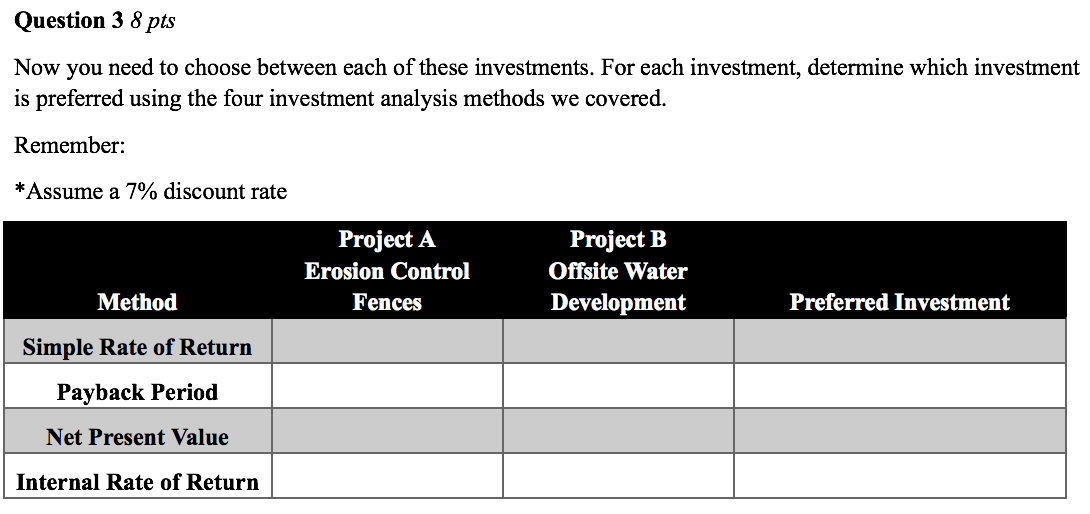

Needing help on question #3.

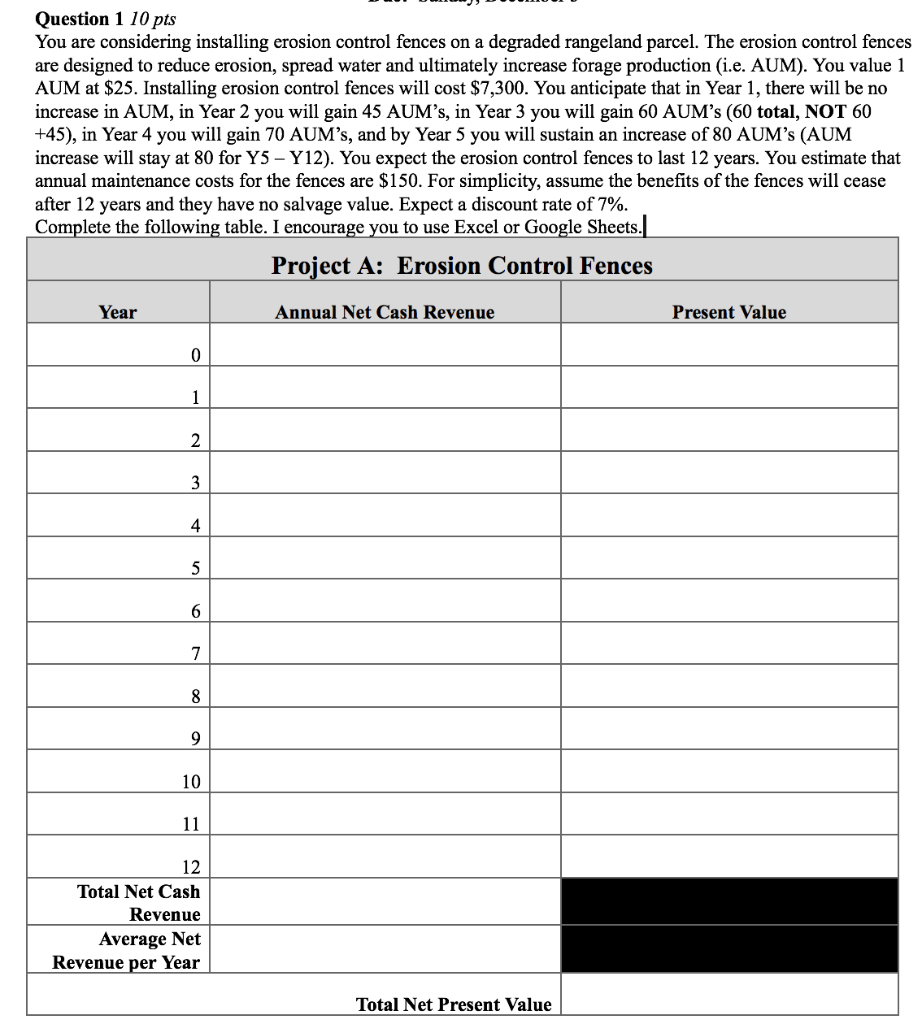

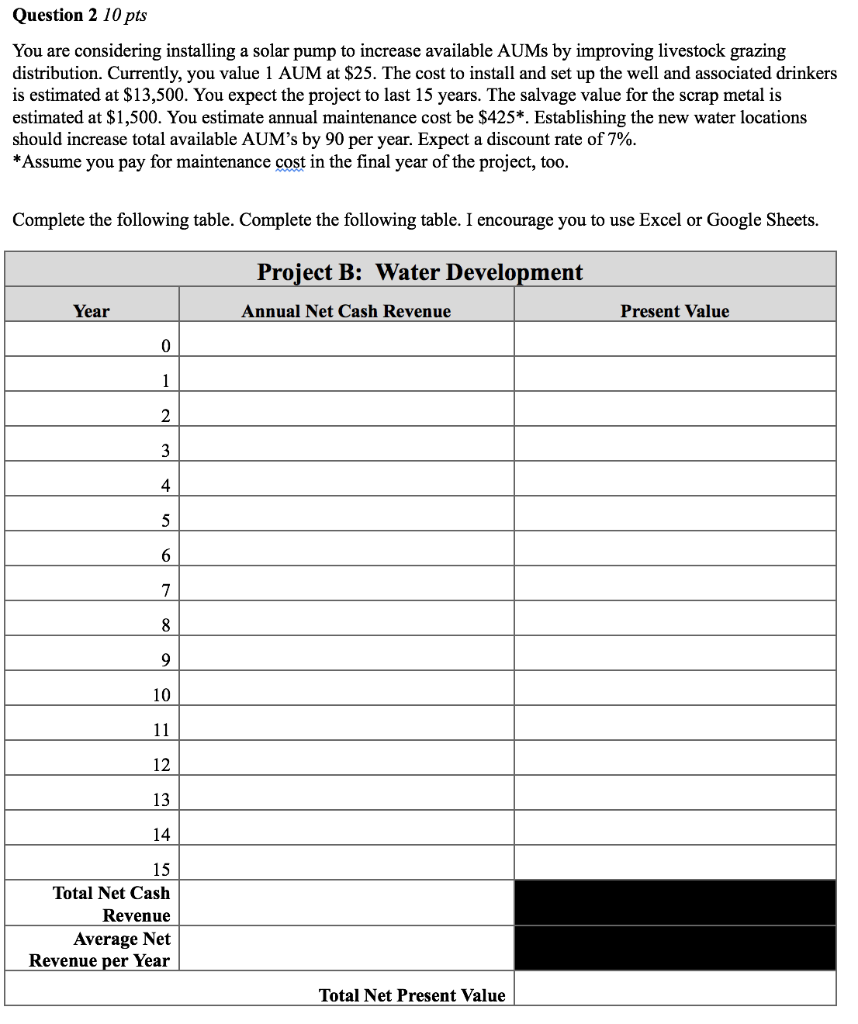

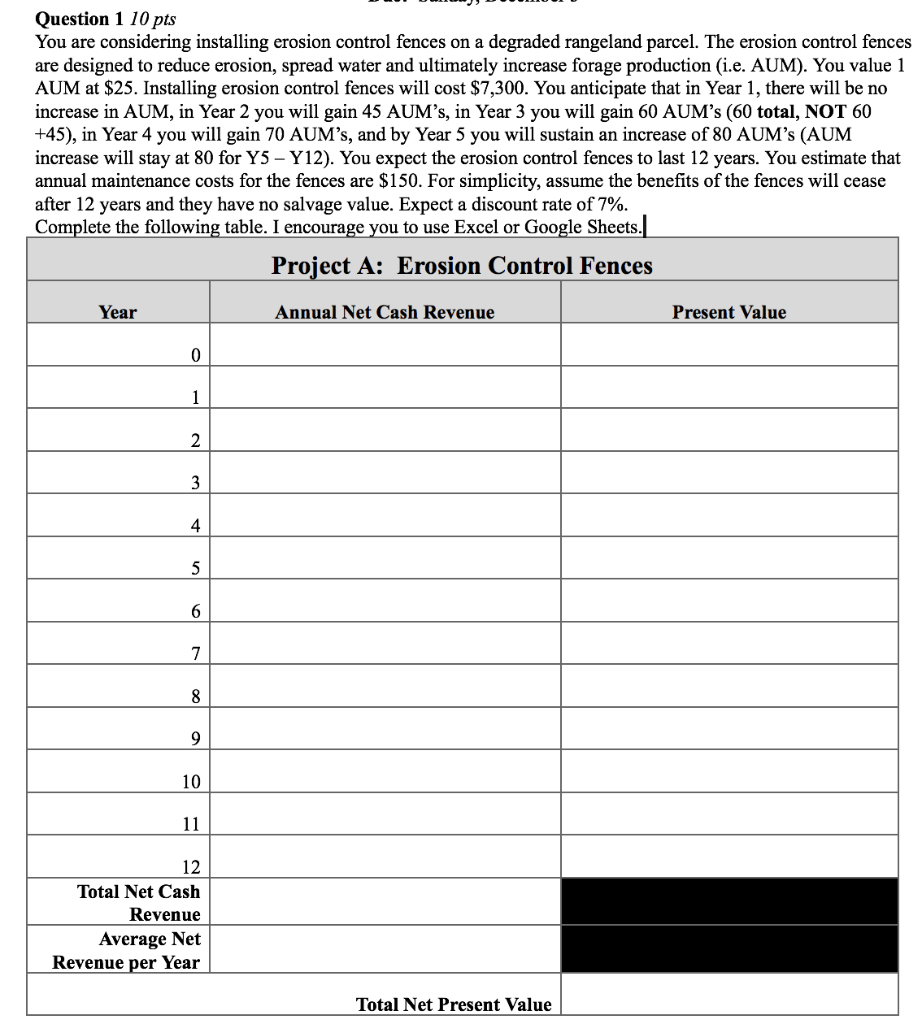

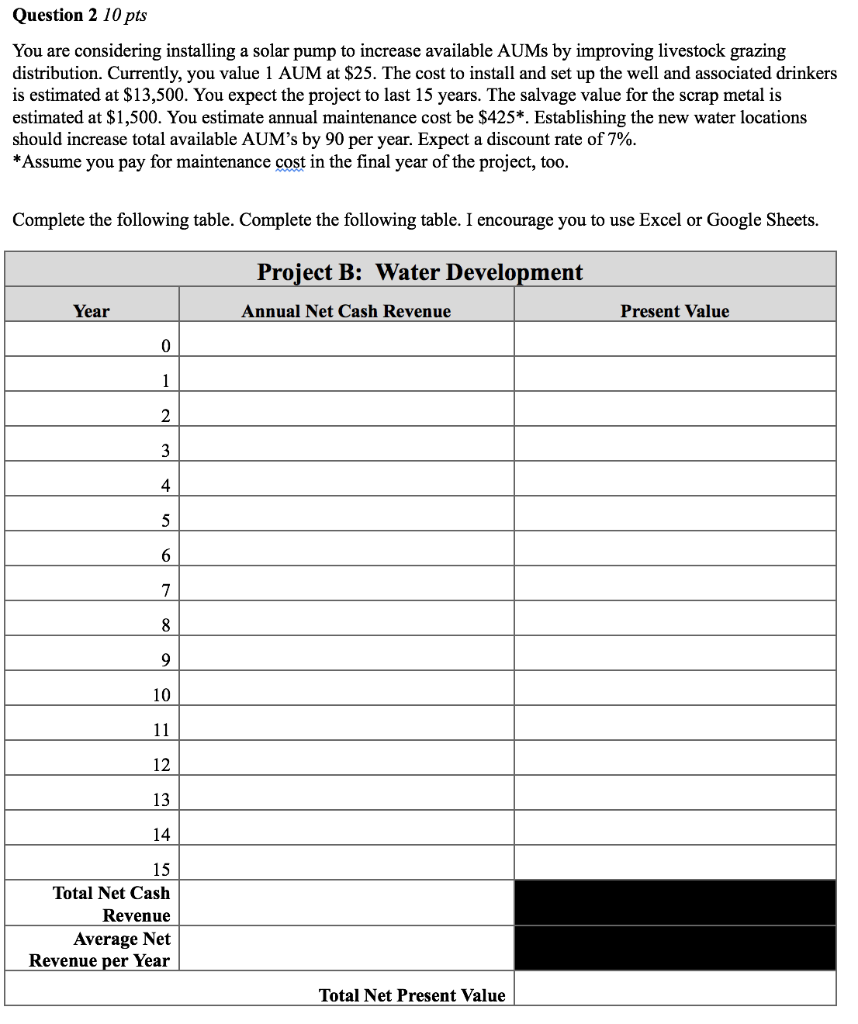

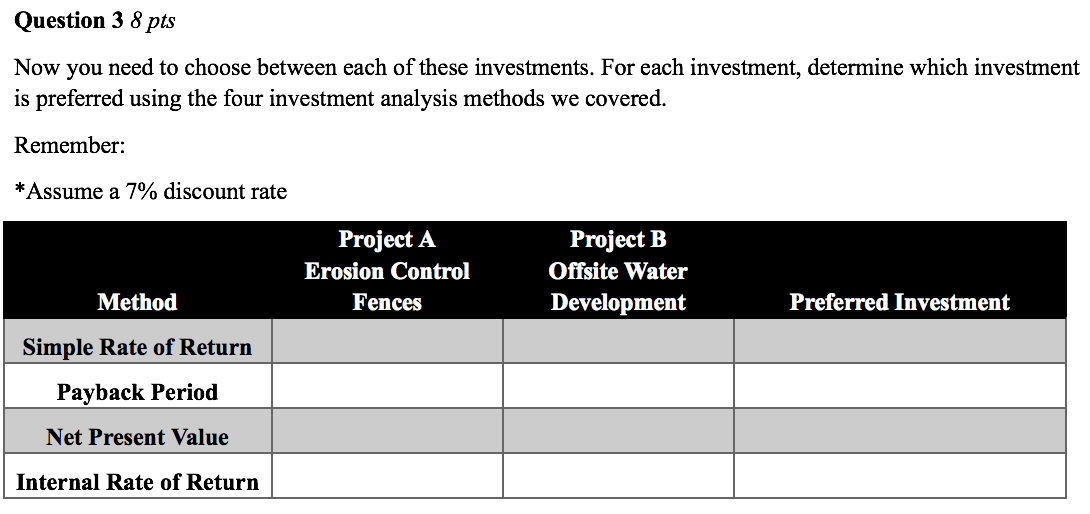

Question 1 10 pts You are considering installing erosion control fences on a degraded rangeland parcel. The erosion control fences are designed to reduce erosion, spread water and ultimately increase forage production (i.e. AUM). You value 1 AUM at $25. Installing erosion control fences will cost $7,300. You anticipate that in Year 1, there will be no increase in AUM, in Year 2 you will gain 45 AUM's, in Year 3 you will gain 60 AUM's (60 total, NOT 60 +45), in Year 4 you will gain 70 AUM's, and by Year 5 you will sustain an increase of 80 AUM's (AUM increase will stay at 80 for Y5 Y12). You expect the erosion control fences to last 12 years. You estimate that annual maintenance costs for the fences are $150. For simplicity, assume the benefits of the fences will cease after 12 years and they have no salvage value. Expect a discount rate of 7%. Complete the following table. I encourage you to use Excel or Google Sheets. Project A: Erosion Control Fences Year Annual Net Cash Revenue Present Value 0 1 2 3 4 5 6 7 8 9 10 11 12 Total Net Cash Revenue Average Net Revenue per Year Total Net Present Value Question 2 10 pts You are considering installing a solar pump to increase available AUMs by improving livestock grazing distribution. Currently, you value 1 AUM at $25. The cost to install and set up the well and associated drinkers is estimated at $13,500. You expect the project to last 15 years. The salvage value for the scrap metal is estimated at $1,500. You estimate annual maintenance cost be $425*. Establishing the new water locations should increase total available AUM's by 90 per year. Expect a discount rate of 7%. *Assume you pay for maintenance cost in the final year of the project, too. Complete the following table. Complete the following table. I encourage you to use Excel or Google Sheets. Project B: Water Development Year Annual Net Cash Revenue Present Value 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Total Net Cash Revenue Average Net Revenue per Year Total Net Present Value Question 3 8 pts Now you need to choose between each of these investments. For each investment, determine which investment is preferred using the four investment analysis methods we covered. Remember: *Assume a 7% discount rate Project A Erosion Control Fences Project B Offsite Water Development Method Preferred Investment Simple Rate of Return Payback Period Net Present Value Internal Rate of Return