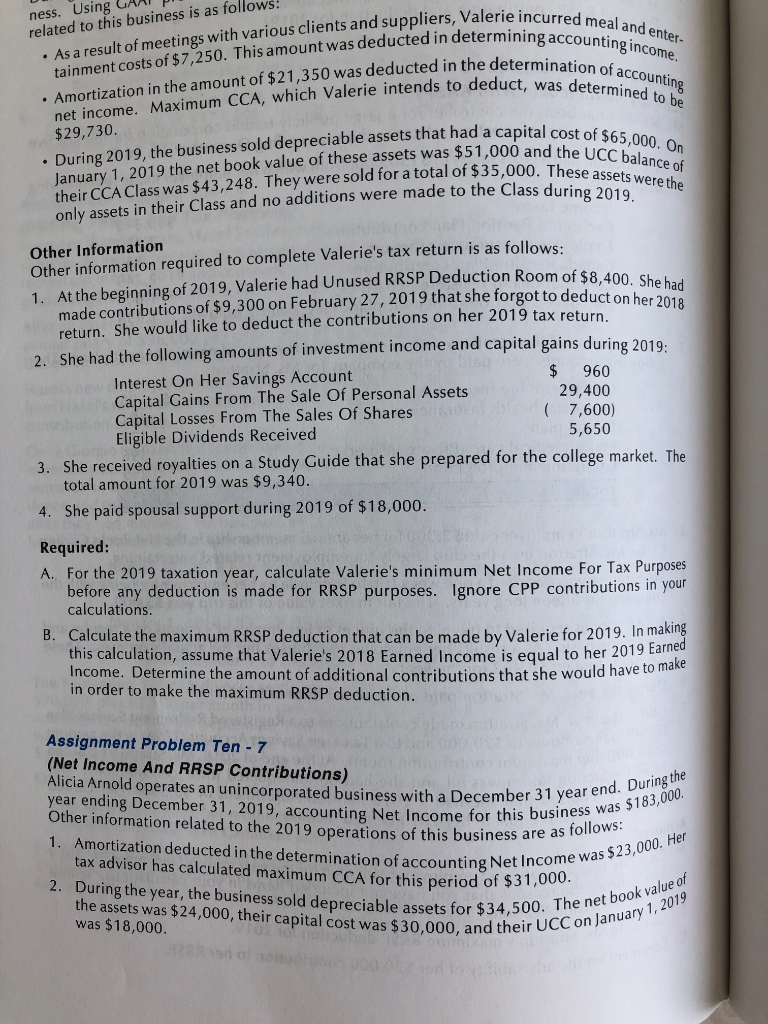

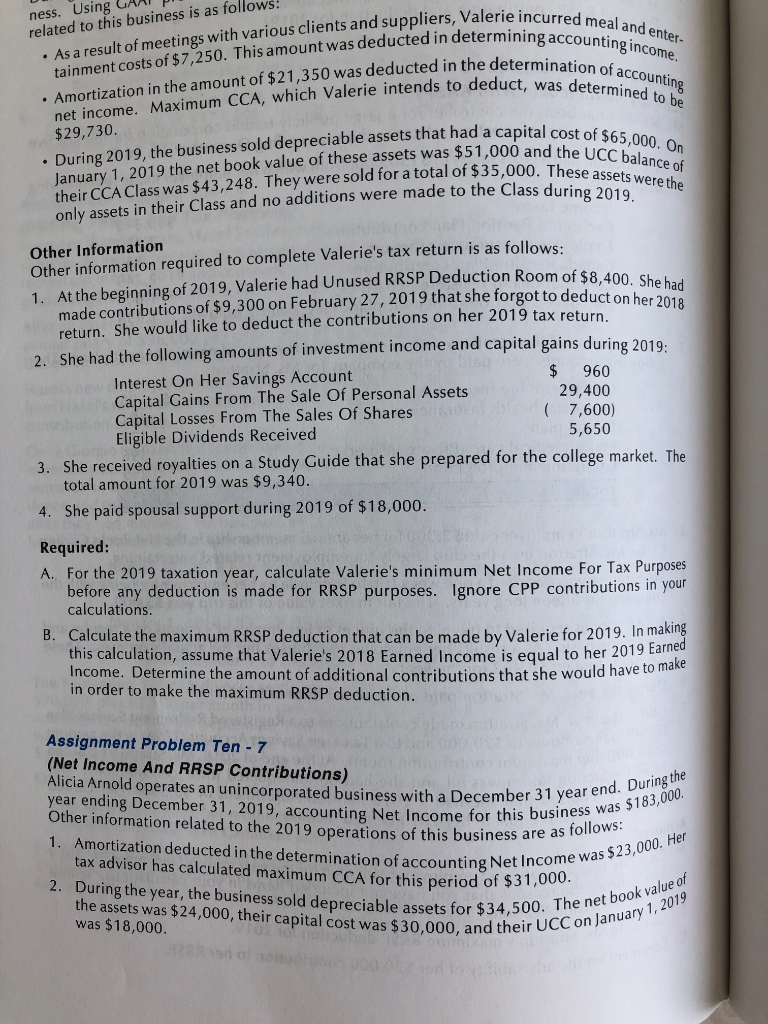

ness. Using related to this business is as follows: $29,730. As a result of meetings with various clients and suppliers, Valerie incurred meal and enter- . Amortization in the amount of $21,350 was deducted in the determination of accounting tainment costs of $7,250. This amount was deducted in determining accounting income. net income. Maximum CCA, which Valerie intends to deduct, was determined to be . During 2019, the business sold depreciable assets that had a capital cost of $65,000. On their CCA Class was $43,248. They were sold for a total of $35,000. These assets were the January 1, 2019 the net book value of these assets was $51,000 and the UCC balance of Alicia Arnold operates an unincorporated business with a December 31 year end. During the year ending December 31, 2019, accounting Net Income for this business was $183,000. Other information related to the 2019 operations of this business are as follows: 1. Amortization deducted in the determination of accounting Net Income was $23,000. Her 2. During the year, the business sold depreciable assets for $34,500. The net book value of the assets was $24,000, their capital cost was $30,000, and their UCC on January 1, 2019 only assets in their Class and no additions were made to the Class during 2019 Other Information Other information required to complete Valerie's tax return is as follows: 1. At the beginning of 2019, Valerie had Unused BRSP Deduction Room of $8,400. She had made contributions of $9,300 on February 27, 2019 that she forgot to deduct on her 2018 return. She would like to deduct the contributions on her 2019 tax return. 2. She had the following amounts of investment income and capital gains during 2019: $ 960 Interest On Her Savings Account Capital Gains From The Sale Of Personal Assets 29,400 Capital Losses From The Sales Of Shares (7,600) Eligible Dividends Received 5,650 3. She received royalties on a Study Guide that she prepared for the college market. The total amount for 2019 was $9,340. 4. She paid spousal support during 2019 of $18,000. Required: A. For the 2019 taxation year, calculate Valerie's minimum Net Income For Tax Purposes before any deduction is made for RRSP purposes. Ignore CPP contributions in your calculations. B. Calculate the maximum RRSP deduction that can be made by Valerie for 2019. In making this calculation, assume that Valerie's 2018 Earned Income is equal to her 2019 Earned Income. Determine the amount of additional contributions that she would have to make in order to make the maximum RRSP deduction. Assignment Problem Ten - 7 (Net Income And RRSP Contributions) was $18,000. tax advisor has calculated maximum CCA for this period of $31,000. 2010 ness. Using related to this business is as follows: $29,730. As a result of meetings with various clients and suppliers, Valerie incurred meal and enter- . Amortization in the amount of $21,350 was deducted in the determination of accounting tainment costs of $7,250. This amount was deducted in determining accounting income. net income. Maximum CCA, which Valerie intends to deduct, was determined to be . During 2019, the business sold depreciable assets that had a capital cost of $65,000. On their CCA Class was $43,248. They were sold for a total of $35,000. These assets were the January 1, 2019 the net book value of these assets was $51,000 and the UCC balance of Alicia Arnold operates an unincorporated business with a December 31 year end. During the year ending December 31, 2019, accounting Net Income for this business was $183,000. Other information related to the 2019 operations of this business are as follows: 1. Amortization deducted in the determination of accounting Net Income was $23,000. Her 2. During the year, the business sold depreciable assets for $34,500. The net book value of the assets was $24,000, their capital cost was $30,000, and their UCC on January 1, 2019 only assets in their Class and no additions were made to the Class during 2019 Other Information Other information required to complete Valerie's tax return is as follows: 1. At the beginning of 2019, Valerie had Unused BRSP Deduction Room of $8,400. She had made contributions of $9,300 on February 27, 2019 that she forgot to deduct on her 2018 return. She would like to deduct the contributions on her 2019 tax return. 2. She had the following amounts of investment income and capital gains during 2019: $ 960 Interest On Her Savings Account Capital Gains From The Sale Of Personal Assets 29,400 Capital Losses From The Sales Of Shares (7,600) Eligible Dividends Received 5,650 3. She received royalties on a Study Guide that she prepared for the college market. The total amount for 2019 was $9,340. 4. She paid spousal support during 2019 of $18,000. Required: A. For the 2019 taxation year, calculate Valerie's minimum Net Income For Tax Purposes before any deduction is made for RRSP purposes. Ignore CPP contributions in your calculations. B. Calculate the maximum RRSP deduction that can be made by Valerie for 2019. In making this calculation, assume that Valerie's 2018 Earned Income is equal to her 2019 Earned Income. Determine the amount of additional contributions that she would have to make in order to make the maximum RRSP deduction. Assignment Problem Ten - 7 (Net Income And RRSP Contributions) was $18,000. tax advisor has calculated maximum CCA for this period of $31,000. 2010