Answered step by step

Verified Expert Solution

Question

1 Approved Answer

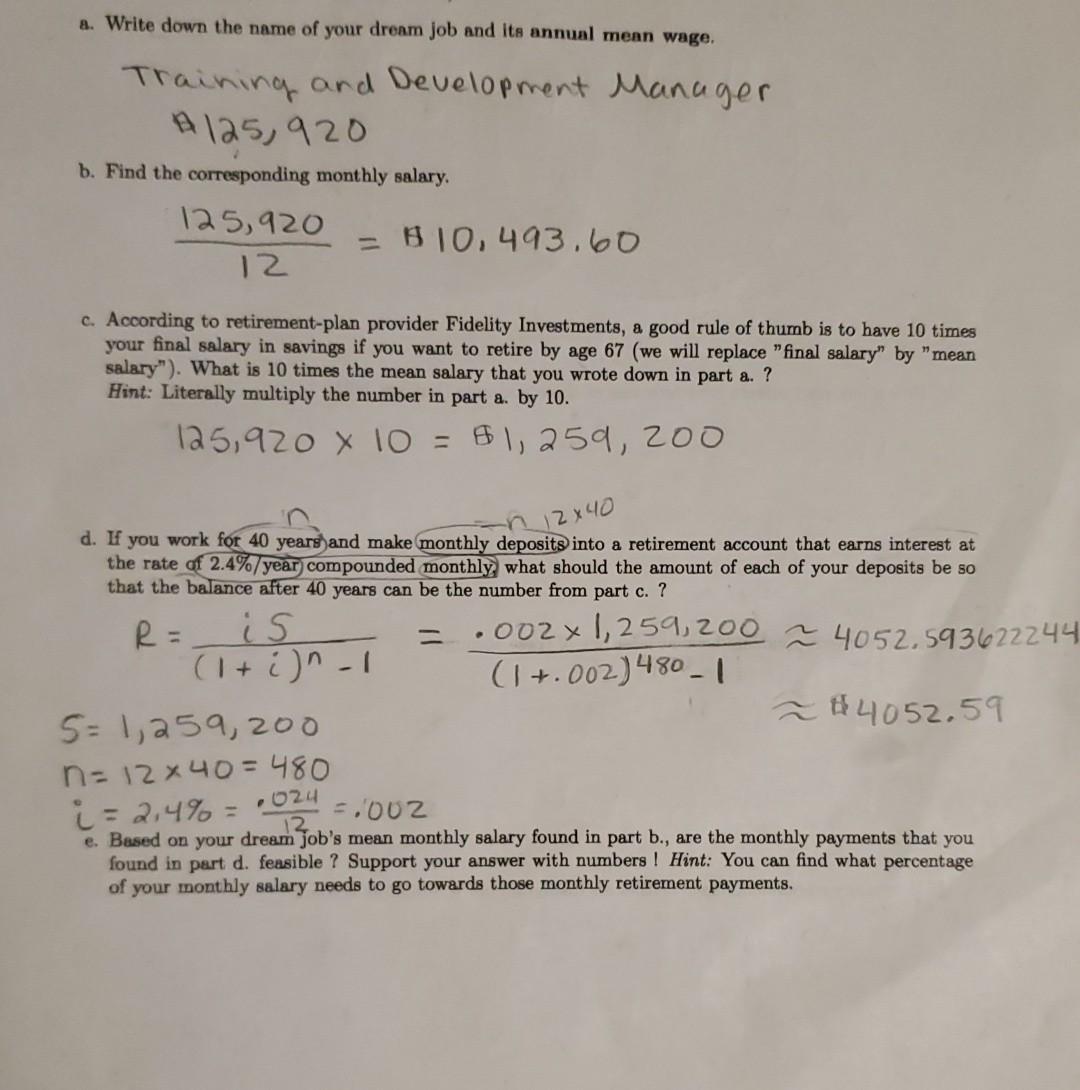

need you to review my answers for part a-d for accuracy and help me with part e. a. Write down the name of your dream

need you to review my answers for part a-d for accuracy and help me with part e.

a. Write down the name of your dream job and its annual mean wage. Training and Development Manager A125, 920 b. Find the corresponding monthly salary. 125,920 = 1810, 493.60 12 c. According to retirement plan provider Fidelity Investments, a good rule of thumb is to have 10 times your final salary in savings if you want to retire by age 67 (we will replace "final salary" by "mean salary"). What is 10 times the mean salary that you wrote down in part a. ? Hint: Literally multiply the number in part a. by 10. 125,920 x 10 = $1,259, 200 12x40 d. If you work for 40 years and make monthly deposits into a retirement account that earns interest at the rate of 2.4%/year compounded monthly what should the amount of each of your deposits be so that the balance after 40 years can be the number from part c. ? R = is .002 x 1,259,200 4052.593622244 (1+i)n-1 (1 +.002)480-1 5= 1,259,200 04052.59 na 12x40 = 480 i = 2,4% = .002 12 e. Based on your dream job's mean monthly salary found in part b., are the monthly payments that you found in part d. feasible ? Support your answer with numbers ! Hint: You can find what percentage of your monthly salary needs to go towards those monthly retirement payments. .024Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started