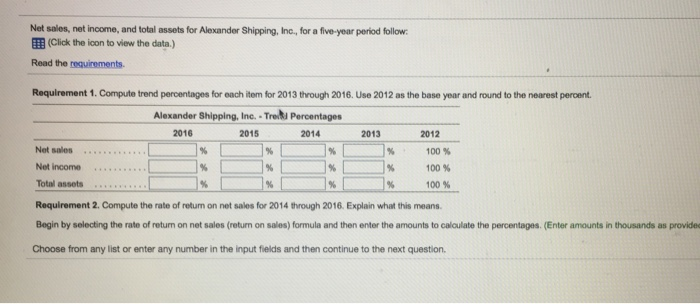

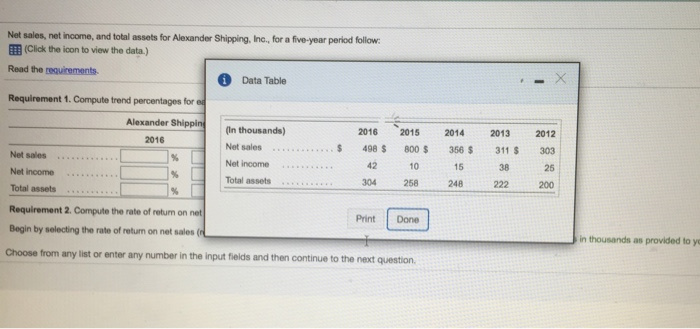

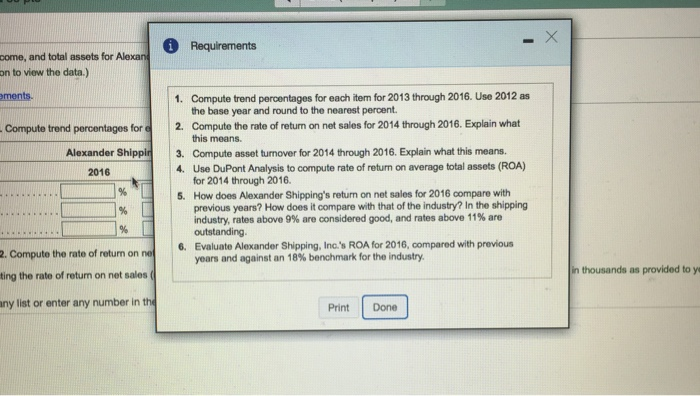

Net sales, net income, and total assets for Alexander Shipping, Inc., for a five-year period follow (Click the icon to view the data.) Read the requirements Requirement 1. Compute trend percentages for each item for 2013 through 2016. Use 2012 as the base your and round to the nearest percent. Alexander Shipping, Inc. - Trelle Percentages 2016 2015 2014 2013 2012 Net sales 100% Net Income 100% Total assets .. 100 % Requirement 2. Compute the rate of retum on net sales for 2014 through 2016. Explain what this means Begin by selecting the rate of rotum on net sales (return on sales) formula and then enter the amounts to calculate the percentages (Enter amounts in thousands as provided Choose from any list or enter any number in the input fields and then continue to the next question Net sales, net income, and total assets for Alexander Shipping, Inc., for a five-year period follow: (Click the icon to view the data.) Read the requirements Data Table Requirement 1. Compute trend percentages for e Alexander Shipping 2016 2012 Net sales ............. Net Income Total assets (In thousands) Net sales Not income Total assets 2016 498 $ 42 304 303 2015 800 $ 10 258 2014 356 $ 15 248 2013 311 S 38 222 25 200 Requirement 2. Compute the rate of return on net Begin by selecting the rate of return on net sales Print Done in thousands as provided to yo Choose from any list or enter any number in the input fields and then continue to the next question Requirements - X zome, and total assets for Alexand un to view the data.) iments Compute trend percentages for Alexander Shippir 2016 1. Compute trend percentages for each item for 2013 through 2016. Use 2012 as the base year and round to the nearest percent. 2. Compute the rate of return on net sales for 2014 through 2016. Explain what this means. 3. Compute asset tumover for 2014 through 2016. Explain what this means 4. Use DuPont Analysis to compute rate of return on average total assets (ROA) for 2014 through 2016 5. How does Alexander Shipping's return on net sales for 2016 compare with previous years? How does it compare with that of the industry? In the shipping industry, rates above 9% are considered good, and rates above 11% are outstanding 6. Evaluate Alexander Shipping, Inc.'s ROA for 2016, compared with previous years and against an 18% benchmark for the industry. 2. Compute the rate of return on ne iting the rate of return on net sales in thousands as provided to y any list or enter any number in the Print Done