Answered step by step

Verified Expert Solution

Question

1 Approved Answer

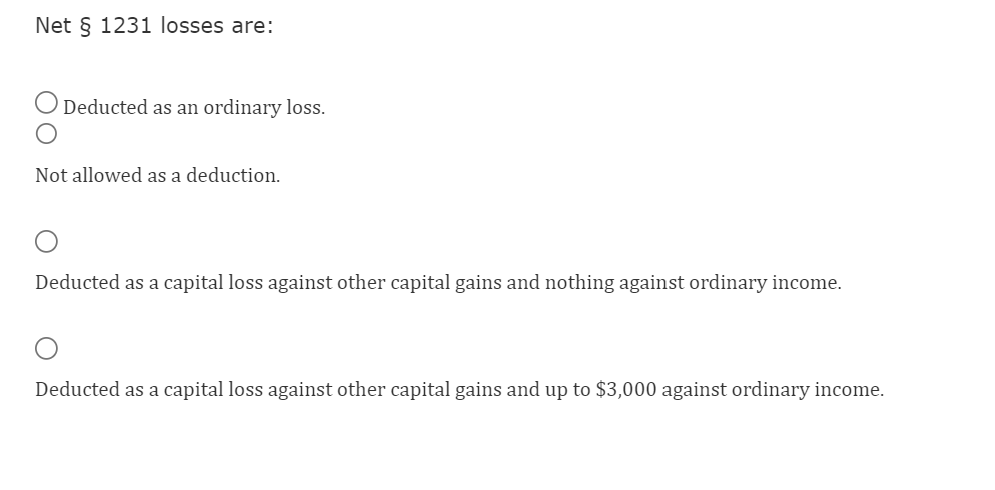

Net ( S 1231 ) losses are: Deducted as an ordinary loss. Not allowed as a deduction. Deducted as a capital loss against other capital

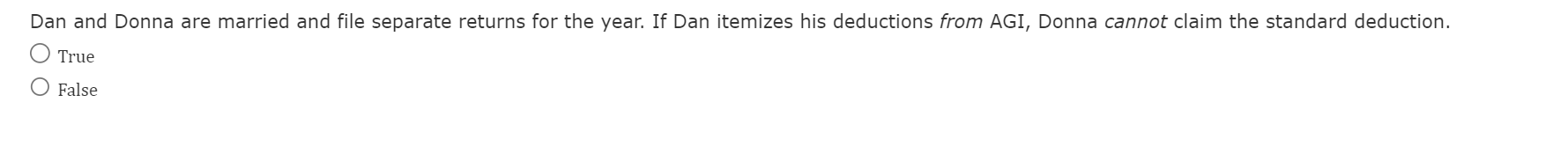

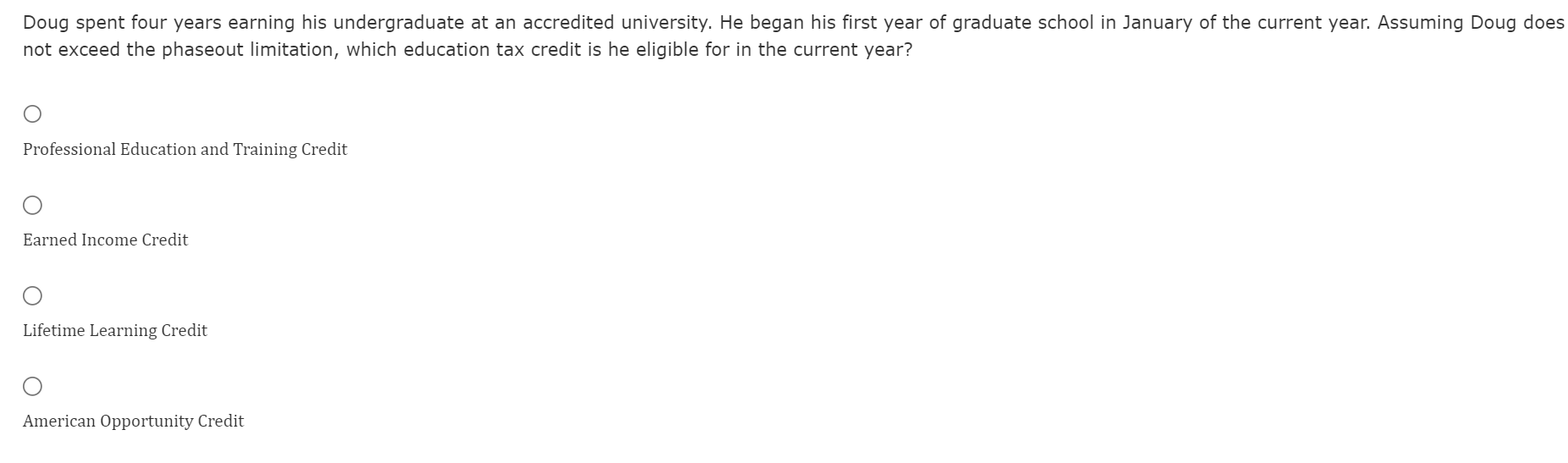

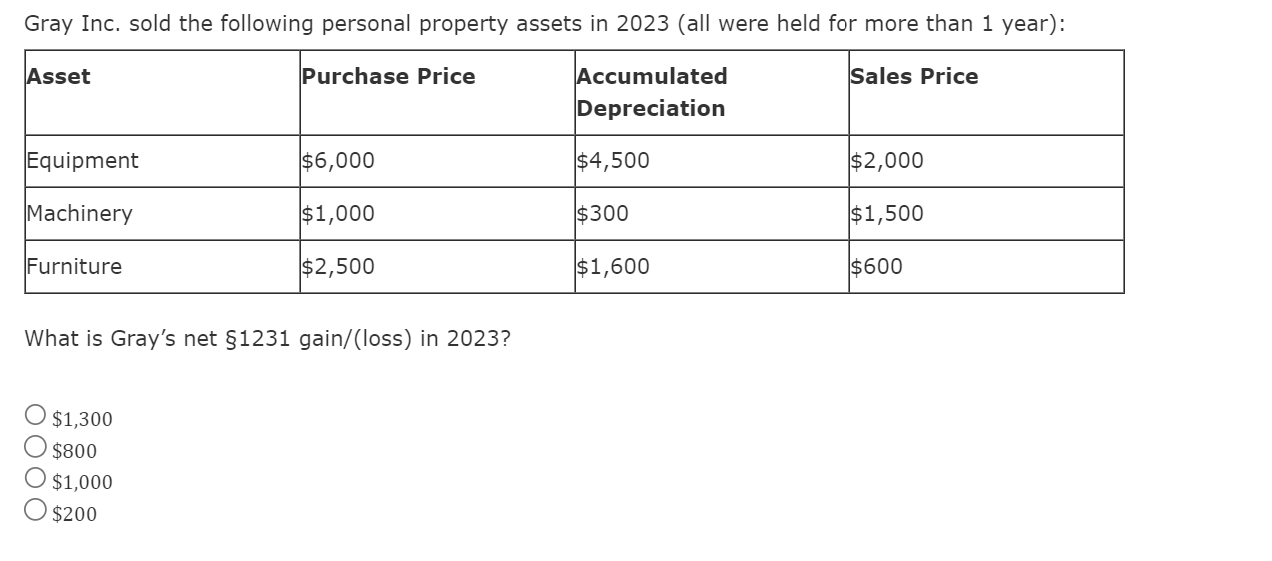

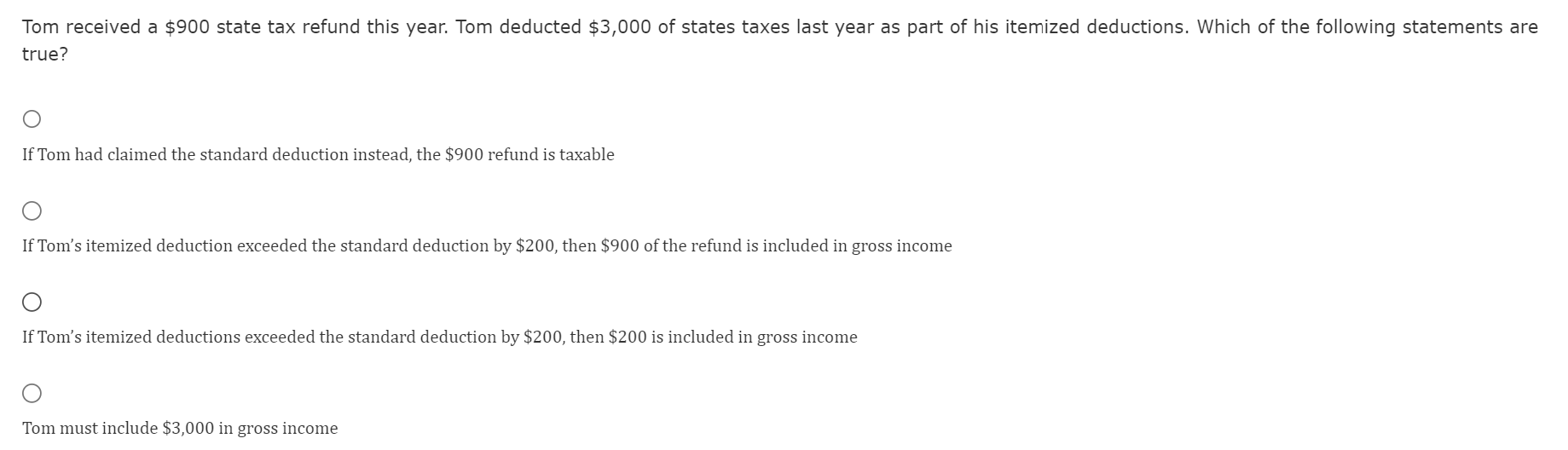

Net \\( \\S 1231 \\) losses are: Deducted as an ordinary loss. Not allowed as a deduction. Deducted as a capital loss against other capital gains and nothing against ordinary income. Deducted as a capital loss against other capital gains and up to \\( \\$ 3,000 \\) against ordinary income. Dan and Donna are married and file separate returns for the year. If Dan itemizes his deductions from AGI, Donna cannot claim the standard deduction. True False Doug spent four years earning his undergraduate at an accredited university. He began his first year of graduate school in January of the current year. Assuming Doug does not exceed the phaseout limitation, which education tax credit is he eligible for in the current year? Professional Education and Training Credit Earned Income Credit Lifetime Learning Credit American Opportunity Credit What is Gray's net \\( \\S 1231 \\) gain/(loss) in 2023? \\[ \\begin{array}{l} \\$ 1,300 \\\\ \\$ 800 \\\\ \\$ 1,000 \\\\ \\$ 200 \\end{array} \\] Tom received a \\( \\$ 900 \\) state tax refund this year. Tom deducted \\( \\$ 3,000 \\) of states taxes last year as part of his itemized deductions. Which of the following statements are true? If Tom had claimed the standard deduction instead, the \\( \\$ 900 \\) refund is taxable If Tom's itemized deduction exceeded the standard deduction by \\( \\$ 200 \\), then \\( \\$ 900 \\) of the refund is included in gross income If Tom's itemized deductions exceeded the standard deduction by \\( \\$ 200 \\), then \\( \\$ 200 \\) is included in gross income Tom must include \\( \\$ 3,000 \\) in gross income

Net \\( \\S 1231 \\) losses are: Deducted as an ordinary loss. Not allowed as a deduction. Deducted as a capital loss against other capital gains and nothing against ordinary income. Deducted as a capital loss against other capital gains and up to \\( \\$ 3,000 \\) against ordinary income. Dan and Donna are married and file separate returns for the year. If Dan itemizes his deductions from AGI, Donna cannot claim the standard deduction. True False Doug spent four years earning his undergraduate at an accredited university. He began his first year of graduate school in January of the current year. Assuming Doug does not exceed the phaseout limitation, which education tax credit is he eligible for in the current year? Professional Education and Training Credit Earned Income Credit Lifetime Learning Credit American Opportunity Credit What is Gray's net \\( \\S 1231 \\) gain/(loss) in 2023? \\[ \\begin{array}{l} \\$ 1,300 \\\\ \\$ 800 \\\\ \\$ 1,000 \\\\ \\$ 200 \\end{array} \\] Tom received a \\( \\$ 900 \\) state tax refund this year. Tom deducted \\( \\$ 3,000 \\) of states taxes last year as part of his itemized deductions. Which of the following statements are true? If Tom had claimed the standard deduction instead, the \\( \\$ 900 \\) refund is taxable If Tom's itemized deduction exceeded the standard deduction by \\( \\$ 200 \\), then \\( \\$ 900 \\) of the refund is included in gross income If Tom's itemized deductions exceeded the standard deduction by \\( \\$ 200 \\), then \\( \\$ 200 \\) is included in gross income Tom must include \\( \\$ 3,000 \\) in gross income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started