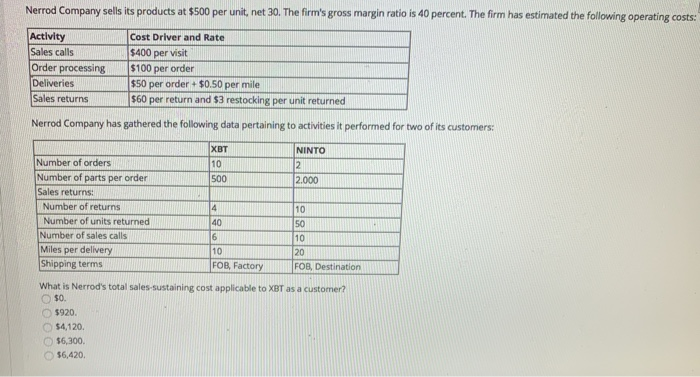

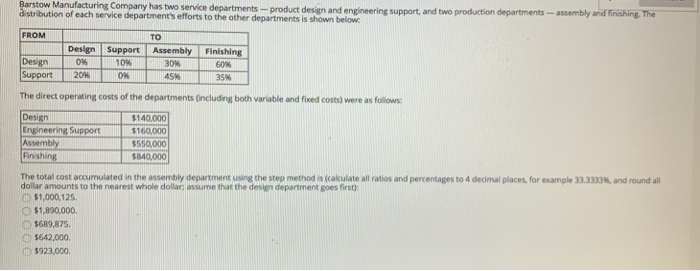

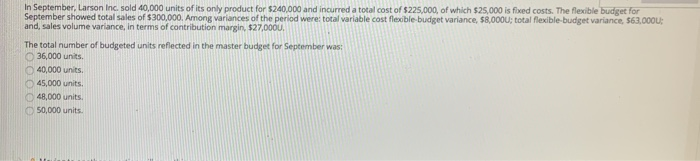

Nerrod Company sell ts products at $500 per unit, net 30. The firm's gross margin ratio is 40 percent. The firm has estimated the following operating costs: Activity Sales calls Order processing $100 per order Deliveries Sales returns$60 per return and $3 restocking per unit returned Cost Driver and Rate $400 per visit $50 per order $0.50 per mile Nerrod Company has gathered the following data pertaining to activities it performed for two of its customers XBT 10 500 NINTO Number of orders Number of parts per order Sales returns 2.000 Number of returns Number of units returned Number of sales calls Miles per delivery Shipping terms 10 50 10 20 FOB, Destination 40 10 FOB, Factory What is Nerrod's total sales-sustaining cost applicable to XBT as a customer? O so. O $920. o $4,120. o $6,300. $6,420 arstow Manufacturing Company has two service departments-product tdduct design nd enginering support and two prodution departments assembly wnid frishing The e bution of each service department's efforts to the other departments is shown below FROM TO Design Support Assembly Finishing 10% 0% 30% 45% 60% 35% Support 20% The direct operating costs of the departments (including both variable and fixed costs) were as follows Design Engineering Support Assembly Finishing 140,000 $160,000 550,000 $840,000 The total cost accumulated in the assembly department using the step method is (cakulate all ratios and percentages to 4 decimal places, for example 33.3333M, and round all dollar amounts to the nearest whole dollar; assume that the design department goes first): D $1,000,125 $1,890,000. o $689,875. $642,000 D $923,000 In September, Larson Inc. sold 40,000 units of its only product for $240,000 and incurred a total cost of $225,000, of which $25,000 is fixed costs. The flexible budget for September showed total sales of $300,000. Among variances of the period were: total variable cost flexible-budget variance, $8,000u; total flexible-budget variance, $63,000U and, sales volume variance, in terms of contribution margin, $27.000U The total number of budgeted units reflected in the master budget for September w O 36,000 units. O 40,000 units O 45,000 units O 48,000 units 50,000 units Nerrod Company sell ts products at $500 per unit, net 30. The firm's gross margin ratio is 40 percent. The firm has estimated the following operating costs: Activity Sales calls Order processing $100 per order Deliveries Sales returns$60 per return and $3 restocking per unit returned Cost Driver and Rate $400 per visit $50 per order $0.50 per mile Nerrod Company has gathered the following data pertaining to activities it performed for two of its customers XBT 10 500 NINTO Number of orders Number of parts per order Sales returns 2.000 Number of returns Number of units returned Number of sales calls Miles per delivery Shipping terms 10 50 10 20 FOB, Destination 40 10 FOB, Factory What is Nerrod's total sales-sustaining cost applicable to XBT as a customer? O so. O $920. o $4,120. o $6,300. $6,420 arstow Manufacturing Company has two service departments-product tdduct design nd enginering support and two prodution departments assembly wnid frishing The e bution of each service department's efforts to the other departments is shown below FROM TO Design Support Assembly Finishing 10% 0% 30% 45% 60% 35% Support 20% The direct operating costs of the departments (including both variable and fixed costs) were as follows Design Engineering Support Assembly Finishing 140,000 $160,000 550,000 $840,000 The total cost accumulated in the assembly department using the step method is (cakulate all ratios and percentages to 4 decimal places, for example 33.3333M, and round all dollar amounts to the nearest whole dollar; assume that the design department goes first): D $1,000,125 $1,890,000. o $689,875. $642,000 D $923,000 In September, Larson Inc. sold 40,000 units of its only product for $240,000 and incurred a total cost of $225,000, of which $25,000 is fixed costs. The flexible budget for September showed total sales of $300,000. Among variances of the period were: total variable cost flexible-budget variance, $8,000u; total flexible-budget variance, $63,000U and, sales volume variance, in terms of contribution margin, $27.000U The total number of budgeted units reflected in the master budget for September w O 36,000 units. O 40,000 units O 45,000 units O 48,000 units 50,000 units