Question: Needed ASAP Which has the highest return on investment-the S&P 500, high-grade corporate bonds, or U S. Treasury bonds? Download the Inyestment Returns data set

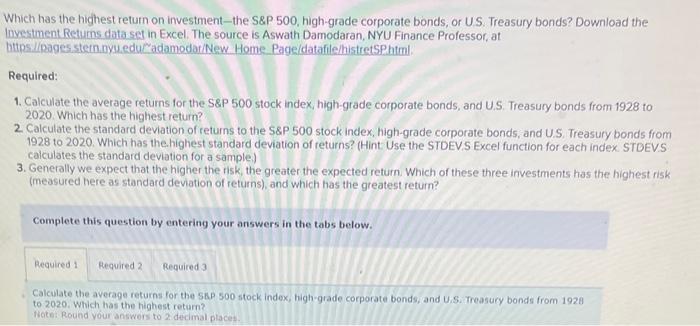

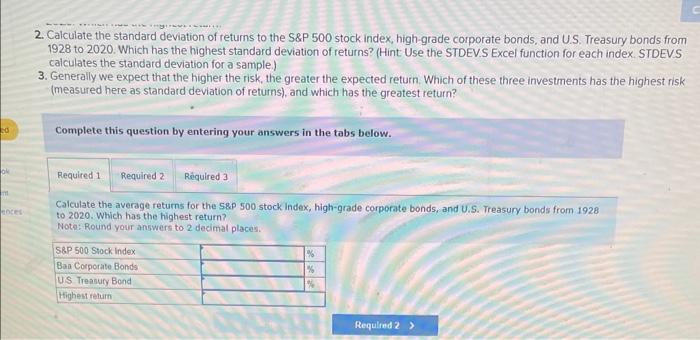

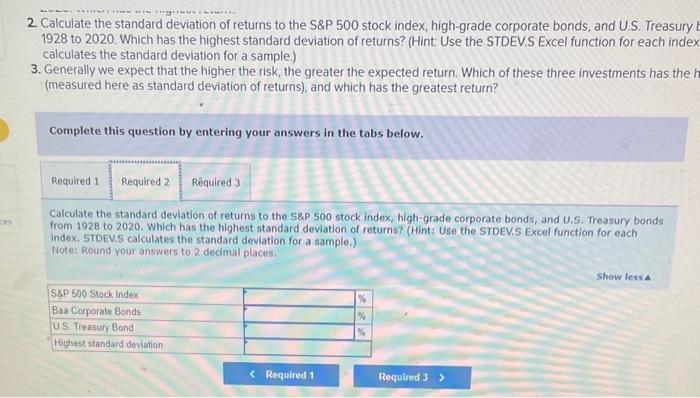

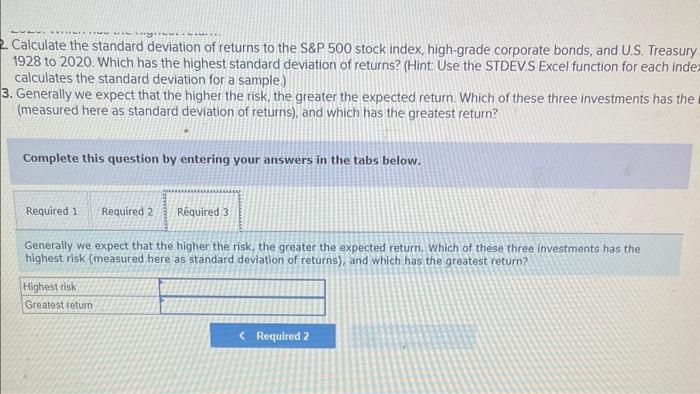

Which has the highest return on investment-the S\&P 500, high-grade corporate bonds, or U S. Treasury bonds? Download the Inyestment Returns data set in Excel. The source is Aswath Damodaran, NYU Finance Professor, at htips.ilpages stemn.nyueduldamodariNew Home Page/datafile/histretSPhtml. Required: 1. Calculate the average returns for the S\&P 500 stock index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the highest return? 2. Calculate the standard deviation of returns to the S\&P 500 stock index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the.highest standard deviation of returns? (Hint Use the STDEV.S Excel function for each index. STDEVS calculates the standard deviation for a sample.) 3. Generally we expect that the higher the risk, the greater the expected return. Which of these three investments has the highest risk (measured here as standard deviation of returns), and which has the greatest return? Complete this question by entering your answers in the tabs below. Calculate the average returns for the SE. 500 stock index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the highest return? Hate: Round your answers to 2 detimal places. 2. Calculate the standard deviation of returns to the S\&P 500 stock index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the highest standard deviation of returns? (Hint Use the STDEV.S Excel function for each index. STDEV.S calculates the standard deviation for a sample.) 3. Generally we expect that the higher the risk, the greater the expected return. Which of these three investments has the highest risk (measured here as standard deviation of returns), and which has the greatest return? Complete this question by entering your answers in the tabs below. Calculate the average returns for the S&P.500 stock Index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the highest return? Note: Round your answers to 2 decimat places. 2. Calculate the standard deviation of returns to the S\&P 500 stock index, high-grade corporate bonds, and U.S. Treasury 1928 to 2020. Which has the highest standard deviation of returns? (Hint Use the STDEV.S Excel function for each inde calculates the standard deviation for a sample.) 3. Generally we expect that the higher the risk, the greater the expected return. Which of these three investments has the (measured here as standard deviation of returns), and which has the greatest return? Complete this question by entering your answers in the tabs below. Calculate the standard deviation of returns to the 58.500 stock index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the highest standard deviation of returns? (Hint: Use the STDEV.S Excel function for each index. STOEV.S calculates the standard deviation for a sample.) Note: Round your answers to 2 decimal places. - Calculate the standard deviation of returns to the S\&P 500 stock index, high-grade corporate bonds, and U.S. Treasury 1928 to 2020. Which has the highest standard deviation of returns? (Hint Use the STDEV.S Excel function for each inde calculates the standard deviation for a sample.) 3. Generally we expect that the higher the risk. the greater the expected return. Which of these three investments has the (measured here as standard deviation of returns), and which has the greatest return? Complete this question by entering your answers in the tabs below. Generally we expect that the higher the risk, the greater the expected return, Which of these three investments has the highest risk (measured here as standard deviation of returns), and which has the greatest return? Which has the highest return on investment-the S\&P 500, high-grade corporate bonds, or U S. Treasury bonds? Download the Inyestment Returns data set in Excel. The source is Aswath Damodaran, NYU Finance Professor, at htips.ilpages stemn.nyueduldamodariNew Home Page/datafile/histretSPhtml. Required: 1. Calculate the average returns for the S\&P 500 stock index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the highest return? 2. Calculate the standard deviation of returns to the S\&P 500 stock index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the.highest standard deviation of returns? (Hint Use the STDEV.S Excel function for each index. STDEVS calculates the standard deviation for a sample.) 3. Generally we expect that the higher the risk, the greater the expected return. Which of these three investments has the highest risk (measured here as standard deviation of returns), and which has the greatest return? Complete this question by entering your answers in the tabs below. Calculate the average returns for the SE. 500 stock index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the highest return? Hate: Round your answers to 2 detimal places. 2. Calculate the standard deviation of returns to the S\&P 500 stock index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the highest standard deviation of returns? (Hint Use the STDEV.S Excel function for each index. STDEV.S calculates the standard deviation for a sample.) 3. Generally we expect that the higher the risk, the greater the expected return. Which of these three investments has the highest risk (measured here as standard deviation of returns), and which has the greatest return? Complete this question by entering your answers in the tabs below. Calculate the average returns for the S&P.500 stock Index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the highest return? Note: Round your answers to 2 decimat places. 2. Calculate the standard deviation of returns to the S\&P 500 stock index, high-grade corporate bonds, and U.S. Treasury 1928 to 2020. Which has the highest standard deviation of returns? (Hint Use the STDEV.S Excel function for each inde calculates the standard deviation for a sample.) 3. Generally we expect that the higher the risk, the greater the expected return. Which of these three investments has the (measured here as standard deviation of returns), and which has the greatest return? Complete this question by entering your answers in the tabs below. Calculate the standard deviation of returns to the 58.500 stock index, high-grade corporate bonds, and U.S. Treasury bonds from 1928 to 2020. Which has the highest standard deviation of returns? (Hint: Use the STDEV.S Excel function for each index. STOEV.S calculates the standard deviation for a sample.) Note: Round your answers to 2 decimal places. - Calculate the standard deviation of returns to the S\&P 500 stock index, high-grade corporate bonds, and U.S. Treasury 1928 to 2020. Which has the highest standard deviation of returns? (Hint Use the STDEV.S Excel function for each inde calculates the standard deviation for a sample.) 3. Generally we expect that the higher the risk. the greater the expected return. Which of these three investments has the (measured here as standard deviation of returns), and which has the greatest return? Complete this question by entering your answers in the tabs below. Generally we expect that the higher the risk, the greater the expected return, Which of these three investments has the highest risk (measured here as standard deviation of returns), and which has the greatest return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts