Answered step by step

Verified Expert Solution

Question

1 Approved Answer

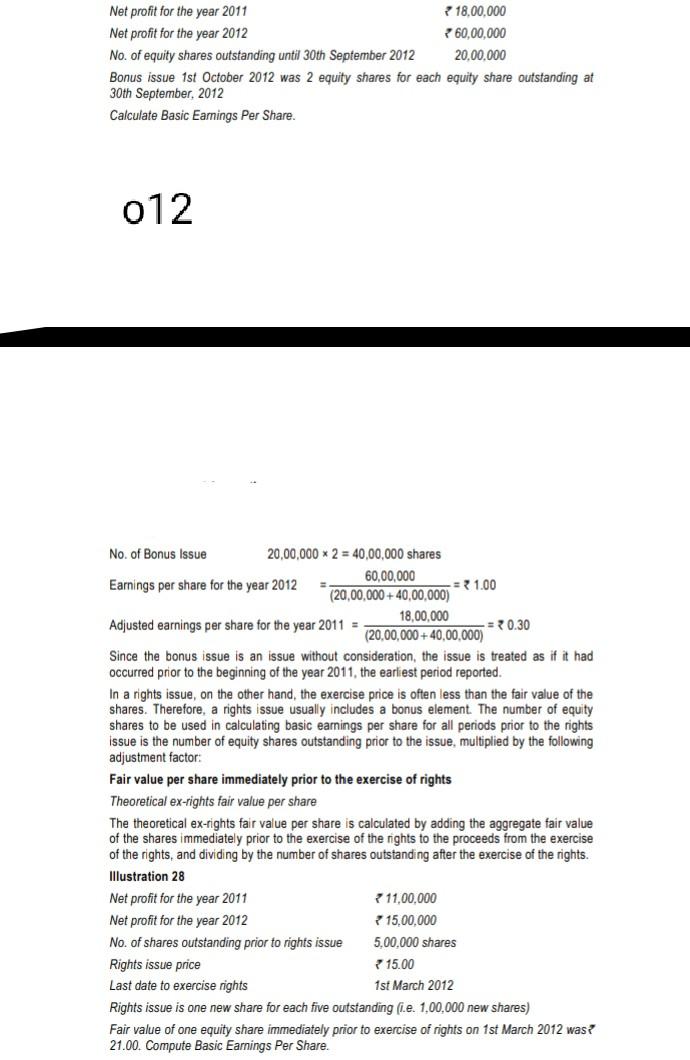

Net profit for the year 2011 18.00.000 Net profit for the year 2012 360,00,000 No. of equity shares outstanding until 30th September 2012 20,00.000 Bonus

Net profit for the year 2011 18.00.000 Net profit for the year 2012 360,00,000 No. of equity shares outstanding until 30th September 2012 20,00.000 Bonus issue 1st October 2012 was 2 equity shares for each equity share outstanding at 30th September, 2012 Calculate Basic Earnings Per Share. 012 No. of Bonus Issue 20,00,000 2 = 40,00,000 shares 60,00,000 Earnings per share for the year 2012 => 1.00 (20,00,000 + 40,00,000) 18,00,000 Adjusted earnings per share for the year 2011 = = 30.30 (20,00,000 + 40,00.000) Since the bonus issue is an issue without consideration, the issue is treated as if it had occurred prior to the beginning of the year 2011, the earliest period reported. In a rights issue, on the other hand, the exercise price is often less than the fair value of the shares. Therefore, a rights issue usually includes a bonus element. The number of equity shares to be used in calculating basic earnings per share for all periods prior to the rights issue is the number of equity shares outstanding prior to the issue, multiplied by the following adjustment factor: Fair value per share immediately prior to the exercise of rights Theoretical ex-rights fair value per share The theoretical ex-rights fair value per share is calculated by adding the aggregate fair value of the shares immediately prior to the exercise of the nghts to the proceeds from the exercise of the rights, and dividing by the number of shares outstanding after the exercise of the rights. Illustration 28 Net profit for the year 2011 11,00.000 Net profit for the year 2012 15,00,000 No. of shares outstanding prior to rights issue 5.00.000 shares Rights issue price * 15.00 Last date to exercise nights 1st March 2012 Rights issue is one new share for each five outstanding (.e. 1,00,000 new shares) Fair value of one equity share immediately prior to exercise of rights on 1st March 2012 was? 21.00. Compute Basic Earnings Per Share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started