Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Net income $125,000 SIRO,000 SIOR.000 Trace Company, an electronics component manufacturer, is located in the United States. On 1/1/20x1, Trace Company paid $50 per share

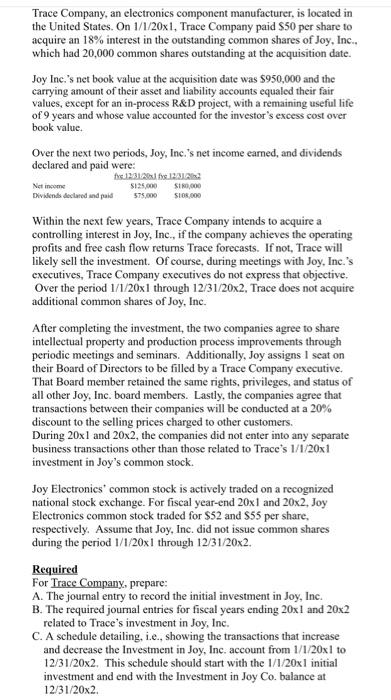

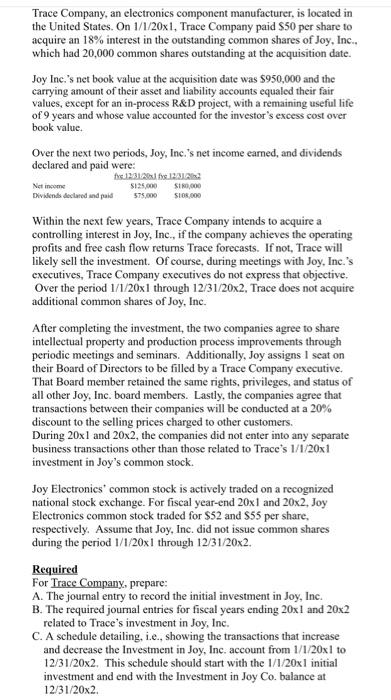

Net income $125,000 SIRO,000 SIOR.000 Trace Company, an electronics component manufacturer, is located in the United States. On 1/1/20x1, Trace Company paid $50 per share to acquire an 18% interest in the outstanding common shares of Joy, Inc., which had 20,000 common shares outstanding at the acquisition date. Joy Inc.'s net book value at the acquisition date was $950,000 and the carrying amount of their asset and liability accounts equaled their fair values, except for an in-process R&D project, with a remaining useful life of 9 years and whose value accounted for the investor's excess cost over book value. Over the next two periods, Joy, Inc.'s net income earned, and dividends declared and paid were: fys1231.2123123 Divends declared and paid 575.000 Within the next few years, Trace Company intends to acquire a controlling interest in Joy, Inc., if the company achieves the operating profits and free cash flow returns Trace forecasts. If not, Trace will likely sell the investment. Of course, during meetings with Joy, Inc.'s executives, Trace Company executives do not express that objective. Over the period 1/1/20x1 through 12/31/20x2. Trace does not acquire additional common shares of Joy, Inc. After completing the investment, the two companies agree to share intellectual property and production process improvements through periodic meetings and seminars. Additionally, Joy assigns I seat on their Board of Directors to be filled by a Trace Company executive. That Board member retained the same rights, privileges, and status of all other Joy, Inc. board members. Lastly, the companies agree that transactions between their companies will be conducted at a 20% discount to the selling prices charged to other customers. During 20x1 and 20x2, the companies did not enter into any separate business transactions other than those related to Trace's 1/1/20x1 investment in Joy's common stock. Joy Electronics' common stock is actively traded on a recognized national stock exchange. For fiscal year-end 20x1 and 20x2, Joy Electronics common stock traded for $52 and 55 per share, respectively. Assume that Joy, Inc. did not issue common shares during the period 1/1/20x1 through 12/31/20x2. Required For Trace Company, prepare: A. The journal entry to record the initial investment in Joy, Inc. B. The required journal entries for fiscal years ending 20x 1 and 20x2 related to Trace's investment in Joy, Inc. C. A schedule detailing, i.e., showing the transactions that increase and decrease the Investment in Joy, Inc. account from 1/1/20x1 to 12/31/20x2. This schedule should start with the 1/1/20xl initial investment and end with the Investment in Joy Co. balance at 12/31/20x2

Net income $125,000 SIRO,000 SIOR.000 Trace Company, an electronics component manufacturer, is located in the United States. On 1/1/20x1, Trace Company paid $50 per share to acquire an 18% interest in the outstanding common shares of Joy, Inc., which had 20,000 common shares outstanding at the acquisition date. Joy Inc.'s net book value at the acquisition date was $950,000 and the carrying amount of their asset and liability accounts equaled their fair values, except for an in-process R&D project, with a remaining useful life of 9 years and whose value accounted for the investor's excess cost over book value. Over the next two periods, Joy, Inc.'s net income earned, and dividends declared and paid were: fys1231.2123123 Divends declared and paid 575.000 Within the next few years, Trace Company intends to acquire a controlling interest in Joy, Inc., if the company achieves the operating profits and free cash flow returns Trace forecasts. If not, Trace will likely sell the investment. Of course, during meetings with Joy, Inc.'s executives, Trace Company executives do not express that objective. Over the period 1/1/20x1 through 12/31/20x2. Trace does not acquire additional common shares of Joy, Inc. After completing the investment, the two companies agree to share intellectual property and production process improvements through periodic meetings and seminars. Additionally, Joy assigns I seat on their Board of Directors to be filled by a Trace Company executive. That Board member retained the same rights, privileges, and status of all other Joy, Inc. board members. Lastly, the companies agree that transactions between their companies will be conducted at a 20% discount to the selling prices charged to other customers. During 20x1 and 20x2, the companies did not enter into any separate business transactions other than those related to Trace's 1/1/20x1 investment in Joy's common stock. Joy Electronics' common stock is actively traded on a recognized national stock exchange. For fiscal year-end 20x1 and 20x2, Joy Electronics common stock traded for $52 and 55 per share, respectively. Assume that Joy, Inc. did not issue common shares during the period 1/1/20x1 through 12/31/20x2. Required For Trace Company, prepare: A. The journal entry to record the initial investment in Joy, Inc. B. The required journal entries for fiscal years ending 20x 1 and 20x2 related to Trace's investment in Joy, Inc. C. A schedule detailing, i.e., showing the transactions that increase and decrease the Investment in Joy, Inc. account from 1/1/20x1 to 12/31/20x2. This schedule should start with the 1/1/20xl initial investment and end with the Investment in Joy Co. balance at 12/31/20x2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started