Answered step by step

Verified Expert Solution

Question

1 Approved Answer

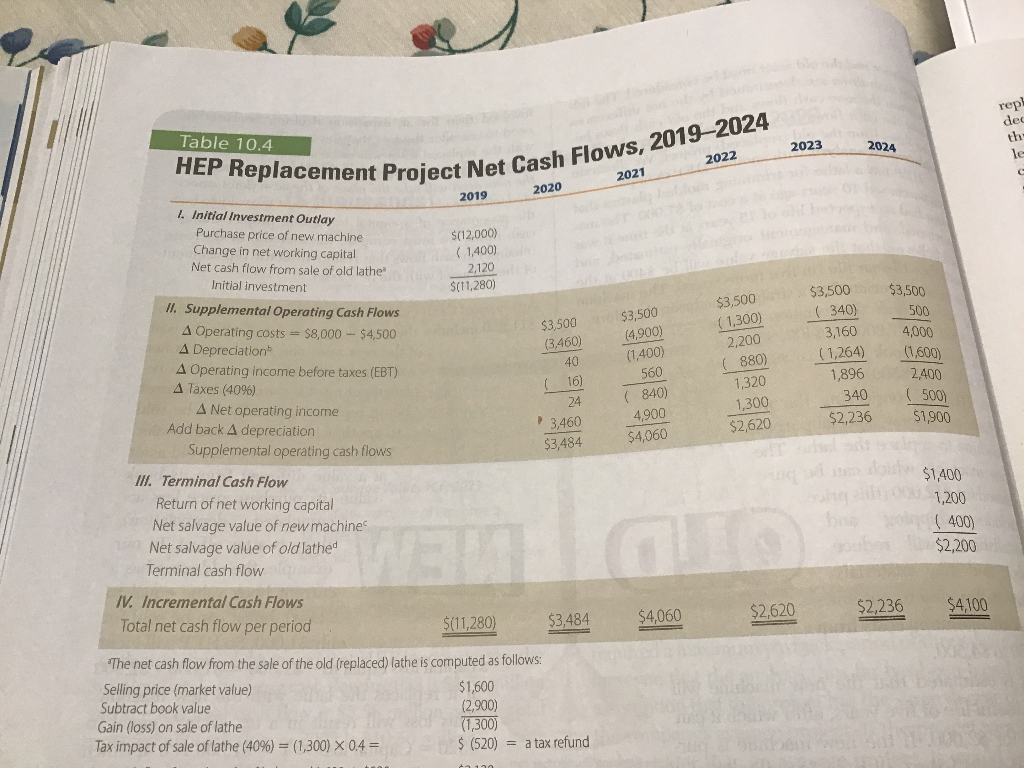

Needs to be set up in a cash flow spreadsheet rep ded 2023 2024 2022 Net Cash Flows, 2019-2024 2021 2020 $(12,000) ( 1,400) $(11,280)

Needs to be set up in a cash flow spreadsheet

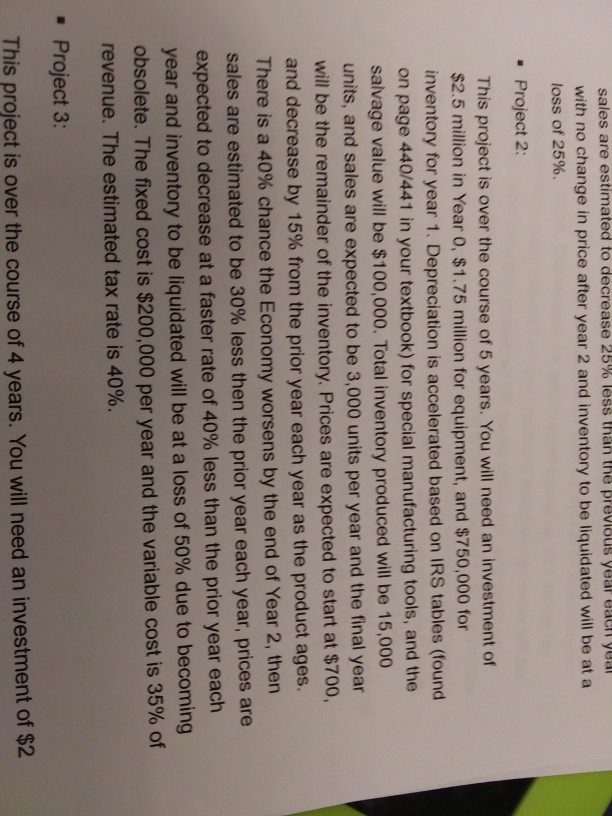

rep ded 2023 2024 2022 Net Cash Flows, 2019-2024 2021 2020 $(12,000) ( 1,400) $(11,280) $3,500 ( 1,300) $3,500 (4,900) $3,500 (3,460) 2,200 Table 10.4 HEP Replacement Project Net Ca 2019 1. Initial Investment Outlay Purchase price of new machine Change in net working capital Net cash flow from sale of old lathe 2,120 Initial investment II. Supplemental Operating Cash Flows A Operating costs = $8,000 - $4,500 A Depreciation A Operating income before taxes (EBT) A Taxes (40%) A Net operating income Add back A depreciation Supplemental operating cash flows III. Terminal Cash Flow Return of net working capital Net salvage value of new machine Net salvage value of old lathed Terminal cash flow 40 $3,500 ( 340) 3,160 (1,264) 1,896 340 $2,236 $3,500 _500 4,000 (1.600) 2,400 (500) $1,900 (1,400) 560 (840) 4,900 $4,060 ( (880) 1,320 1,300 $2,620 16) 3,460 $3,484 $1,400 1,200 (400) $2,200 IV. Incremental Cash Flows Total net cash flow per period $2,236 $4,100 $2,620 $3,484 $(11,280) $4,060 "The net cash flow from the sale of the old (replaced) lathe is computed as follows: Selling price (market value) $1,600 Subtract book value (2,900) Gain (loss) on sale of lathe (1,300) Tax impact of sale of lathe (40%) = (1,300) X 0.4 = $ (520) = a tax refund sales are estimated to decrease 25% less than the previous year each year with no change in price after year 2 and inventory to be liquidated will be at a loss of 25% Project 2 This project is over the course of 5 years. You will need an investment of $2.5 million in Year 0, $1.75 million for equipment, and $750,000 for inventory for year 1. Depreciation is accelerated based on IRS tables (found on page 440/441 in your textbook) for special manufacturing tools, and the salvage value will be $100,000. Total inventory produced will be 15,000 units, and sales are expected to be 3,000 units per year and the final year will be the remainder of the inventory. Prices are expected to start at $700, and decrease by 15% from the prior year each year as the product ages. There is a 40% chance the Economy worsens by the end of Year 2, then sales are estimated to be 30% less then the prior year each year, prices are expected to decrease at a faster rate of 40% less than the prior year each year and inventory to be liquidated will be at a loss of 50% due to becoming obsolete. The fixed cost is $200,000 per year and the variable cost is 35% of revenue. The estimated tax rate is 40%. . Project 3 This project is over the course of 4 years. You will need an investment of $2 rep ded 2023 2024 2022 Net Cash Flows, 2019-2024 2021 2020 $(12,000) ( 1,400) $(11,280) $3,500 ( 1,300) $3,500 (4,900) $3,500 (3,460) 2,200 Table 10.4 HEP Replacement Project Net Ca 2019 1. Initial Investment Outlay Purchase price of new machine Change in net working capital Net cash flow from sale of old lathe 2,120 Initial investment II. Supplemental Operating Cash Flows A Operating costs = $8,000 - $4,500 A Depreciation A Operating income before taxes (EBT) A Taxes (40%) A Net operating income Add back A depreciation Supplemental operating cash flows III. Terminal Cash Flow Return of net working capital Net salvage value of new machine Net salvage value of old lathed Terminal cash flow 40 $3,500 ( 340) 3,160 (1,264) 1,896 340 $2,236 $3,500 _500 4,000 (1.600) 2,400 (500) $1,900 (1,400) 560 (840) 4,900 $4,060 ( (880) 1,320 1,300 $2,620 16) 3,460 $3,484 $1,400 1,200 (400) $2,200 IV. Incremental Cash Flows Total net cash flow per period $2,236 $4,100 $2,620 $3,484 $(11,280) $4,060 "The net cash flow from the sale of the old (replaced) lathe is computed as follows: Selling price (market value) $1,600 Subtract book value (2,900) Gain (loss) on sale of lathe (1,300) Tax impact of sale of lathe (40%) = (1,300) X 0.4 = $ (520) = a tax refund sales are estimated to decrease 25% less than the previous year each year with no change in price after year 2 and inventory to be liquidated will be at a loss of 25% Project 2 This project is over the course of 5 years. You will need an investment of $2.5 million in Year 0, $1.75 million for equipment, and $750,000 for inventory for year 1. Depreciation is accelerated based on IRS tables (found on page 440/441 in your textbook) for special manufacturing tools, and the salvage value will be $100,000. Total inventory produced will be 15,000 units, and sales are expected to be 3,000 units per year and the final year will be the remainder of the inventory. Prices are expected to start at $700, and decrease by 15% from the prior year each year as the product ages. There is a 40% chance the Economy worsens by the end of Year 2, then sales are estimated to be 30% less then the prior year each year, prices are expected to decrease at a faster rate of 40% less than the prior year each year and inventory to be liquidated will be at a loss of 50% due to becoming obsolete. The fixed cost is $200,000 per year and the variable cost is 35% of revenue. The estimated tax rate is 40%. . Project 3 This project is over the course of 4 years. You will need an investment of $2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started