Question

Neptune Co. sells backpacks, laptop bags, briefcases, and other bags. The bags are purchased already made, then the Neptune branding and finish is added. Because

Neptune Co. sells backpacks, laptop bags, briefcases, and other bags. The bags are purchased already made, then the Neptune branding and finish is added. Because of several exclusive contracts and high quality products, the company has a strong following in its home state of Georgia and the surrounding area. In addition to its own brand, the company also has contracts with many colleges, firms, and local organizations to sell bags with these other groups’ logos. This practice has greatly increased Neptune’s sales, especially since the company is usually able to use lower quality inventory to fill these orders (this leads to lower costs for the other groups without damaging Neptune’s reputation).

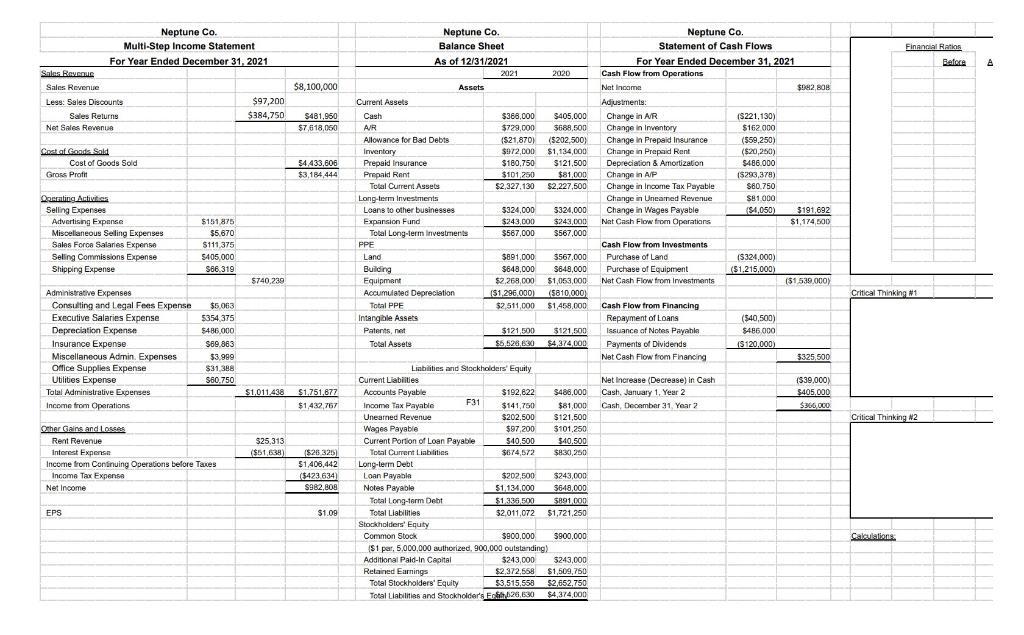

Neptune has already completed most of the necessary transactions for the current year (see below). However, they have neglected to include several key pieces of information. Neptune’s tax rate is 30%.

Under new GAAP (the Current Expected Credit Loss or 'CECL' rules), companies are required to estimate their Allowance for Bad Debt based not only on their historical loss rates but also on current market conditions and future predictions. The accounting process is the same (debit Bad Debt Expense and credit Allowance for Bad Debt), but the estimate is different. Based on the new rules, Neptune's management team has decided to adjust their historical rate based on a weighted average of their prediction of general economic risk in their area (weighted at 49.5%) and on the credit risk of their customers (weighted at 50.5%), as their loss rate. No adjusting entry has been made this year for bad debt.

At the beginning of the year, Neptune's collection team reported a historical loss rate of 4.5%. They believe the local economy will grow by .9% and that their average customer's credit risk has increased by 2.7%. They have also decided to round their calculations to three (3) decimal places for consistency

In addition, the team reported that on December 31, they received a $4,000 payment from SSG, Inc. Neptune closed SSG's account in July when they believed the company would not be able to pay any of their outstanding bill. No entries have been made for these transactions either

Neptune’s management would like to know the effect of these adjustments on the following ratios:

• Quick Ratio ([Cash + Cash Equivalents + net A/R*] / Current Liabilities) • Accounts Receivable Turnover Ratio (Net Sales / Average net A/R) • Current Ratio (Current Assets / Current Liabilities)

Make the appropriate journal entries, if any, to account for the changes in receivables (including any necessary changes to income tax expenses). Make any necessary changes to the financial statements. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes)

Hints: You'll need to adjust A/R and the Allowance for Bad Debt for the write off and unexpected repayment BEFORE you can make the adjusting entry for bad debt. Since they are changing, I recommend creating t-accounts for both accounts. Once you have the updated balances for each account (after the adjustments), then you can use those updated balances and your adjusted loss rate to calculate the adjusting entry for bad debt. To calculate the percentage needed to estimate the ending Allowance for Bad Debt, you'll need to first calculate the weighted average of the economic and risk adjustments. For example, if they believe that economic risk will decrease by 10%, but that their customer's risk has increased by 4%, then they would subtract 3.% from their historical loss rate. Remember to round to 3 decimal places! If we think the economy will GROW, then the economic risk will SHRINK, so we use a NEGATIVE number for our current estimate. Similiarly, if we think our customer risk will DECREASE, then our risk will SHRINK and we'll use a negative number for our current estimate. Make sure you check the wording for Neptune's assumptions so that you can use the correct sign!

Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Net Sales Revenue Cost of Goods Sald Gross Profit Neptune Co. Multi-Step Income Statement For Year Ended December 31, 2021 Cost of Goods Sold Operating Activites Selling Expenses Advertising Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Administrative Expenses Consulting and Legal Fees Expense Executive Salaries Expense Depreciation Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense Utilities Expense Total Administrative Expenses Income from Operations Other Gains and Losses Rent Revenue Interest Expense EPS $151,875 $5,670 $111,375 $405,000 $66.319 $5,063 $354,375 $486.000 $69.863 $3,999 $31,388 $60,750 Income from Continuing Operations before Taxes Income Tax Expense Net Income $97,200 $384,750 $740.239 $8,100,000 $25,313 ($51,638) $481,950 $7,618,000 $4,433,606 $3,184,444 $1,011,438 $1,751,677 $1,432,767 ($28.325) $1,406,442 ($423.634) $982,808 $1.09 Current Assets Cash A/R Allowance for Bad Debts Inventory Prepaid Insurance Prepaid Rent Total Current Assets Long-term Investments Loans to other businesses. Expansion Fund PPE Total Long-term Investments Land Building Equipment Accumulated Depreciation Total PPE Intangible Assets Patents, net Total Assets Neptune Co. Balance Sheet As of 12/31/2021 Long-term Debt Current Liabilities Accounts Payable Income Tax Payable Unearned Revenue Wages Payable Current Portion of Loan Payable Total Current Liabilities Loan Payable Notes Payable Assets Total Long-term Debt Total Liabilities Stockholders' Equity Common Stock Liabilities and Stockholders' Equity $192,822 $141,750 $202,500 $97,200 $40,500 $674,572 2021 F31 Retained Earnings Total Stockholders Equity $368,000 $405,000 $729,000 $688,500 ($21,870) ($202,500) $972,000 $1,134,000 $180,750 $121,500 $101,250 $81,000) $2,327.130 $2,227,500 $324,000 $324,000 $243,000 $243,000 $567,000 $567,000 $891,000 $567,000 $648,000 $648,000 $2,268,000 $1,053,000 ($1.296.000) (5810,000) $2,511,000 $1,458,000) $121,500 $5,526,630 $202,500 $1.134.000 2020 $1,336,500 $2,011,072 $243,000 $2,372,558 $3,515,558 Total Liabilities and Stockholder's Edit26,630 $900.000 ($1 par, 5,000,000 authorized, 900,000 outstanding) Additional Paid-In Capital $121,500 $4,374,000 $486,000 $81,000 $121,500 $101,250 $40,500 $830,250 $243,000 $648,000 $891.000 $1,721,250 $900,000 $243.000 $1,509,750 $2,652,750 $4,374,000 Neptune Co. Statement of Cash Flows For Year Ended December 31, 2021 Cash Flow from Operations Net Income Adjustments: Change in A/R Change in Inventory Change in Prepaid Insurance Change in Prepaid Rent Depreciation & Amortization Change in A/P Change in Income Tax Payable Change in Uneamed Revenue Change in Wages Payable Net Cash Flow from Operations Cash Flow from Investments Purchase of Land Purchase of Equipment Net Cash Flow from Investments Cash Flow from Financing Repayment of Loans Issuance of Notes Payable Payments of Dividends Net Cash Flow from Financing Net Increase (Decrease) in Cash Cash, January 1, Year 2 Cash, December 31, Year 2 ($221,130) $162.000 ($59,250) ($20,250) $486.000 ($293,378) $60.750 $81.000 ($4,050) ($324,000) ($1,215,000) ($40,500) $486.000 ($120,000) $982,808 $191,692 $1,174,500 ($1.539.000)) $325,500 ($39,000) $405.000 $366,000 Financial Ratios Before Critical Thinking #1 Critical Thinking #2 Calculations A Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Net Sales Revenue Cost of Goods Sald Gross Profit Neptune Co. Multi-Step Income Statement For Year Ended December 31, 2021 Cost of Goods Sold Operating Activites Selling Expenses Advertising Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Administrative Expenses Consulting and Legal Fees Expense Executive Salaries Expense Depreciation Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense Utilities Expense Total Administrative Expenses Income from Operations Other Gains and Losses Rent Revenue Interest Expense EPS $151,875 $5,670 $111,375 $405,000 $66.319 $5,063 $354,375 $486.000 $69.863 $3,999 $31,388 $60,750 Income from Continuing Operations before Taxes Income Tax Expense Net Income $97,200 $384,750 $740.239 $8,100,000 $25,313 ($51,638) $481,950 $7,618,000 $4,433,606 $3,184,444 $1,011,438 $1,751,677 $1,432,767 ($28.325) $1,406,442 ($423.634) $982,808 $1.09 Current Assets Cash A/R Allowance for Bad Debts Inventory Prepaid Insurance Prepaid Rent Total Current Assets Long-term Investments Loans to other businesses. Expansion Fund PPE Total Long-term Investments Land Building Equipment Accumulated Depreciation Total PPE Intangible Assets Patents, net Total Assets Neptune Co. Balance Sheet As of 12/31/2021 Long-term Debt Current Liabilities Accounts Payable Income Tax Payable Unearned Revenue Wages Payable Current Portion of Loan Payable Total Current Liabilities Loan Payable Notes Payable Assets Total Long-term Debt Total Liabilities Stockholders' Equity Common Stock Liabilities and Stockholders' Equity $192,822 $141,750 $202,500 $97,200 $40,500 $674,572 2021 F31 Retained Earnings Total Stockholders' Equity $368,000 $405,000 $729,000 $688,500 ($21,870) ($202,500) $972,000 $1,134,000 $180,750 $121,500 $101,250 $81,000) $2,327.130 $2,227,500 $324,000 $324,000 $243,000 $243,000 $567,000 $567,000 $891,000 $567,000 $648,000 $648,000 $2,268,000 $1,053,000 ($1.296.000) (5810,000) $2,511,000 $1,458,000) $121,500 $5,526,630 $202,500 $1.134.000 2020 $1,336,500 $2,011,072 $243,000 $2,372,558 $3,515,558 Total Liabilities and Stockholder's Ecl26,630 $900.000 ($1 par, 5,000,000 authorized, 900,000 outstanding) Additional Paid-In Capital $121,500 $4,374,000 $486,000 $81,000 $121,500 $101,250 $40,500 $830,250 $243,000 $648,000 $891.000 $1,721,250 $900,000 $243.000 $1,509,750 $2,652,750 $4,374,000 Neptune Co. Statement of Cash Flows For Year Ended December 31, 2021 Cash Flow from Operations Net Income Adjustments: Change in A/R Change in Inventory Change in Prepaid Insurance Change in Prepaid Rent Depreciation & Amortization Change in A/P Change in Income Tax Payable Change in Uneamed Revenue Change in Wages Payable Net Cash Flow from Operations Cash Flow from Investments Purchase of Land Purchase of Equipment Net Cash Flow from Investments Cash Flow from Financing Repayment of Loans Issuance of Notes Payable Payments of Dividends Net Cash Flow from Financing Net Increase (Decrease) in Cash Cash, January 1, Year 2 Cash, December 31, Year 2 ($221,130) $162.000 ($59,250) ($20,250) $486.000 ($293,378) $60.750 $81.000 ($4,050) ($324,000) ($1,215,000) ($40,500) $486.000 ($120,000) $982,808 $191,692 $1,174,500 ($1.539.000)) $325,500 ($39,000) $405.000 $366,000 Financial Ratios Before Critical Thinking #1 Critical Thinking #2 Calculations A

Step by Step Solution

3.68 Rating (186 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries To record the writeoff of SSGs account Debit Allowance for Bad Debts 4000Credit Acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started