Answered step by step

Verified Expert Solution

Question

1 Approved Answer

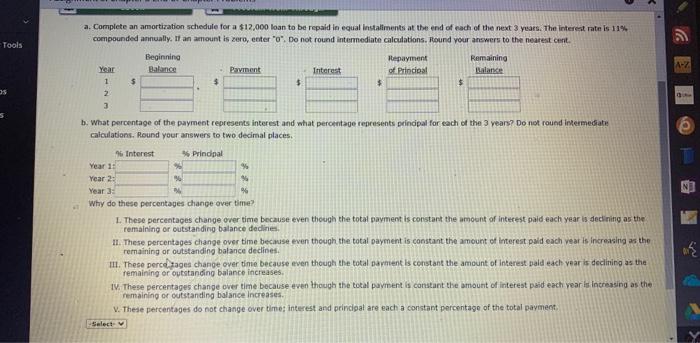

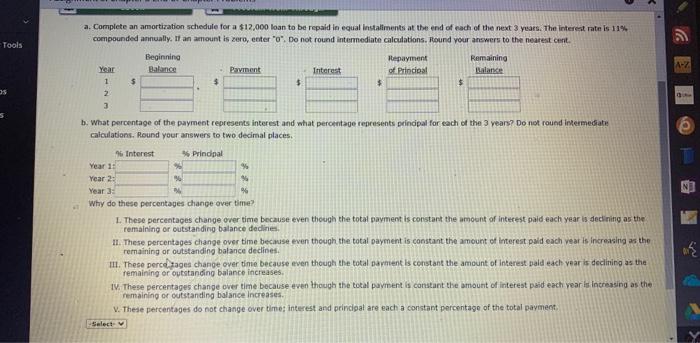

need urgently!! a. Complete an amortization schedule for a $12.000 loan to be repaid in equal linstaliments at the end of nadh of the next

need urgently!!

a. Complete an amortization schedule for a $12.000 loan to be repaid in equal linstaliments at the end of nadh of the next 3 years. The intereat rate is 11%. compounded annually. If an amount is zero, enter " 0 ", Do not round intermediate calculations. Found your answers to the nearest cent. What percentage of the payrnent represents interest and what percentage represents principal for each of the 3 years? Do not round infermediate calculations, Round your answers to two decimal places, Wry a0 tnese percentages crange over vimer: L. These percentages change over time because even though the totat payment is constant the amount of interest paid each year is dedining as the: remaining or outstanding balance declines. 11. These percentages change over time because even theugh the total payment is constant the amount of lnterest paid each vear is increasing as the remaining of outstanding balance declines. III. These percel tages change over timie because even theugh the total parnent is corstant the amount of interest bald edeh year is deciining as the remaining of outstanding balance increases. 1V. These percentages change over time because even though the total payrient is carstant the amount of interest paid each year is intreasing as the remaining or outstanding balance increases. V. These percentages do not change over time: interest and prinidpal are each a constant percentage of the total paymegt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started