Answered step by step

Verified Expert Solution

Question

1 Approved Answer

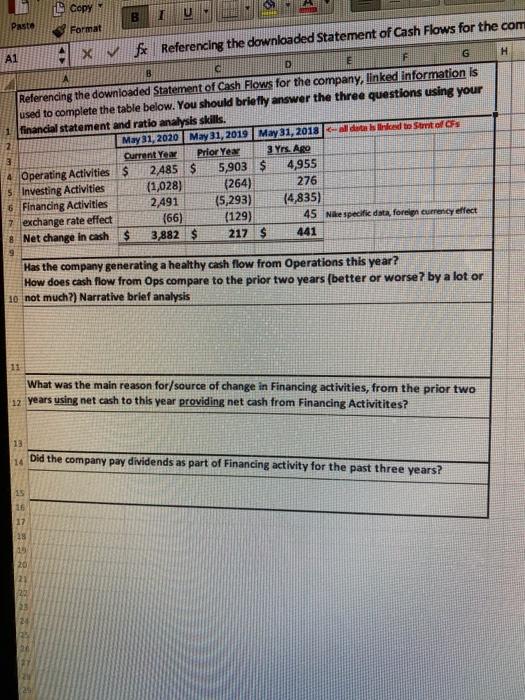

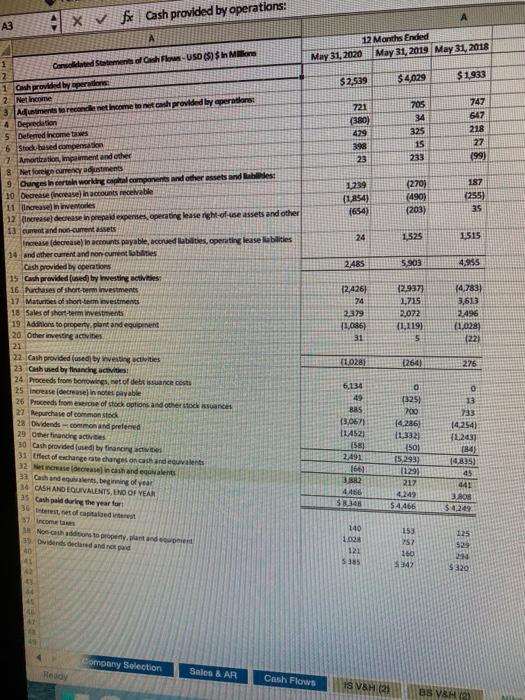

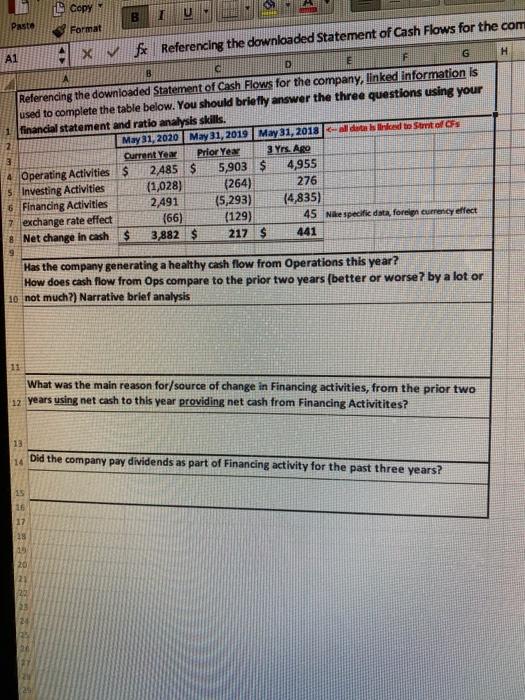

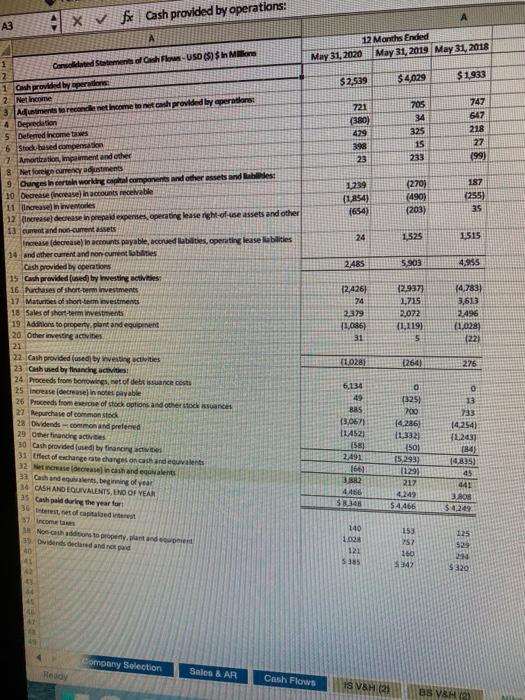

Needed some guidance please and thank you. LL Copy Pasto 8 Format A1 Alx ft Referencing the downloaded Statement of Cash Flows for the com

Needed some guidance please and thank you.

LL Copy Pasto 8 Format A1 Alx ft Referencing the downloaded Statement of Cash Flows for the com G H D B c Referencing the downloaded Statement of Cash Flows for the company, linked information is used to complete the table below. You should briefly answer the three questions using your financial statement and ratio analysis skills. 2 May 31, 2020 May 31, 2019 May 31, 2018 Na sliced to Stratos 3 Current Year Prior Year 3 Yrs. Ago 4 Operating Activities $ 2485 $ 5,903 $ 4,955 5. Investing Activities (1,028) (264) 276 6 Financing Activities 2.491 (5,293) (4,835) 7 exchange rate effect (66) (129) 45 Nespecific data, foreign currency effect 8 Net change in cash $ 3,882 $ 217 $ 441 9 Has the company generating a healthy cash flow from Operations this year? How does cash flow from Ops compare to the prior two years (better or worse? by a lot or 10 not much?) Narrative brief analysis 11 What was the main reason for/source of change in Financing activities, from the prior two 12 years using net cash to this year providing net cash from Financing Activitites? 13 Did the company pay dividends as part of Financing activity for the past three years? 14 16 17 28 x 12 Months Ended May 31, 2020 May 31, 2019 May 31, 2018 $2539 $4,029 $1,933 721 (380) 279 398 23 705 34 325 15 233 747 647 218 27 199) 187 1239 (1,854) (654) (270) (490) (203) (255) 35 for cash provided by operations: A3 A 1 Carated Statement of Cash Flow-USD ($) $ in Moe 2 1 Cash provided by operations 2 Net Income 3 Mustments to recordenetheme to net cash provided by operations 4 Depredation 5 Deferred income taxes 6 Sted based compensation 7 Amortation, impairment and other & Netfon currency adjustments 9 Chunges leertain working capital components and other assets and tables 10 Decrease increase in accounts receivable 11 Increase inventores 12 Increase decease in prepad expenses, operating leaseh-of-se assets and other 13 Cureat and nothurrent sets nese (decrease in accounts payable, accruedabate, operating lease abilities 14 and other current and noncurrenties Cash provided by operations 15 Cash previded (used by vesting activities 16 Marchases of short term wivestments 17 Matures of short term investments 18 Sales of short term westments 19 Addition to property.plant and equipment 20. Other investing activities 21 22. Cash provided fused by Westing activities 23 Cathed by financing activities! 24 Proceeds from borrowings, net of deb issuance costs 25 Increase (decrease in the payable 26 Proceeds from were of stock options and other stockscancel 22 Repurchase of common stock 28 Olvidends common and preferred 24 1,525 1515 2485 5903 4,955 12.426) 74 2.379 1.686) 31 2.937) 1,715 2.072 (1119) 5 14,783) 3,613 2496 (1.028) (22) 11.0281 (264) 276 29 Other funding activities 30 Cash provided used by financirates 31 Cfect of exchange rate changes on cash and events 32 eraseanchando alets 31 Gashent, begring of year 34 CASH AND EQUIVALENTS, END OF YEAR 35 Cashpad during the year for 36, of capitales 6,134 49 BBS 13,0671 1452) 158) 2.491 1661 3.82 0 (325) 700 14.2861 (1,332) 150) 15,293) 1129) 217 4249 $4466 0 15 733 14.254) 14.2431 (84) 14.835) 45 441 5348 $4249 Nos controlat and wonen 15 werd declared and not and 40 140 100 121 5385 153 VS? 160 842 3320 Company Selection Ready Sales & AR Cash Flows 18 V&H 23 BS VBH 12 LL Copy Pasto 8 Format A1 Alx ft Referencing the downloaded Statement of Cash Flows for the com G H D B c Referencing the downloaded Statement of Cash Flows for the company, linked information is used to complete the table below. You should briefly answer the three questions using your financial statement and ratio analysis skills. 2 May 31, 2020 May 31, 2019 May 31, 2018 Na sliced to Stratos 3 Current Year Prior Year 3 Yrs. Ago 4 Operating Activities $ 2485 $ 5,903 $ 4,955 5. Investing Activities (1,028) (264) 276 6 Financing Activities 2.491 (5,293) (4,835) 7 exchange rate effect (66) (129) 45 Nespecific data, foreign currency effect 8 Net change in cash $ 3,882 $ 217 $ 441 9 Has the company generating a healthy cash flow from Operations this year? How does cash flow from Ops compare to the prior two years (better or worse? by a lot or 10 not much?) Narrative brief analysis 11 What was the main reason for/source of change in Financing activities, from the prior two 12 years using net cash to this year providing net cash from Financing Activitites? 13 Did the company pay dividends as part of Financing activity for the past three years? 14 16 17 28 x 12 Months Ended May 31, 2020 May 31, 2019 May 31, 2018 $2539 $4,029 $1,933 721 (380) 279 398 23 705 34 325 15 233 747 647 218 27 199) 187 1239 (1,854) (654) (270) (490) (203) (255) 35 for cash provided by operations: A3 A 1 Carated Statement of Cash Flow-USD ($) $ in Moe 2 1 Cash provided by operations 2 Net Income 3 Mustments to recordenetheme to net cash provided by operations 4 Depredation 5 Deferred income taxes 6 Sted based compensation 7 Amortation, impairment and other & Netfon currency adjustments 9 Chunges leertain working capital components and other assets and tables 10 Decrease increase in accounts receivable 11 Increase inventores 12 Increase decease in prepad expenses, operating leaseh-of-se assets and other 13 Cureat and nothurrent sets nese (decrease in accounts payable, accruedabate, operating lease abilities 14 and other current and noncurrenties Cash provided by operations 15 Cash previded (used by vesting activities 16 Marchases of short term wivestments 17 Matures of short term investments 18 Sales of short term westments 19 Addition to property.plant and equipment 20. Other investing activities 21 22. Cash provided fused by Westing activities 23 Cathed by financing activities! 24 Proceeds from borrowings, net of deb issuance costs 25 Increase (decrease in the payable 26 Proceeds from were of stock options and other stockscancel 22 Repurchase of common stock 28 Olvidends common and preferred 24 1,525 1515 2485 5903 4,955 12.426) 74 2.379 1.686) 31 2.937) 1,715 2.072 (1119) 5 14,783) 3,613 2496 (1.028) (22) 11.0281 (264) 276 29 Other funding activities 30 Cash provided used by financirates 31 Cfect of exchange rate changes on cash and events 32 eraseanchando alets 31 Gashent, begring of year 34 CASH AND EQUIVALENTS, END OF YEAR 35 Cashpad during the year for 36, of capitales 6,134 49 BBS 13,0671 1452) 158) 2.491 1661 3.82 0 (325) 700 14.2861 (1,332) 150) 15,293) 1129) 217 4249 $4466 0 15 733 14.254) 14.2431 (84) 14.835) 45 441 5348 $4249 Nos controlat and wonen 15 werd declared and not and 40 140 100 121 5385 153 VS? 160 842 3320 Company Selection Ready Sales & AR Cash Flows 18 V&H 23 BS VBH 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started