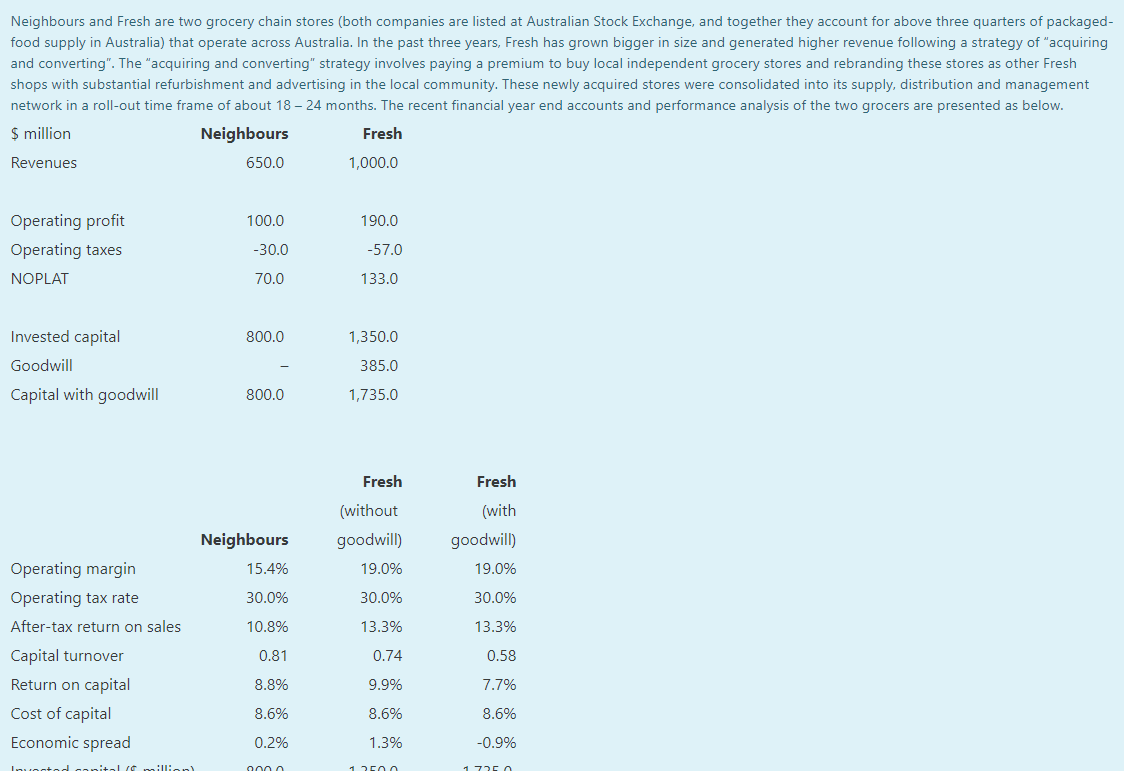

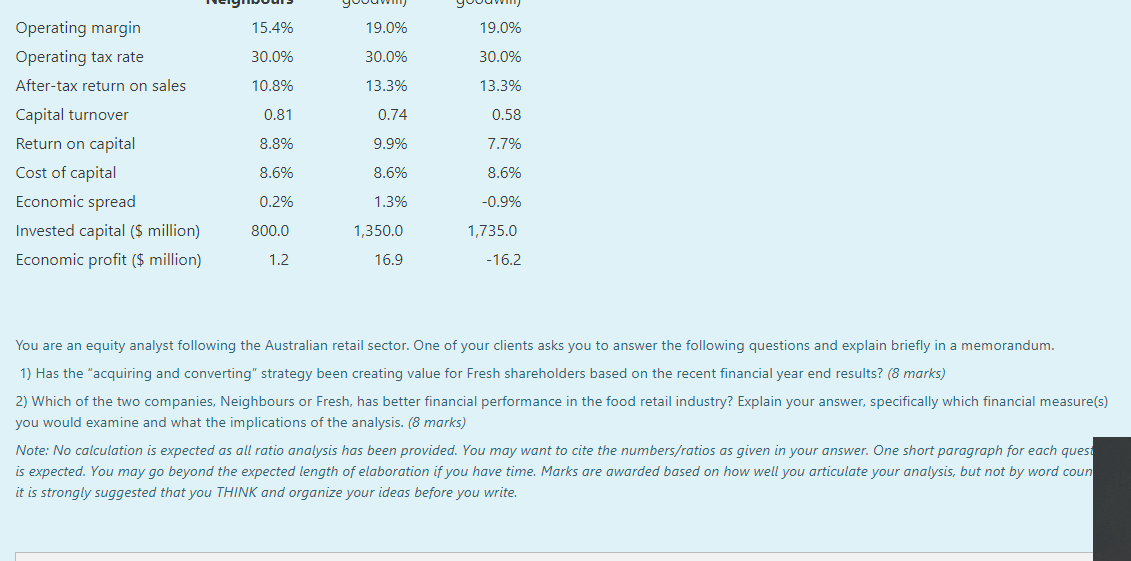

Neighbours and Fresh are two grocery chain stores (both companies are listed at Australian Stock Exchange, and together they account for above three quarters of packaged- food supply in Australia) that operate across Australia. In the past three years, Fresh has grown bigger in size and generated higher revenue following a strategy of "acquiring and converting". The "acquiring and converting" strategy involves paying a premium to buy local independent grocery stores and rebranding these stores as other Fresh shops with substantial refurbishment and advertising in the local community. These newly acquired stores were consolidated into its supply, distribution and management network in a roll-out time frame of about 18 - 24 months. The recent financial year end accounts and performance analysis of the two grocers are presented as below. $ million Neighbours Fresh Revenues 650.0 1,000.0 100.0 190.0 Operating profit Operating taxes -30.0 -57.0 NOPLAT 70.0 133.0 800.0 1,350.0 Invested capital Goodwill Capital with goodwill 385.0 800.0 1,735.0 Fresh Fresh (without goodwill) 19.0% Neighbours 15.4% (with goodwill) 19.0% 30.0% 30.0% 30.0% 10.8% 13.3% 13.3% Operating margin Operating tax rate After-tax return on sales Capital turnover Return on capital Cost of capital Economic spread 0.81 0.74 0.58 8.8% 9.9% 7.7% 8.6% 8.6% 8.6% 0.2% 1.3% -0.9% Totodat alle Billiant nnnn 120 17250 15.4% 19.0% 19.0% 30.0% 30.0% 30.0% 10.8% 13.3% 13.3% 0.81 0.74 0.58 Operating margin Operating tax rate After-tax return on sales Capital turnover Return on capital Cost of capital Economic spread Invested capital ($ million) Economic profit ($ million) 8.8% 9.9% 7.7% 8.6% 8.6% 8.6% 0.2% 1.3% -0.9% 800.0 1,350.0 1,735.0 1.2 16.9 -16.2 You are an equity analyst following the Australian retail sector. One of your clients asks you to answer the following questions and explain briefly in a memorandum. 1) Has the "acquiring and converting" strategy been creating value for Fresh shareholders based on the recent financial year end results? (8 marks) 2) Which of the two companies, Neighbours or Fresh, has better financial performance in the food retail industry? Explain your answer, specifically which financial measure(s) you would examine and what the implications of the analysis. (8 marks) Note: No calculation is expected as all ratio analysis has been provided. You may want to cite the numbers/ratios as given in your answer. One short paragraph for each quest is expected. You may go beyond the expected length of elaboration if you have time. Marks are awarded based on how well you articulate your analysis, but not by word coun it is strongly suggested that you THINK and organize your ideas before you write. Neighbours and Fresh are two grocery chain stores (both companies are listed at Australian Stock Exchange, and together they account for above three quarters of packaged- food supply in Australia) that operate across Australia. In the past three years, Fresh has grown bigger in size and generated higher revenue following a strategy of "acquiring and converting". The "acquiring and converting" strategy involves paying a premium to buy local independent grocery stores and rebranding these stores as other Fresh shops with substantial refurbishment and advertising in the local community. These newly acquired stores were consolidated into its supply, distribution and management network in a roll-out time frame of about 18 - 24 months. The recent financial year end accounts and performance analysis of the two grocers are presented as below. $ million Neighbours Fresh Revenues 650.0 1,000.0 100.0 190.0 Operating profit Operating taxes -30.0 -57.0 NOPLAT 70.0 133.0 800.0 1,350.0 Invested capital Goodwill Capital with goodwill 385.0 800.0 1,735.0 Fresh Fresh (without goodwill) 19.0% Neighbours 15.4% (with goodwill) 19.0% 30.0% 30.0% 30.0% 10.8% 13.3% 13.3% Operating margin Operating tax rate After-tax return on sales Capital turnover Return on capital Cost of capital Economic spread 0.81 0.74 0.58 8.8% 9.9% 7.7% 8.6% 8.6% 8.6% 0.2% 1.3% -0.9% Totodat alle Billiant nnnn 120 17250 15.4% 19.0% 19.0% 30.0% 30.0% 30.0% 10.8% 13.3% 13.3% 0.81 0.74 0.58 Operating margin Operating tax rate After-tax return on sales Capital turnover Return on capital Cost of capital Economic spread Invested capital ($ million) Economic profit ($ million) 8.8% 9.9% 7.7% 8.6% 8.6% 8.6% 0.2% 1.3% -0.9% 800.0 1,350.0 1,735.0 1.2 16.9 -16.2 You are an equity analyst following the Australian retail sector. One of your clients asks you to answer the following questions and explain briefly in a memorandum. 1) Has the "acquiring and converting" strategy been creating value for Fresh shareholders based on the recent financial year end results? (8 marks) 2) Which of the two companies, Neighbours or Fresh, has better financial performance in the food retail industry? Explain your answer, specifically which financial measure(s) you would examine and what the implications of the analysis. (8 marks) Note: No calculation is expected as all ratio analysis has been provided. You may want to cite the numbers/ratios as given in your answer. One short paragraph for each quest is expected. You may go beyond the expected length of elaboration if you have time. Marks are awarded based on how well you articulate your analysis, but not by word coun it is strongly suggested that you THINK and organize your ideas before you write