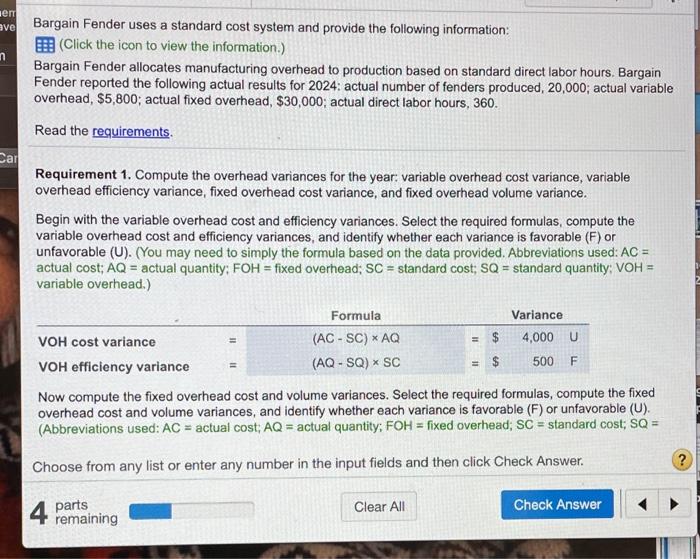

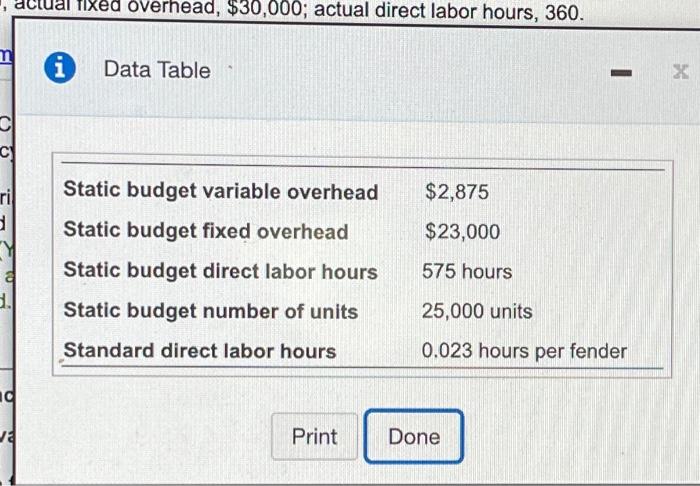

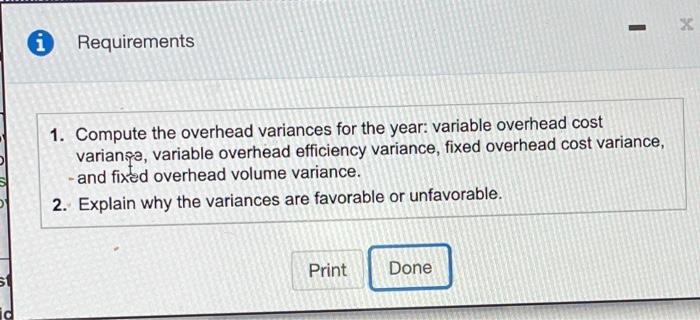

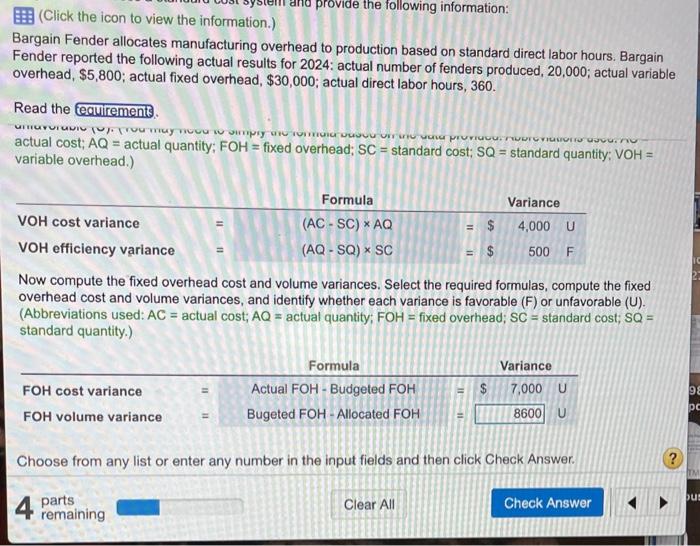

nem ve n Bargain Fender uses a standard cost system and provide the following information: (Click the icon to view the information.) Bargain Fender allocates manufacturing overhead to production based on standard direct labor hours. Bargain Fender reported the following actual results for 2024: actual number of fenders produced, 20,000; actual variable overhead, $5,800; actual fixed overhead, $30,000; actual direct labor hours, 360. Read the requirements. Car Requirement 1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. Begin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (You may need to simply the formula based on the data provided. Abbreviations used: AC = actual cost; AQ = actual quantity: FOH = fixed overhead: SC = standard cost; SQ = standard quantity: VOH = variable overhead.) = F Formula Variance VOH cost variance (AC-SC) * AQ = $ 4,000U VOH efficiency variance (AQ - SQ) SC = $ 500 Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity: FOH = fixed overhead; SC = standard cost; SQ = Choose from any list or enter any number in the input fields and then click Check Answer. Clear All parts 4 remaining Check Answer fixed Overhead, $30,000; actual direct labor hours, 360. Data Table - 50 cl c) ri $2,875 Static budget variable overhead Static budget fixed overhead $23,000 Static budget direct labor hours 575 hours a . Static budget number of units 25,000 units Standard direct labor hours 0.023 hours per fender d va Print Done x 1 Requirements 1. Compute the overhead variances for the year: variable overhead cost varianza, variable overhead efficiency variance, fixed overhead cost variance, - and fixed overhead volume variance. 2. Explain why the variances are favorable or unfavorable. Print Done 51 id provide the following information: (Click the icon to view the information.) Bargain Fender allocates manufacturing overhead to production based on standard direct labor hours. Bargain Fender reported the following actual results for 2024: actual number of fenders produced, 20,000; actual variable overhead, $5,800; actual fixed overhead, $30,000; actual direct labor hours, 360. Read the fequirement TUVUIUVI u trou my nou wpy TIVI VUJU U vind provider VIONI www.no actual cost; AQ = actual quantity: FOH = fixed overhead: SC = standard cost; SQ = standard quantity: VOH = variable overhead.) $ 500 24 Formula Variance VOH cost variance (AC-SC) * AQ = $ 4,000 U VOH efficiency variance (AQ - SQ) SC $ F Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity: FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance FOH cost variance Actual FOH - Budgeted FOH $ 7,000 U FOH volume variance Bugeted FOH - Allocated FOH 8600 U 98 pc Choose from any list or enter any number in the input fields and then click Check Answer. bus 4 parts Clear All Check Answer remaining