Needing help in understanding what it is that my professor is looking for?

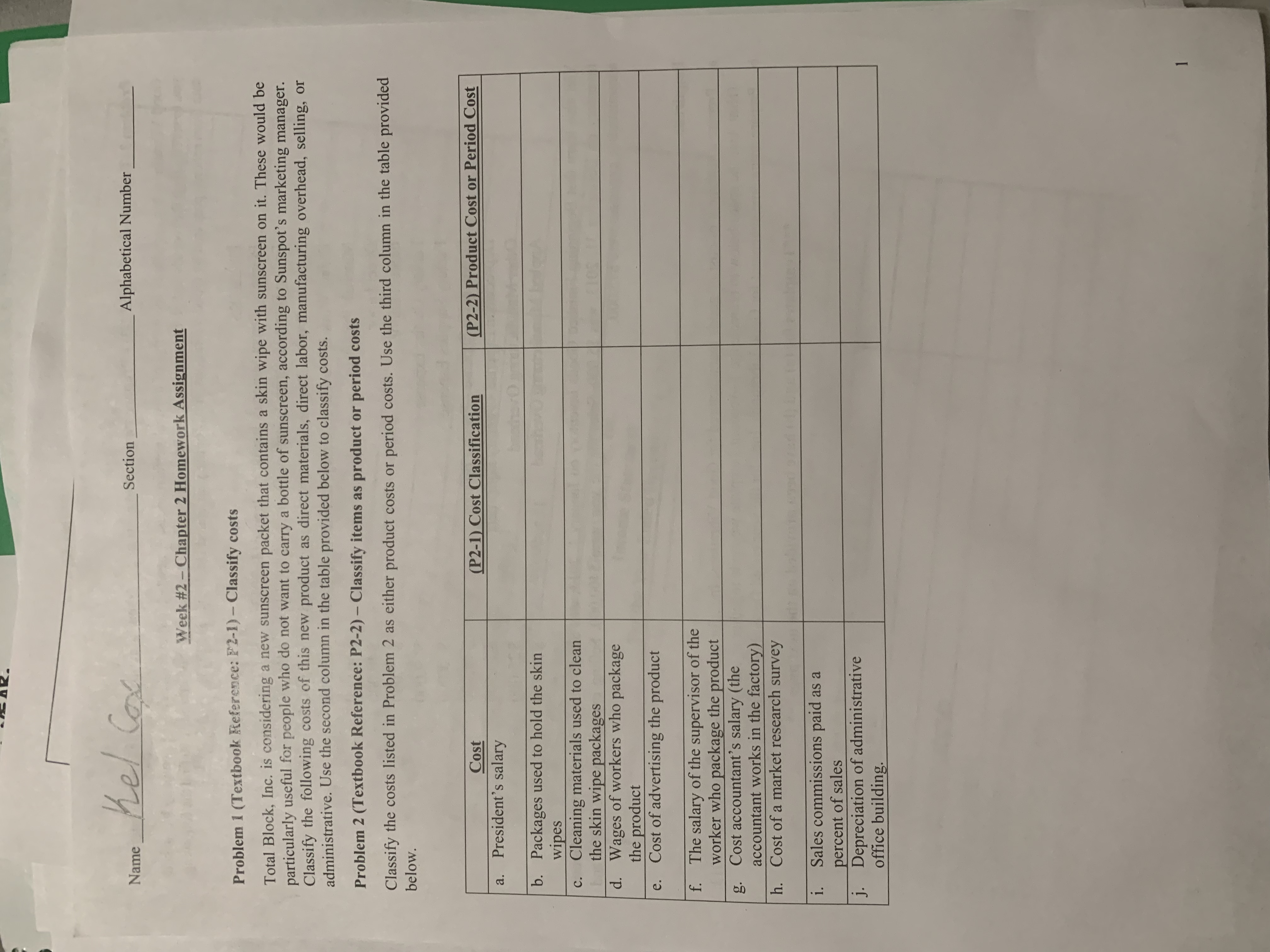

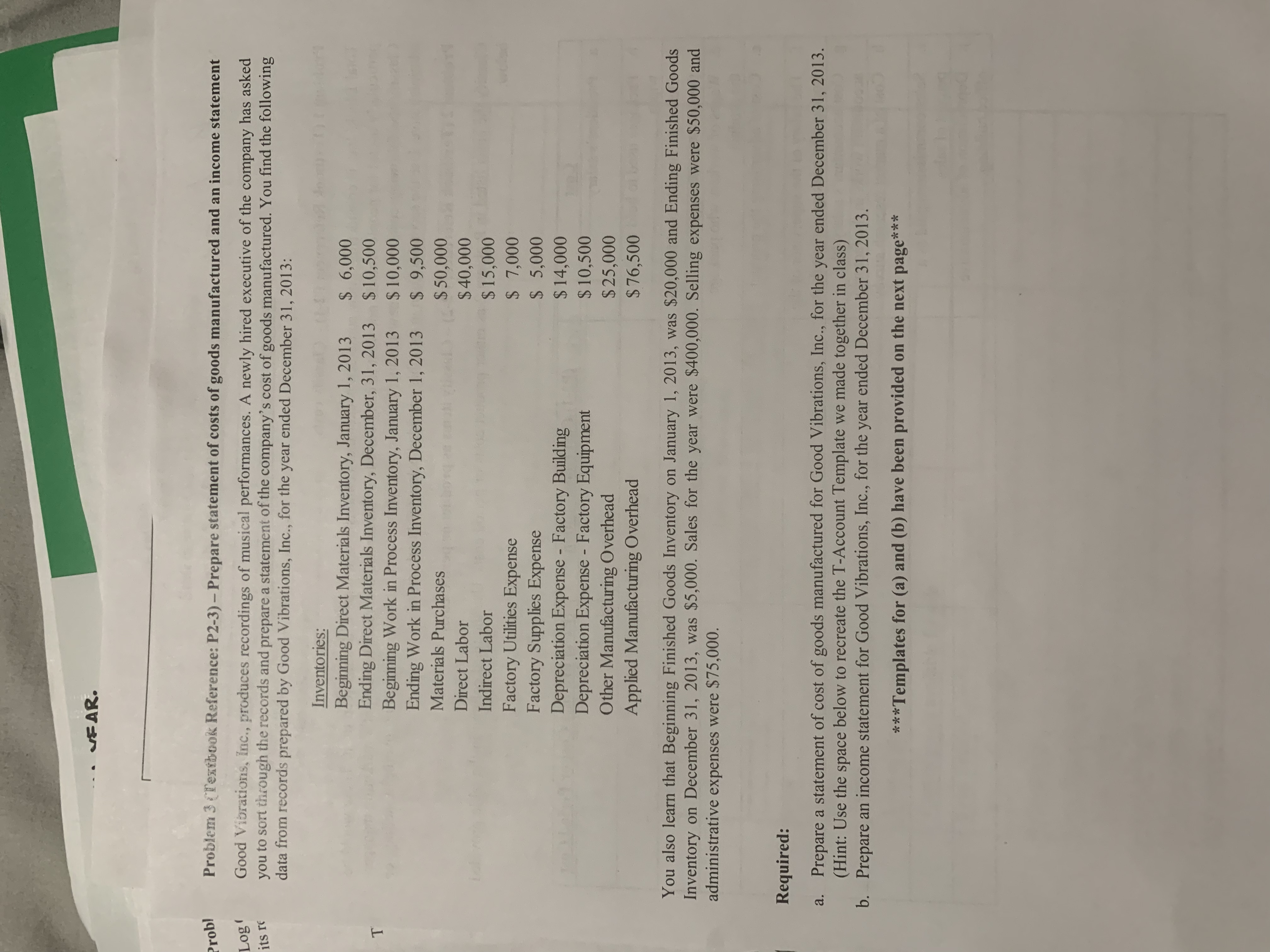

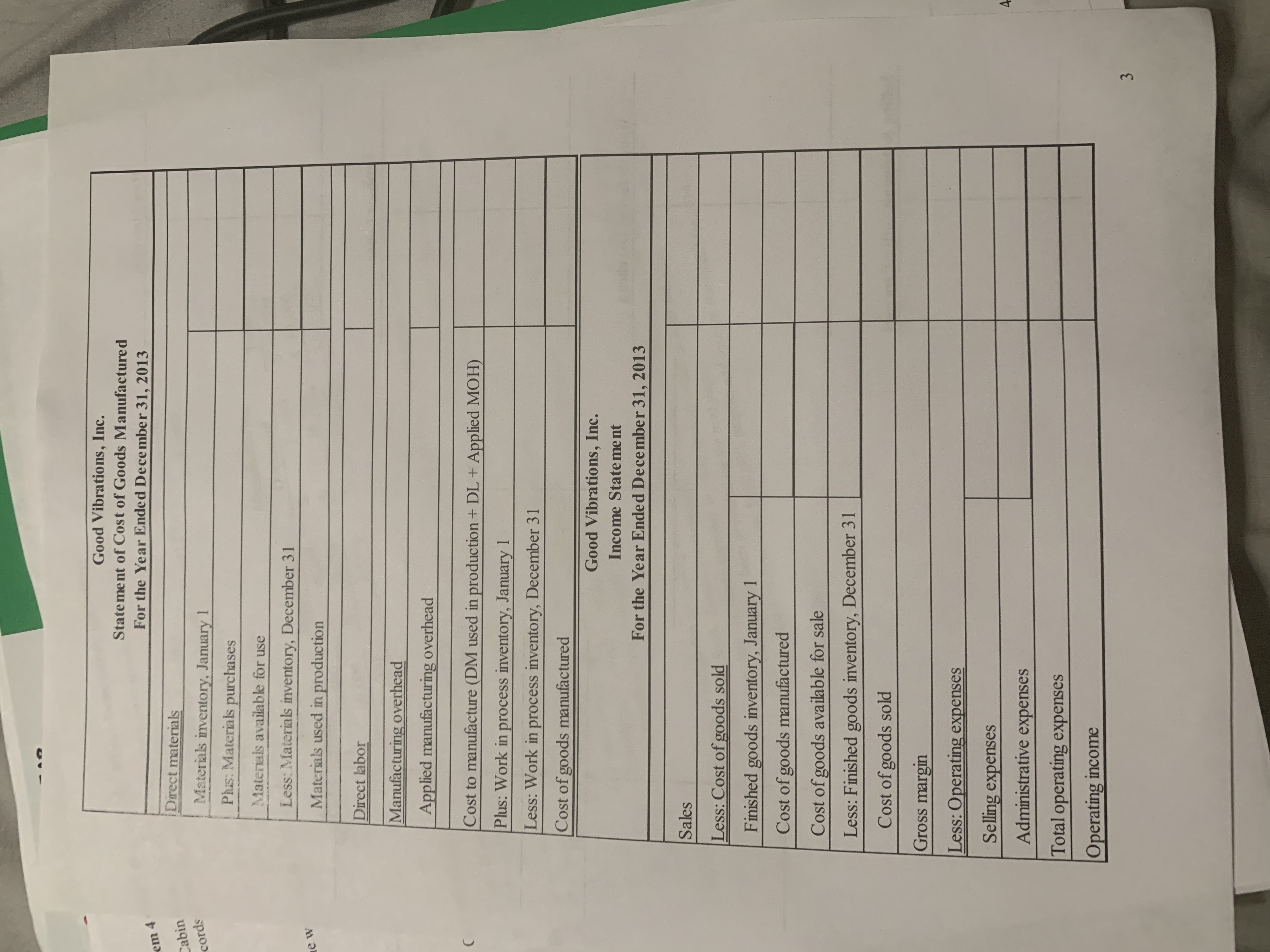

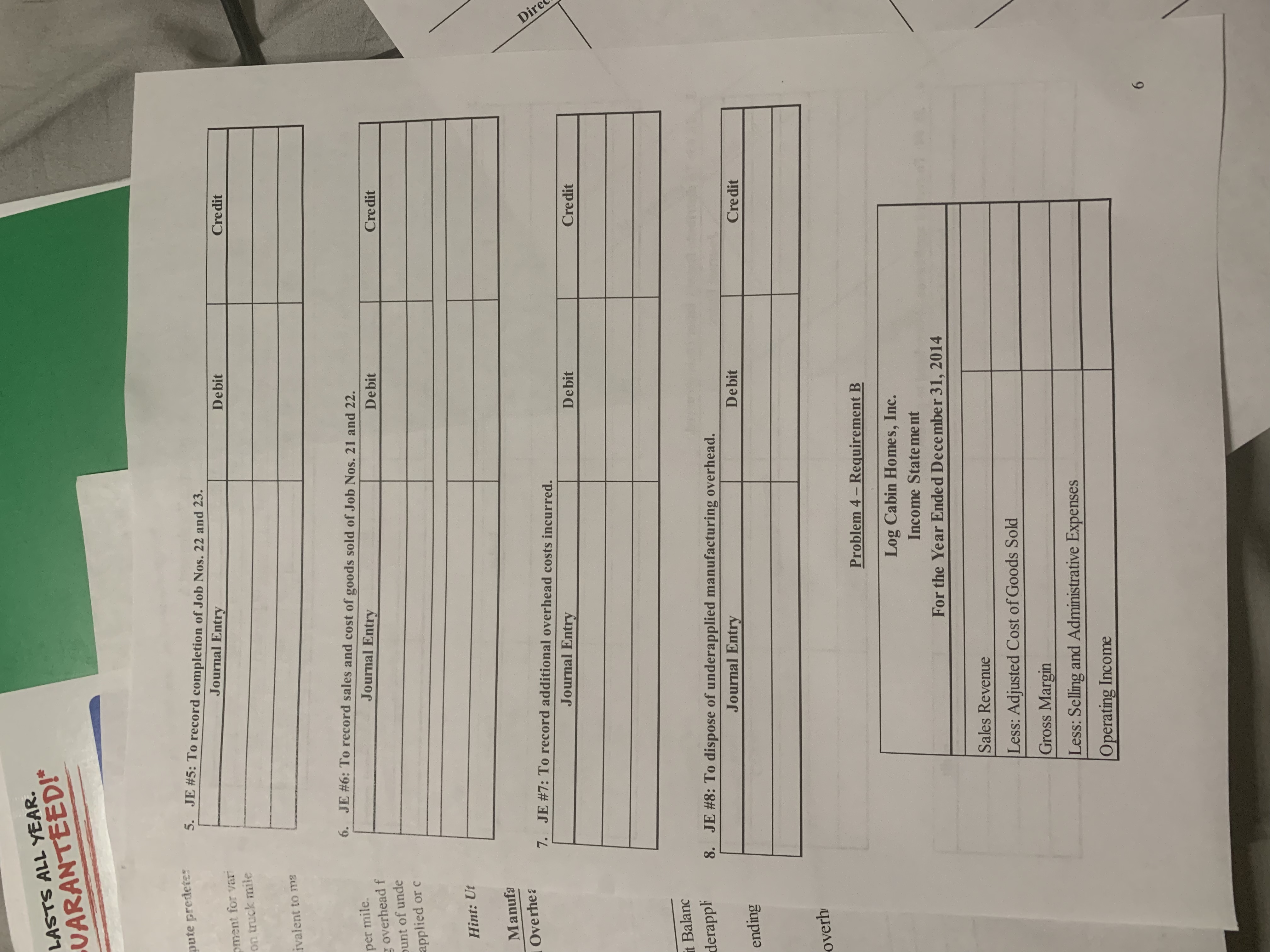

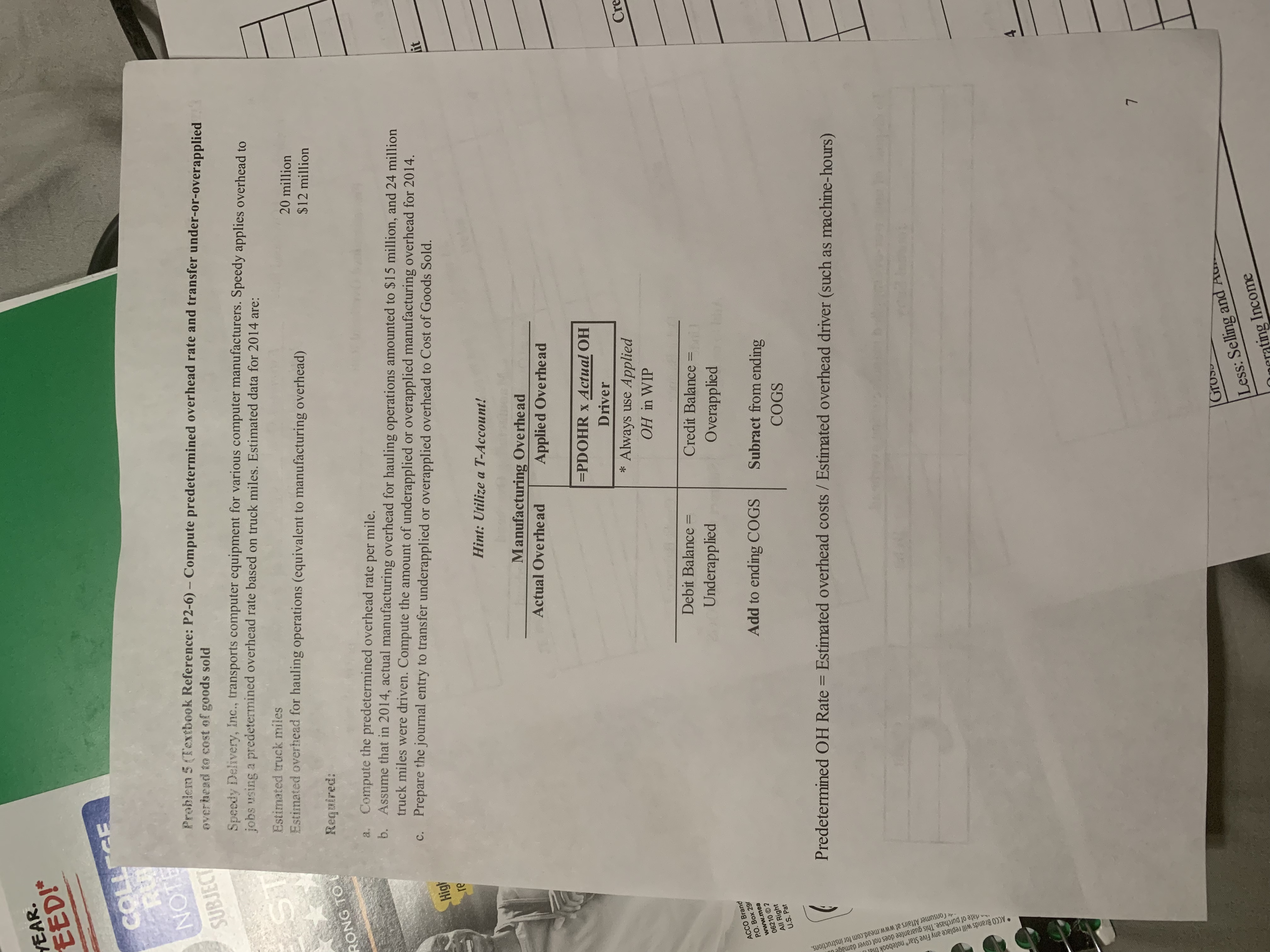

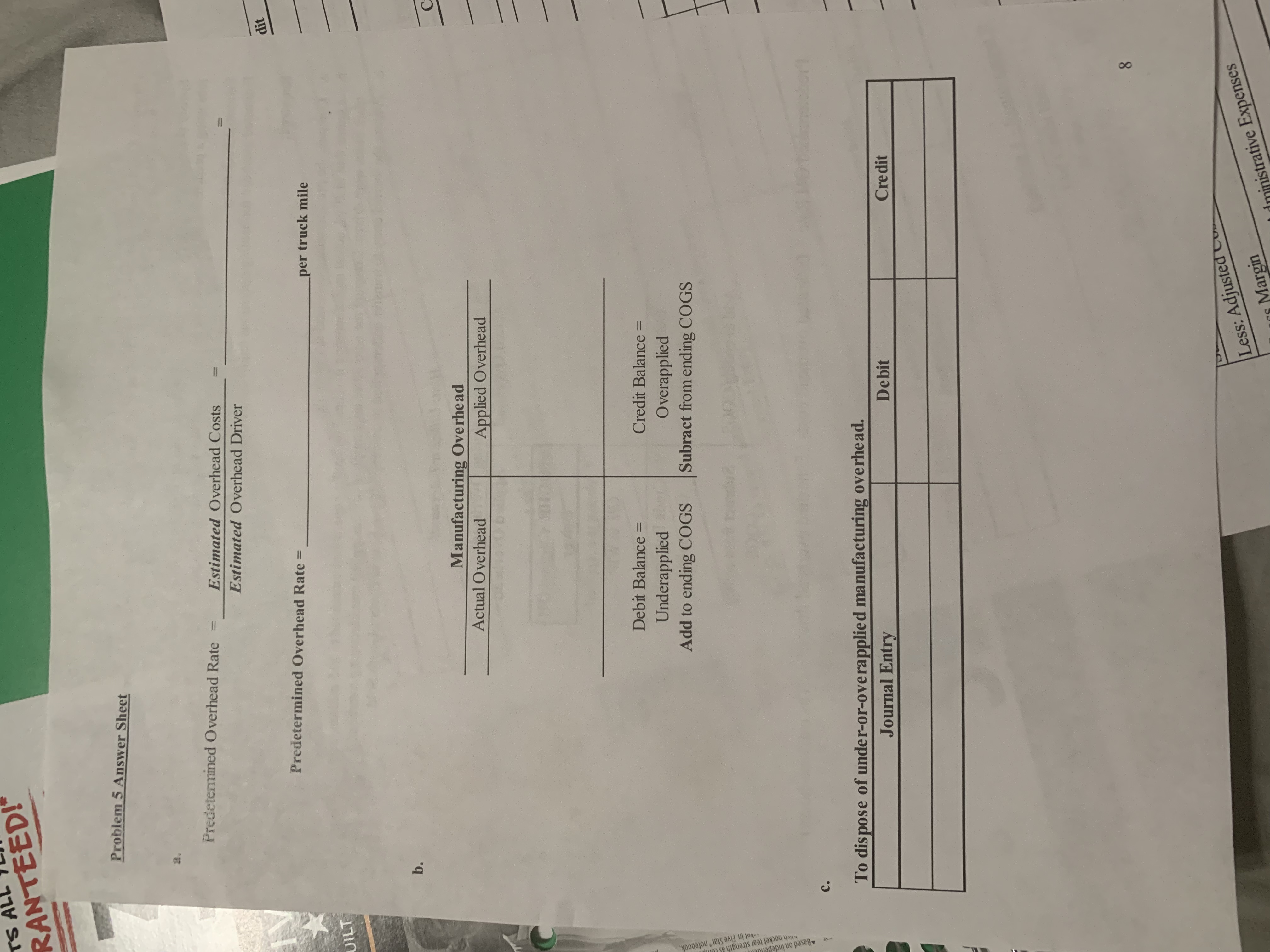

Name Kel cox Section Alphabetical Number Week #2 - Chapter 2 Homework Assignment Problem 1 (Textbook Reference: P2-1) - Classify costs Total Block, Inc. is considering a new sunscreen packet that contains a skin wipe with sunscreen on it. These would be particularly useful for people who do not want to carry a bottle of sunscreen, according to Sunspot's marketing manager. Classify the following costs of this new product as direct materials, direct labor, manufacturing overhead, selling, or administrative. Use the second column in the table provided below to classify costs Problem 2 (Textbook Reference: P2-2) - Classify items as product or period costs Classify the costs listed in Problem 2 as either product costs or period costs. Use the third column in the table provided below. Cost (P2-1) Cost Classification (P2-2) Product Cost or Period Cost . President's salary b. Packages used to hold the skin wipes c. Cleaning materials used to clean the skin wipe packages d. Wages of workers who package the product e. Cost of advertising the product f. The salary of the supervisor of the worker who package the product Cost accountant's salary ( the accountant works in the factory) Cost of a market research survey Sales commissions paid as a percent of sales Depreciation of administrative office buildingVFAR. robl Problem 3 (Textbook Reference: P2-3) - Prepare statement of costs of goods manufactured and an income statement Log Good Vibrations, Inc., produces recordings of musical performances. A newly hired executive of the company has asked its re you to sort through the records and prepare a statement of the company's cost of goods manufactured. You find the following data from records prepared by Good Vibrations, Inc., for the year ended December 31, 2013 Inventories: Beginning Direct Materials Inventory, January 1, 2013 $ 6,000 Ending Direct Materials Inventory, December, 31, 2013 $ 10,500 Beginning Work in Process Inventory, January 1, 2013 $ 10,000 Ending Work in Process Inventory, December 1, 2013 $ 9,500 Materials Purchases $ 50,000 Direct Labor $ 40,000 Indirect Labor $ 15,000 Factory Utilities Expense $ 7,000 Factory Supplies Expense $ 5,000 Depreciation Expense - Factory Building $ 14,000 Depreciation Expense - Factory Equipment $ 10,500 Other Manufacturing Overhead $ 25,000 Applied Manufacturing Overhead $ 76,500 You also learn that Beginning Finished Goods Inventory on January 1, 2013, was $20,000 and Ending Finished Goods Inventory on December 31, 2013, was $5,000. Sales for the year were $400,000. Selling expenses were $50,000 and administrative expenses were $75,000. Required: a. Prepare a statement of cost of goods manufactured for Good Vibrations, Inc., for the year ended December 31, 2013. (Hint: Use the space below to recreate the T-Account Template we made together in class) b. Prepare an income statement for Good Vibrations, Inc., for the year ended December 31, 2013. * * *Templates for (a) and (b) have been provided on the next page** *Good Vibrations, Inc. Statement of Cost of Goods Manufactured For the Year Ended December 31, 2013 em 4 Cabin Direct materials cords Materials inventory, January 1 Plus: Materials purchases Materials available for use Less: Materials inventory, December 31 Materials used in production Direct labor Manufacturing overhead Applied manufacturing overhead Cost to manufacture (DM used in production + DL + Applied MOH) Plus: Work in process inventory, January 1 Less: Work in process inventory, December 31 Cost of goods manufactured Good Vibrations, Inc. Income Statement For the Year Ended December 31, 2013 Sales Less: Cost of goods sold Finished goods inventory, January 1 Cost of goods manufactured Cost of goods available for sale Less: Finished goods inventory, December 31 Cost of goods sold Gross margin Less: Operating expenses Selling expenses Administrative expenses Total operating expenses Operating incomeLASTS ALL YEAR. GUARANTEED!* COLLEGE Raw Materials Textbor Homes, ! showed rk in pr Direct Labor Finished Goods Work in Process t and Manufacturing Overhead Cost of Goods Sold Selling & Administrative ExpensesNOTEBOOK - .ACT | 150 SHEETS Problem 4 (Textbook Reference: P2-4) - Demonstrate job costing Log Cabin Homes, Inc. uses a job cost system to account for its jobs, which are prefabricated houses. As of January 1, 2014, its records showed inventories as follows: Materials and supplies $ 100,000 Work in process (Job Nos. 22 and 23) $ 180,000 Finished goods (Job No. 21) $ 140,000 The work in process inventory consisted of two jobs: Direct Manufacturing Job No. Materials Direct Labor Overhead Total GA GA GA 36,000 40,000 20,000 $ 96,000 40,000 28,000 16,000 $ 84,000 76,000 68,000 36,000 $ 180,000 Cost and sales data for 2014: 1. Materials purchased on account, $400,000. 2. Direct materials used: Job No. 22, $60,000; Job No. 23, $120,000; Job No. 24, $180,000. Indirect materials used, $10,000. 3. Direct labor costs: Job No. 22, $100,000; Job No. 23, $200,000; and Job No. 24, $80,000. Indirect labor costs, $80,000 4. Overhead is assigned to jobs at $100 per machine-hours. Job No. 22 used 500 machine-hours, Job No. 23 used 1,000 machine-hours, and Job No. 24 used 300 machine hours in January. 5. Job Nos. 22 and 23 were completed and transferred to Finished Goods Inventory. 6. Job Nos. 21 and 22 were sold on account for $1,200,000, total . Manufacturing overhead costs incurred, other than indirect materials and indirect labor, were depreciation, $80,000, and heat, light, power, miscellaneous, $40,000. Required: a. Prepare journal entries to assign the preceding costs to jobs. Show the appropriate entries debiting Finished Goods Inventory and Cost of Goods Sold. Transfer overapplied or underapplied overhead to Cost of Goods Sold. (Hint: Recreate the T-Account Template we made together in class to keep track of your job costs before you record your journal entries. A T-Account template has been provided on the next page., Assuming selling and administrative expenses were $100,000, prepare and income statement for 2014.LASTS GUARANTEED Raw Materials unts Pa Direct Labor counts ccumul Finished Goods ost of #1: T Work in Process Manufacturing Overhead L Cost of Goods Sold Selling & Administrative Expenses inLASTS ALL YEAR. -SFD!* Problem 4 Answer Sheet - Requirement A Chart of Accounts Accounts Payable Finished Goods Inventory Sales Revenue Accounts Receivable Manufacturing Overhead WIP Inventory - Job No. 22 Accumulated Depreciation Materials Inventory WIP Inventory - Job No. 23 Cost of Goods Sold Payroll Summary WIP Inventory - Job No. 24 JE #1: To record the purchase of direct materials. Journal Entry Debit Credit JE#2: To record direct and indirect materials issued. Journal Entry Debit Credit - n ar resists ink bleed with com 3. JE #3: To distribute factory labor costs incurred. Journal Entry Debit Credit 4. JE #4: To record application of overhead to production. Journal Entry Debit CreditLASTS ALL YEAR. VARANTEED!* pute predeter 5. JE #5: To record completion of Job Nos. 22 and 23. Journal Entry Debit ment for var Credit on truck mile ivalent to ma 6. JE #6: To record sales and cost of goods sold of Job Nos. 21 and 22. per mile overhead f Journal Entry Debit Credit unt of unde applied or c Hint: Ut Manufa Overhez 7. JE #7: To record additional overhead costs incurred. Direc Journal Entry Debit Credit t Balanc derappli 8. JE #8: To dispose of underapplied manufacturing overhead. Journal Entry Debit Credit ending overh Problem 4 - Requirement B Log Cabin Homes, Inc. Income Statement For the Year Ended December 31, 2014 Sales Revenue Less: Adjusted Cost of Goods Sold Gross Margin Less: Selling and Administrative Expenses Operating IncomeYEAR. EED!* COLLEGE NOTE Problem 5 (Textbook Reference: P2-6) - Compute predetermined overhead rate and transfer under-or-overapplied SUBJECT overhead to cost of goods sold Speedy Delivery, inc., transports computer equipment for various computer manufacturers. Speedy applies overhead to jobs using a predetermined overhead rate based on truck miles. Estimated data for 2014 are: Estimated truck miles 20 million Estimated overhead for hauling operations (equivalent to manufacturing overhead) $12 million RONG TO Required: Compute the predetermined overhead rate per mile . Assume that in 2014, actual manufacturing overhead for hauling operations amounted to $15 million, and 24 million truck miles were driven. Compute the amount of underapplied or overapplied manufacturing overhead for 2014. c. Prepare the journal entry to transfer underapplied or overapplied overhead to Cost of Goods Sold. Hig Hint: Utilize a T-Account! Manufacturing Overhead Actual Overhead Applied Overhead =PDOHR x Actual OH Driver * Always use Applied Cre OH in WIP Debit Balance = Credit Balance = Underapplied Overapplied ACCO Brand P.O. Box 29 Add to ending COGS Subract from ending 0bagigh Allpat COGS Predetermined OH Rate = Estimated overhead costs / Estimated overhead driver (such as machine-hours) - de Consumer Affairs at www.mead.com for instruction the rate of purchase. This guarantee does not cover ACCO Brands will replace any Five Star noteb Less: Selling and Au ing IncomeTS ALL RANTEED! Problem 5 Answer Sheet Predetermined Overhead Rate = Estimated Overhead Costs Estimated Overhead Driver dit Predetermined Overhead Rate = per truck mile Manufacturing Overhead Actual Overhead Applied Overhead Debit Balance = Credit Balance = Underapplied Overapplied Add to ending COGS Subract from ending COGS w uo pasedy To dispose of under-or-overapplied manufacturing overhead. Journal Entry Debit Credit 00 Less: Adjusted Com Margin nistrative Expenses