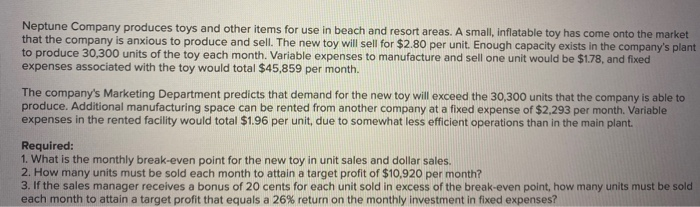

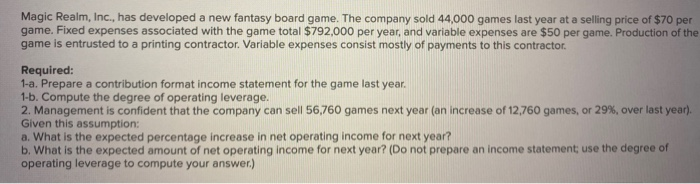

Neptune Company produces toys and other items for use in beach and resort areas. A small, inflatable toy has come onto the market that the company is anxious to produce and sell. The new toy will sell for $2.80 per unit. Enough capacity exists in the company's plant to produce 30,300 units of the toy each month. Variable expenses to manufacture and sell one unit would be $1.78, and fixed expenses associated with the toy would total $45,859 per month. The company's Marketing Department predicts that demand for the new toy will exceed the 30,300 units that the company is able to produce. Additional manufacturing space can be rented from another company at a fixed expense of $2,293 per month. Variable expenses in the rented facility would total $1.96 per unit, due to somewhat less efficient operations than in the main plant. Required: 1. What is the monthly break-even point for the new toy in unit sales and dollar sales. 2. How many units must be sold each month to attain a target profit of $10,920 per month? 3. If the sales manager receives a bonus of 20 cents for each unit sold in excess of the break-even point, how many units must be sold each month to attain a target profit that equals a 26% return on the monthly investment in fixed expenses? Magic Realm, Inc., has developed a new fantasy board game. The company sold 44,000 games last year at a selling price of $70 per game. Fixed expenses associated with the game total $792,000 per year, and variable expenses are $50 per game. Production of the game is entrusted to a printing contractor. Variable expenses consist mostly of payments to this contractor. Required: 1-a. Prepare a contribution format income statement for the game last year. 1-b. Compute the degree of operating leverage. 2. Management is confident that the company can sell 56,760 games next year (an increase of 12,760 games, or 29%, over last year). Given this assumption: a. What is the expected percentage increase in net operating income for next year? b. What is the expected amount of net operating income for next year? (Do not prepare an income statement; use the degree of operating leverage to compute your answer.)