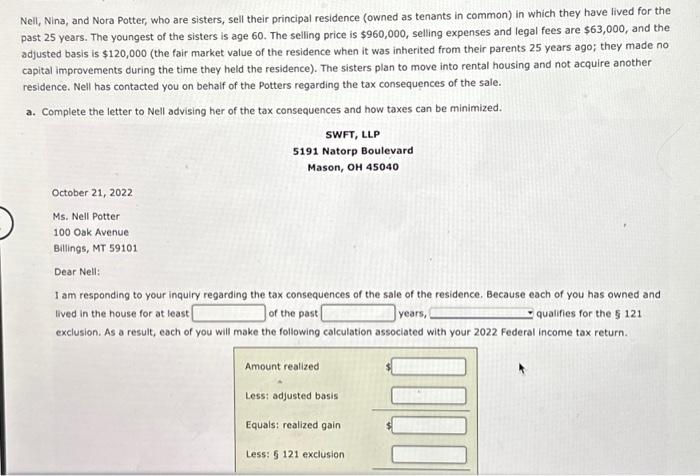

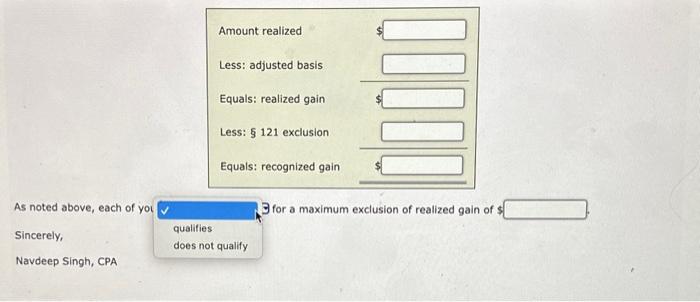

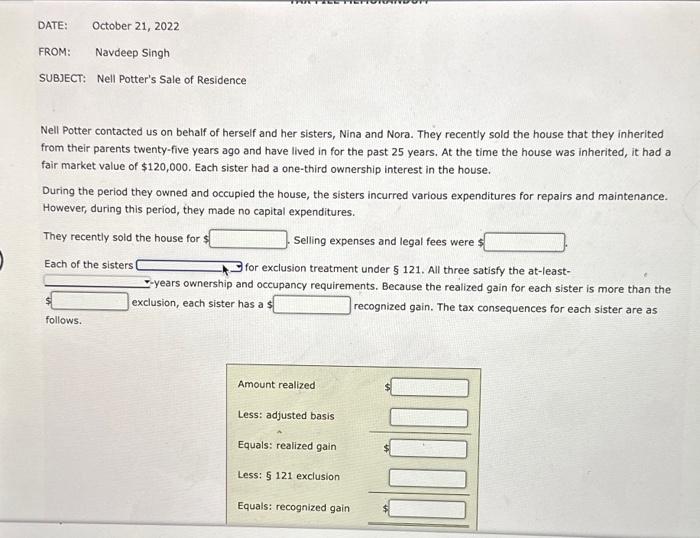

Nell, Nina, and Nora Potter, who are sisters, sell their principal residence (owned as tenants in common) in which they have lived for the past 25 years. The youngest of the sisters is age 60 . The selling price is $960,000, selling expenses and legal fees are $63,000, and the adjusted basis is $120,000 (the fair market value of the residence when it was inherited from their parents 25 years ago; they made no capital improvements during the time they held the residence). The sisters plan to move into rental housing and not acquire another residence. Nell has contacted you on behalf of the Potters regarding the tax consequences of the sale. a. Complete the letter to Nell advising her of the tax consequences and how taxes can be minimized. SWFT, LLP 5191 Natorp Boulevard Mason, OH45040 October 21,2022 Ms. Nell Potter 100 Oak Avenue Billings, MT 59101 Dear Nell: 1 am responding to your inquiry regarding the tax consequences of the sale of the residence. Because each of you has owned and lived in the house for at least of the past years, qualifies for the 5121 exclusion. As a result, each of you will make the following calculation associated with your 2022 Federal income tax return. As noted above, each of you Th for a maximum exclusion of realized gain of $ Sincerely, Navdeep Singh, CPA Nell Potter contacted us on behalf of herself and her sisters, Nina and Nora. They recently sold the house that they inherited from their parents twenty-five years ago and have lived in for the past 25 years. At the time the house was inherited, it had a fair market value of $120,000. Each sister had a one-third ownership interest in the house. During the period they owned and occupied the house, the sisters incurred various expenditures for repairs and maintenance. However, during this period, they made no capital expenditures. They recently sold the house for $ . Selling expenses and legal fees were Each of the sisters for exclusion treatment under 121. All three satisfy the at-least- -years ownership and occupancy requirements. Because the realized gain for each sister is more than the 4 exclusion, each sister has a s recognized gain. The tax consequences for each sister are as follows