Answered step by step

Verified Expert Solution

Question

1 Approved Answer

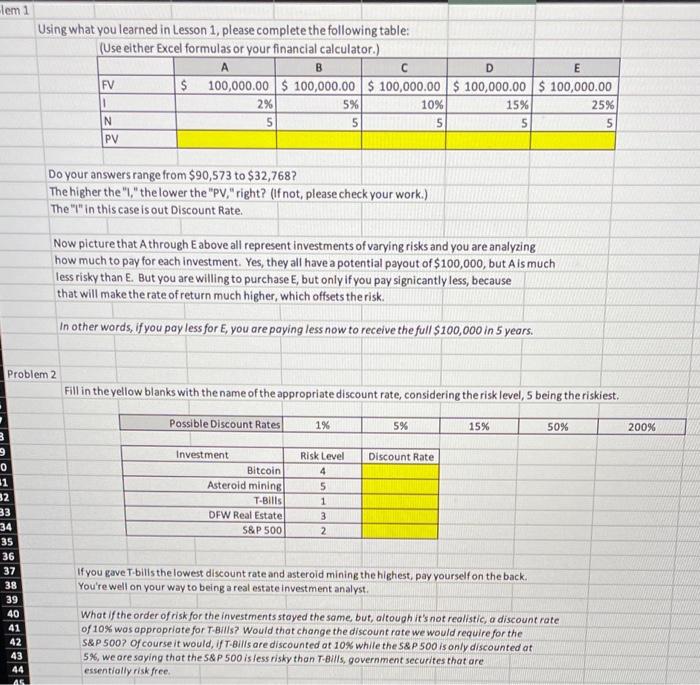

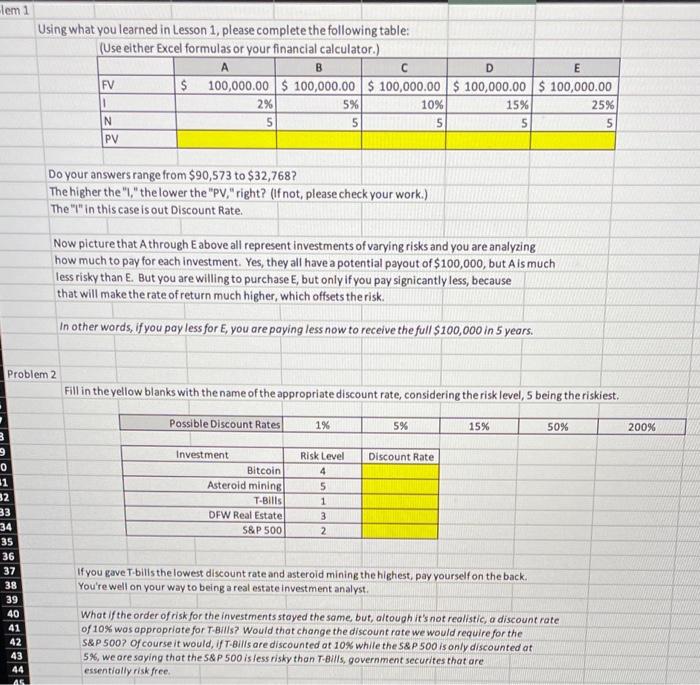

Needing problem 1 & 2 please. lem 1 Using what you learned in lesson 1, please complete the following table: (Use either Excel formulas or

Needing problem 1 & 2 please.

lem 1 Using what you learned in lesson 1, please complete the following table: (Use either Excel formulas or your financial calculator.) B D E FV $ 100,000.00 $ 100,000.00 $ 100,000.00 $ 100,000.00 $ 100,000.00 2% 5% 10% 15% 25% N 5 5 5 5 5 PV 1 Do your answers range from $90,573 to $32,768? The higher the","the lower the "PV,"right? (If not, please check your work.) The "I"in this case is out Discount Rate. Now picture that Athrough E above all represent investments of varying risks and you are analyzing how much to pay for each investment. Yes, they all have a potential payout of $100,000, but Ais much less risky than E. But you are willing to purchase E, but only if you pay signicantly less, because that will make the rate of return much higher, which offsets the risk In other words, if you pay less for E, you are paying less now to receive the full $100,000 in 5 years. Problem 2 Fill in the yellow blanks with the name of the appropriate discount rate, considering the risk level, 5 being the riskiest. Possible Discount Rates 1% 5% 15% 50% 200% Discount Rate 3 9 0 11 32 33 34 35 36 37 38 39 40 Investment Bitcoin Asteroid mining T-Bills DFW Real Estate S&P 500 Risk Level 4 5 1 3 2 If you gave T-bills the lowest discount rate and asteroid mining the highest, pay yourself on the back You're well on your way to being a real estate Investment analyst What i the order ofrisk for the investments stayed the same but, altough it's not realistic, a discount rate of 10% was appropriate for T-Bills? Would that change the discount rate we would require for the S&P 500? Of course it would, if T-Bills are discounted ot 10% while the S&P 500 is only discounted or 5%, we are saying that the S&P 500 Isless risky than T-Bills, government securites that are essentially risk free 41 42 43 44 A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started