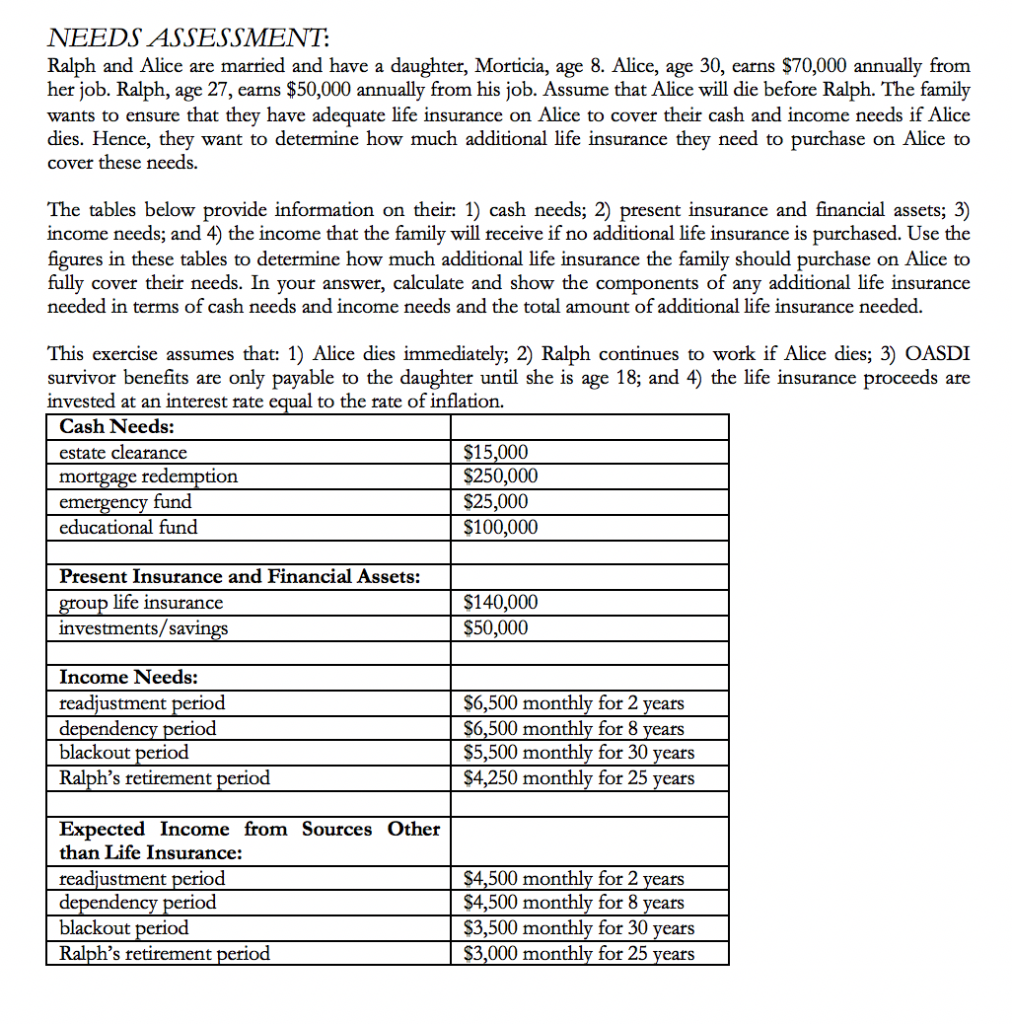

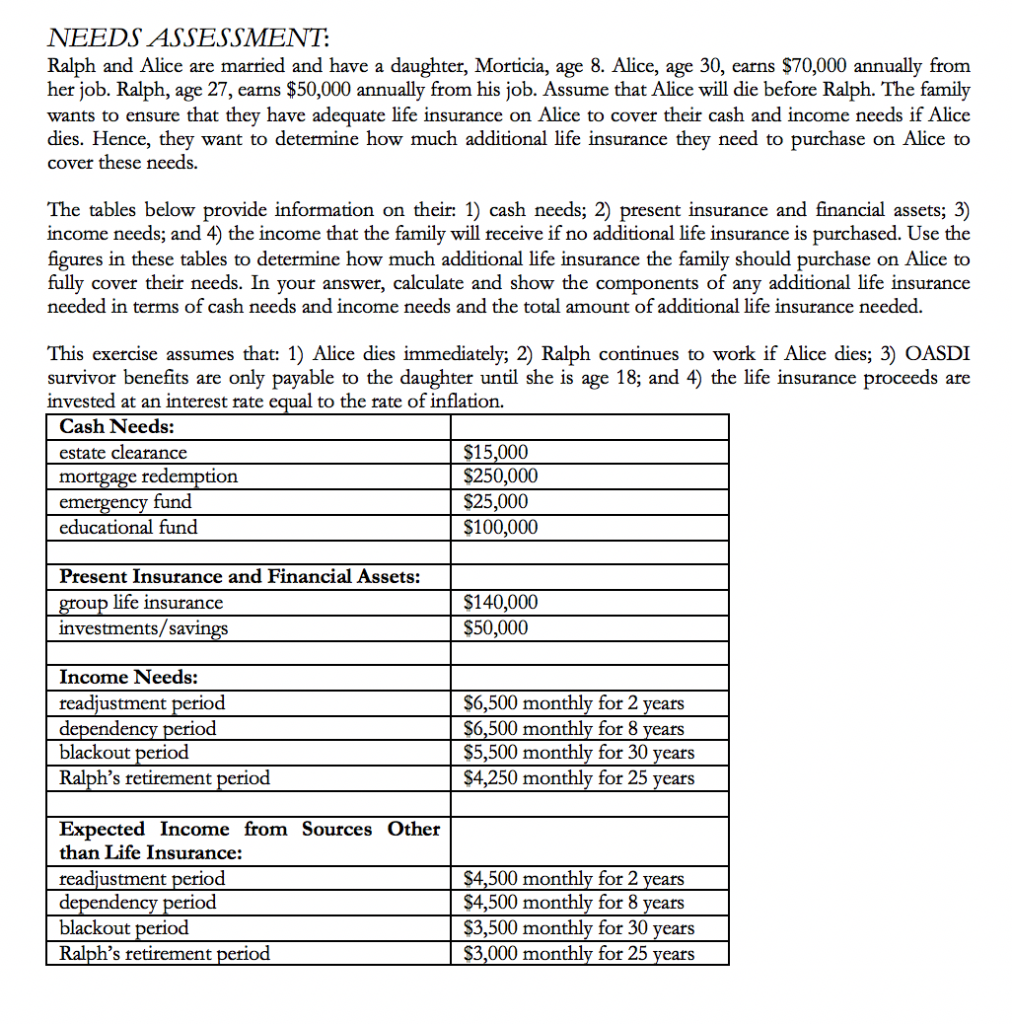

NEEDS ASSESSMENT: Ralph and Alice are married and have a daughter, Morticia, age 8. Alice, age 30, earns $70,000 annually from her job. Ralph, age 27, earns $50,000 annually from his job. Assume that Alice will die before Ralph. The family wants to ensure that they have adequate life insurance on Alice to cover their cash and income needs if Alice dies. Hence, they want to determine how much additional life insurance they need to purchase on Alice to cover these needs. The tables below provide information on their: 1) cash needs; 2) present insurance and financial assets; 3) income needs; and 4) the income that the family will receive if no additional life insurance is purchased. Use the figures in these tables to determine how much additional life insurance the family should purchase on Alice to fully cover their needs. In your answer, calculate and show the components of any additional life insurance needed in terms of cash needs and income needs and the total amount of additional life insurance needed. This exercise assumes that: 1) Alice dies immediately; 2) Ralph continues to work if Alice dies; 3) OASDI survivor benefits are only payable to the daughter until she is age 18; and 4) the life insurance proceeds are invested at an interest rate equal to the rate of inflation. Cash Needs: estate clearance $15,000 mortgage redemption $250,000 emergency fund $25,000 educational fund $100,000 Present Insurance and Financial Assets: group life insurance investments/savings $140,000 $50,000 Income Needs: readjustment period dependency period blackout period Ralph's retirement period $6,500 monthly for 2 years $6,500 monthly for 8 years $5,500 monthly for 30 years $4,250 monthly for 25 years Expected Income from Sources Other than Life Insurance: readjustment period dependency period blackout period Ralph's retirement period $4,500 monthly for 2 years $4,500 monthly for 8 years $3,500 monthly for 30 years $3,000 monthly for 25 years NEEDS ASSESSMENT: Ralph and Alice are married and have a daughter, Morticia, age 8. Alice, age 30, earns $70,000 annually from her job. Ralph, age 27, earns $50,000 annually from his job. Assume that Alice will die before Ralph. The family wants to ensure that they have adequate life insurance on Alice to cover their cash and income needs if Alice dies. Hence, they want to determine how much additional life insurance they need to purchase on Alice to cover these needs. The tables below provide information on their: 1) cash needs; 2) present insurance and financial assets; 3) income needs; and 4) the income that the family will receive if no additional life insurance is purchased. Use the figures in these tables to determine how much additional life insurance the family should purchase on Alice to fully cover their needs. In your answer, calculate and show the components of any additional life insurance needed in terms of cash needs and income needs and the total amount of additional life insurance needed. This exercise assumes that: 1) Alice dies immediately; 2) Ralph continues to work if Alice dies; 3) OASDI survivor benefits are only payable to the daughter until she is age 18; and 4) the life insurance proceeds are invested at an interest rate equal to the rate of inflation. Cash Needs: estate clearance $15,000 mortgage redemption $250,000 emergency fund $25,000 educational fund $100,000 Present Insurance and Financial Assets: group life insurance investments/savings $140,000 $50,000 Income Needs: readjustment period dependency period blackout period Ralph's retirement period $6,500 monthly for 2 years $6,500 monthly for 8 years $5,500 monthly for 30 years $4,250 monthly for 25 years Expected Income from Sources Other than Life Insurance: readjustment period dependency period blackout period Ralph's retirement period $4,500 monthly for 2 years $4,500 monthly for 8 years $3,500 monthly for 30 years $3,000 monthly for 25 years