Answered step by step

Verified Expert Solution

Question

1 Approved Answer

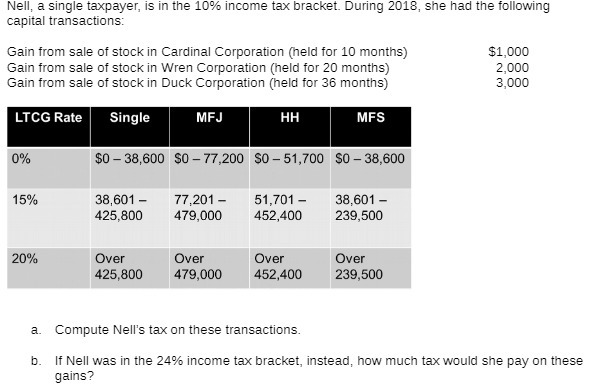

Nell, a single taxpayer, is in the 10% income tax bracket. During 2018, she had the following capital transactions: Gain from sale of stock

Nell, a single taxpayer, is in the 10% income tax bracket. During 2018, she had the following capital transactions: Gain from sale of stock in Cardinal Corporation (held for 10 months) Gain from sale of stock in Wren Corporation (held for 20 months) Gain from sale of stock in Duck Corporation (held for 36 months) LTCG Rate Single HH MFS 0% 15% 20% $0-38,600 $0-77,200 $0-51,700 $0-38,600 38,601 - 425,800 MFJ Over 425,800 77,201 - 479,000 Over 479,000 51,701 - 452,400 Over 452,400 38,601 - 239,500 Over 239,500 $1,000 2,000 3,000 a. Compute Nell's tax on these transactions. b. If Nell was in the 24% income tax bracket, instead, how much tax would she pay on these gains?

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

aComputation of Nells tax in the 10 bracket Gain from Cardinal stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started