Answered step by step

Verified Expert Solution

Question

1 Approved Answer

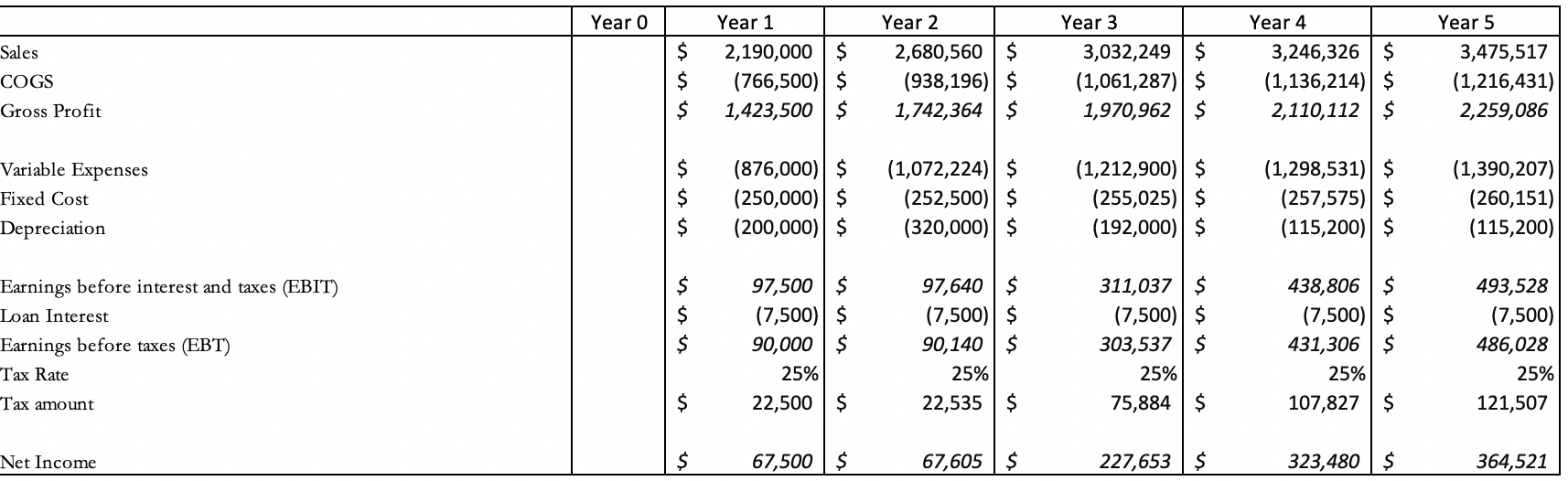

Net Working Capital to Sales is 20% Initial investment is $ 1,000,000 Leasing Deposit is $28,000 * Percentage of NWC recovered in year 5 is

Net Working Capital to Sales is 20%

Initial investment is $ 1,000,000

Leasing Deposit is $28,000

* Percentage of NWC recovered in year 5 is 90%

* Calculate the Free Cash Flow for each year (show the full work) and present it as a statement

* Calculate Net Present Value, payback period, discounted payback, and profitability index (show full work)

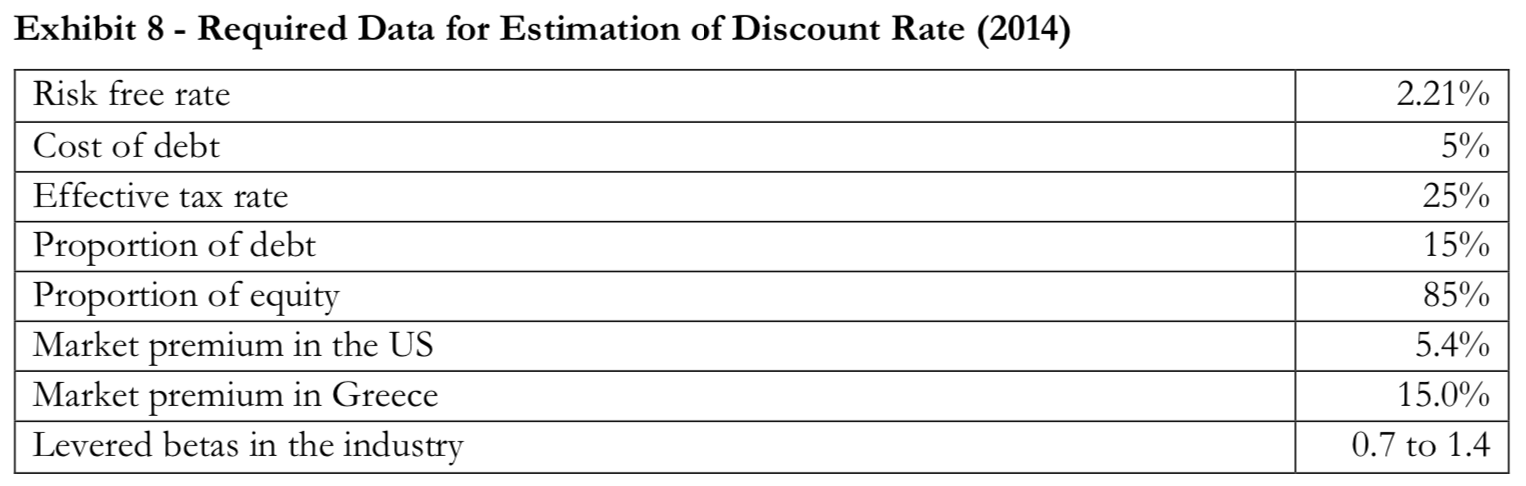

Year o Sales COGS Gross Profit $ $ Year 1 2,190,000 $ (766,500) $ 1,423,500 Year 2 2,680,560 $ (938,196) $ 1,742,364 is usis Year 3 3,032,249 (1,061,287) $ 1,970,962 Year 4 3,246,326 (1,136,214) $ 2,110,112 Year 5 3,475,517 (1,216,431) 2,259,086 Variable Expenses Fixed Cost Depreciation (876,000) (250,000) (200,000) $ (1,072,224) (252,500) $ (320,000)| $ (1,212,900) $ (255,025) (192,000) $ (1,298,531) $ (257,575) (115,200) $ (1,390,207) (260,151) (115,200) $ Earnings before interest and taxes (EBIT) Loan Interest Earnings before taxes (EBT) Tax Rate 97,500 (7,500) 90,000 25% 22,500 97,640 (7,500) $ 90,140 25% 22,535 311,037 (7,500) 303,537 25% 75,884 $ 438,806 (7,500) 431,306 25% 107,827 $ 493,528 (7,500) 486,028 25% 121,507 Tax amount Net Income 67,500 $ 67,605 $ 227,653 $ 323,480 $ 364,521 Exhibit 8 - Required Data for Estimation of Discount Rate (2014) Risk free rate Cost of debt Effective tax rate Proportion of debt Proportion of equity Market premium in the US Market premium in Greece Levered betas in the industry 2.21% 5% 25% 15% 85% 5.4% 15.0% 0.7 to 1.4 Year o Sales COGS Gross Profit $ $ Year 1 2,190,000 $ (766,500) $ 1,423,500 Year 2 2,680,560 $ (938,196) $ 1,742,364 is usis Year 3 3,032,249 (1,061,287) $ 1,970,962 Year 4 3,246,326 (1,136,214) $ 2,110,112 Year 5 3,475,517 (1,216,431) 2,259,086 Variable Expenses Fixed Cost Depreciation (876,000) (250,000) (200,000) $ (1,072,224) (252,500) $ (320,000)| $ (1,212,900) $ (255,025) (192,000) $ (1,298,531) $ (257,575) (115,200) $ (1,390,207) (260,151) (115,200) $ Earnings before interest and taxes (EBIT) Loan Interest Earnings before taxes (EBT) Tax Rate 97,500 (7,500) 90,000 25% 22,500 97,640 (7,500) $ 90,140 25% 22,535 311,037 (7,500) 303,537 25% 75,884 $ 438,806 (7,500) 431,306 25% 107,827 $ 493,528 (7,500) 486,028 25% 121,507 Tax amount Net Income 67,500 $ 67,605 $ 227,653 $ 323,480 $ 364,521 Exhibit 8 - Required Data for Estimation of Discount Rate (2014) Risk free rate Cost of debt Effective tax rate Proportion of debt Proportion of equity Market premium in the US Market premium in Greece Levered betas in the industry 2.21% 5% 25% 15% 85% 5.4% 15.0% 0.7 to 1.4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started