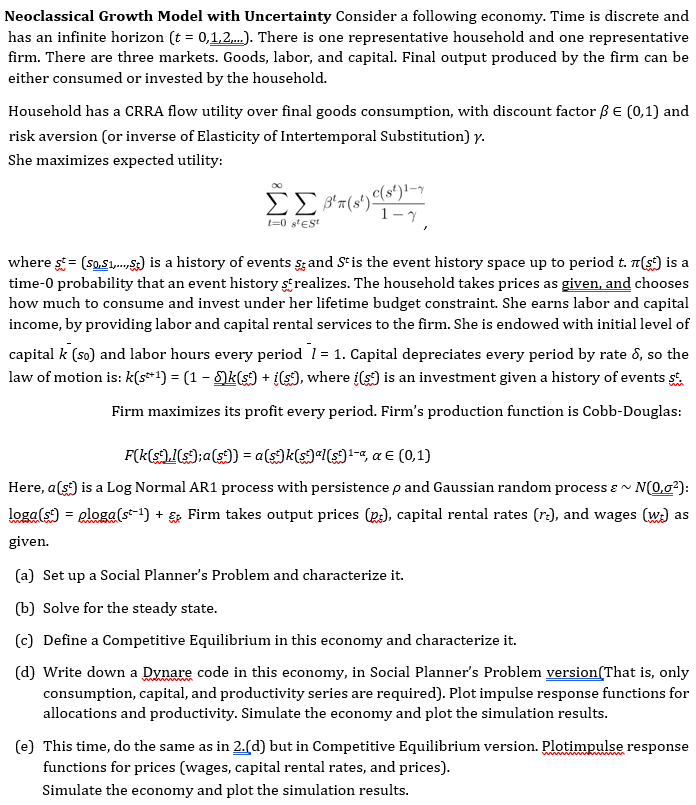

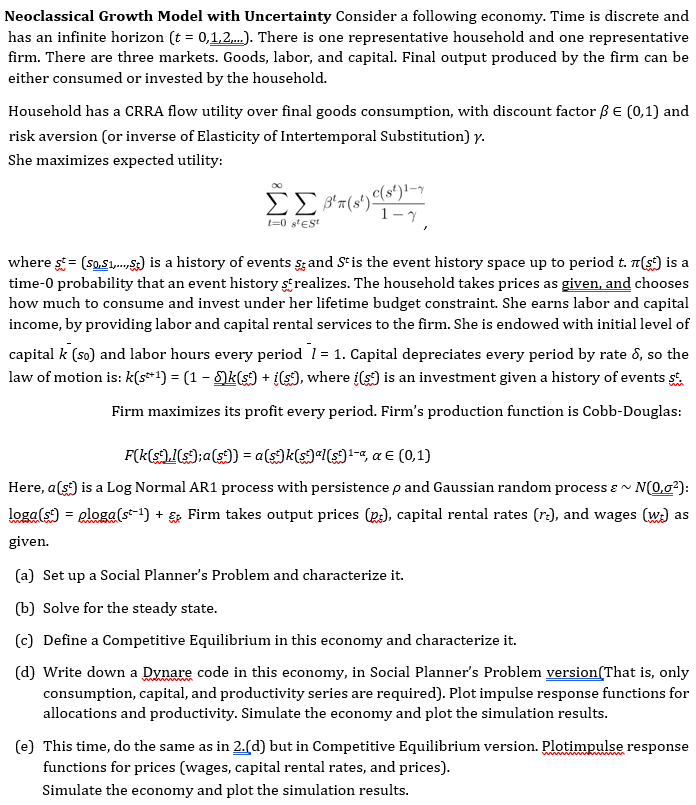

Neoclassical Growth Model with Uncertainty Consider a following economy. Time is discrete and has an infinite horizon (t = 0,1,2,...). There is one representative household and one representative firm. There are three markets. Goods, labor, and capital. Final output produced by the firm can be either consumed or invested by the household. Household has a CRRA flow utility over final goods consumption, with discount factor B (0,1) and risk aversion (or inverse of Elasticity of Intertemporal Substitution) y. She maximizes expected utility: ' D 39(89)C(90) cs 1-9, t=0 g'ES where s'= (0,5 ...,S) is a history of events Szand St is the event history space up to period t. rt(sis a time-o probability that an event history st realizes. The household takes prices as given, and chooses how much to consume and invest under her lifetime budget constraint. She earns labor and capital income, by providing labor and capital rental services to the firm. She is endowed with initial level of capital k (so) and labor hours every period 1 = 1. Capital depreciates every period by rate 8, so the law of motion is: k(5+1) = (1 - Sk(s) + (($9, where i(59) is an investment given a history of events sein Firm maximizes its profit every period. Firm's production function is Cobb-Douglas: F(k(51)/(39;a(51) = a(99k(5947(591-4, a E (0,1) Here, a(s) is a Log Normal AR1 process with persistence p and Gaussian random process e ~ N(0.04): loga(54) = gloga(s+-1) + E Firm takes output prices (Rs), capital rental rates (r:), and wages (w) as given. (a) Set up a Social Planner's Problem and characterize it. (b) Solve for the steady state. (c) Define a Competitive Equilibrium in this economy and characterize it. (d) Write down a Dynare code in this economy, in Social Planner's Problem version(That is, only consumption, capital, and productivity series are required). Plot impulse response functions for allocations and productivity. Simulate the economy and plot the simulation results. (e) This time, do the same as in 2.(d) but in Competitive Equilibrium version. Plotimpulse response functions for prices (wages, capital rental rates, and prices). Simulate the economy and plot the simulation results. Neoclassical Growth Model with Uncertainty Consider a following economy. Time is discrete and has an infinite horizon (t = 0,1,2,...). There is one representative household and one representative firm. There are three markets. Goods, labor, and capital. Final output produced by the firm can be either consumed or invested by the household. Household has a CRRA flow utility over final goods consumption, with discount factor B (0,1) and risk aversion (or inverse of Elasticity of Intertemporal Substitution) y. She maximizes expected utility: ' D 39(89)C(90) cs 1-9, t=0 g'ES where s'= (0,5 ...,S) is a history of events Szand St is the event history space up to period t. rt(sis a time-o probability that an event history st realizes. The household takes prices as given, and chooses how much to consume and invest under her lifetime budget constraint. She earns labor and capital income, by providing labor and capital rental services to the firm. She is endowed with initial level of capital k (so) and labor hours every period 1 = 1. Capital depreciates every period by rate 8, so the law of motion is: k(5+1) = (1 - Sk(s) + (($9, where i(59) is an investment given a history of events sein Firm maximizes its profit every period. Firm's production function is Cobb-Douglas: F(k(51)/(39;a(51) = a(99k(5947(591-4, a E (0,1) Here, a(s) is a Log Normal AR1 process with persistence p and Gaussian random process e ~ N(0.04): loga(54) = gloga(s+-1) + E Firm takes output prices (Rs), capital rental rates (r:), and wages (w) as given. (a) Set up a Social Planner's Problem and characterize it. (b) Solve for the steady state. (c) Define a Competitive Equilibrium in this economy and characterize it. (d) Write down a Dynare code in this economy, in Social Planner's Problem version(That is, only consumption, capital, and productivity series are required). Plot impulse response functions for allocations and productivity. Simulate the economy and plot the simulation results. (e) This time, do the same as in 2.(d) but in Competitive Equilibrium version. Plotimpulse response functions for prices (wages, capital rental rates, and prices). Simulate the economy and plot the simulation results