Answered step by step

Verified Expert Solution

Question

1 Approved Answer

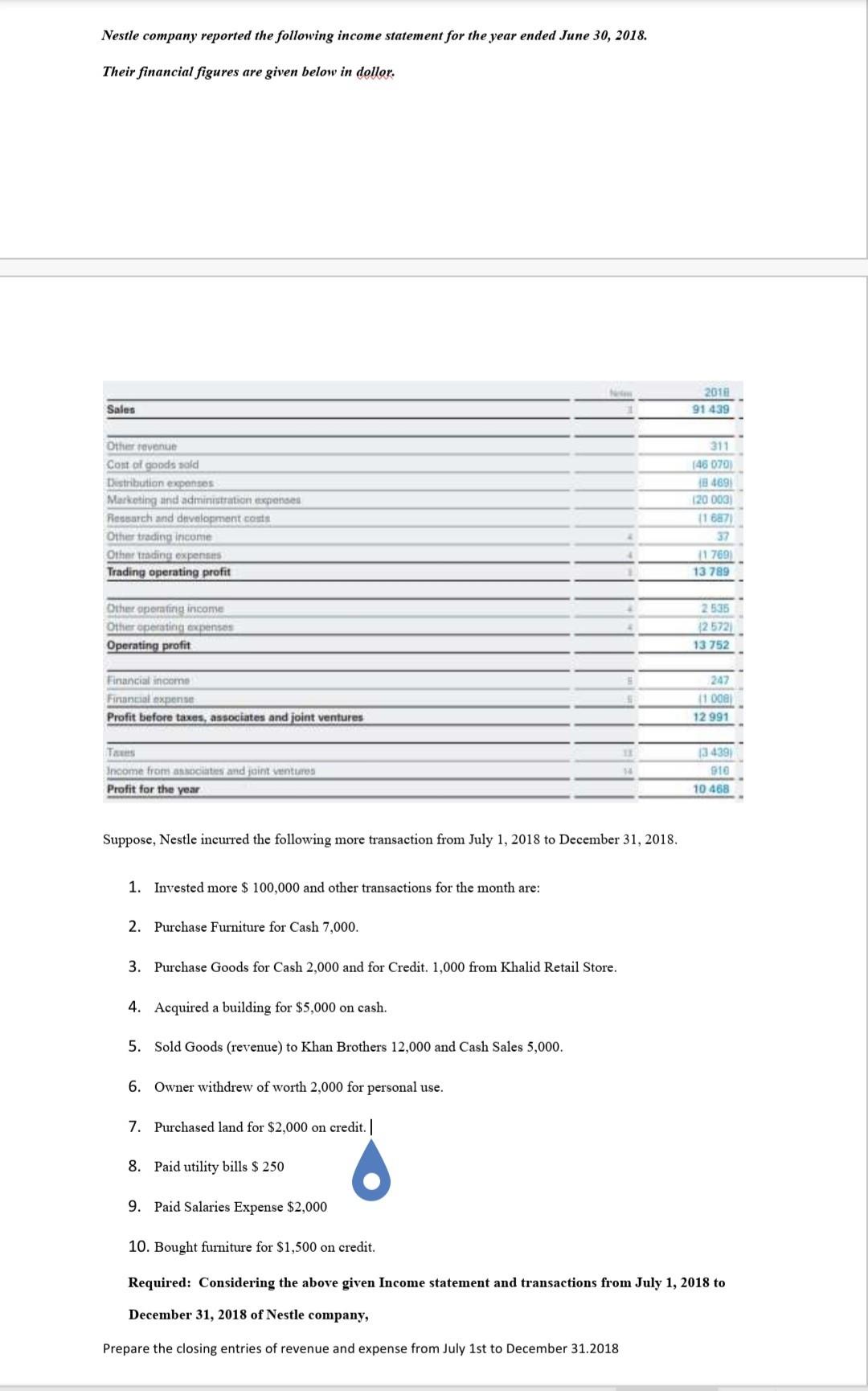

Nestle company reported the following income statement for the year ended June 30, 2018. Their financial figures are given below in dollor. 2018 91 439

Nestle company reported the following income statement for the year ended June 30, 2018. Their financial figures are given below in dollor. 2018 91 439 Sales Other revenue Cont of goods sold Distribution expenses Marketing and administration expenses Passarch and development costs Other tradin income Other trading expenses Trading operating profit 311 146 0701 18 469 120 003 11 687 37 11 769) 13 789 Other sporting income Other operating expenses Operating profit 2535 25721 13 752 Financial income Financial expense Profit before taxes, associates and joint ventures 247 11 0001 12 991 Tun Income from ancies and joint ventures Profit for the year (3 439) 910 10 468 Suppose, Nestle incurred the following more transaction from July 1, 2018 to December 31, 2018, 1. Invested more $ 100,000 and other transactions for the month are: 2. Purchase Furniture for Cash 7,000. 3. Purchase Goods for Cash 2,000 and for Credit. 1,000 from Khalid Retail Store. 4. Acquired a building for $5,000 on cash. 5. Sold Goods (revenue) to Khan Brothers 12,000 and Cash Sales 5,000. 6. Owner withdrew of worth 2,000 for personal use. 7. Purchased land for $2,000 on credit. | 8. Paid utility bills $ 250 9. Paid Salaries Expense $2,000 10. Bought furniture for $1,500 on credit. Required: Considering the above given Income statement and transactions from July 1, 2018 to December 31, 2018 of Nestle company, Prepare the closing entries of revenue and expense from July 1st to December 31.2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started