Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need urgent -:02 6 . Question 4 Seal limited and Deal limited are both working in pharmaceutical industry and currently manufactures various types of medicines

need urgent

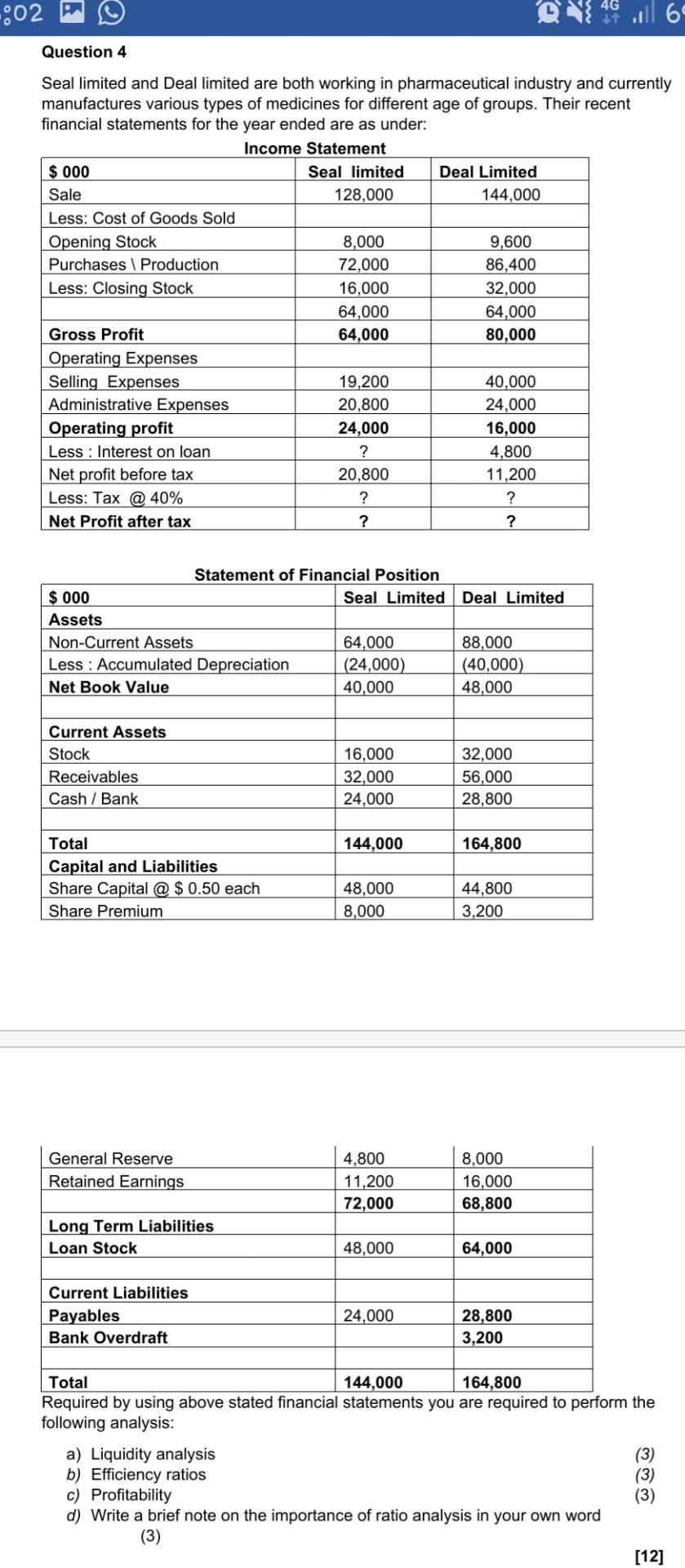

-:02 6 . Question 4 Seal limited and Deal limited are both working in pharmaceutical industry and currently manufactures various types of medicines for different age of groups. Their recent financial statements for the year ended are as under: Income Statement $ 000 Seal limited Deal Limited Sale 128,000 144,000 Less: Cost of Goods Sold Opening Stock 8,000 9,600 Purchases Production 72,000 86,400 Less: Closing Stock 16,000 32,000 64,000 64.000 Gross Profit 64,000 80,000 Operating Expenses Selling Expenses 19,200 40,000 Administrative Expenses 20,800 24,000 Operating profit 24,000 16,000 Less : Interest on loan ? 4,800 Net profit before tax 20,800 11,200 Less: Tax @ 40% ? ? Net Profit after tax ? ? Statement of Financial Position $ 000 Seal Limited Deal Limited Assets Non-Current Assets 64,000 88,000 Less : Accumulated Depreciation (24,000) (40,000) Net Book Value 40,000 48,000 Current Assets Stock Receivables Cash / Bank 16,000 32,000 24,000 32,000 56,000 28,800 144,000 164,800 Total Capital and Liabilities Share Capital @ $ 0.50 each Share Premium 48,000 8,000 44,800 3,200 General Reserve Retained Earnings 4,800 11,200 72,000 8,000 16,000 68,800 Long Term Liabilities Loan Stock 48,000 64,000 Current Liabilities Payables Bank Overdraft 24,000 28,800 3,200 Total 144,000 164,800 Required by using above stated financial statements you are required to perform the following analysis: a) Liquidity analysis (3) b) Efficiency ratios (3) c) Profitability (3) d) Write a brief note on the importance of ratio analysis in your own word (3) [12]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started