Answered step by step

Verified Expert Solution

Question

1 Approved Answer

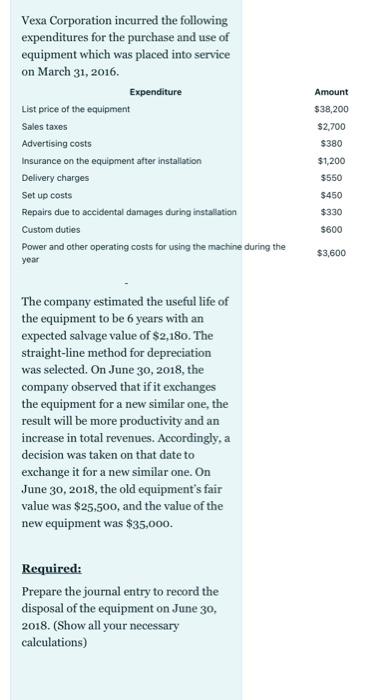

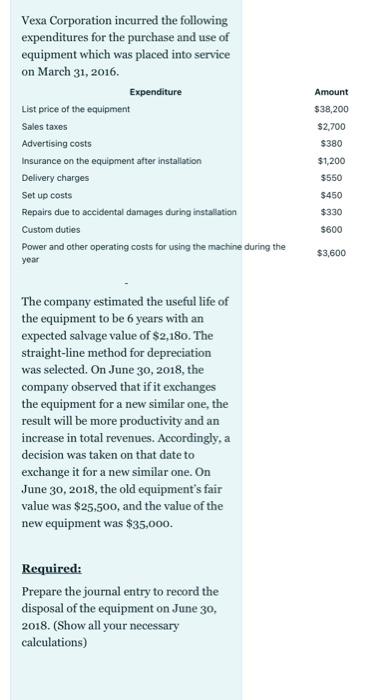

Needed Asappp Vexa Corporation incurred the following expenditures for the purchase and use of equipment which was placed into service on March 31, 2016. Expenditure

Needed Asappp

Vexa Corporation incurred the following expenditures for the purchase and use of equipment which was placed into service on March 31, 2016. Expenditure List price of the equipment Sales taxes Advertising costs Insurance on the equipment after installation Delivery charges Set up costs Repairs due to accidental damages during installation Custom duties Power and other operating costs for using the machine during the Amount $38,200 $2,700 $380 $1,200 $550 $450 $330 $600 $3,600 year The company estimated the useful life of the equipment to be 6 years with an expected salvage value of $2,180. The straight-line method for depreciation was selected. On June 30, 2018, the company observed that if it exchanges the equipment for a new similar one, the result will be more productivity and an increase in total revenues. Accordingly, a decision was taken on that date to exchange it for a new similar one. On June 30, 2018, the old equipment's fair value was $25,500, and the value of the new equipment was $35,000. Required: Prepare the journal entry to record the disposal of the equipment on June 30, 2018. (Show all your necessary calculations)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started