Answered step by step

Verified Expert Solution

Question

1 Approved Answer

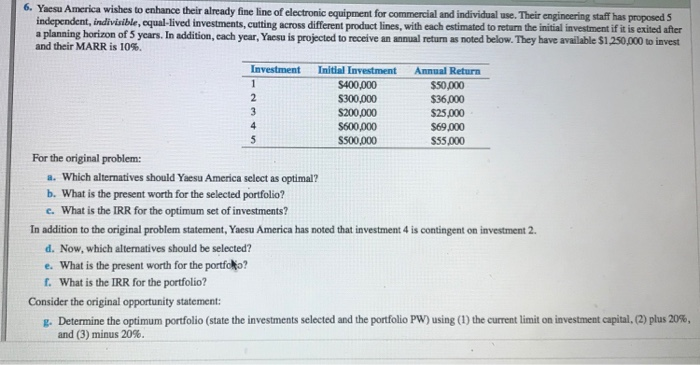

needs to be done in excel 6. Yaesu America wishes to enhance their already fine line of electronic equipment for commercial and individual use. Their

needs to be done in excel

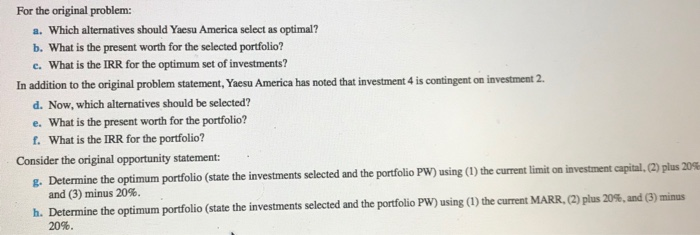

6. Yaesu America wishes to enhance their already fine line of electronic equipment for commercial and individual use. Their engineering staff has proposed 5 independent, indivisible, equal-lived investments, cutting across different product lines, with each estimated to return the initial investment if it is exited after a planning horizon of 5 years. In addition, cach year, Yacsu is projected to receive an annual return as noted below. They have available $1,250,000 to invest and their MARR is 10%. Investment Initial Investment $400,000 S300,000 S200,000 S600,000 S500,000 Annual Return $50,000 $36,000 $25,000 4 S69,000 $55,000 For the original problem: a. Which alternatives should Yaesu America select as optimal? b. What is the present worth for the selected portfolio? c. What is the IRR for the optimum set of investments? In addition to the original problem statement, Yaesu America has noted that investment 4 is contingent on investment 2. d. Now, which alternatives should be selected? e. What is the present worth for the portfolo? f. What is the IRR for the portfolio? Consider the original opportunity statement: g. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current limit on investment capital, (2) plus 20%, and (3) minus 20%. For the original problem: a. Which alternatives should Yacsu America select as optimal? b. What is the present worth for the selected portfolio? c. What is the IRR for the optimum set of investments? In addition to the original problem statement, Yaesu America has noted that investment 4 is contingent on investment 2. d. Now, which alternatives should be selected? e. What is the present worth for the portfolio? f. What is the IRR for the portfolio? Consider the original opportunity statement: g. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current limit on investment capital, (2) plus 20% and (3) minus 20%. h. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current MARR, (2) plus 20%, and (3) minus 20% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started