Answered step by step

Verified Expert Solution

Question

1 Approved Answer

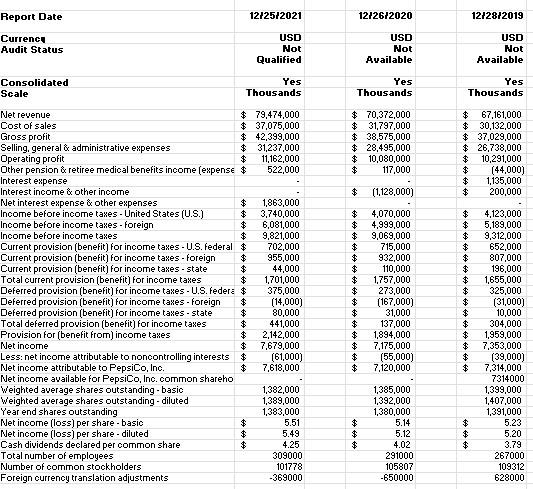

Net Income/Average Total Assets = Net Income/Average Total Equity = Report Date begin{tabular}{r|r|r|} hline 1212512021 & 12/2612020 & 12/2812019 hline USD & USD &

Net Income/Average Total Assets =

Net Income/Average Total Equity =

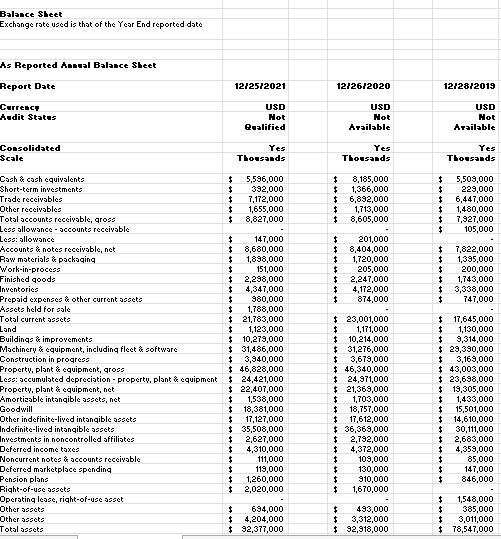

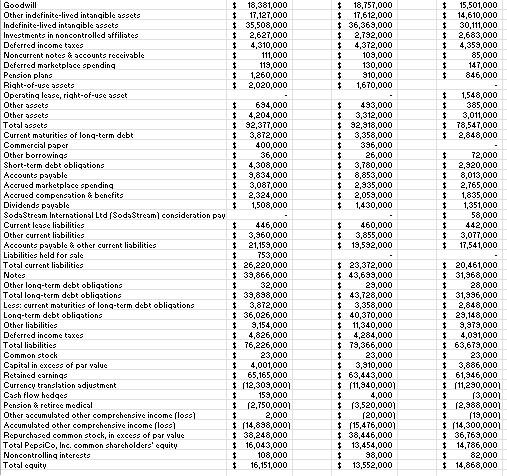

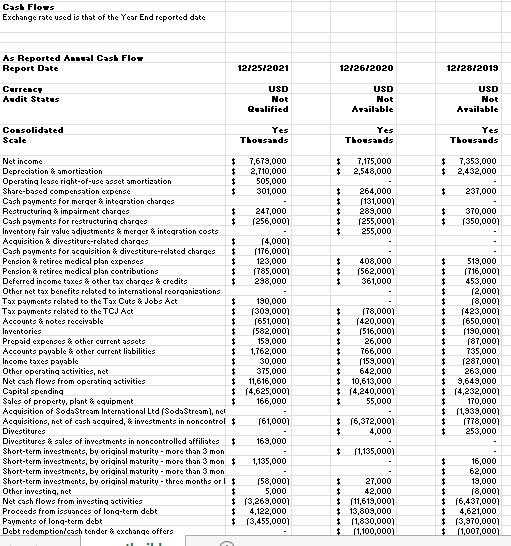

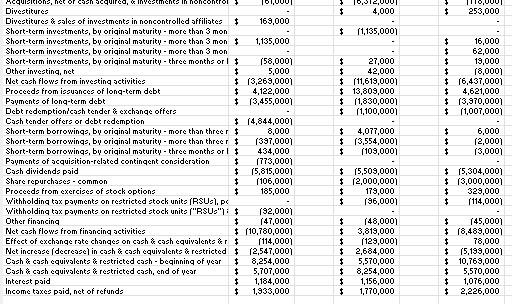

Report Date \begin{tabular}{r|r|r|} \hline 1212512021 & 12/2612020 & 12/2812019 \\ \hline USD & USD & USD \\ \hline Mualified & Not & Not \\ \hline \end{tabular} Currenca Audit Status Consolidated Seale Yes Thousands \begin{tabular}{r|r} Yes & Yes \\ \hline Thousands & Thousands \end{tabular} Net revenue Cost of sales \begin{tabular}{lll|ll} $79,474,000 & $70,372,000 & $ & 67,161,000 \\ \hline 37,075,000 & $31,797,000 & $ & 30,132,000 \end{tabular} Gross profit $37,075,000 Selling. general bo administrative expenses $31,237,000 $38,575,000$37,029,000 Interest expense Interest income 8 other income Net interest expense & other expenses Income betore income taxes - United States (U.S.) Income before income taxes - foreign Income before income taxes Current provision (benefit) for income tanes - U.S. Federal $702,000 Current provision (benefit) for income tages - foreign Current provision (benefit) for income takes -state Total current provision (benefit) for income tases Deferred provision (benefit) for income tanes - U.S. Federe $375,000 Deferred provision (benefit) for income taues - foreign Deferred provision (benefit) for income taxes -state Total deferred provision (benefit) for income taxes Provision for (benefit from) income taues Net income Less: net income attributable to noncontrolling interests $(61,000] Net income attributable to Pepsico, Inc. Net income available for PepsiCo, Inc. common shareho Weighted average shares outstanding - diluted Year end shares outstanding Net income (loss) per share - basic Net income (loss) per share - diluted Cash dividends declared per common share Total number of employees Number of common stockholders Foreign currency translation adjustments Balance Sheth Exchange rate used is that of the Year End reported dote As Reported Annal Balance Sheet Report Date \begin{tabular}{|l|l|l} 1212512021 & 1212612020 & 1212812019 \end{tabular} Carrencp hadit States Consolidated Sicale Yes Thonsands Cash bash equivalente Short-term investmente Trade receivablez Other receivablez Total accounte receivable, grozz Leez allowance - accounte receivable Less: allowance Accounte to notes receivable, net Raw materialz : packaqing Work-in-procesz Finished goods Inventories Prepaid expensez 3 other current sasetz Assetz held for sale Total current assets Land Buildinqe 8 improvements Machinery $ equipment, including fleet 4 software Construction in progresz Propertw, plant 3 equipment, qrosz \begin{tabular}{|r|r} USD & USD \\ Mot & Mot \\ lifitd & Arailable \end{tabular} USD Hot Arailable Goodwill Orher indefinite-lived intanqible sesets Indefinite-lived intanqible szsetz Investments in noncontrolled affiliates Deferred income taxes Noncurrent notes b account receivable Deferred marketplace spending Pension plane Right-of-use assets Operating lesse, riqht-of-use seset Orher aseets Other aseets Total aseets Current maturities of lonq-term debt Commercial paper Dther borrowings Short-term debt obliqations Accounte payable Accrued marketplace spending Accrued compenzation 0 benefitz Dividends paysble Soda Stream International Ltd [SodaStream] consideration pay Eurrent lesse lisbilities Dther current liabilities Account paysble of other current liabilities Cash FloTe: Exchange rate used is that of the Year End reported date As Reported Anenal Cask Flow Report Date \begin{tabular}{|l|l|l|} 1212512021 & 1212612020 & 1212812019 \end{tabular} Carreacp USD USD USD Andit Sitates Qarlified Arailable \begin{tabular}{r|r|r} \hline Yes & Yes & Yes \\ \hline Thonsands & Thonsands & Thonsands \end{tabular} Consolidated Scale Net income Depreciation \& amortization Opersting lesee right-of-uje seset amortizstion Share-based compenzation expense Cosh poumentz for merqer 4 inteqrstion charqes Restructuring 3 impoirment charqes Cosh poymente for restructuring charqee Inventorv fair value sdiustments 4 merger 4 inteqrstion coste Acquisition 4 divestiture-related charqey $7,679,000$2,710,000$$7,175,0002,548,000$$2,432,0007,353,000 Cosh poument for acquisition b divestiture-related charqez Pension \& retiree medical plan expensez Pension 3 retiree medical plan contributions Deferred income toxe * other tox chorqee 3 credits Other net tax benefite related to international reorqanizations Tox poumente related to the Tox Cute 4 Jobe Act Tax paymente related to the TCJ Act Accounte 4 notee receivable Anventoricz Prepsid expengez 3 other current seset Accounte pousble $ other current liabilitief Ancome taxee pousble Other operating activitief, net Net cash flowe from opersting activitief Capital spending Salez of property, plant s equipment $505,000 Arailable Divestituree 4 eale of investmente in noncontrolled affilistes $169,000 Short-term investments, by oriainal maturity - more than 3 mon Short-term investmente, bv oriqinal maturity - more than 3 mon $1,135,000 Short-term investmente, by oriainal maturity - more than 3 mon Short-term investmente, by oriainal maturity - three months or I Other investing, net Net cosh flow from investing sctivities Proceeds from issuances of long-term debt Poumente of long-term debt Debt redemptioni'cash tender 3 exchange offers Divestitures Divestitures s sales of investment in noncontrolled affiliatez $169,000 Short-term investments, by oriqinal maturity - more than 3 mon Short-term investmentz, bu oriqinal maturity - more than 3 mon $1,135,000 Short-term investmente, bu oriqinal maturity - more than 3 mon Short-term investments, by oriqinal maturity - three monthz or 1 Drher investing, net Net cash flowz from investing activities Proceeds from iszuances of long-term debt Payments of long-term debt Debt redemptionicash tender o exchanqe offers Cash tender offerz or debt redemptionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started