Answered step by step

Verified Expert Solution

Question

1 Approved Answer

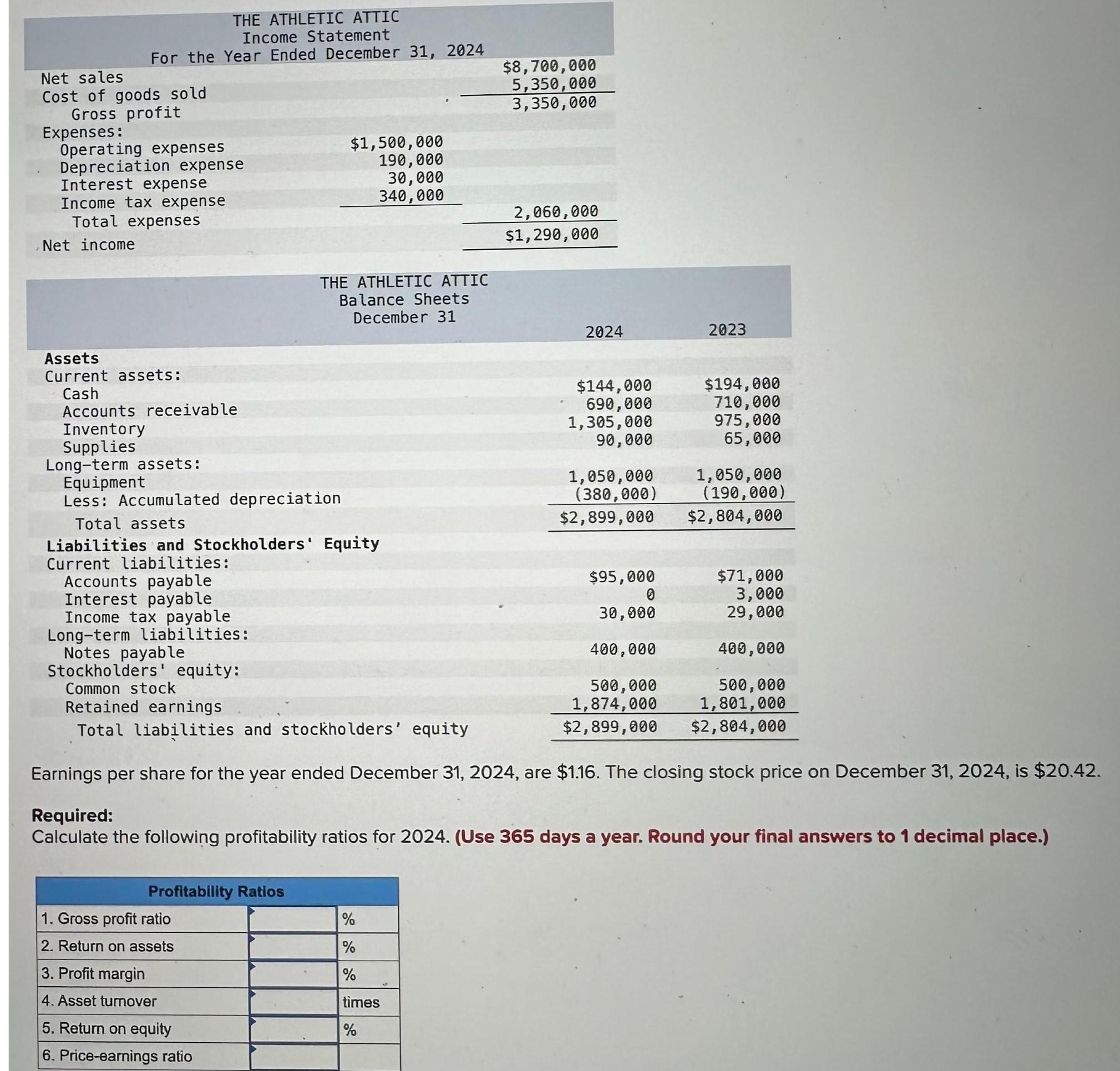

Net sales THE ATHLETIC ATTIC Income Statement For the Year Ended December 31, 2024 Cost of goods sold Gross profit Expenses: Operating expenses Depreciation

Net sales THE ATHLETIC ATTIC Income Statement For the Year Ended December 31, 2024 Cost of goods sold Gross profit Expenses: Operating expenses Depreciation expense Interest expense Income tax expense Total expenses Net income $8,700,000 5,350,000 3,350,000 $1,500,000 190,000 30,000 340,000 2,060,000 $1,290,000 THE ATHLETIC ATTIC Balance Sheets December 31 2024 2023 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment $144,000 690,000 $194,000 710,000 1,305,000 90,000 975,000 65,000 1,050,000 1,050,000 Less: Accumulated depreciation (380,000) (190,000) Total assets $2,899,000 $2,804,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity $95,000 $71,000 3,000 30,000 29,000 400,000 400,000 500,000 500,000 1,874,000 1,801,000 $2,899,000 $2,804,000 Earnings per share for the year ended December 31, 2024, are $1.16. The closing stock price on December 31, 2024, is $20.42. Required: Calculate the following profitability ratios for 2024. (Use 365 days a year. Round your final answers to 1 decimal place.) Profitability Ratios 1. Gross profit ratio % 2. Return on assets 3. Profit margin 4. Asset turnover % % times 5. Return on equity % 6. Price-earnings ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Gross Profit Ratio Gross Profit Net Sales 100 3350000 8700000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started