Answered step by step

Verified Expert Solution

Question

1 Approved Answer

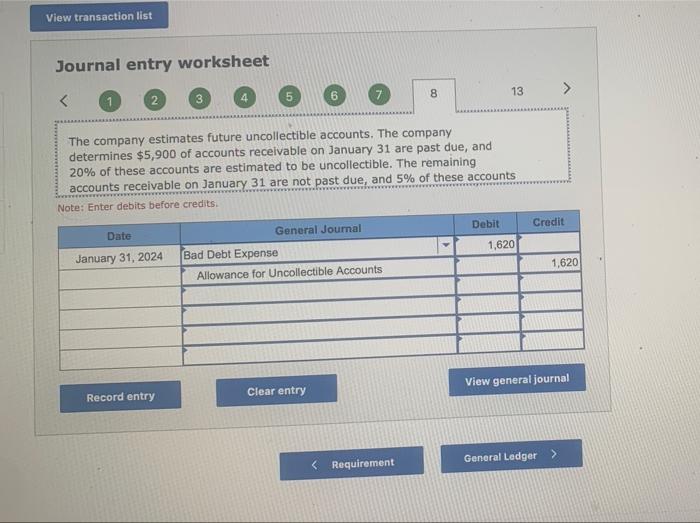

Neeed help figuring this out 1620 is wrong During January 2024, the following transactions occur: 3anuary 2 Provide services to customers for cash, $44,109. January

Neeed help figuring this out "1620" is wrong

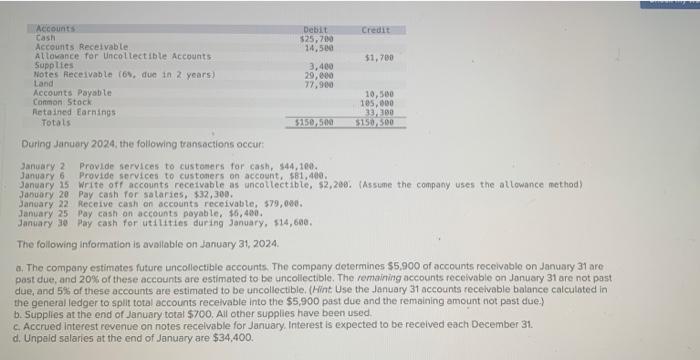

During January 2024, the following transactions occur: 3anuary 2 Provide services to customers for cash, $44,109. January 6 Provide services to custoners on account, 581,400. Jonuary 15 Write off accounts receivable as uncollectible, \$2, 208. (Assume the company uses the allowance method) Jabuary 20 Pay cash for sataries, $32,300. Jancary 22 Recelve cash on accounts receivable, $79,000. January 25 Pay cash on accounts poyatile, $6,430, Janaary: 3 e Pay cash for utilities during January, \$14, 600. The following information is availobie on January 31, 2024. a. The company estimates future uncollectibie accounts. The company determines 55,900 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The romainting accounts recelvable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible, (Hilnt Use the January 31 accounts recelvable balance calculated in the general ledger to split total accounts recelvable into the 55,900 past due and the remaining amount not past due. b. Supplies at the end of January total $700. All other supplies have been used. C. Accrued Interest revente on notes recelvable for January. Interest is expected to be recelved each December 31. d. Unpald salaries at the end of January are $34,400. Journal entry worksheet $5,900 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started