Answered step by step

Verified Expert Solution

Question

1 Approved Answer

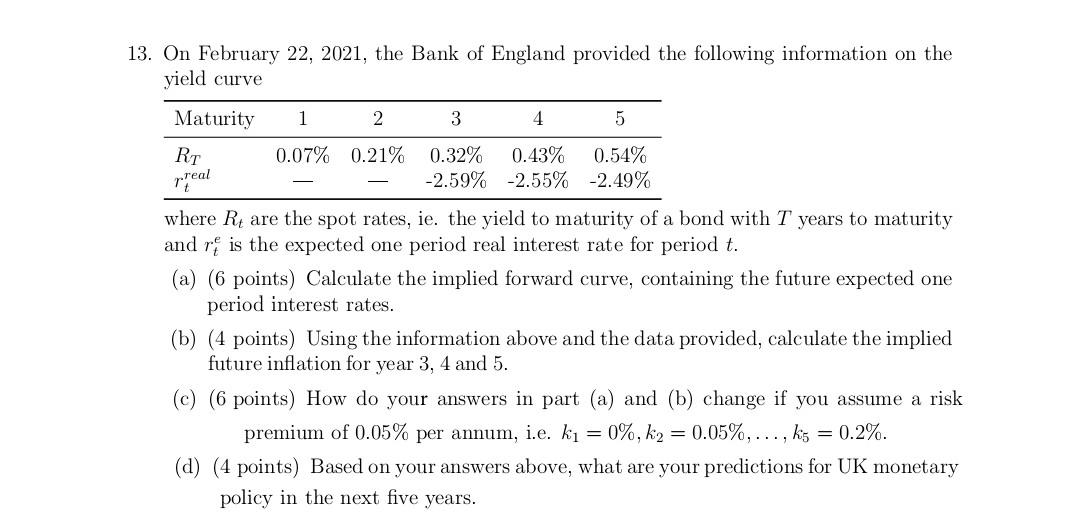

Needed Ans ASAP. 13. On February 22, 2021, the Bank of England provided the following information on the yield curve Maturity 1 2 3 4

Needed Ans ASAP.

13. On February 22, 2021, the Bank of England provided the following information on the yield curve Maturity 1 2 3 4 5 RT 0.07% 0.21% 0.32% 0.43% 0.54% -2.59% -2.55% -2.49% where Rt are the spot rates, ie. the yield to maturity of a bond with T years to maturity and re is the expected one period real interest rate for period t. (a) (6 points) Calculate the implied forward curve, containing the future expected one period interest rates. (b) (4 points) Using the information above and the data provided, calculate the implied future inflation for year 3, 4 and 5. (c) (6 points) How do your answers in part (a) and (b) change if you assume a risk premium of 0.05% per annum, i.e. ki = 0%, k, = 0.05%, ..., ks = 0.2%. (d) (4 points) Based on your answers above, what are your predictions for UK monetary policy in the next five years. 13. On February 22, 2021, the Bank of England provided the following information on the yield curve Maturity 1 2 3 4 5 RT 0.07% 0.21% 0.32% 0.43% 0.54% -2.59% -2.55% -2.49% where Rt are the spot rates, ie. the yield to maturity of a bond with T years to maturity and re is the expected one period real interest rate for period t. (a) (6 points) Calculate the implied forward curve, containing the future expected one period interest rates. (b) (4 points) Using the information above and the data provided, calculate the implied future inflation for year 3, 4 and 5. (c) (6 points) How do your answers in part (a) and (b) change if you assume a risk premium of 0.05% per annum, i.e. ki = 0%, k, = 0.05%, ..., ks = 0.2%. (d) (4 points) Based on your answers above, what are your predictions for UK monetary policy in the next five yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started