Question

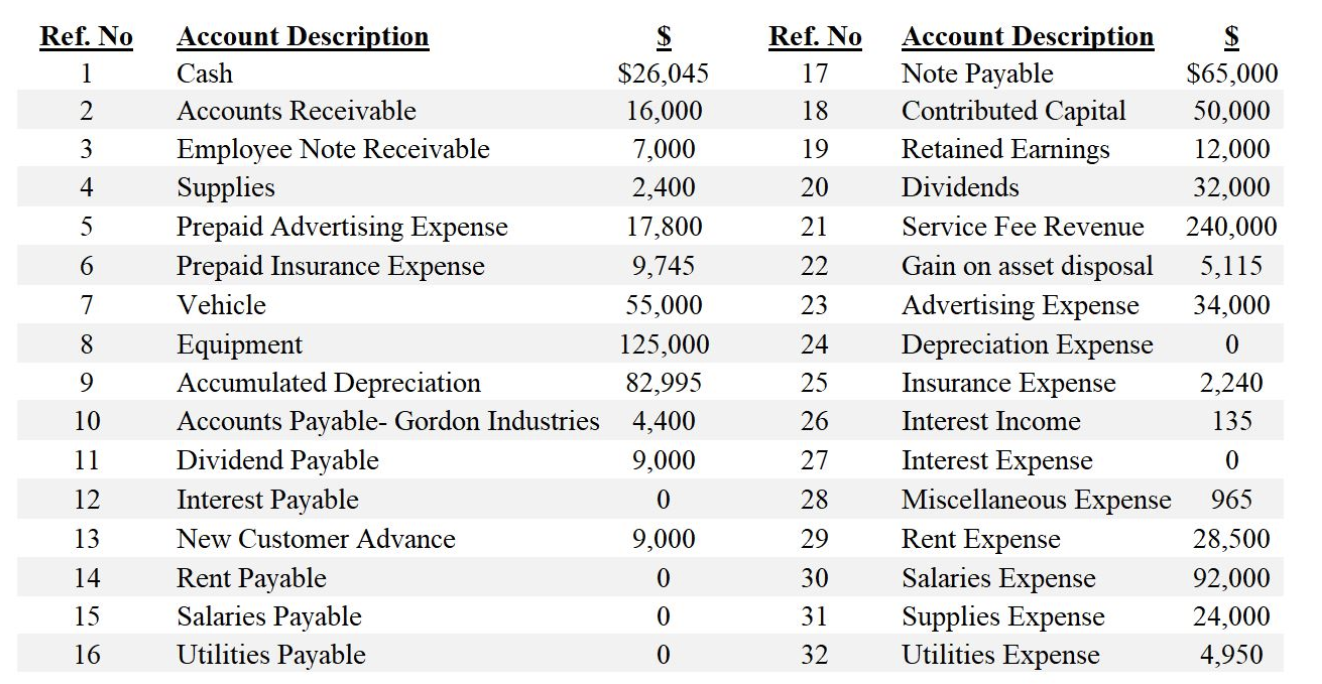

net income for the twelve months ended at 12/31/2019 of $58,595. Please consider the following 2 scenarios: (1) On September 1, 2019 Flash borrowed $65,000

net income for the twelve months ended at 12/31/2019 of $58,595.

Please consider the following 2 scenarios:

(1) On September 1, 2019 Flash borrowed $65,000 from the local bank at a rate of 6%. The loan is due in nine months and all principal and interest will be paid at maturity (June 1, 2020).

(2) Flash Company makes all Supplies purchases on account from vendor Gordon Industries. As of 1/1/2019 Flash had $2,400 of supplies on hand. During 2019 Flash purchased an additional $24,000 of supplies and made no other entries. On December 31, 2019, at the end of the day (after the offices had closed), Flash counted the supplies and determined that $5,500 of supplies were remaining as of this date.

What is the company's net income after any 12/31/2019 adjusting journal entries resulting from the above 2 scenarios? Answers may be rounded to the nearest $1.

| A. | $53,762 | |

| B. | $51,470 | |

| C. | None of the answer choices provided are correct. | |

| D. | $59,962 | |

| E. | $36,395 | |

| F. | $60,395 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started