Question

Nelsons Limited has issued a bank-accepted bill to fund a short-term investment project. The bill is issued for 90 days, with a face value

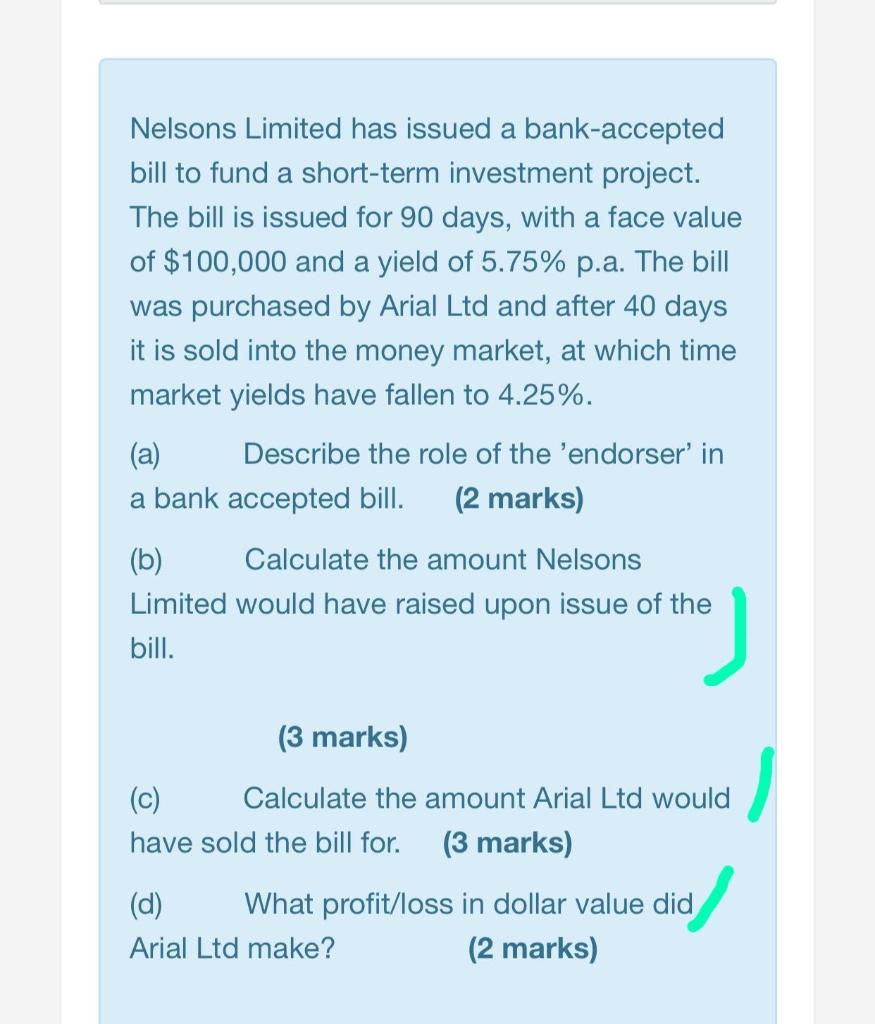

Nelsons Limited has issued a bank-accepted bill to fund a short-term investment project. The bill is issued for 90 days, with a face value of $100,000 and a yield of 5.75% p.a. The bill was purchased by Arial Ltd and after 40 days it is sold into the money market, at which time market yields have fallen to 4.25%. (a) Describe the role of the 'endorser' in a bank accepted bill. (2 marks) (b) Calculate the amount Nelsons Limited would have raised upon issue of the bill. (3 marks) (c) Calculate the amount Arial Ltd would have sold the bill for. (3 marks) (d) What profit/loss in dollar value did Arial Ltd make? (2 marks)

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a A bank endorsement is an assurance that it will stand behind a check or other negotiable ins...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering economy

Authors: Leland Blank, Anthony Tarquin

7th Edition

9781259027406, 0073376302, 1259027406, 978-0073376301

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App