Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need urgent You have been asked by a client to advice on the financial position of two companses in a similar tride sector, you have

need urgent

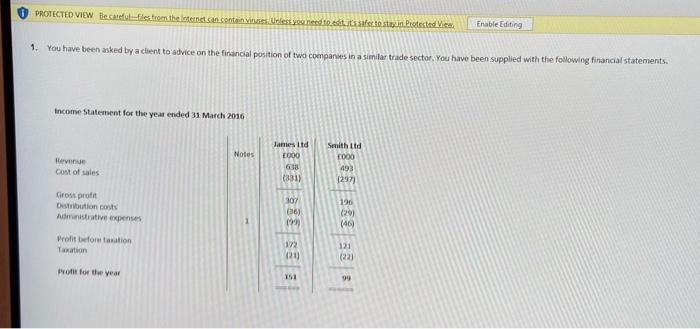

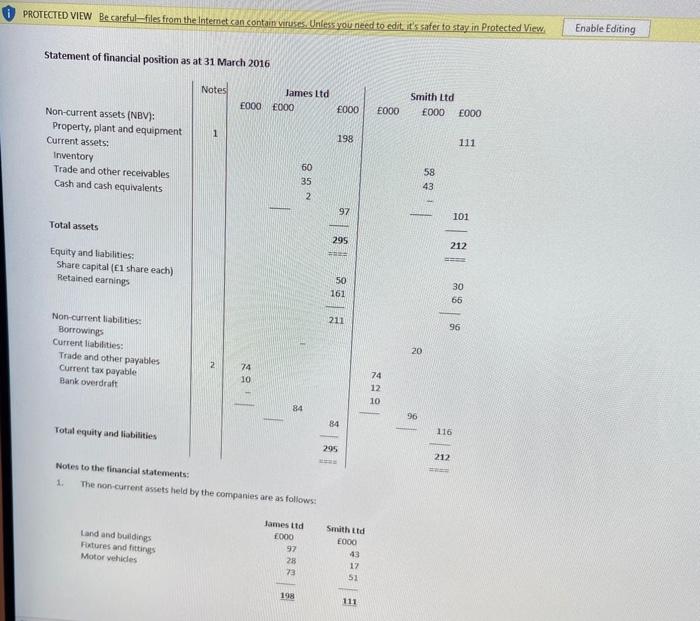

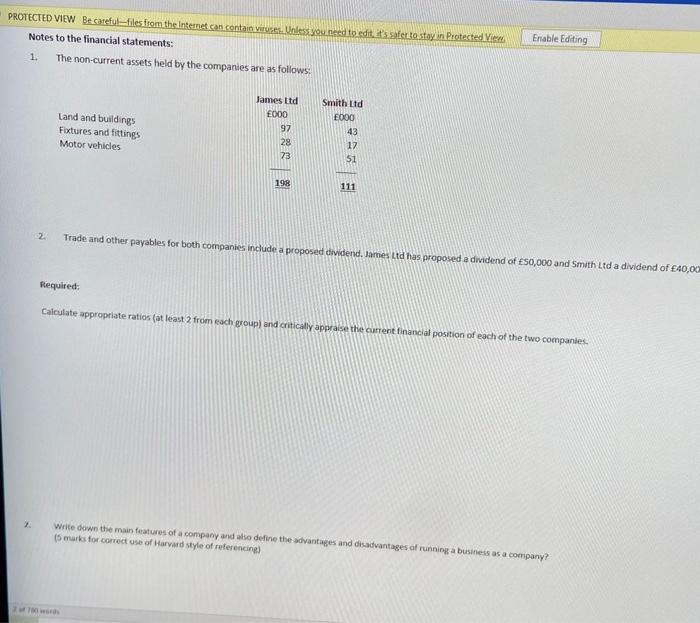

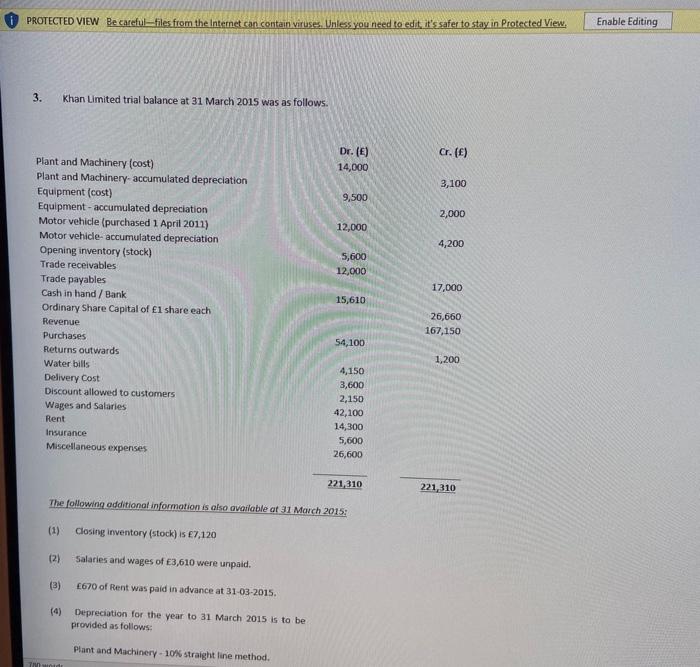

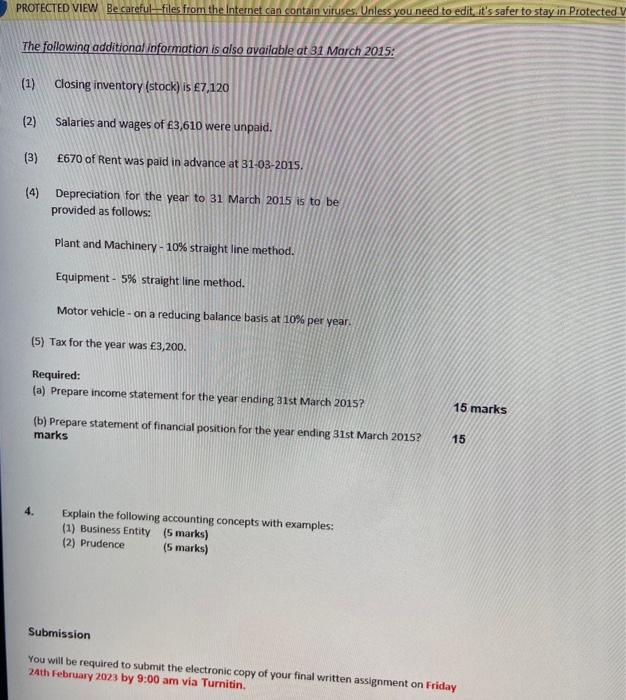

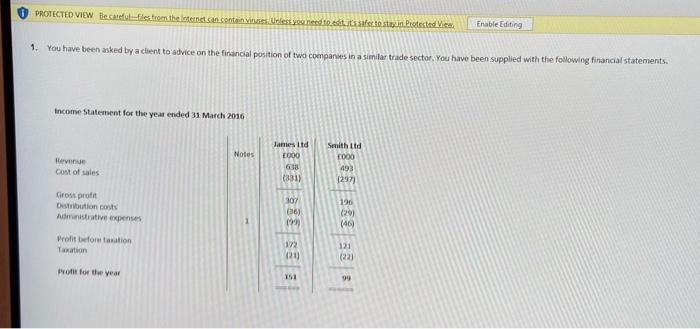

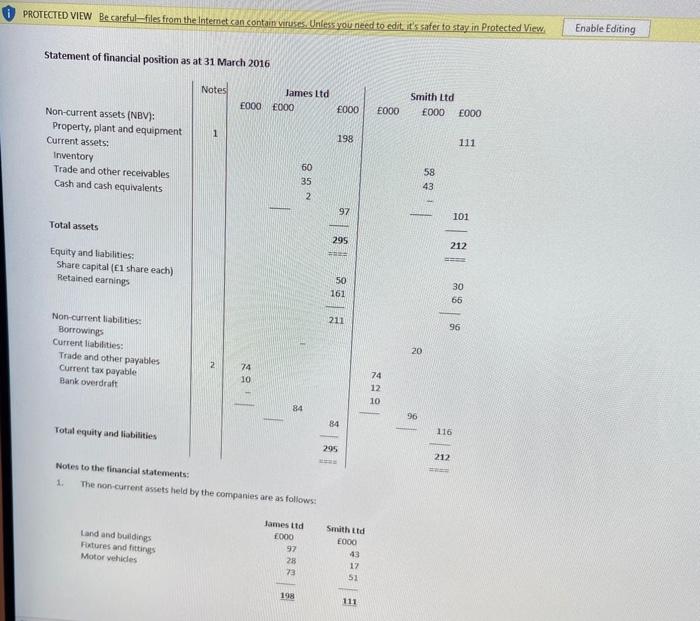

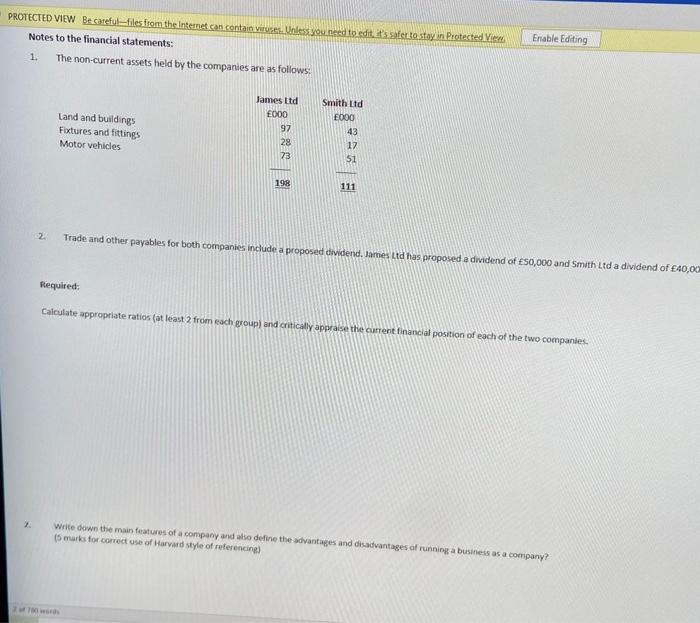

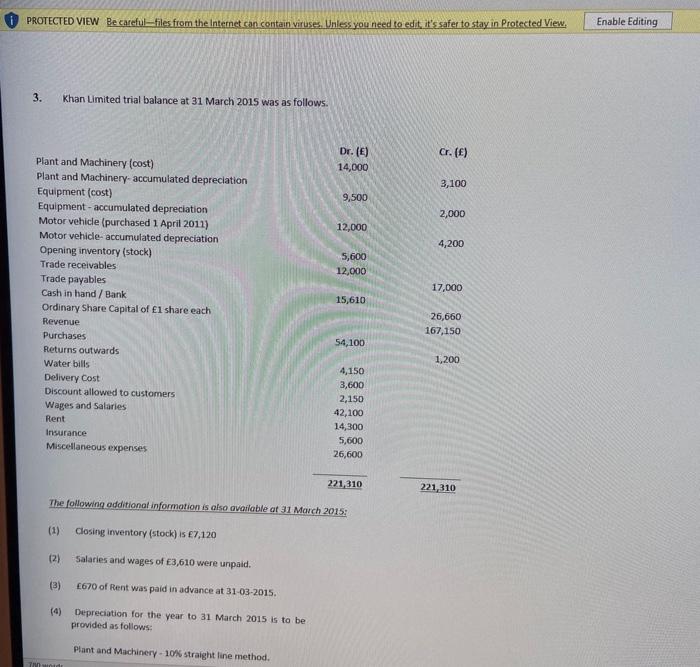

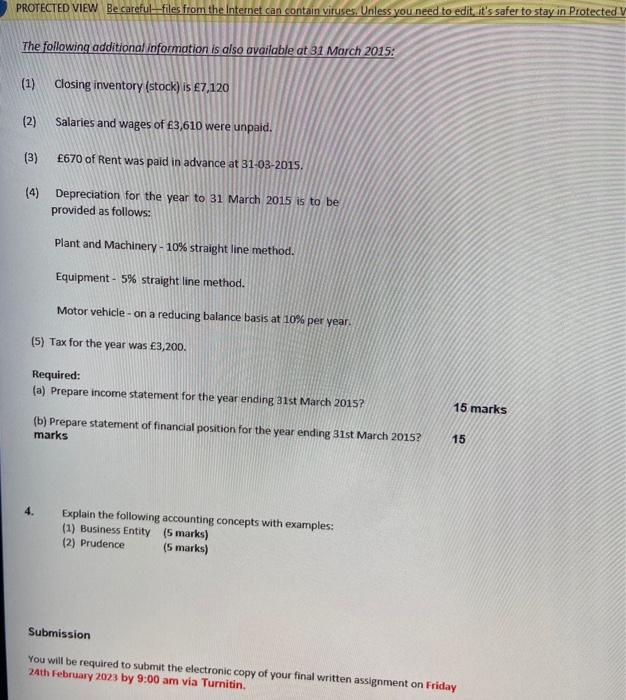

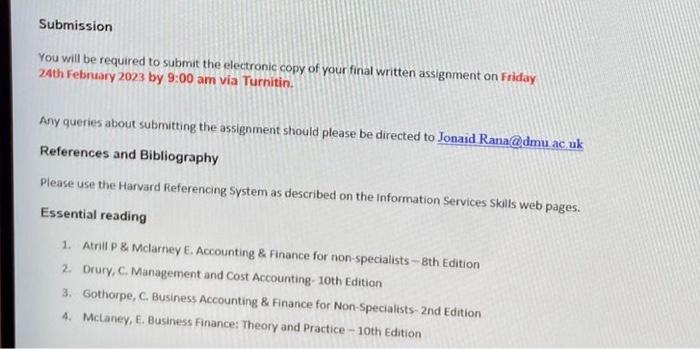

You have been asked by a client to advice on the financial position of two companses in a similar tride sector, you have been supplied with the following fintancial statements. income Staterment for the year ended 31 March 2016 PROTECTED VIEW Be careful-files from the Intemet san contair viruses, Uniess you need to edit, it s safer to stay in Protected View Statement of financial position as at 31 March 2016 1. The non-current assets held by the companies are as follows: Notes to the financial statements: 1. The non-current assets held by the companies are as follows: 2. Trade and other payables for both companies include a proposed dividend. James Ltd has proposed a dividend of E 50,000 and 5m. frequired: Calculate appropriate ratios (at least 2 from each group) and critically apprase the current financial position of each of the two companies. Write down the main features of a company and abso define the advantages and disadvantages of running a business as a company? (S marks for correct use of Harvand style of referencing) 3. Khan Limited trial balance at 31 March 2015 was as follows. The following additionat information is olso quailoble at 31 March 2015: (1) Closing inventory (stock) is 7,120 (2) Salaries and wages of E3,610 were unpaid. (3) 6670 of Rent was paid in advance at 31-03-2015. (4) Depreciation for the year to 31 March 2015 is to be provided as follows: Plant and Machinery - 10 S straight line method. The following additional information is also avoilable at 31 March 2015: (1) Closing inventory (stock) is f7,120 (2) Salaries and wages of 3,610 were unpaid. (3) 870 of Rent was paid in advance at 31032015. (4) Depreciation for the year to 31 March 2015 is to be provided as follows: Plant and Machinery - 10\% straight line method. Equipment - 5% straight line method. Motor vehicle - on a reducing balance basis at 10% per year. (5) Tax for the year was 3,200. Required: (a) Prepare income statement for the year ending 31st March 2015? 15 marks (b) Prepare statement of financial position for the year ending 31st March 2015? 15 4. Explain the following accounting concepts with examples: (1) Business Entity (5 marks) (2) Prudence (5 marks) Submission You will be required to submit the electronic copy of your final written assignment on Friday 24th February 2023 by 9:00 am via Turnitin. Submission You will be required to submit the electronic copy of your final written assignment on Friday 24th february 2023 by 9:00 am via Turnitin. Any queries about submitting the assignment should please be directed to Jonaid Rana@dmu ac.uk References and Bibliography Please use the Harvard Referencing System as described on the information Services Skills web pages. Essential reading 1. Atrill P& Mclarney E. Accounting \& Finance for non-specialists -8 th Edition 2. Drury, C. Management and Cost Accounting-10th Edition 3. Gothorpe, C. Business Accounting \& Finance for Non-Specialists-2nd Edition 4. Mcianey, E. Business finance: Theory and Practice - 10th Edition

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started