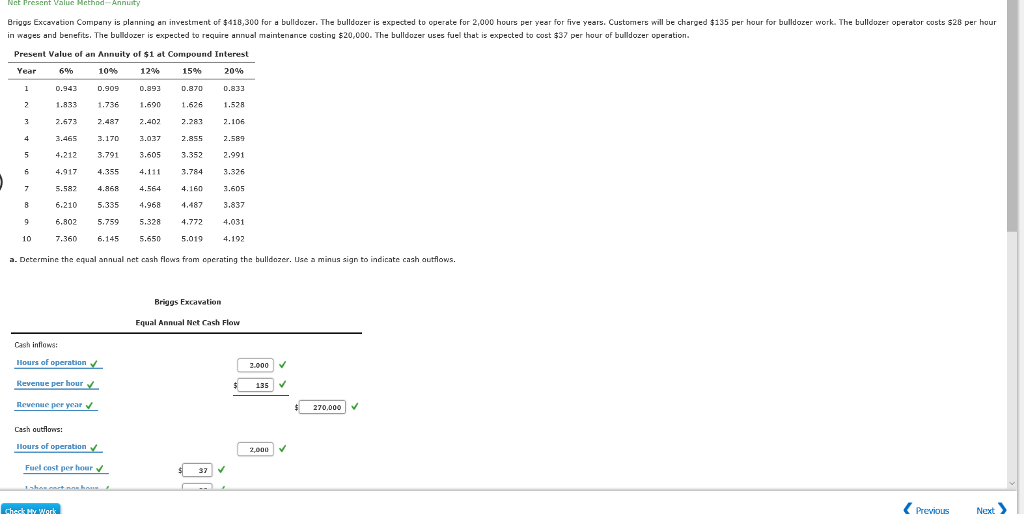

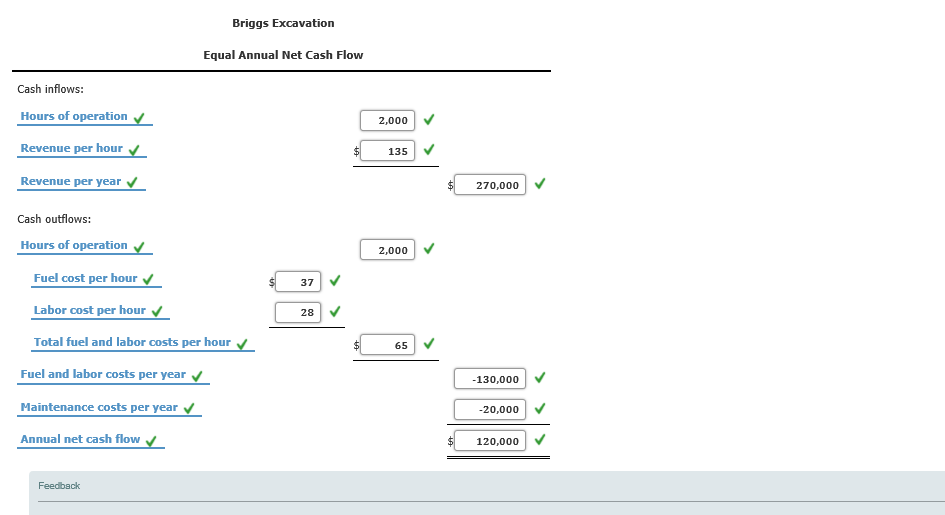

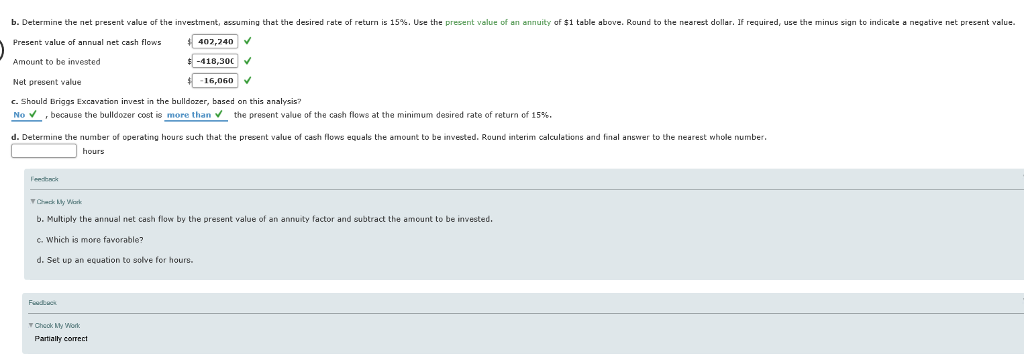

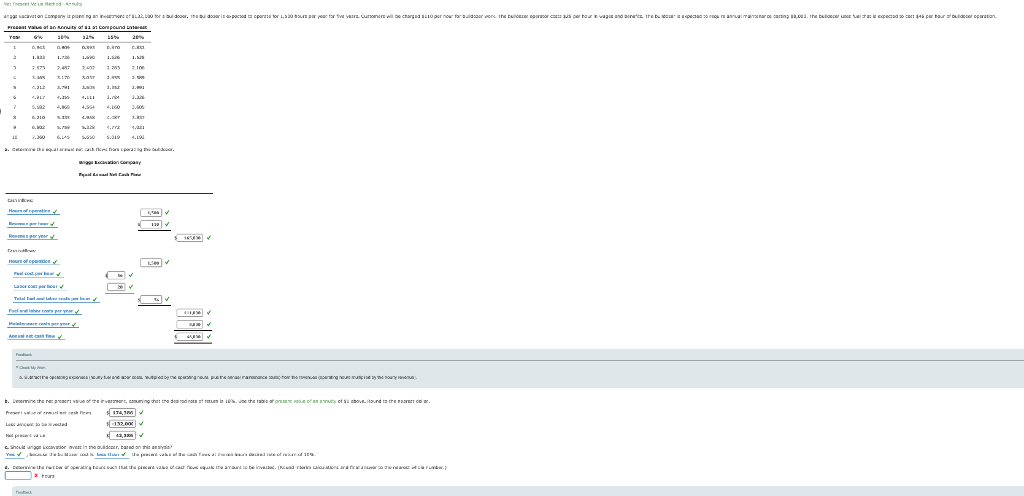

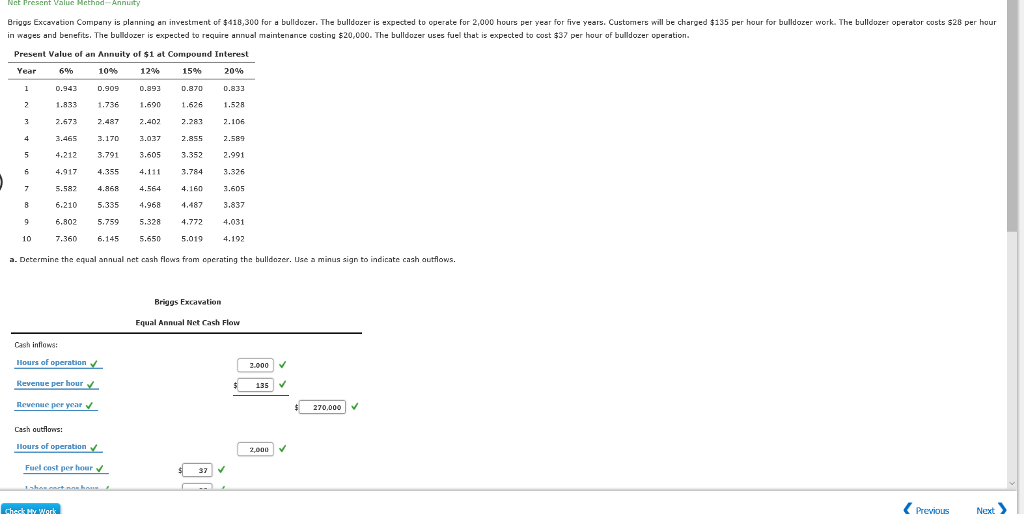

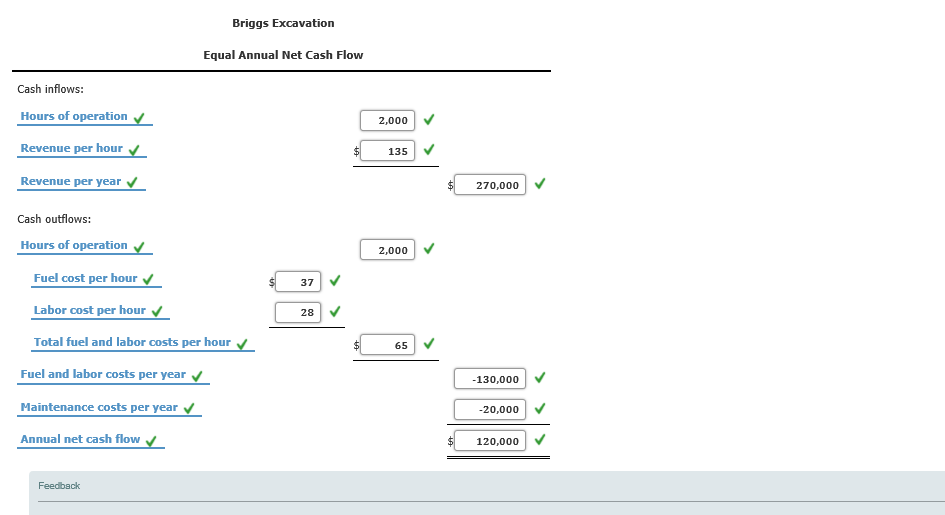

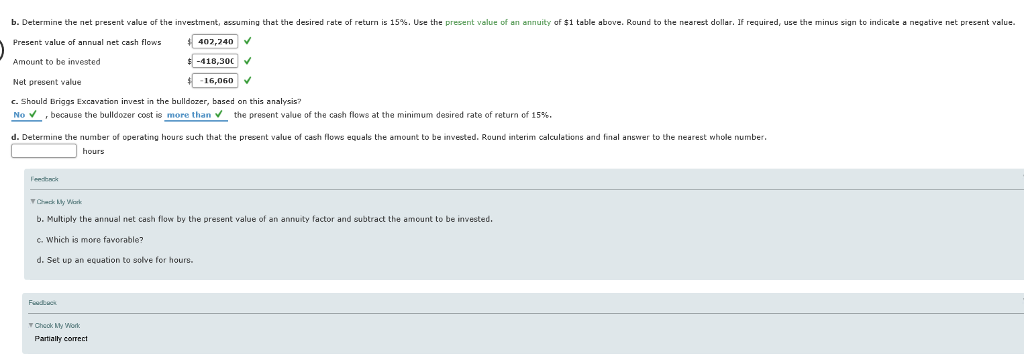

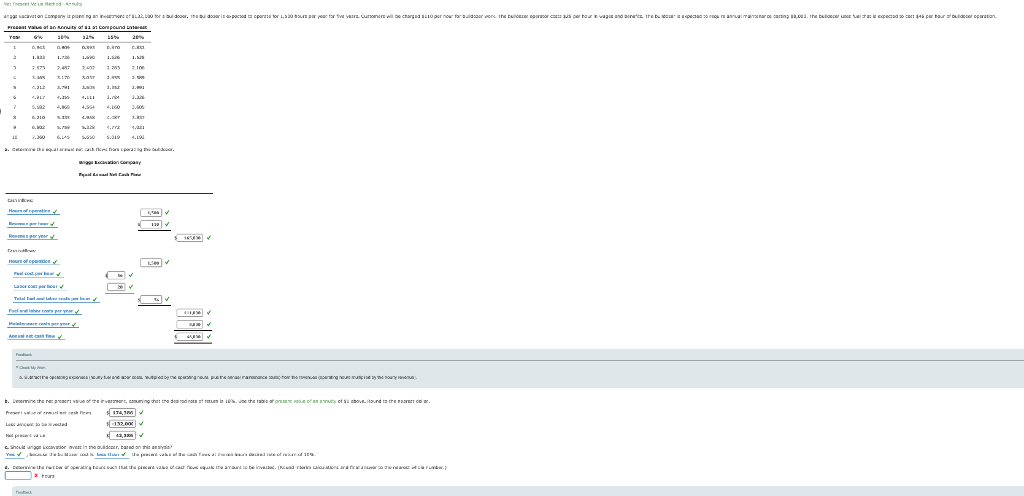

Net Present Value Method Anniuity Briggs Excavation Company is planning an investment of $418,300 for a bulldozer. The bulldozer is expected to operate for 2,000 hours per year for five years. Customers will be charged $135 per hour for bulldozer work. The bulldozer operator costs $28 per hour in wages and benefits, The bulldozer is expected to require annual maintenance costing $20,000. The bulldozer uses fuel that is expected to cost $37 per hour of bulldozer operation Present Value of dn Annuity of1 at Compound Interest Year 15% 20% 870 0.833 1.8331.736 1.690.6261.528 2.6732.487 2.402 2.2832.106 69% 10% 12% 0.909 4.212 3.791 3.605 3.352 .991 4.9174.3554.1113.784 3.326 5.582 4.868 4.564 4.160 3.605 6,210 5.3354.968 ,4873.837 6.802 5.759 5.328 4.7724.031 7.360 6.145 5.650 5.019 4.192 a. Determine the equal annual net cash flows from cperating the bulldozer. Use a minus sign to indicate cash autflows Briggs Excavation Fqual Annual Net Cash Flow Cash inflows: Hours of operation Revenue per hour Revenue per year 270,000 Cash autlows: lours of operation 2000 Fuel cost per hour Briggs Excavation Equal Annual Net Cash Flow Cash inflows: 2,000 Revenue per hour 135 Revenue per year 270,000 Cash outflows: Hours of operation 2,000 Fuel cost per hour Labor cost per hour Total fuel and labor costs per hour 37 28 65 Fuel and labor costs per year Maintenance costs per year Annual net cash flow 130,000 20,000 120,000 Feedback Determine th b. e net present value of the investment, assuming that the desired rate of return is 15% Use the present value of an annuity of $1 table above. Round to the nearest dollar. If required, use the minus sagn to indicate a negative net present value. Present value of annual net cash flows Amount to be invested Net present value c. Should Briggs Excavation invest in the bulldozer, based on this analysis? 402,240 -418,300 16,060V No , because the bulldozer cost is more than the present value of the cash flows at the minimum desired rate of return of 15%, Determine th e number of operating hours such that the present value o cash Bowe quals the d mount to be invested. Ro und in errn calculations and final dnswer to the nearest whole num hours Check Ly Work b. Multiply the annual net cash flow by the present value of an annuity factor and subtract the amount to be invested. c. Which is more favorable? d. Set up an equation to solve to solve for hours. Partialty correct Net Present Value Method Anniuity Briggs Excavation Company is planning an investment of $418,300 for a bulldozer. The bulldozer is expected to operate for 2,000 hours per year for five years. Customers will be charged $135 per hour for bulldozer work. The bulldozer operator costs $28 per hour in wages and benefits, The bulldozer is expected to require annual maintenance costing $20,000. The bulldozer uses fuel that is expected to cost $37 per hour of bulldozer operation Present Value of dn Annuity of1 at Compound Interest Year 15% 20% 870 0.833 1.8331.736 1.690.6261.528 2.6732.487 2.402 2.2832.106 69% 10% 12% 0.909 4.212 3.791 3.605 3.352 .991 4.9174.3554.1113.784 3.326 5.582 4.868 4.564 4.160 3.605 6,210 5.3354.968 ,4873.837 6.802 5.759 5.328 4.7724.031 7.360 6.145 5.650 5.019 4.192 a. Determine the equal annual net cash flows from cperating the bulldozer. Use a minus sign to indicate cash autflows Briggs Excavation Fqual Annual Net Cash Flow Cash inflows: Hours of operation Revenue per hour Revenue per year 270,000 Cash autlows: lours of operation 2000 Fuel cost per hour Briggs Excavation Equal Annual Net Cash Flow Cash inflows: 2,000 Revenue per hour 135 Revenue per year 270,000 Cash outflows: Hours of operation 2,000 Fuel cost per hour Labor cost per hour Total fuel and labor costs per hour 37 28 65 Fuel and labor costs per year Maintenance costs per year Annual net cash flow 130,000 20,000 120,000 Feedback Determine th b. e net present value of the investment, assuming that the desired rate of return is 15% Use the present value of an annuity of $1 table above. Round to the nearest dollar. If required, use the minus sagn to indicate a negative net present value. Present value of annual net cash flows Amount to be invested Net present value c. Should Briggs Excavation invest in the bulldozer, based on this analysis? 402,240 -418,300 16,060V No , because the bulldozer cost is more than the present value of the cash flows at the minimum desired rate of return of 15%, Determine th e number of operating hours such that the present value o cash Bowe quals the d mount to be invested. Ro und in errn calculations and final dnswer to the nearest whole num hours Check Ly Work b. Multiply the annual net cash flow by the present value of an annuity factor and subtract the amount to be invested. c. Which is more favorable? d. Set up an equation to solve to solve for hours. Partialty correct