Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need urgently Parry Corp. acquired new equipment for $6,600,000 in 20X6. For accounting purposes, the equipment will be depreciated over fin years, straight-line, with a

need urgently

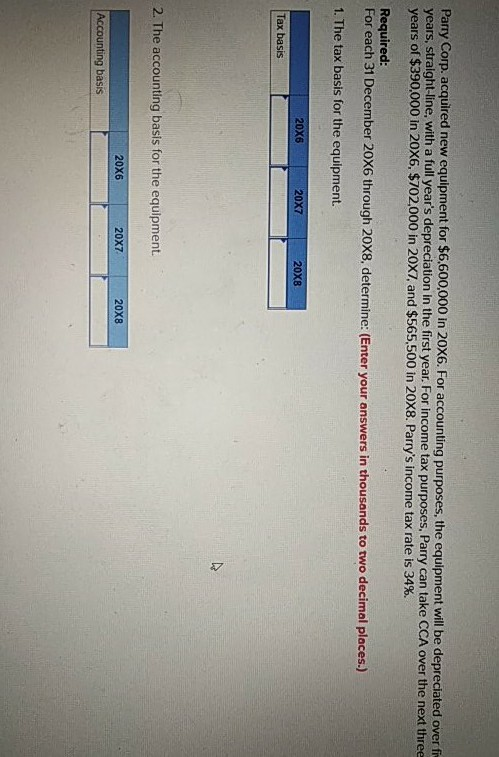

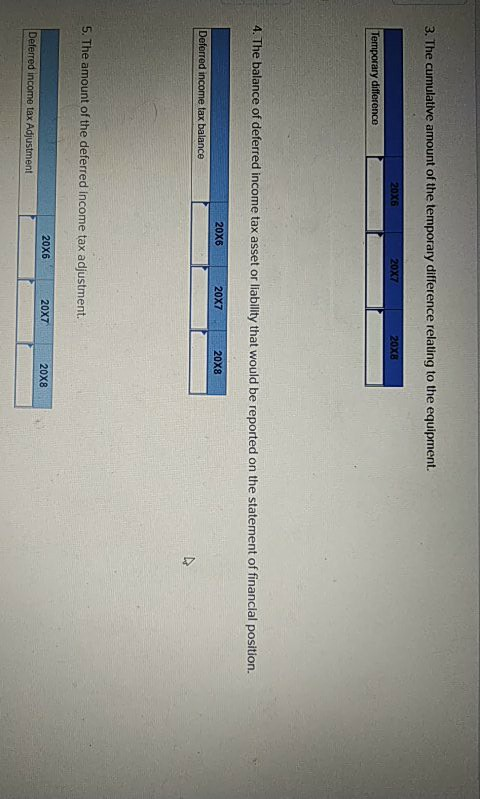

Parry Corp. acquired new equipment for $6,600,000 in 20X6. For accounting purposes, the equipment will be depreciated over fin years, straight-line, with a full year's depreciation in the first year. For income tax purposes, Parry can take CCA over the next three years of $390,000 in 20X6, $702,000 in 20X7, and $565,500 in 20X8. Parry's income tax rate is 34%. Required: For each 31 December 20X6 through 20X8, determine: (Enter your answers in thousands to two decimal places.) 1. The tax basis for the equipment. 2026 2027 2028 Tax basis 2. The accounting basis for the equipment 20X620x720X8 Accounting basis 3. The cumulative amount of the temporary difference relating to the equipment. 2036 2037 2038 Temporary difference 4. The balance of deferred income tax asset or liability that would be reported on the statement of financial position. 20x620x720x8 Deferred income tax balance 5. The amount of the deferred income tax adjustment. 20x620x7 20X8 Deferred income tax AdjustmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started