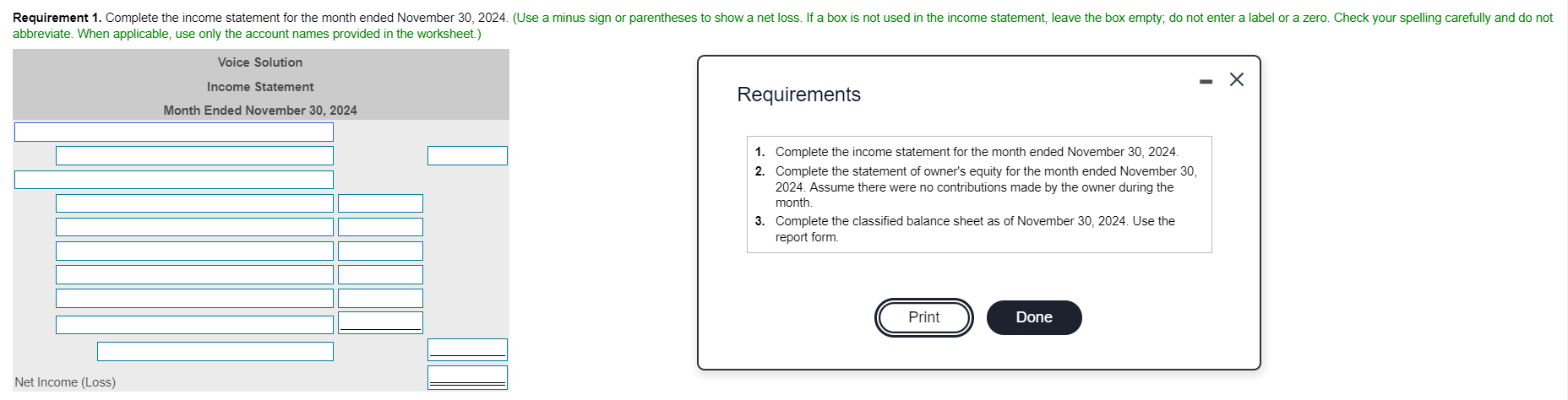

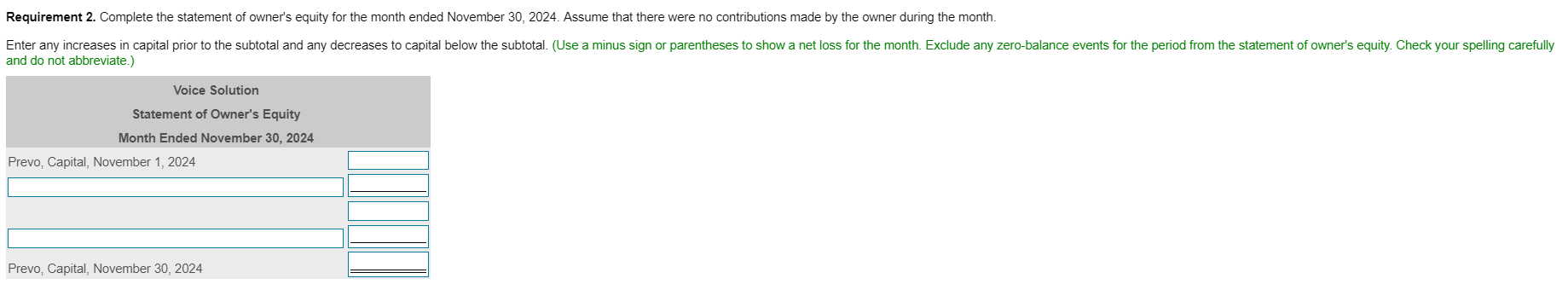

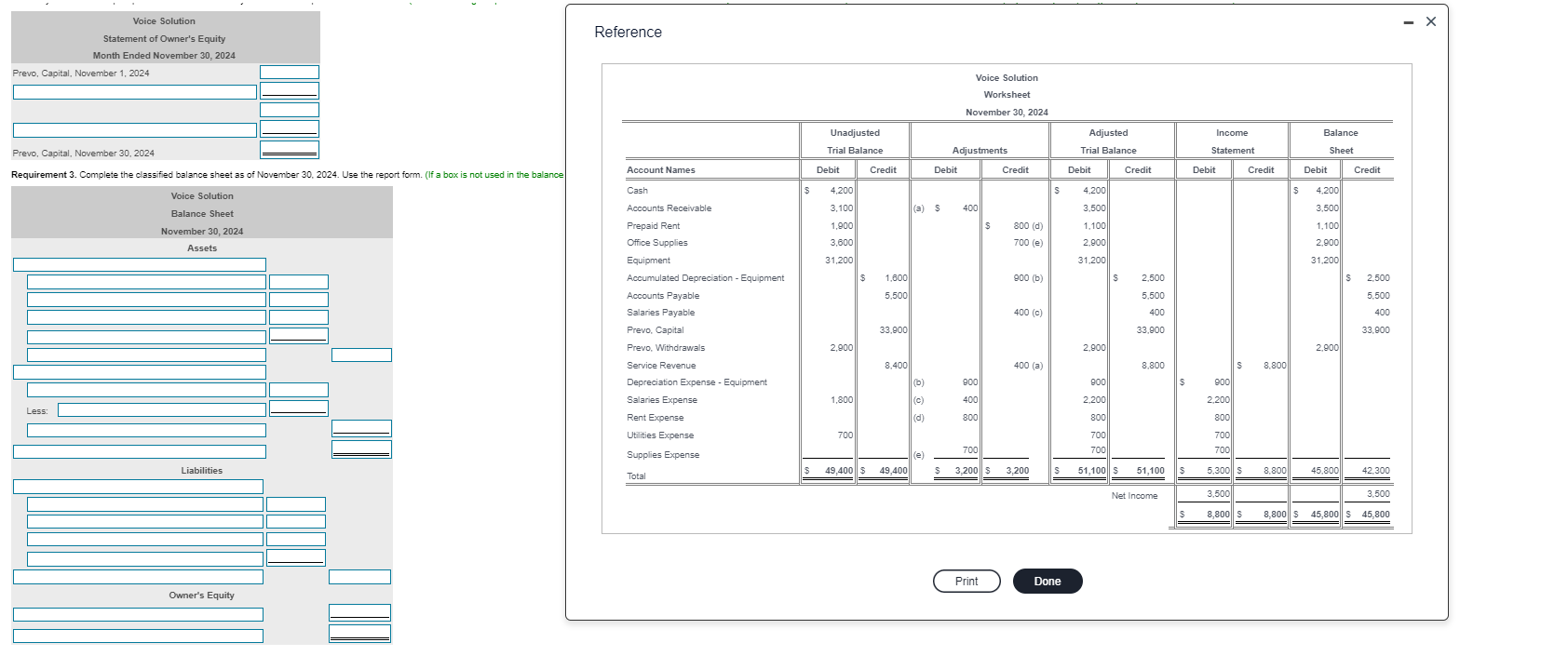

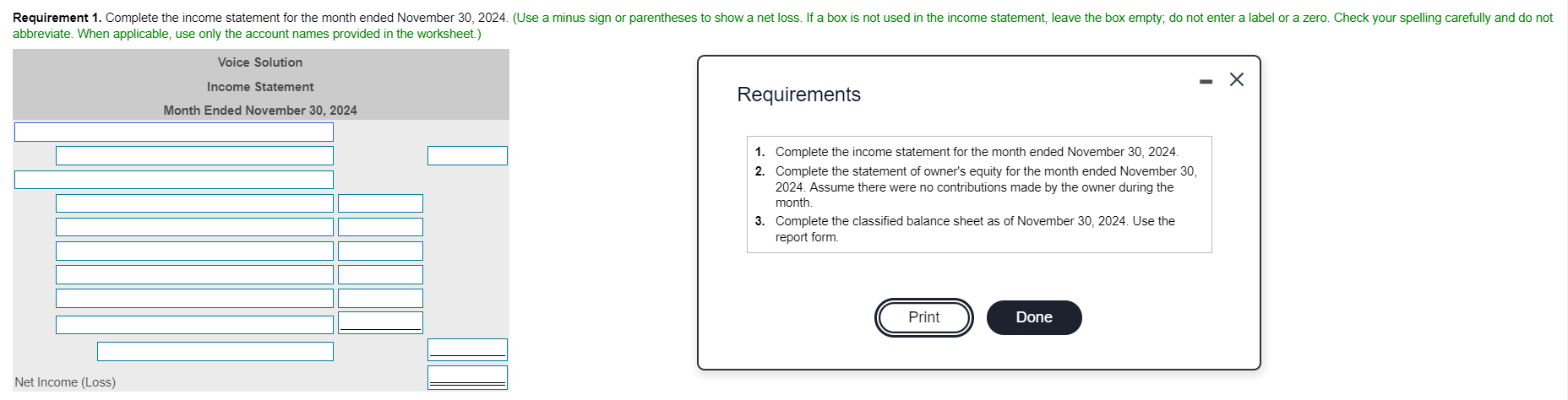

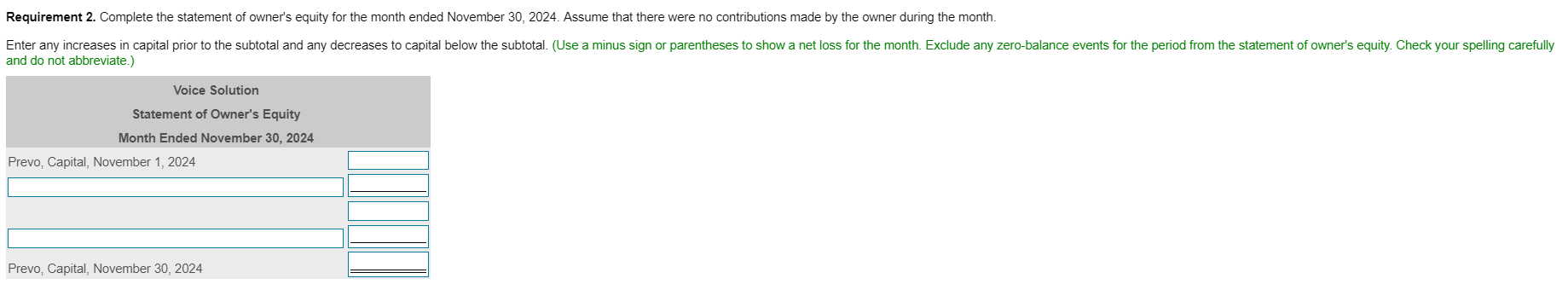

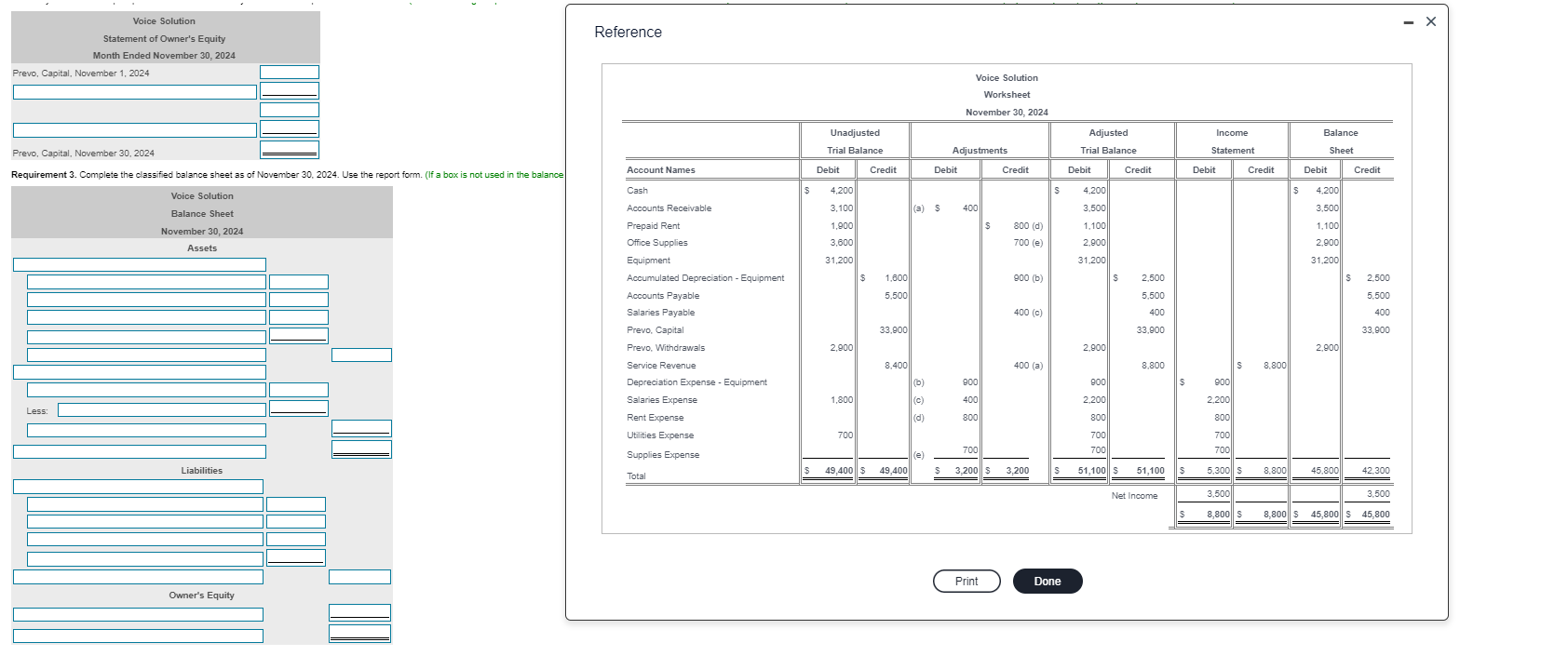

net loss. If a box is not used in the income statement, leave the box empty, do not enter a label or a zero. Check your spelling carefully and do not Requirement 1. Complete the income statement for the month ended November 30, 2024. (Use a minus sign or parentheses to show abbreviate. When applicable, use only the account names provided in the worksheet.) Voice Solution Income Statement Requirements Month Ended November 30, 2024 1. Complete the income statement for the month ended November 30, 2024. 2. Complete the statement of owner's equity for the month ended November 30, 2024. Assume there were no contributions made by the owner during the month. 3. Complete the classified balance sheet as of November 30, 2024. Use the report form Print Done II Net Income (Loss) Requirement 2. Complete the statement of owner's equity for the month ended November 30, 2024. Assume that there were no contributions made by the owner during the month. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. (Use a minus sign or parentheses to show a net loss for the month. Exclude any zero-balance events for the period from the statement of owner's equity. Check your spelling carefully and do not abbreviate.) Voice Solution Statement of Owner's Equity Month Ended November 30, 2024 Prevo, Capital, November 1, 2024 Prevo, Capital, November 30, 2024 Reference Voice Solution Statement of Owner's Equity Month Ended November 30, 2024 Prevo, Capital, November 1, 2024 Voice Solution Worksheet November 30, 2024 Unadjusted Adjusted Income Balance Prevo, Capital, November 30, 2024 Trial Balance Adjustments Trial Balance Statement Sheet Debit Account Names Credit Debit Credit Debit Credit Debit Credit Requirement 3. Complete the classified balance sheet as of November 30, 2024. Use the report form. (If a box is not used in the balance Debit Credit Cash $ S 4,200 $ Voice Solution 4,200 3,500 4,200 3,100 1,900 (a) 5 400 3,500 Balance Sheet Accounts Receivable Prepaid Rent $ November 30, 2024 Assets 800 (d) 700 e 1.100 2,900 1.100 2.900 Office Supplies 3,600 31,200 31.200 31,200 1.600 900 (b) S 2,500 S 2.500 5,500 5,500 400 (0 5,500 400 33,900 400 33,9001 33,900 2,900 2.900 2,900 Equipment Accumulated Depreciation - Equipment Accounts Payable Salaries Payable Prevo, Capital Prevo, Withdrawals Service Revenue Depreciation Expense - Equipment Salaries Expense Rent Expense Utilities Expense Supplies Expense 8.400 400 (a) 8.800 s 8.800 (b) 900 900 $ 9001 1.800 c) 400 2.200 Less: || (d) 800 2.200 800 7001 700 800 700 700 700 700 e) 49,4001 Liabilities S 49.400 $ 3,200 $ 3.200 S 51,100ll $ 51.100 S 8.800 5.300 S Total 45.800 42.300 Net Income 3.500 3.500 $ 8,800 S 8,800 $ 45,800 $ 45,800 Print Done Owner's Equity UNO