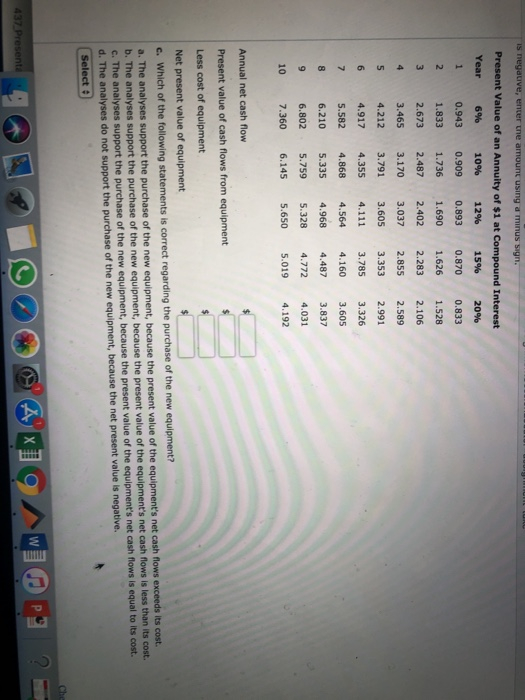

Net Present Value Method -- Annuity Connor Company is considering purchasing new equipment for $160,000. The expected life of the equipment is 8 years with no residual value. The equipment is expected to generate revenues of $122,000 per year. Total expenses, including depreciation (calculated using the straight-line method), are expected to be $100,000 per year. Connor management has set a minimum acceptable rate of return of 15%. a. Determine the equal annual net cash flows from operating the equipment. b. Calculate the net present value of the new equipment. Use the present value of an annuity of $1 table below. If required, round to the nearest dollar. If the net present value is negative, enter the amount using a minus sign Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0 .909 0.893 0.870 0.833 1.833 1.736 1.690 1.626 1.528 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 4.917 4.355 4.111 3.785 3.326 5.582 4.868 4.564 4.160 3.605 5 1 OR is negative, enter the amount using a minus sign. Present Value of an Annuity of $1 at Compound Interest Year 6 % 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 4.917 4.355 4.111 3.785 3.326 5.582 4.868 4.564 4.160 3.605 6.210 5.335 4.968 4.487 3.837 6.802 5.759 5.328 4.772 4.031 7.360 6.145 5.650 5.019 4.192 10 Annual net cash flow Present value of cash flows from equipment Less cost of equipment Net present value of equipment c. Which of the following statements is correct regarding the purchase of the new equipment? a. The analyses support the purchase of the new equipment, because the present value of the equipment's net cash flows exceeds its cost. b. The analyses support the purchase of the new equipment, because the present value of the equipment's net cash flows is less than its cost. c. The analyses support the purchase of the new equipment, because the present value of the equipment's net cash flows is equal to its cost. d. The analyses do not support the purchase of the new equipment, because the net present value is negative. Select AX19wi PS? 437 Presenta