets 25,708,607 99.15 12.99,2711651 11,263,417 5,605,202 4611) 19,407,602 16.568,928,774 11,314861 34.) 21,315,333 1547 20,192,191 11.22 10,125,766 (3.14) 9,218,376 439 19,345,142 16.56 8,687,831 10.09 8,373,637 1334 17,061,468 21.3! 7,161,700 240 19.89 6,989,750 6940 20.56 14,151,457 31.10 Vertical Anar Equity & Liabilities Shareholders equity Non-current liabilities Current liabilities 19,672,533 52 82 17,976,734 7710 15,305 256 75.00 11,770.090 71.18 10,797,254 63.28 8,587,467 0.61 6,188,125 19.54 1,660,565 742 2,102,230 10.41 2,313,269 11.96 2,141,344 12.55 1,668,454 13.20 5,523,905 17.54 3,679,030 15.78 2,783,703 13.79 3,261,783 16.66 4,122,870 24.16 3,595,537 26.11 31,314,69 100,00 23,316, 3100.00 20,192,191 100,00 19,345,142 100.00 17,061,468 100.00 14,151,457 100,00 Assets Non-current assets Current assets 25,700,00782.10 12,909,271 55.37 11,262 417 55.78 10,126,766 52.35 8,687,831 50.92 7,161,708 50.61 5,606,262 17.90 10,407,062 4663 3,928,774 44.229,216,376 47.65 8,373,637 49.08 6,989,750 30.114,369 100,00 23,316.20 100.00 20,192,191 100.00 19,345,142 100.00 17,061,468 100.00 14,151,457 100.00 Of Profit and Loss Account 2019 2018 2017 2016 2015 2014 Rs. DOO Rs.000 Rs.000 Rs.000 % Rs. 000 Rs.000 Horizontal Analysis Sales-Net 15,5656 16.2 1,035,50 (0.751 13,500,305 11.421 14,019 343 12.41 12,472,197 (210) 12,765,670 13.00 Cost of goods sold (11.439,568) 25.52 11.12 18.16 17.712,937) 257 (7.921,221 (175) (7,57,171) 3.79) 17,953,970) 10.4 Gross profit 4,206,081 4,125,36 (2578) 5827,368 12.) 6,436,565 34.93 4114921 0.17 4866701 10.22 Seling and distribution expenses (11,271 22.09 CT 125.291 20,451 (112) 1154,50 64.17 H.142 1397 112527 41.4 Administrative and prepares 254,154 25.11 (2021150) 24,62 11,00 2241 m. 17.03 1117,751 122.19) 14,151) 69.11 Other operating expenses 480,135) 46.36 C146) 123.971 1417 541 1415,000 29.04 337,5 8.33 11.00TL 33.43 Other operating income 348 620 012 361,697 7.901 293.1047 479,315 3.74 462.015 74.19 265,255 632.28 Operating profit 1,122,131.0 4,07,183 26.105,519,866 11:11 6,292,181 32.154,731112 4.41 4511,275 12.76 Finance cost 141.8159675 (106511) 25.39 3,92 1.76 (14.67) 12,70 (39.391 156) (07.07) Pruit before tax 1,876,071 17:41 3,970,292 595) 5,434,924 1.176,174057 33.14 467,411 5.96 4376,50)16.10 Taxation (1,217,415 21.92 (940,357) 14760) 1898,109) 7.03 11,715,00 34.28 1,115,1221 7.64 (1,221,772) 7.45 Profit after mx 2.468,656716 2.02,95 15337,544,815 18:54 4408,076 32.68 1122268 5.31 2,154,127 19.84 Vertical Araba Sales Net 15.845,649 100.00 11.438.843 100.00 11.540.305 1000 14,019,14 100.00 12,472,47 100.00 12.715,670 100.00 Cost of goods sold (11.433,508 ma 121 13,412 (07.813 17.712.937) 151.351 2353.66) 07.07.2013 17,953,970) 12,351 Gross profit 4,206,081 26.86 4125381 32.19 5,827,366 13.04 6,496,565 46.34 4,114,921 38.61 4306,700 1765 Seling and distribution expenses 116176 (0.76) 1,471 10.723 1129,666) 11 115451 11.10) 144.183) (075) (82,6221 015) Administrative and elepeses 254,114 (1.021 1211,151) 1.51) 163,009) 1201 133,012 (0.95) 1113025) (091) 1146,151) 1.34 Other operating expenses 11,125) 2.94 314 (231) 407,911) 2011 01.0101 (3.11) 337,186 12.71) 311,907 2.41 Other operating income 346.622 2.23 361,097 2.69 393,104 290 19,305 3.42 462,035 3.70 265,255 20 Dperating profit 3,122,17 23.79 4,976,883 30.34 5,519,886 40.77 6.252,183 44.60 4,731, 132 37.934,531,275 35.50 Finance cost 46,8951 (0.291 106,538 10.79 (54,362) 11611 174,117 10.56) 199,741) (075) (154,676) 11:21) Profit before tax 3,676,071 23,50 1,971,352 29.54 5.434,924 40.14 6,174,067 44.04 4,637,401 37.13 4,375,5993425 Taxation 11,207,4557.721 10,3571 27.37) (129,109) 1961 11,745,940 17:56 15:17 10:54) (1.221,772) 1957) Profit after to 2418,6 15,782,979,995 22.17 0,544,815 26.11 4,486,07 31.44 122,268 26.64 2,154,827 24.71 Annual Report for the year ended June 30, 2019 Statement Of Changes in Equity For the year ended 30 June 2019 Reserve Ravne reserves Capitals Fair value rever Share Stuar Total Tail Rupes 1545,46,KO 26.514 70.000,00 13,541,639,146 13,761,170,711 15,24,257,611 As a 01 July 2017 Total comprensivo income Profit after tax for the year other comprehensive loss for the year 2,371,71,79 2:57.7H, 713 ow.co01 2.871,9,19 7,979,2017,211 2.11.971 (07.2011 17,400 2,179,497,21 (309,017,380) 209,017,380 (309,017,380) 70,000.00 16,311,576,65 14,41,400,724 17,994,737,624 1,545,0M, 200 49,714.951 123,114 Transactions with the owners of the Company Final cash dividend at Rs 2.00 per share for the year ended June 2017 Asa 30 June 2011 Total comprehensive income for the year Profferta forte Other comprehensive loss for the 2.4.655,190 | 2.495,3 2.462,655,290 Q11.2001 1211.2001 211.2001 2,44,455,140 2,464,444.10 2,461,444.440 211,2) 771,544501772,541,450) 772 50,4901 Transactions within the Company Final cu dividend at Rs.5.00 per shume for the year anded 30 June 2014 Bona share at 30bonusshares for wery 10. urdinary shares ond during the year As at 30 June 2019 1463,574.00 1,524,07) 2,008,612,970 49,704,951 117,914 70.000.000 1754,203,2% 7,056.005,234 19.672,638,864 The annexed notes from 1 to 47 form an integral part of these financial statements. Statement of Value Added 2019 2018 Rs. R. Value Added Gross Revenue Generated Materials & Service 23,230,703,659 (11,264,591,105) 11,966,112,554 694,207.302 19,940,547,870 (8,848,553,921) 11,091,963,949 540,078,024 To Employees as Remuneration 5-80% 4.87% 73.14% 57.10% 8.94% To Government as Taxes Income Tax Sales Tax Federal excise duty Royalty and excise duty Workers welfare fund Workers profit participation fund 8,751.184.261 1,207,415,551 3,702,082,792 3,353,748,705 216,920,844 73,661,979 197,354,390 10.09% 30.94% 28.03% 1.819 7.442.008,156 990,357,268 3,248,835,985 7,723,644,621 192,376,359 73,936,622 212,857,299 29.299 24.56% 1.73% 0.67% 1.92% 1.65% 0.95% 46,065,101 6,000,000 To Provider of Finance as Finance Cost To Society as Donation To Shareholders as Dividend Ratained within the Business 772,543,450 1,696,112,440 11,966,112,554 0.38% 0.05% 6.464 14.17% 100% 106,531,176 23,351,800 309,017,380 2.670,977,413 11,091,963,949 0.21% 2.79% 24.07% 100% Value Added - 2019 Pertapal Value Added - 2018 To 12 Annual Report the yarn 2010 Chief Executive Chief Financial oricot Director Kohatenet Company Limited Cash Flow Statement For the year ended 30 June 2019 Note 2019 Rupees 2018 Rupons 34 Cash flows from operating activities Cash generated from operations Finance cost paid Compensated absences paid Income tax paid Payment made to Workers' Welfare Fund Payment made to Workers' Profit Participation Fund 3.2 6,012,464,630 (339,201,880) 12,136,622) (770,952.781) (74,902,288) (80,000,000) (1.267,193,571) 4,628,024,214 (64,802,876) 11,685,294) (1.340,382,640) (106,603 797) (88,544,500 11,602,019,107) 3,026,005, 107 4,745,271,109 Net cash generated from operating activities Cash fiows from investing activities Acquisition of property, plant and equipment Proceeds from disposal of property, plant and equipment Acquisition of intangibles Purchase of investment property Short term investments.net Interest on bank deposits and loan Long term loans - net Long term retention money.net Net cash used in investing activities (13,002,354,534) 3,985,264 (2,806,242) (36,216,950) (326,126,067) 259,545,748 (90,617,954) 104,857,705 11,591,577,714) 17,164,321 14,273,754) (592.790,685) 11.265,863,496) 165,375.839 39,301 (13,089.733,030) (3.271.934,109) (200,000,000) (284,210,528) Cash flows from financing activities Short term borrowing.net 243,000,000 Repayment of long term finances 1779,387,626) Disbursement of long term finances-net off transaction cost 5,757,222,956 Dividend paid (766,915,076) Net cash generated from / (used in) financing activities 4,453,920,254 Net decrease in cash and cash equivalents (3,890,541.667) Cast and cash equivalents at beginning of the year 4,574,427,690 Cash and cash equivalents at end of the year 35 683,806,023 The annexed notes from 1 to 47 form an integral part of these financial statements. (306,604,344) 1790,814,872) (1,036,743,874) 5,611,171,564 4.574.427,690 thing Chlut Financial Officer Dructor Chief Executive Annual Report for the year anded June 30, 2019 with respect to years comparison with the help o line chart Net Sales Net Profit Account Receivables/ Trade Debts (current assets) / Trade Receivables >Short term Investments Current Assets Current Liabilities Property plant and Equipment > Long term loans/Long term Financing > Account payable/ Trade Payable Authorized Shares Capital > Issued, subscribed and paid-up Capital >Reserves > Owner Equity Total Assets Total Liabilities Net Cash from Operating activities Net Cash from Investing activities Net Cash from Financing activities of line chart. Account Receivable Turnover Ratio Average Collection period in days Current Ratio >Assets Turn Over Ratio Debt to Assets Ratio Earnings per share Book Value per Share Notes to the Financial Statements For the year ended 30 June 2019 Rupees Am Select All Smart Lookup 128,657,206 (21,790,5011 104,857,705 2013 Charge reversal Wipes Opening hatan Closing balance Deferred liabilities 8.1 Deferred taxation Table/ (decucitle) temporary derence Accelerated tax depreciation Unrealted loss on investments In mutual funds Provision for loss allowance for trade debts 1,401,906,876 106,052.778 1,599,050,654 6,021,451 15.783,220) 236,271 1,490,928,327 11.951,486) 96,116,072 13,951,4116) 1,596,244,390 2013 Clarge Opening balance Closing talace Rupes Taxable temporary difference Accelerated tak depreciation Unrealized yain on investments in mutual funds 1,660,261,114 1166,254,438) 1,493.906,875 6,021,451 (160), 12.957) 1,021,451 1,400,921, 127 1,660,261,314 2019 2011 Rupee 8.2 Compensated absences At being of the year Charge for the year Less: Payments made during the year Closiny balance 16,495,500 897,978 12,136,422) 15,256,866 13,616,897 4,563,905 (1,685,294) 16,495,500 key financialdata for the Last Six Years 2010 2016 2017 2011 2018 2014 19,672,635 6,118,326 5,523,905 25,209,607 5,606,262 17.976,70 1,660,565 3,679,030 12,909,271 10,407,062 15,306,250 2.102.210 2.731,701 11.263.417 20.774 11,170.090 2,313,255 1,281.711 10.126.766 1.214,376 10,797,254 2,141.341 4,122,170 0,687,831 1,373,637 1,557,457 1,855,454 2,695.537 7.161,701 6,989,750 Balance sheet (f. 000 Shareholders equity Non-current labaitis Current liabilities Non-current assets Current assets Profile Secco S000 Salas - net Gross profit EBITDA EBIT Profit before tas Profit after tax Cashflows Rs.000) Cash flows from Operations Operating activities Investing activities Financing activities Cash and casheuvent at the beginning of the year Cash and cash events at the end of the year 15,645,649 4,206,081 4,311,SOS 3,722.137 3,676,071 2.468,656 13,438,64) 4,325,261 4,503,050 4,076,683 3,970,352 2.979.995 11.540,305 5,127.361 1,017.04 5.519.116 5,434,924 14.09.04) $494.555 5,591.965 6.252.16 6.174.067 4.431.05 12,472,197 4,614,921 5,122.656 4,731,182 4,637.441 3.122.26 12.765,670 4,605,70D 4,903,322 4,531,275 4.376,599 3.154,327 4,628,024 3,026,005 6,012,465 4.745,271 113,089,7351 4,453,920 5.417.041 1,555.01 1.105.493) (2.654 486) 5,359,322 2.979.111 11.350.2021 (1.01300) 4,724,799 2,554,140 1,776,170 5,544,291 4,636,154 (2.104.122) (790,815) 4.574,428 5,611.172 5,036461 4.224.446 1.855.340 1.020.697 653,086 4,574,420 3,611.172 5,0.34.451 6,224,445 2,855,34D 12.15 22.179 14.255 4) DEN 26.169 11619 26.54 15.78 17.564 12.559 2016 11.IS 31.449 47.7 32.015 33.875 24715 39.405 36,745 43.345 20.75 10.774 16.574 111 1.01 0.67 2.1 2.07 31.504 1.31 2.11 2.03 1.69 17.30 40.01 1.49 43434 6.74 54.34 7.38 49.46 21.91 16.66 0.50 1.95 . TILFE Gross proht ratio Net profit to saler ratio EBITDA to sales ratio Return on quity Return on capital employeed Liquidation Current ratio Quick ratio Cash flow from operations to sales ratio Activity Turnover Rain Inventory turnover ratio No. of days in thventory Debtor turnover ratio No. of days in receivables Total assets turnover ratin Fixed assets tumover ratio Investmentmarket ratios Earnings per share Price Earning Ratio Dividend Yield Ratio Dividend Payout Ratio Dividend Cover Ratio Cash Dividend Stock Dividend Market Value per Share - Closing High - Low Breakup value per share of Rs. 10 each Contructure Debt to equity ratio Interest cover ratin 4.14 75.46 20.82 17.53 0.56 1.64 6.76 8.99 40.50 56.53 6.46 0.73 1.92 42.33 155.37 2.35 0.90 1.17 1.42 17.5 16.54 12.29 4.27 4.76 2014 0.29 11.93 2.21 27.345 12.00 4.50 15.71 1.14 1561 12.73 7.85 204 33.700 2.97 79,33 1.84 1409 GOS 105 52.53 124.43 47.55 121.07 225.01 112.50 89.50 229.24 311.00 216.00 76.20 261.92 20.00 181.54 19.15 220,00 106.72 59.75 127.2 132.40 66.05 42.75 298 6:14 10 190 22.78 2010 16:14 50.47 09191 2930 3.27 Kabutment Comme Read Only - You can't save changes to t... Notes to the Financial Statements For the year ended 30 June 2019 2018 2018 647.24 Cash and band balance Cash in hand Cihat bant current accounts Deposits with conventional tanks Deposits with Islamic banks 100.242.101 7.5. 2746 6,112,181 20171,041 157,115,519 24.1 saving amounts Deposits with conventional trans Deposits with islamic banks 100,310.00 $5,0234 351843.00 107,214,076 155, 145,621 . an 124.411.40 341 These can returato 11.783 2018-2.sto.) 2013 2018 25 Sales Sales Local 12.171.710,10 To 23 12.12.03.152 19,000,000,017 1.000.000,017 S11.50,21 11.378,851.241 Le Sales tax Federal Esche Duty Decount/rebate cu 11.02.02 12.151.745.7057 (180,001,1437 17.234,414.5401 15.145.648,712 (1.241.119,1893 2.723.944,023 107.317.612) 1,140,0012201 11. L 54, 25.1 Disaggregation of revenge 25.1.1 Type of customers. Gross sales Contract with great Contracts with grunt customer 797.28.179 IT4 2.140 22.014.184,471 12.12.03.15 19.204.029,100 19.371.551 208 25.12 Burn the year the correany has recognised revenue, mounting to Rs. 53.15 minuta contractability at 01 sty 2018 25.1. All export sales are made to Afghanistan Notes to the Financial Statements For the year onded 30 June 2019 2013 2018 26 Coff yold Raw materials comune Packing materials con Power and tu and furnace 26.1 22 Stores and pares comuned Salaries wages and other benefits Royalty and enche duty Tentand tem Hepaintenance surance Depreciatim other expenset 736,418,00 10,29 2.217.257,542 3.512,335,147 403.184,521 457.614101 1140,141 25.151.494 1,181 16.000,00 5777, 1,1,200 112.12.03 70,11,1 1.723,119,103 4.410.04.17 314,181,220 147, 101.699 192,174, 155 29, 114,714 118,741,17 40,663,912 316.152.000 111,400,00 1.100,00 13.3 1.1.140,172 Work in process At beginning of the year At end of the year 01.173.131 (592471,3001 17.146,725 O, 4491,771,331 1.098,191,79 Finished goods Albeginning of the year At end of the year 192.167,579 92.067, 106.776,7701 119.237,475 ( (129,511.1991 11.419.167.816 1.174,141,471 (10.109,290) Less Coast attributable to own cement comunition 9,113,111 211 Salaries, wage and other benefits indulo R1.34 million 2018: 7.7 million and Rs.0.1 million 2013 H. 3.17 million in resect of provident funt contribution and compensated For the year ended 30 June 2019 15.2 "Factory buildings and plant civil structure, housing colony, plant, machinery and equipment, storage tanks and pipelines, power Installations, weighing scale and railway sidings are located at freehold land measuring 1.77 kanals and 6 marlas located at Mouza Toch Bala Babri Banda District Kohat office building is located at land measuring 1 kanal and 8 marlas located at 37p. Gubery II, Lahore 2018 Note Rupee 2019 153 Depreciation charge for the year las been allocated as follows Cast of goods sold Selling and distribution expenses Administrative and general expenses 26 27 28 577,977,792 2,309,394 4.893.724 516,552,800 1,487,675 4,370,213 122,410,716 585,181,110 15.4 Disposal of property, plant and equipment A Net Path Cost depressie Sale Gain walional Modeli LE Fast and Nadine 12,081,546 6,125,41 641,901|| 116.410 letlet ens havnost value less than Rs.500,00 1092,611 1.929,20 1,223,1 3,24 2,061, 2015 20111 11,41,14 1,654,715 4,156,441 1,45,2 14,17,18 9,19,95 42.59.904 14,590.697 17,164,321 574. Notu Rupees 2010 Rupees 15.5 Capital work in progress Opening balance Additions during the year Transfers to property, plant and equipment Closing balance 15.6 1,153,040,980 13,264,278,000 (531,546,671) 13,565,772,360 6111,421,35 1,534,080,191 (1,062,660,762) 1,153,040,980 15.6 The breakup is as follows: Plant and machinery Civil works 51,847,264 831,207,254 Borrowing con 9.474 873.924 1,962,055, 392,135,578 35,007,479 13,865,772,369 Advances to contractors / suppliers 247,901,462 1,151,040,900 15.7 Balance in capital work in progress at year end significantly represent new cement line 4 Kontman Notes to the Financial Statements For the year ended 30 June 2019 2019 Rupees 2018 Tu OS Intangible et Cost Less Accumulated amortization 26,902,035 24,095,793 18,836, 1961) 113,021.350) 13,878,685 15,259,395 2015 Percentage 2030 Pentage Amortization rate 20% 204 NO 2019 Rupes 2018 Rupes 17 Long term loans and advances Loans to employees - secured, considered good Less Receivable within one year 40,100 139,054) 22.1 245,654 154,7098 190,585 90,412.000 90,601,185 446 Advance against purchase af land 440 TIL Long term deposits This mainly represents security deposit with Peshawar Electric Supply Company Horizontal & Vertical Analysis Of Balance Sheet 2017 2019 2018 Rs.000 % Rs.000 % Rs.000 2016 Rs.000 2015 XRs.000 % 2014 Rs.000 Horizontal Analysis Equity & Liabilities Shareholders equity Non-current liabilities Current liabilities 19,672,839 9.0 17,976,735 1745 15,306,258 111613,770,090 27:53 10,197,254 6,118,13 268.45 1,660,565 21:01) 2,102,230 (9.12) 2,313,269 8.03 2,141,344 5,523,905 5115 3.679,030 12.16 2,783,703 (1466) 3,261,783 (2089) 4122,870 11,314869 340 21,316,33 1547 20,192,191 4.38 19,345,142 1334 17,061,466 25.73 6,587467 42.15 14.61 1,868,454 2463) 11.55 3,695,517 61.08 20.56 14,151,457 31.10 Non-current assets Current assets 25,708,607 99.15 12.99,2711651 11,263,417 5,605,202 4611) 19,407,602 16.568,928,774 11,314861 34.) 21,315,333 1547 20,192,191 11.22 10,125,766 (3.14) 9,218,376 439 19,345,142 16.56 8,687,831 10.09 8,373,637 1334 17,061,468 21.3! 7,161,700 240 19.89 6,989,750 6940 20.56 14,151,457 31.10 Vertical Anar Equity & Liabilities Shareholders equity Non-current liabilities Current liabilities 19,672,533 52 82 17,976,734 7710 15,305 256 75.00 11,770.090 71.18 10,797,254 63.28 8,587,467 0.61 6,188,125 19.54 1,660,565 742 2,102,230 10.41 2,313,269 11.96 2,141,344 12.55 1,668,454 13.20 5,523,905 17.54 3,679,030 15.78 2,783,703 13.79 3,261,783 16.66 4,122,870 24.16 3,595,537 26.11 31,314,69 100,00 23,316, 3100.00 20,192,191 100,00 19,345,142 100.00 17,061,468 100.00 14,151,457 100,00 Assets Non-current assets Current assets 25,700,00782.10 12,909,271 55.37 11,262 417 55.78 10,126,766 52.35 8,687,831 50.92 7,161,708 50.61 5,606,262 17.90 10,407,062 4663 3,928,774 44.229,216,376 47.65 8,373,637 49.08 6,989,750 30.114,369 100,00 23,316.20 100.00 20,192,191 100.00 19,345,142 100.00 17,061,468 100.00 14,151,457 100.00 Of Profit and Loss Account 2019 2018 2017 2016 2015 2014 Rs. DOO Rs.000 Rs.000 Rs.000 % Rs. 000 Rs.000 Horizontal Analysis Sales-Net 15,5656 16.2 1,035,50 (0.751 13,500,305 11.421 14,019 343 12.41 12,472,197 (210) 12,765,670 13.00 Cost of goods sold (11.439,568) 25.52 11.12 18.16 17.712,937) 257 (7.921,221 (175) (7,57,171) 3.79) 17,953,970) 10.4 Gross profit 4,206,081 4,125,36 (2578) 5827,368 12.) 6,436,565 34.93 4114921 0.17 4866701 10.22 Seling and distribution expenses (11,271 22.09 CT 125.291 20,451 (112) 1154,50 64.17 H.142 1397 112527 41.4 Administrative and prepares 254,154 25.11 (2021150) 24,62 11,00 2241 m. 17.03 1117,751 122.19) 14,151) 69.11 Other operating expenses 480,135) 46.36 C146) 123.971 1417 541 1415,000 29.04 337,5 8.33 11.00TL 33.43 Other operating income 348 620 012 361,697 7.901 293.1047 479,315 3.74 462.015 74.19 265,255 632.28 Operating profit 1,122,131.0 4,07,183 26.105,519,866 11:11 6,292,181 32.154,731112 4.41 4511,275 12.76 Finance cost 141.8159675 (106511) 25.39 3,92 1.76 (14.67) 12,70 (39.391 156) (07.07) Pruit before tax 1,876,071 17:41 3,970,292 595) 5,434,924 1.176,174057 33.14 467,411 5.96 4376,50)16.10 Taxation (1,217,415 21.92 (940,357) 14760) 1898,109) 7.03 11,715,00 34.28 1,115,1221 7.64 (1,221,772) 7.45 Profit after mx 2.468,656716 2.02,95 15337,544,815 18:54 4408,076 32.68 1122268 5.31 2,154,127 19.84 Vertical Araba Sales Net 15.845,649 100.00 11.438.843 100.00 11.540.305 1000 14,019,14 100.00 12,472,47 100.00 12.715,670 100.00 Cost of goods sold (11.433,508 ma 121 13,412 (07.813 17.712.937) 151.351 2353.66) 07.07.2013 17,953,970) 12,351 Gross profit 4,206,081 26.86 4125381 32.19 5,827,366 13.04 6,496,565 46.34 4,114,921 38.61 4306,700 1765 Seling and distribution expenses 116176 (0.76) 1,471 10.723 1129,666) 11 115451 11.10) 144.183) (075) (82,6221 015) Administrative and elepeses 254,114 (1.021 1211,151) 1.51) 163,009) 1201 133,012 (0.95) 1113025) (091) 1146,151) 1.34 Other operating expenses 11,125) 2.94 314 (231) 407,911) 2011 01.0101 (3.11) 337,186 12.71) 311,907 2.41 Other operating income 346.622 2.23 361,097 2.69 393,104 290 19,305 3.42 462,035 3.70 265,255 20 Dperating profit 3,122,17 23.79 4,976,883 30.34 5,519,886 40.77 6.252,183 44.60 4,731, 132 37.934,531,275 35.50 Finance cost 46,8951 (0.291 106,538 10.79 (54,362) 11611 174,117 10.56) 199,741) (075) (154,676) 11:21) Profit before tax 3,676,071 23,50 1,971,352 29.54 5.434,924 40.14 6,174,067 44.04 4,637,401 37.13 4,375,5993425 Taxation 11,207,4557.721 10,3571 27.37) (129,109) 1961 11,745,940 17:56 15:17 10:54) (1.221,772) 1957) Profit after to 2418,6 15,782,979,995 22.17 0,544,815 26.11 4,486,07 31.44 122,268 26.64 2,154,827 24.71 Annual Report for the year ended June 30, 2019 Statement Of Changes in Equity For the year ended 30 June 2019 Reserve Ravne reserves Capitals Fair value rever Share Stuar Total Tail Rupes 1545,46,KO 26.514 70.000,00 13,541,639,146 13,761,170,711 15,24,257,611 As a 01 July 2017 Total comprensivo income Profit after tax for the year other comprehensive loss for the year 2,371,71,79 2:57.7H, 713 ow.co01 2.871,9,19 7,979,2017,211 2.11.971 (07.2011 17,400 2,179,497,21 (309,017,380) 209,017,380 (309,017,380) 70,000.00 16,311,576,65 14,41,400,724 17,994,737,624 1,545,0M, 200 49,714.951 123,114 Transactions with the owners of the Company Final cash dividend at Rs 2.00 per share for the year ended June 2017 Asa 30 June 2011 Total comprehensive income for the year Profferta forte Other comprehensive loss for the 2.4.655,190 | 2.495,3 2.462,655,290 Q11.2001 1211.2001 211.2001 2,44,455,140 2,464,444.10 2,461,444.440 211,2) 771,544501772,541,450) 772 50,4901 Transactions within the Company Final cu dividend at Rs.5.00 per shume for the year anded 30 June 2014 Bona share at 30bonusshares for wery 10. urdinary shares ond during the year As at 30 June 2019 1463,574.00 1,524,07) 2,008,612,970 49,704,951 117,914 70.000.000 1754,203,2% 7,056.005,234 19.672,638,864 The annexed notes from 1 to 47 form an integral part of these financial statements. Statement of Value Added 2019 2018 Rs. R. Value Added Gross Revenue Generated Materials & Service 23,230,703,659 (11,264,591,105) 11,966,112,554 694,207.302 19,940,547,870 (8,848,553,921) 11,091,963,949 540,078,024 To Employees as Remuneration 5-80% 4.87% 73.14% 57.10% 8.94% To Government as Taxes Income Tax Sales Tax Federal excise duty Royalty and excise duty Workers welfare fund Workers profit participation fund 8,751.184.261 1,207,415,551 3,702,082,792 3,353,748,705 216,920,844 73,661,979 197,354,390 10.09% 30.94% 28.03% 1.819 7.442.008,156 990,357,268 3,248,835,985 7,723,644,621 192,376,359 73,936,622 212,857,299 29.299 24.56% 1.73% 0.67% 1.92% 1.65% 0.95% 46,065,101 6,000,000 To Provider of Finance as Finance Cost To Society as Donation To Shareholders as Dividend Ratained within the Business 772,543,450 1,696,112,440 11,966,112,554 0.38% 0.05% 6.464 14.17% 100% 106,531,176 23,351,800 309,017,380 2.670,977,413 11,091,963,949 0.21% 2.79% 24.07% 100% Value Added - 2019 Pertapal Value Added - 2018 To 12 Annual Report the yarn 2010 Chief Executive Chief Financial oricot Director Kohatenet Company Limited Cash Flow Statement For the year ended 30 June 2019 Note 2019 Rupees 2018 Rupons 34 Cash flows from operating activities Cash generated from operations Finance cost paid Compensated absences paid Income tax paid Payment made to Workers' Welfare Fund Payment made to Workers' Profit Participation Fund 3.2 6,012,464,630 (339,201,880) 12,136,622) (770,952.781) (74,902,288) (80,000,000) (1.267,193,571) 4,628,024,214 (64,802,876) 11,685,294) (1.340,382,640) (106,603 797) (88,544,500 11,602,019,107) 3,026,005, 107 4,745,271,109 Net cash generated from operating activities Cash fiows from investing activities Acquisition of property, plant and equipment Proceeds from disposal of property, plant and equipment Acquisition of intangibles Purchase of investment property Short term investments.net Interest on bank deposits and loan Long term loans - net Long term retention money.net Net cash used in investing activities (13,002,354,534) 3,985,264 (2,806,242) (36,216,950) (326,126,067) 259,545,748 (90,617,954) 104,857,705 11,591,577,714) 17,164,321 14,273,754) (592.790,685) 11.265,863,496) 165,375.839 39,301 (13,089.733,030) (3.271.934,109) (200,000,000) (284,210,528) Cash flows from financing activities Short term borrowing.net 243,000,000 Repayment of long term finances 1779,387,626) Disbursement of long term finances-net off transaction cost 5,757,222,956 Dividend paid (766,915,076) Net cash generated from / (used in) financing activities 4,453,920,254 Net decrease in cash and cash equivalents (3,890,541.667) Cast and cash equivalents at beginning of the year 4,574,427,690 Cash and cash equivalents at end of the year 35 683,806,023 The annexed notes from 1 to 47 form an integral part of these financial statements. (306,604,344) 1790,814,872) (1,036,743,874) 5,611,171,564 4.574.427,690 thing Chlut Financial Officer Dructor Chief Executive Annual Report for the year anded June 30, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started