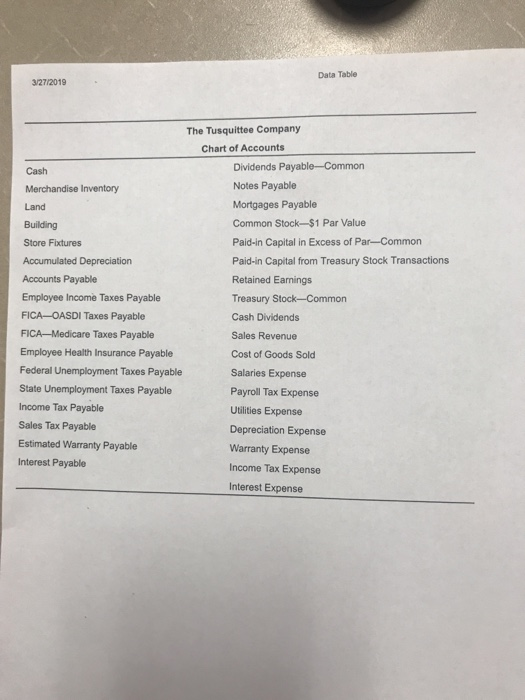

needed journal entries.

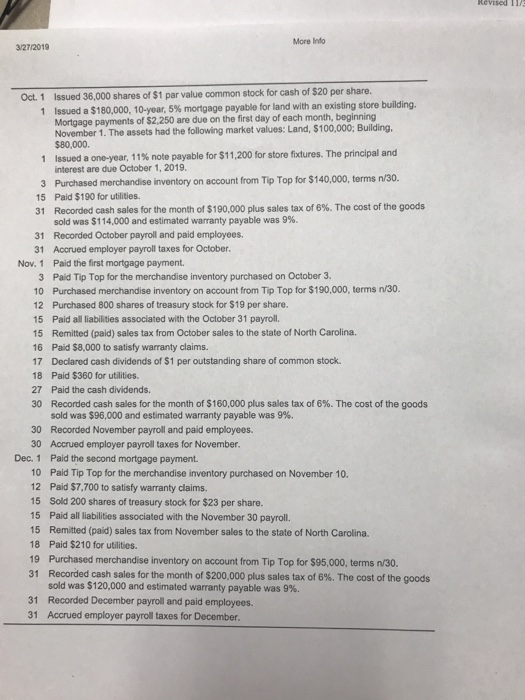

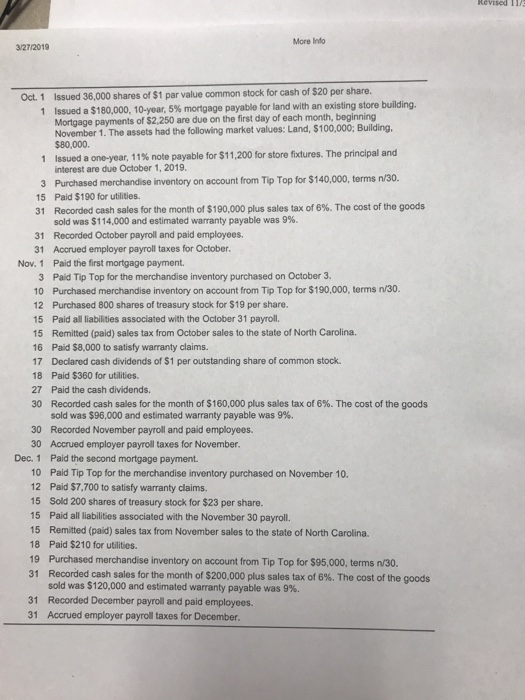

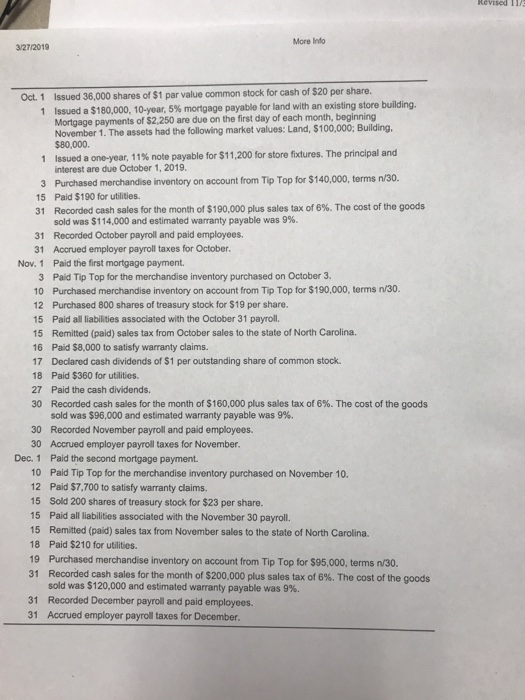

More Info 3/27/2019 Issued 36,000 shares of $1 par value common stock for cash of $20 per share. 1 Oct. 1 Issued a $180,000, 10-year, 5% mortgage payable for land with an existing store building. Mortgage payments of $2,250 are due on the first day of each month, beginning November 1. The assets had the following market values: Land, $100,000; Building $80,000. 1 issued a one-year, 11% note payable for $11,200 for store fixtures. The principal and interest are due October 1, 2019. 3 Purchased merchandise inventory on account from Tip Top for $140,000, terms n/30. 15 Paid $190 for utlities 31 Recorded cash sales for the month of $190,000 plus sales tax of 6%. The cost of the goods sold was $114,000 and estimated warranty payable was 996. 31 Recorded October payroll and paid employees 31 Accrued employer payroll taxes for October. Nov. 1 Paid the first mortgage payment. 3 Paid Tip Top for the merchandise inventory purchased on October 3. 10 12 15 15 16 17 18 27 30 Purchased merchandise inventory on account from Tip Top for $190,000, terms n/30. Purchased 800 shares of treasury stock for $19 per share. Paid all liabilities associated with the October 31 payroll. Remitted (paid) sales tax from October sales to the state of North Carolina. Paid $8,000 to satisfy warranty claims. Declared cash dividends of $1 per outstanding share of common stock. Paid $360 for utilities. Paid the cash dividends. Recorded cash sales for the month of $160,000 plus sales tax of 6%. The cost of the goods sold was $96,000 and estimated warranty payable was 9%. Recorded November payroll and paid employees. Accrued employer payroll taxes for November 30 30 Dec. 1 Paid the second mortgage payment 10 Paid Tip Top for the merchandise inventory purchased on November 10 12 Paid $7,700 to satisfy warranty claims. 15 Sold 200 shares of treasury stock for $23 per share. 15 Paid all liabilities associated with the November 30 payroll. 15 Remitted (paid) sales tax from November sales to the state of North Carolina. 18 Paid $210 for utilities. 19 Purchased merchandise inventory on account from Tip Top for $95,000, terms n/30. 31 Recorded cash sales for the month of S200.000 plus sales tax of 6%. The cost of the goods sold was $120,000 and estimated warranty payable was 9%. Recorded December payrol and paid employees. 31 31 Accrued employer payroll taxes for December