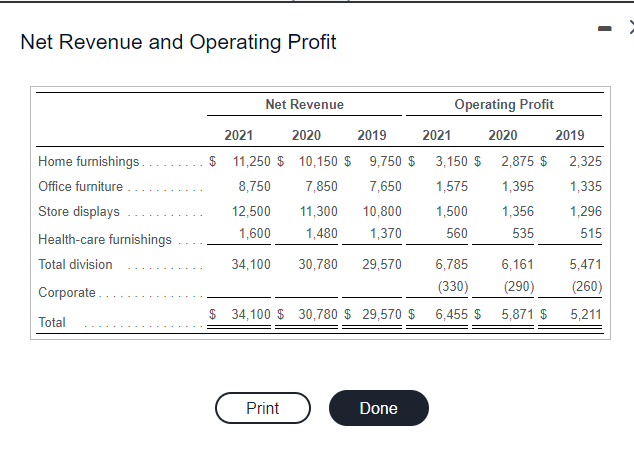

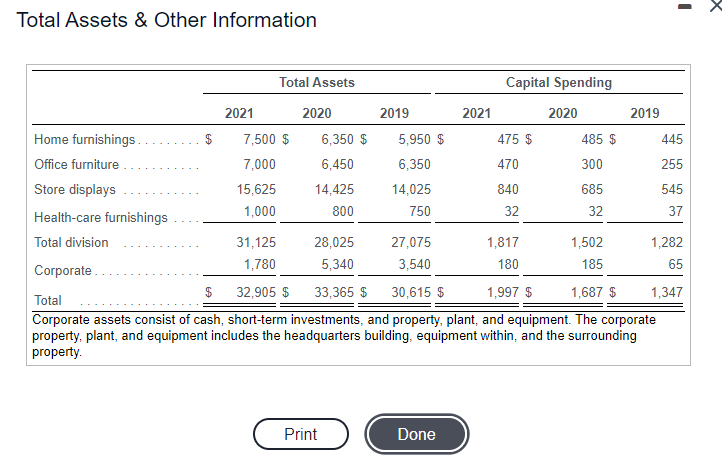

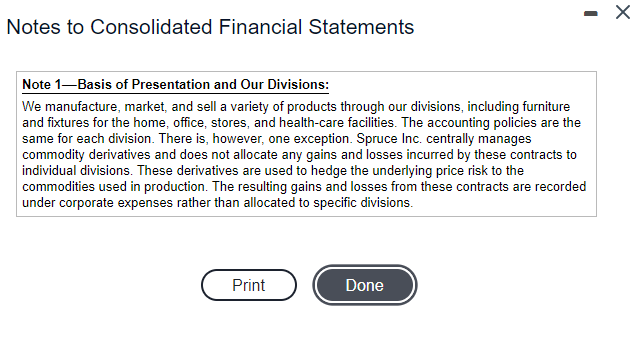

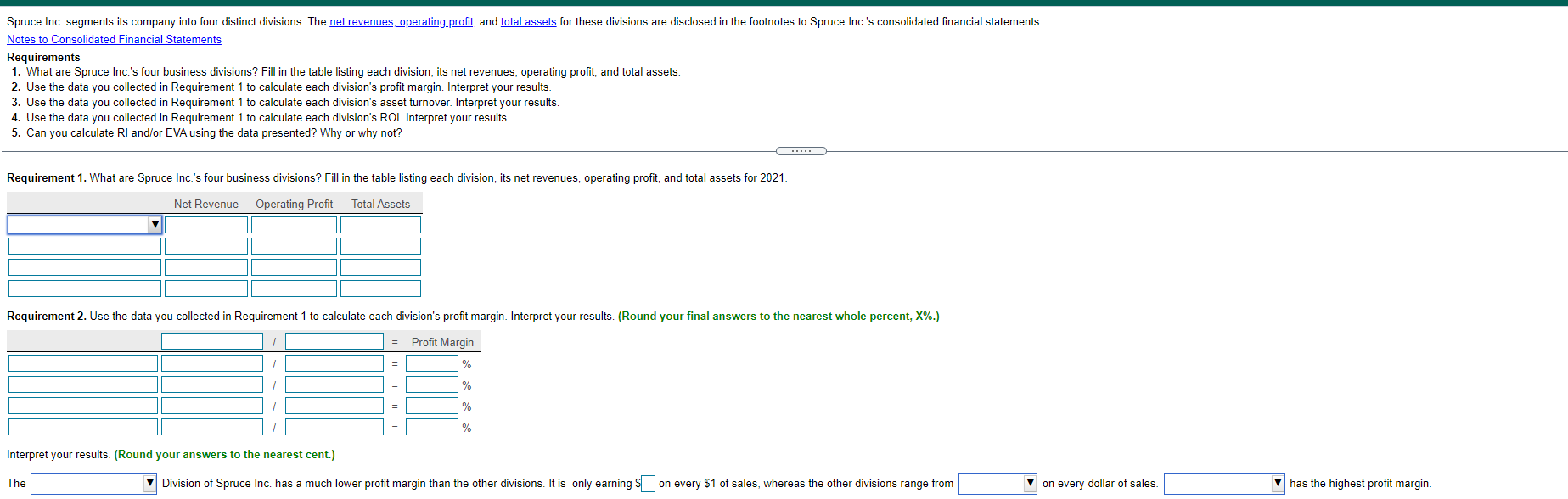

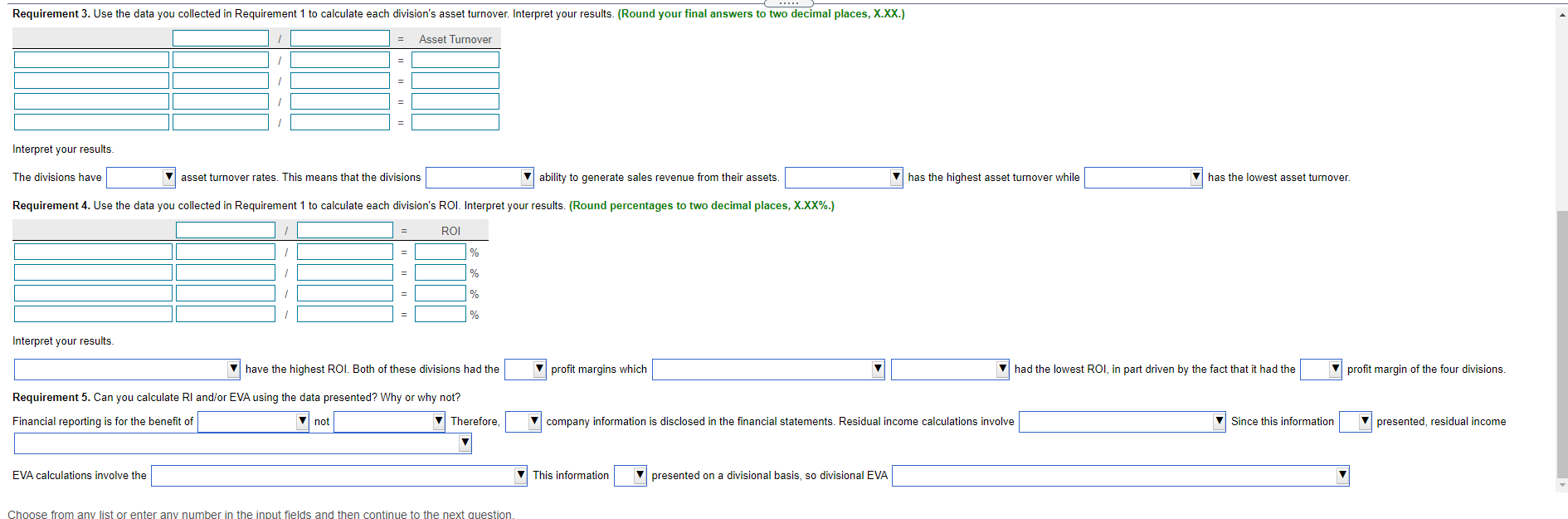

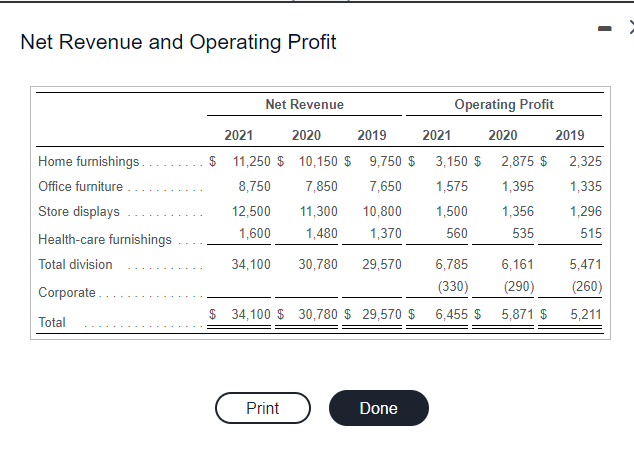

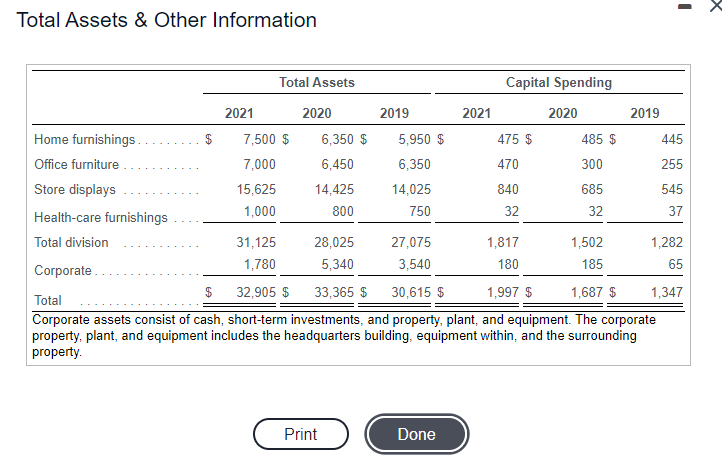

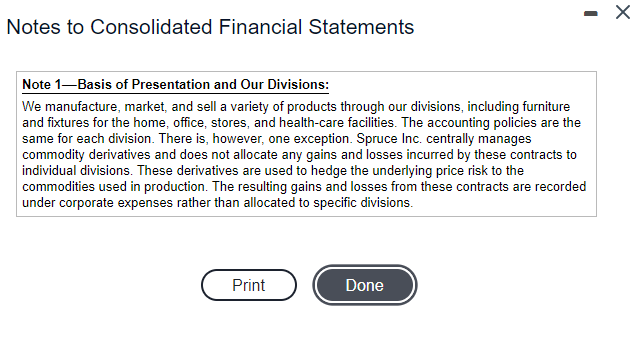

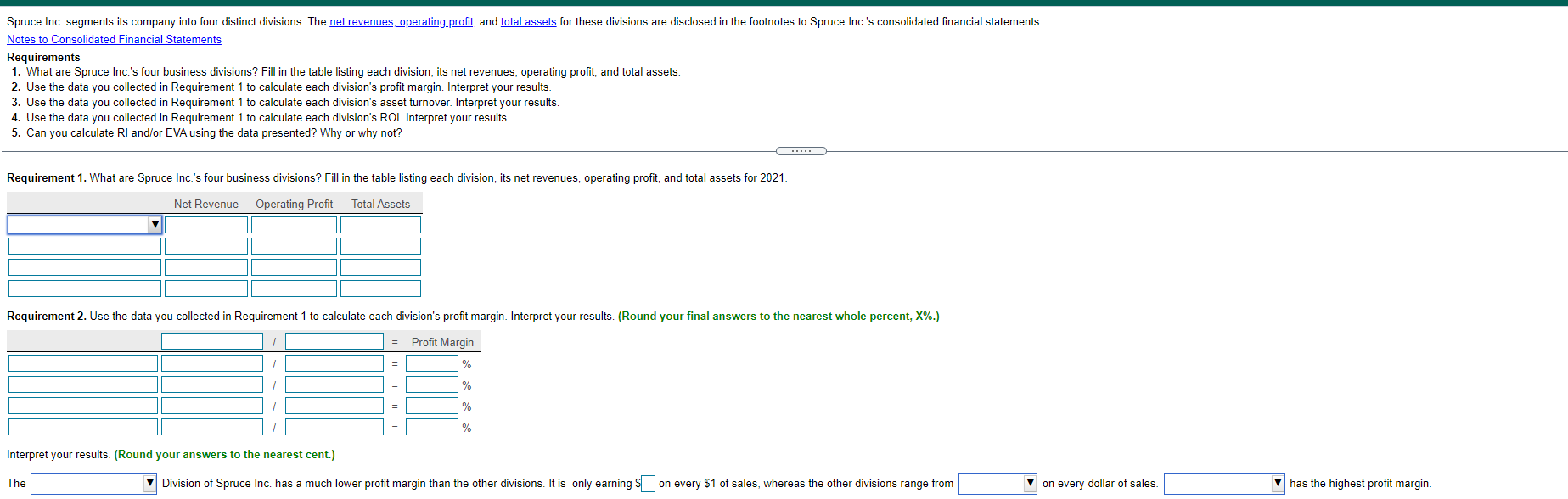

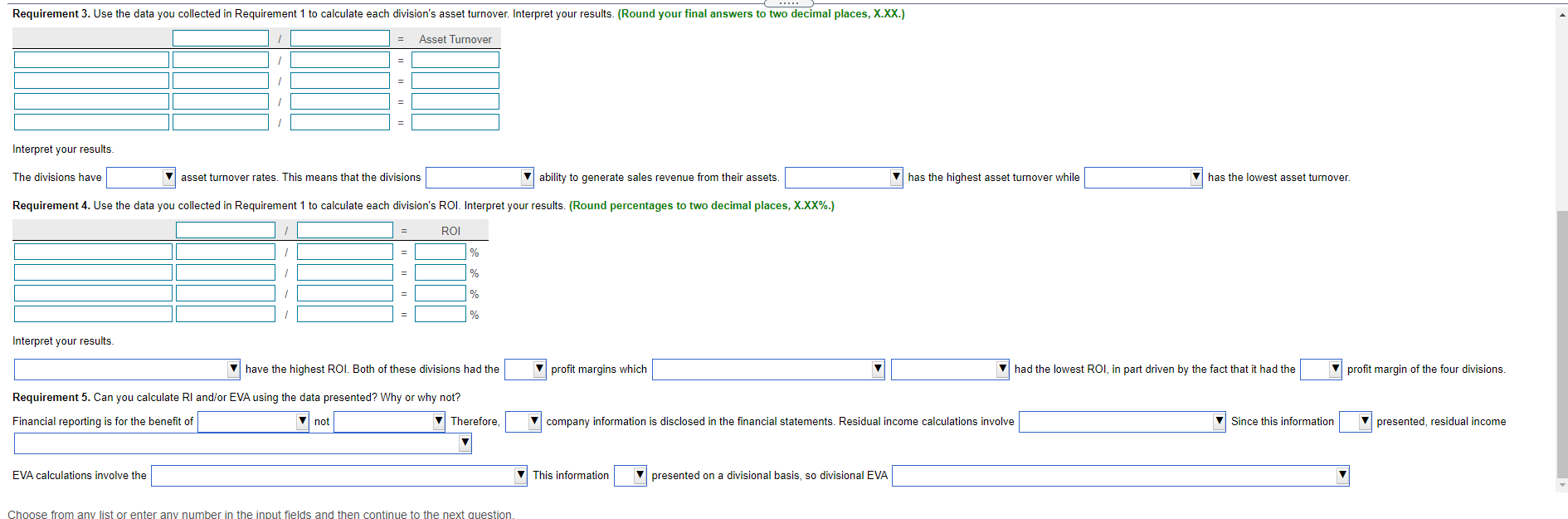

Net Revenue and Operating Profit Net Revenue Operating Profit 2021 2020 2019 2021 2020 2019 3,150 $ 2,875 $ 2,325 1,575 1,395 1,335 Home furnishings Office furniture Store displays Health-care furnishings Total division $ 11,250 $ 10,150 $ 9,750 $ 8,750 7,850 7,650 12,500 11,300 10,800 1,600 1,480 1,370 1,500 560 1,356 535 1,296 515 34,100 30,780 29,570 6,785 (330) 6,455 $ 6,161 (290) 5,471 (260) Corporate Total $ 34,100 $ 30,780 $ 29,570 $ 5,871 $ 5,211 Print Done - X Total Assets & Other Information Total Assets Capital Spending 2021 2020 2019 2021 2020 2019 Home furnishings 7,500 $ 6,350 $ 5,950 $ 475 $ 485 $ 445 Office furniture 7,000 6,450 6,350 470 300 255 Store displays 15,625 14,425 14,025 840 685 545 Health-care furnishings 1,000 800 750 32 32 37 Total division 31,125 28,025 27,075 1,817 1,502 1,282 Corporate 1,780 5,340 3,540 180 185 65 $ Total 32,905 $ 33,365 $ 30,615 $ 1,997 $ 1,687 $ 1,347 Corporate assets consist of cash, short-term investments, and property, plant, and equipment. The corporate property, plant, and equipment includes the headquarters building, equipment within, and the surrounding property. Print Done - Notes to Consolidated Financial Statements Note 1Basis of Presentation and Our Divisions: We manufacture, market, and sell a variety of products through our divisions, including furniture and fixtures for the home, office, stores, and health-care facilities. The accounting policies are the same for each division. There is, however, one exception. Spruce Inc. centrally manages commodity derivatives and does not allocate any gains and losses incurred by these contracts to individual divisions. These derivatives are used to hedge the underlying price risk to the commodities used in production. The resulting gains and losses from these contracts are recorded under corporate expenses rather than allocated to specific divisions. Print Done Spruce Inc. segments its company into four distinct divisions. The net revenues, operating profit, and total assets for these divisions are disclosed in the footnotes to Spruce Inc.'s consolidated financial statements. Notes to Consolidated Financial Statements Requirements 1. What are Spruce Inc.'s four business divisions? Fill in the table listing each division, its net revenues, operating profit, and total assets. 2. Use the data you collected in Requirement 1 to calculate each division's profit margin. Interpret your results. 3. Use the data you collected in Requirement 1 to calculate each division's asset turnover. Interpret your results. 4. Use the data you collected in Requirement 1 to calculate each division's ROI. Interpret your results. 5. Can you calculate Rl and/or EVA using the data presented? Why or why not? Requirement 1. What are Spruce Inc.'s four business divisions? Fill in the table listing each division, its net revenues, operating profit, and total assets for 2021. Net Revenue Operating Profit Total Assets Requirement 2. Use the data you collected in Requirement 1 to calculate each division's profit margin. Interpret your results. (Round your final answers to the nearest whole percent, X%.) 1 = Profit Margin 1 = % 1 % / % 1 Interpret your results. (Round your answers to the nearest cent.) The Division of Spruce Inc. has a much lower profit margin than the other divisions. It is only earning $ on every S1 of sales, whereas the other divisions range from on every dollar of sales. V has the highest profit margin. Requirement 3. Use the data you collected in Requirement 1 to calculate each division's asset turnover. Interpret your results. (Round your final answers to two decimal places, X.XX.) Asset Turnover = = Interpret your results. The divisions have asset turnover rates. This means that the divisions V ability to generate sales revenue from their assets. V has the highest asset turnover while V has the lowest asset turnover Requirement 4. Use the data you collected in Requirement 1 to calculate each division's ROI. Interpret your results. (Round percentages to two decimal places, X.XX%.) ROI % % 1 = = % Interpret your results. have the highest ROI. Both of these divisions had the profit margins which had the lowest ROI, in part driven by the fact that it had the profit margin of the four divisions. Requirement 5. Can you calculate Rl and/or EVA using the data presented? Why or why not? Financial reporting is for the benefit of V not Therefore V company information is disclosed in the financial statements. Residual income calculations involve Since this information V presented, residual income EVA calculations involve the This information presented on a divisional basis, so divisional EVA Choose from any list or enter any number in the input fields and then continue to the next