Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Net sales THE ATHLETIC ATTIC Income Statements For the Years Ended December 31 Cost of goods sold Gross profit Expenses: Operating expenses Depreciation expense

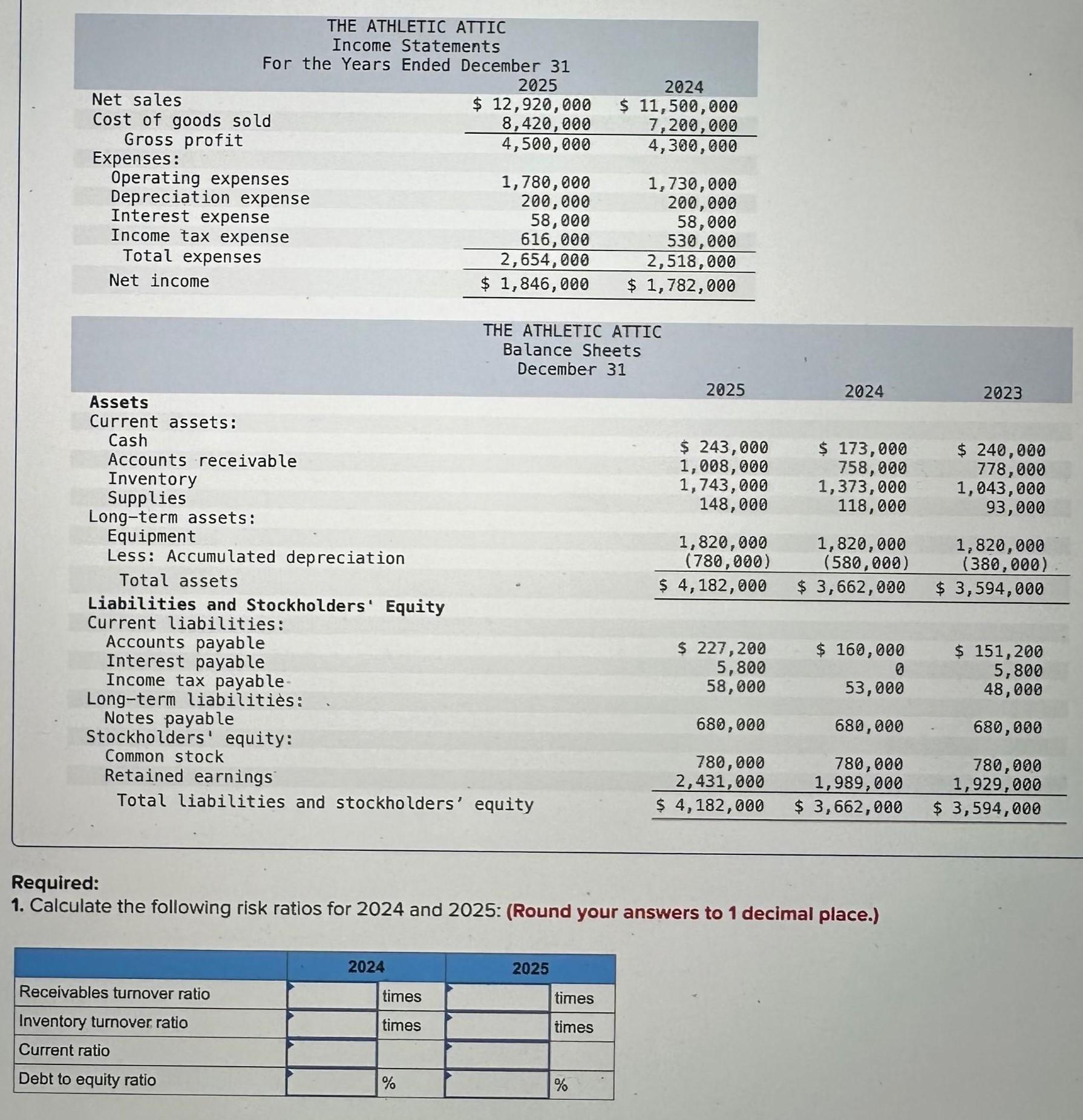

Net sales THE ATHLETIC ATTIC Income Statements For the Years Ended December 31 Cost of goods sold Gross profit Expenses: Operating expenses Depreciation expense Interest expense Income tax expense Total expenses Net income 2025 $ 12,920,000 8,420,000 2024 $ 11,500,000 7,200,000 4,500,000 4,300,000 1,780,000 1,730,000 200,000 200,000 58,000 616,000 2,654,000 $ 1,846,000 58,000 530,000 2,518,000 $ 1,782,000 THE ATHLETIC ATTIC Balance Sheets December 31 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable 2025 2024 2023 $ 243,000 1,008,000 1,743,000 148,000 1,820,000 (780,000) $ 4,182,000 $ 173,000 758,000 1,373,000 118,000 1,820,000 (580,000) $ 3,662,000 $ 240,000 778,000 1,043,000 93,000 1,820,000 (380,000) $ 3,594,000 Interest payable $ 227,200 5,800 $ 169,000 $ 151,200 0 5,800 Income tax payable 58,000 53,000 48,000 Long-term liabilities: Notes payable 680,000 680,000 680,000 Stockholders' equity: Common stock 780,000 780,000 Retained earnings 2,431,000 1,989,000 Total liabilities and stockholders' equity $ 4,182,000 $ 3,662,000 780,000 1,929,000 $ 3,594,000 Required: 1. Calculate the following risk ratios for 2024 and 2025: (Round your answers to 1 decimal place.) Receivables turnover ratio Inventory turnover ratio Current ratio Debt to equity ratio 2024 2025 times times times times % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started