Answered step by step

Verified Expert Solution

Question

1 Approved Answer

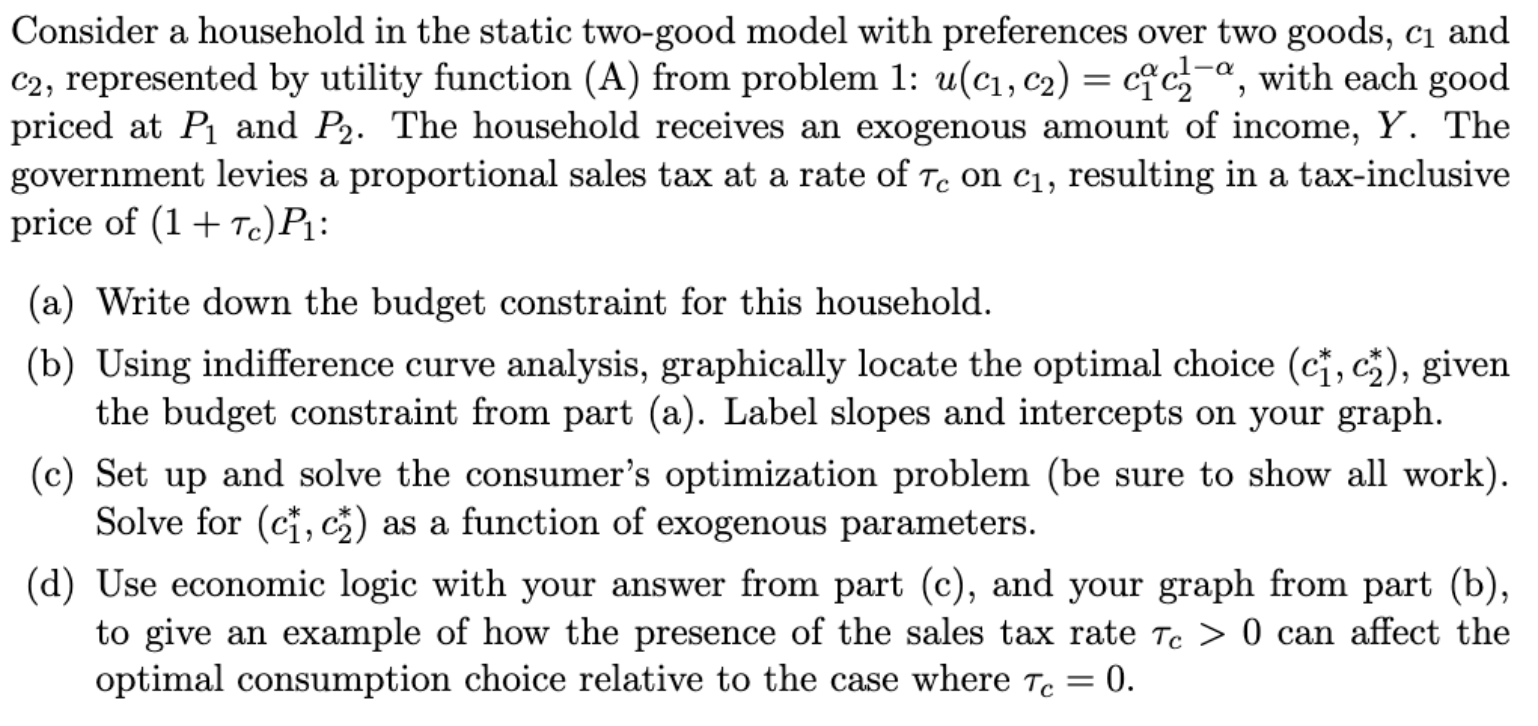

Consider a household in the static two-good model with preferences over two goods, c and C2, represented by utility function (A) from problem 1:

Consider a household in the static two-good model with preferences over two goods, c and C2, represented by utility function (A) from problem 1: u(c, c) = cc-, with each good priced at P and P2. The household receives an exogenous amount of income, Y. The government levies a proportional sales tax at a rate of Te on c, resulting in a tax-inclusive price of (1 + Tc) P: (a) Write down the budget constraint for this household. (b) Using indifference curve analysis, graphically locate the optimal choice (c, c), given the budget constraint from part (a). Label slopes and intercepts on your graph. (c) Set up and solve the consumer's optimization problem (be sure to show all work). Solve for (c, c) as a function of exogenous parameters. (d) Use economic logic with your answer from part (c), and your graph from part (b), to give an example of how the presence of the sales tax rate Te> 0 can affect the optimal consumption choice relative to the case where Tc = 0.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started