Answered step by step

Verified Expert Solution

Question

1 Approved Answer

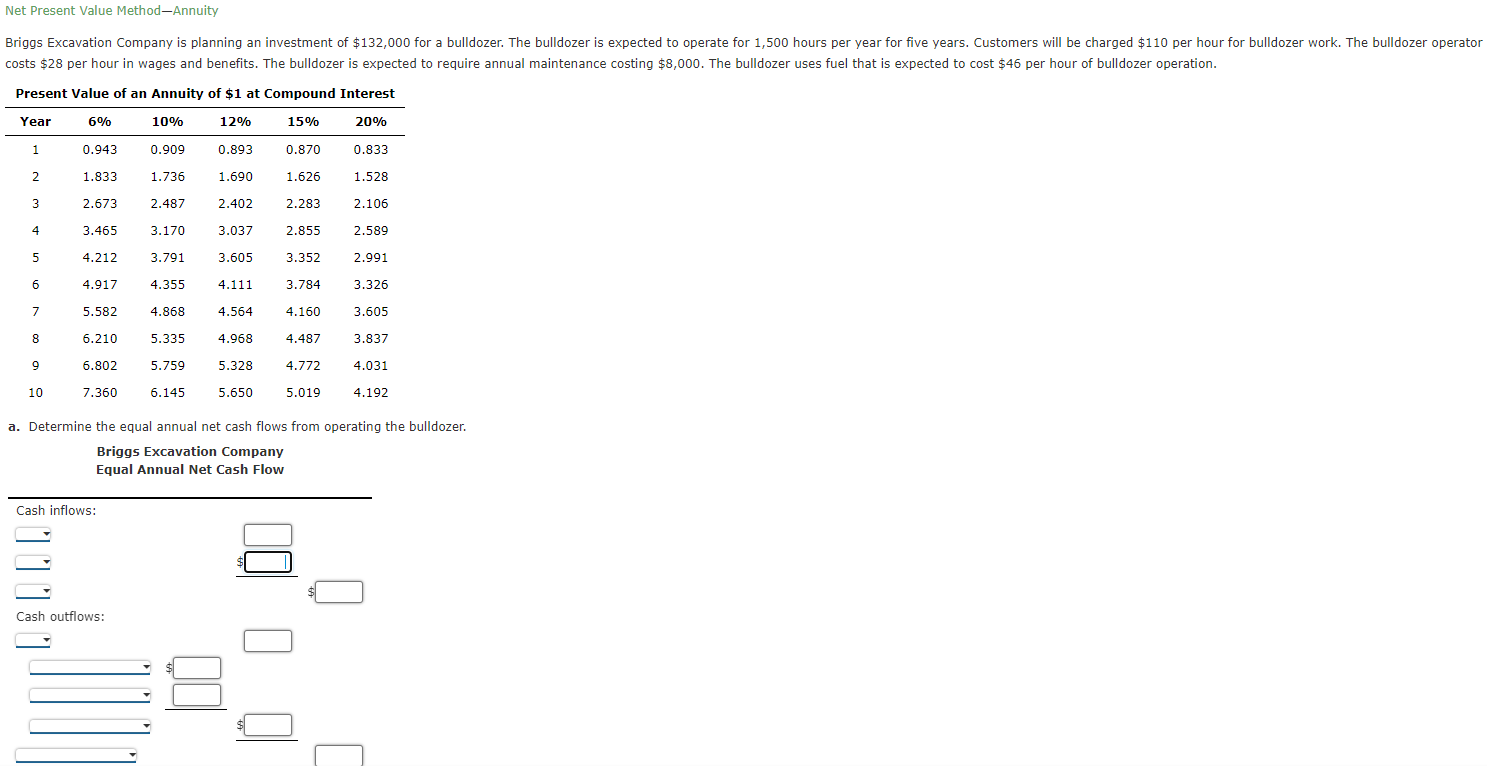

Net Present Value Method-Annuity costs $28 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $8,000. The bulldozer uses

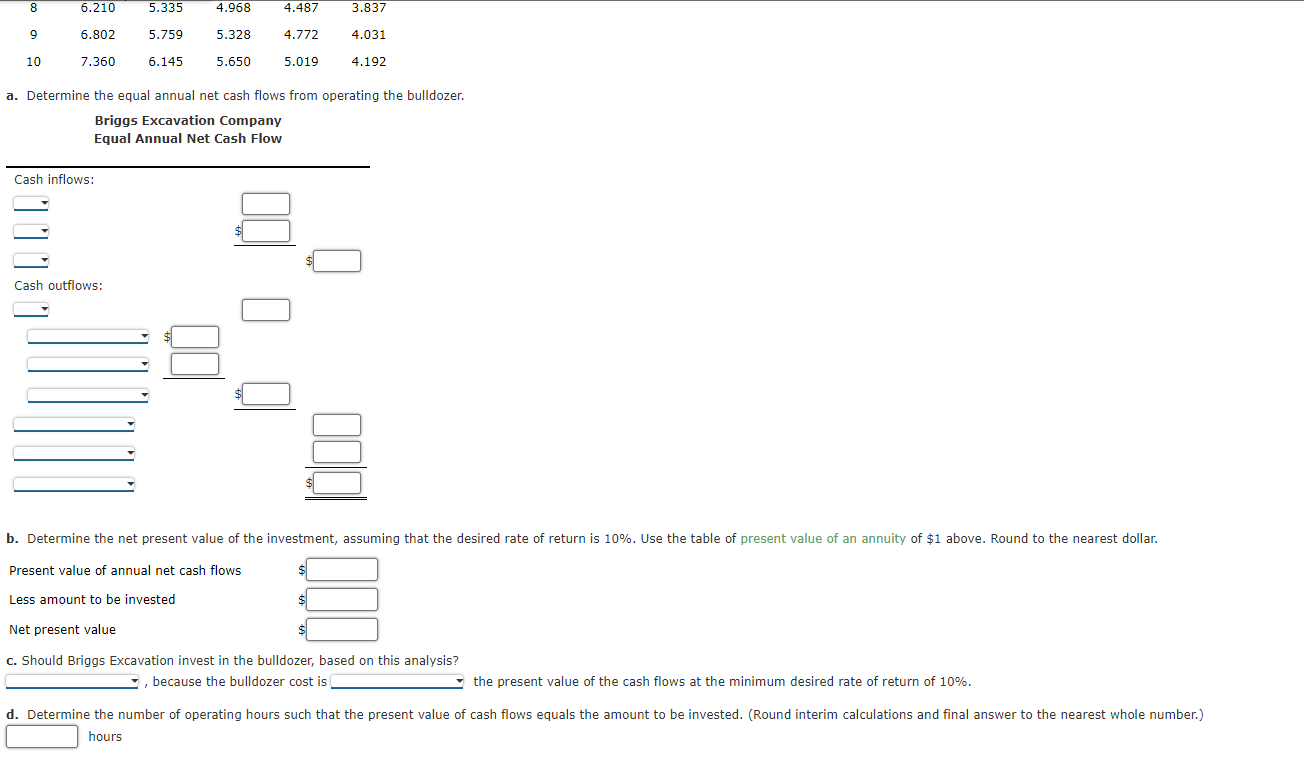

Net Present Value Method-Annuity costs $28 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $8,000. The bulldozer uses fuel that is expected to cost $46 per hour of bulldozer operation. a. Determine the equal annual net cash flows from operating the bulldozer. Briggs Excavation Company Equal Annual Net Cash Flow a. Determine the equal annual net cash flows from operating the bulldozer. c. Should Briggs Excavation invest in the bulldozer, based on this analysis? , because the bulldozer cost is the present value of the cash flows at the minimum desired rate of return of 10%. hours

Net Present Value Method-Annuity costs $28 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $8,000. The bulldozer uses fuel that is expected to cost $46 per hour of bulldozer operation. a. Determine the equal annual net cash flows from operating the bulldozer. Briggs Excavation Company Equal Annual Net Cash Flow a. Determine the equal annual net cash flows from operating the bulldozer. c. Should Briggs Excavation invest in the bulldozer, based on this analysis? , because the bulldozer cost is the present value of the cash flows at the minimum desired rate of return of 10%. hours Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started