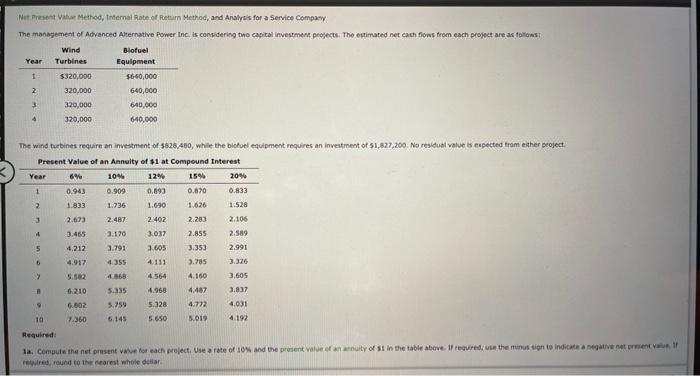

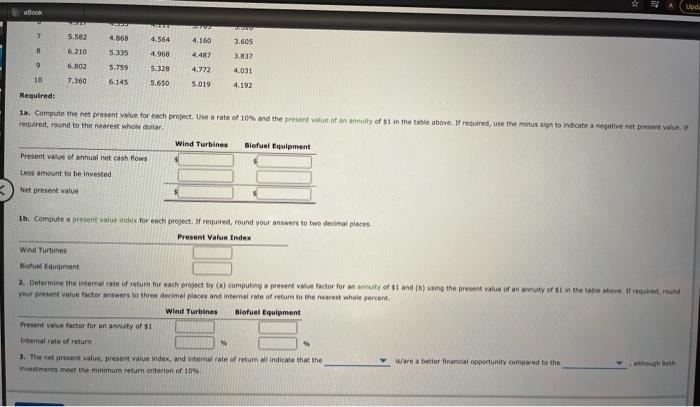

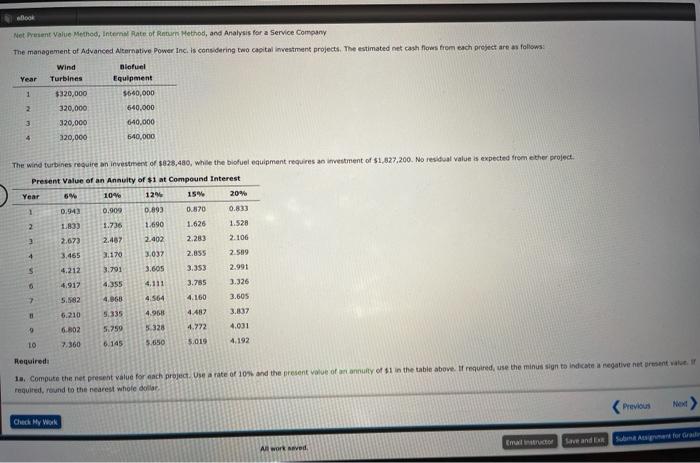

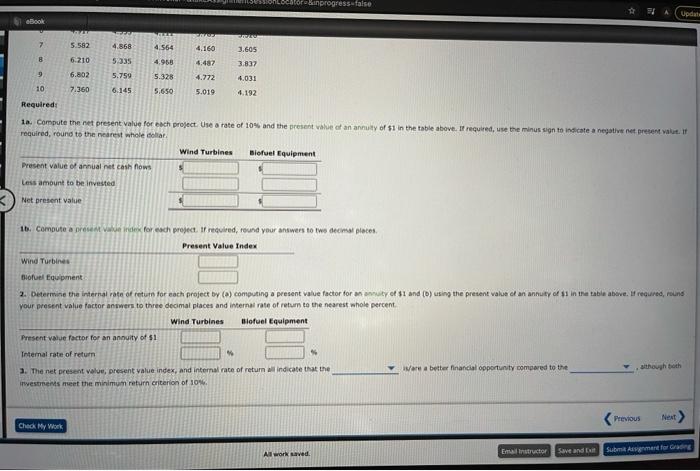

Net Present Value Method, Internal Rate of Retar Method, and Analysis for a Service Company The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows Wind Biofuel Year Turbines Equipment 1 $320,000 $660,000 2. 320,000 640,000 3 320,000 640,000 4 320,000 640,000 The wind turbines require an investment of $828,400, while the biofuel equipment requires an investment of 51,827,200. No residual value is expected from exther project Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 6.909 0.893 0.870 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2402 2.283 2.106 4 3.465 3.170 3.027 2.855 2.589 5 4,212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 4.160 3.326 3.605 2 4 564 6.210 5.335 3.83 4.968 5.328 4487 4.772 9 5.759 4,031 6.802 7.360 10 5.650 5.019 4.192 Required: la Compute the net present for each project. Use a rate of 10% and the present value of annuity of S1 in the table above. If reoved use the unus sign to indicate a negative nereti red round to the nearest whole della Upda book CE 7 5.582 4.668 4,564 4,160 3.605 6.210 5.335 4.968 4,487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Required: ia. Compute the net present value for each project. Use a rate of 10% and the present value of an annuity of $1 in the table above. If required, use the mission to indicate a negative presenta required, round to the nearest who dollar Wind Turbines Biofuel Equipment Present value of annual net cash flows Less amount to be invested Net present value 1b. Compute a present value inde for each project. If required, round your answers to two decimal places Present Value Index Wind Turbines Biofuel Equipment 2. Determine the internat rate of return for each project by (a) computing present factor for annuty of 11 and (b) using the present value of an any of it in the above retround your present value factorswers to three decimal places and internal rate of return to the nearest whole percent Wind Turbines Biofuel Equipment Present value factor for an annuty of 31 Internal rate of return 3. The represent values, present value index, and internal rate of return indicate that the are a better financial opportunity compared to the though both westments meet the minimum return criterion of 10% look Netent Value Method, Internal Rate of Return Method, and Analysis for a Service Company The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows: Wind Biofuel Year Turbines Equipment 1 $320,000 5640,000 320,000 540,000 320,000 640,000 320,000 540,000 The wind turbines require an investment of $828,480, while the biofuel equipment requires an investment of $1,627,200. No residual value is expected from the project. Present Value of an Annuity of $1 at Compound Interest Year 5% 104 12 151 20% 1 0.943 0.900 0,893 0.870 0.833 2 1.83) 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 170 3.037 2.355 2.569 S 4.212 3.791 3,605 3.353 2.991 4.917 4,111 3.785 3.326 5.582 4,068 4.564 4.160 3.605 6.210 5.335 4.968 4.482 3.837 9 6.802 5.328 4.772 4.031 10 7.360 3.650 5.010 4.192 Required: 1a. Compute the net present value for each project. Use a rate of 10% and the present of an annuity of 1 in the table above. If required, use the minus sign to indicate a negative et presente required, round to the nearest whole dollar Previous Check My Work Email Save and E SA forrad All wort ved &inprogressefalse FTA Update Book 7 5.582 4.868 4.564 4.160 3.605 8 5035 6.210 6.852 4.968 9 5.487 4.772 3.837 4.031 5.750 5.328 5.650 10 7.360 6.145 5.019 Required: 1a. Compute the net present value for each project. Use a rate of 10% and the present walue of an annuty of $1 in the table above. If required, use the minus sign to indicate a negative net present valut. It required, round to the nearest whole dobar Wind Turbines Biofuel Equipment Present value of annual net cash flows Less amount to be invested Net present value 1b. Computea prevalence for each project. If required, round your answers to two decimal places Present Value Index Wind Turbines Biofuel Equipment 2. Determine the internal rate of return for each project by (o) computing a present value factor for any of $1 and (b) using the present value of an annuty of $1 in the table above required, round your present value factor answers to three decimal places and internal rate of return to the nearest whole percent Wind Turbines Biofuel Equipment Present value factor for an annuity of 51 Internal rate of return 3. The net present value present value index, and internal rate of return al indicate that the are a better financial opportunity compared to the westens meet the minimum return criterion of 10% Previous Next Check My Work All work ved Email Instructor Save and Submert for GORE