| Needed 1. Calculate the allocation ratios you need to develop using the direct method. 2. Using the direct method, allocate the costs of the Maintenance, Materials Handling, and Building grounds departments to the Machining and Assembly departments. 3. Allocate the departmental overhead from machining and assembly to the two products Weed eater and lawn edger based on a unit of each of these products. 4. Allocate the departmental overhead from machining and assembly to the two products Weed eater and lawn edger based on a unit of each of these products. |

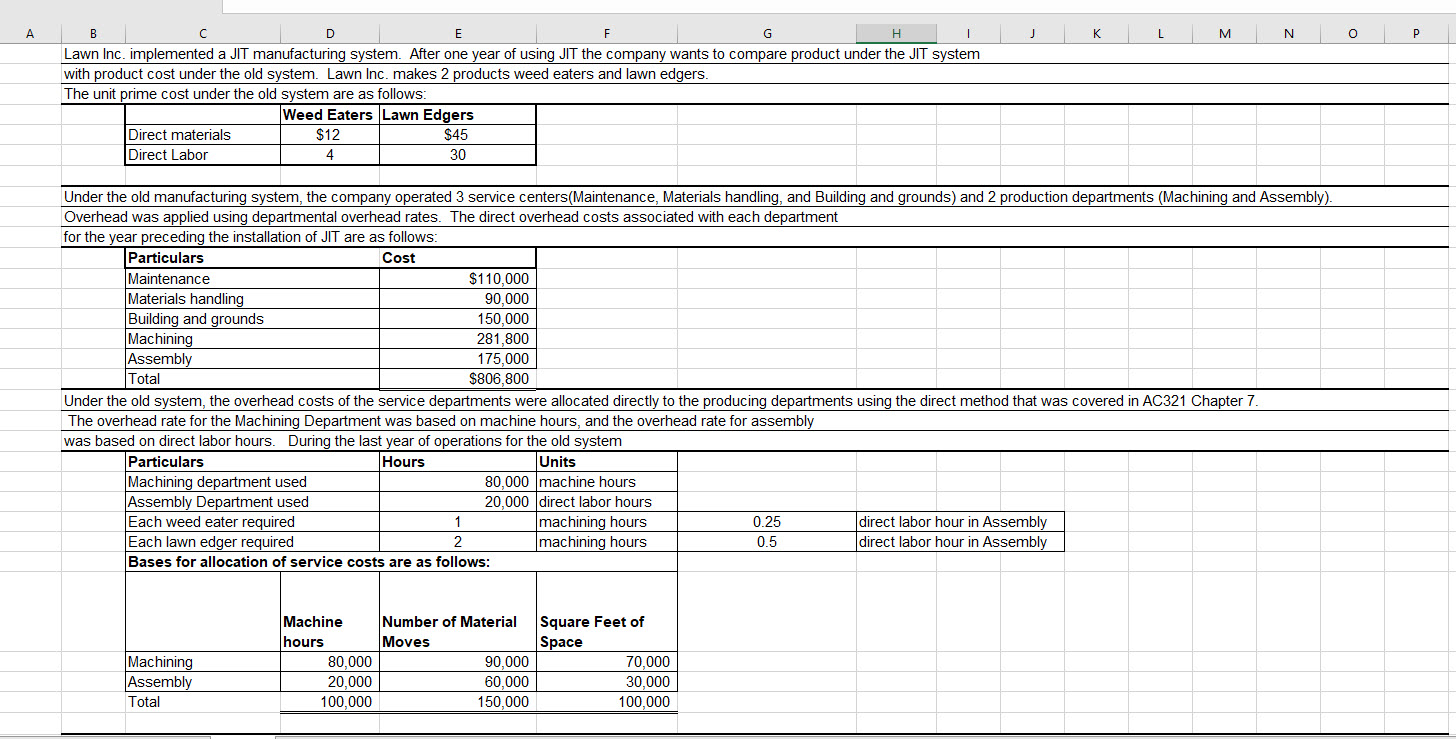

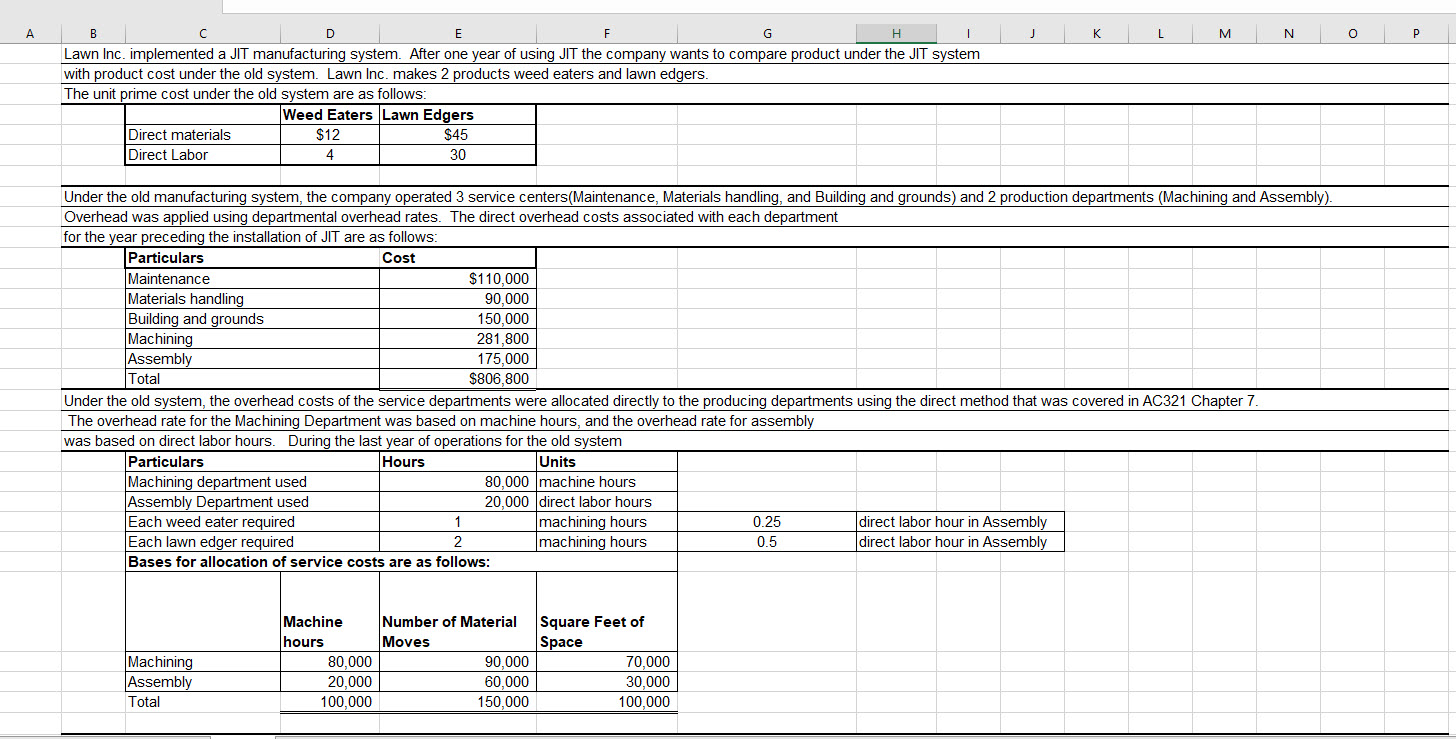

D J K L M N O P I Lawn Inc. implemented a JIT manufacturing system. After one year of using JIT the company wants to compare product under the JIT system with product cost under the old system. Lawn Inc. makes 2 products weed eaters and lawn edgers. The unit prime cost under the old system are as follows: Weed Eaters Lawn Edgers Direct materials $12 Direct Labor 4 30 $45 Under the old manufacturing system, the company operated 3 service centers(Maintenance, Materials handling, and Building and grounds) and 2 production departments (Machining and Assembly). Overhead was applied using departmental overhead rates. The direct overhead costs associated with each department for the year preceding the installation of JIT are as follows: Particulars Cost Maintenance $110,000 Materials handling 90,000 Building and grounds 150,000 Machining 281.800 Assembly 175,000 Total $806,800 Under the old system, the overhead costs of the service departments were allocated directly to the producing departments using the direct method that was covered in AC321 Chapter 7. The overhead rate for the Machining Department was based on machine hours, and the overhead rate for assembly was based on direct labor hours. During the last year of operations for the old system Particulars Hours Units Machining department used 80,000 machine hours Assembly Department used 20,000 direct labor hours Each weed eater required machining hours 0.25 direct labor hour in Assembly Each lawn edger required machining hours 0.5 direct labor hour in Assembly Bases for allocation of service costs are as follows: Machining Assembly Total Machine Number of Material hours Moves 80,000 90,000 20,000 60,000 100,000 150,000 Square Feet of Space 70,000 30,000 100,000 D J K L M N O P I Lawn Inc. implemented a JIT manufacturing system. After one year of using JIT the company wants to compare product under the JIT system with product cost under the old system. Lawn Inc. makes 2 products weed eaters and lawn edgers. The unit prime cost under the old system are as follows: Weed Eaters Lawn Edgers Direct materials $12 Direct Labor 4 30 $45 Under the old manufacturing system, the company operated 3 service centers(Maintenance, Materials handling, and Building and grounds) and 2 production departments (Machining and Assembly). Overhead was applied using departmental overhead rates. The direct overhead costs associated with each department for the year preceding the installation of JIT are as follows: Particulars Cost Maintenance $110,000 Materials handling 90,000 Building and grounds 150,000 Machining 281.800 Assembly 175,000 Total $806,800 Under the old system, the overhead costs of the service departments were allocated directly to the producing departments using the direct method that was covered in AC321 Chapter 7. The overhead rate for the Machining Department was based on machine hours, and the overhead rate for assembly was based on direct labor hours. During the last year of operations for the old system Particulars Hours Units Machining department used 80,000 machine hours Assembly Department used 20,000 direct labor hours Each weed eater required machining hours 0.25 direct labor hour in Assembly Each lawn edger required machining hours 0.5 direct labor hour in Assembly Bases for allocation of service costs are as follows: Machining Assembly Total Machine Number of Material hours Moves 80,000 90,000 20,000 60,000 100,000 150,000 Square Feet of Space 70,000 30,000 100,000